Futures 360 report is an inquiry or screen that contains futures transactions and P&L impact they have:

- Unrealized profit/Loss – Unrealized impact is as of a point in time.

- Open transactions (number of contracts not matched/P&S) as of a certain date (or as of today)

- Unrealized P&L (mark to market) including commissions where applicable for open transactions

- Realized profit/Loss – Reflects realization (match P&S process) executed over a date range

- Previously matched transactions

- P&L Impact including commissions where applicable

- Summary

- There will always be a date range for this inquiry

- The 'to' date will be the same for realized and unrealized

- The 'from' date only applies to realized

- We will only permit one 'to' date so that realized and unrealized are consistent with each other

- Gross PnL- (No. of lots) x (Qty per lot) x (Closing Price per qty – Actual Price per qty)

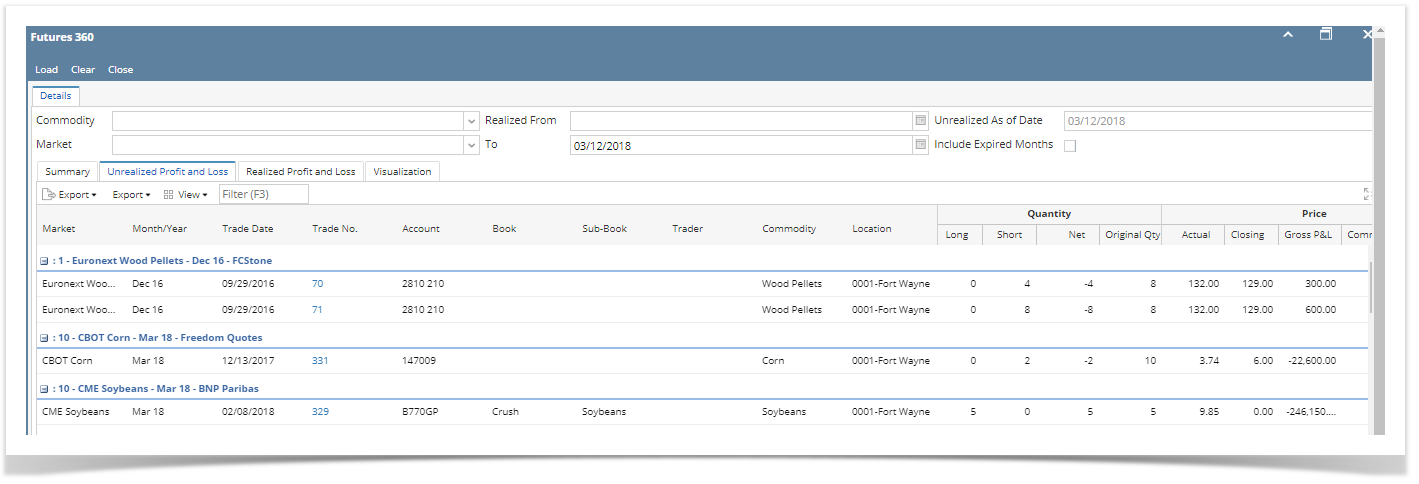

Un-Realized Profit/Loss

This screen provides the unrealized profit or loss for open futures transactions on the 'to' date specified in the report header. It is populated when user clicks Load.

- Each line is a transaction that had an open (unmatched ) quantity as of the 'To' date, or per update below, may have a zero balance but would appear if half turn commission (with zero net amount but original quantity included)

For eg:

Open Derivative entry and create a long entry for Mar-18 Future month 10 Lots , ICE coffee market - Open future 360

- select unrealized tab - filter by market - ICE coffee

It will load the same long trade which we created. since it is unmatched.

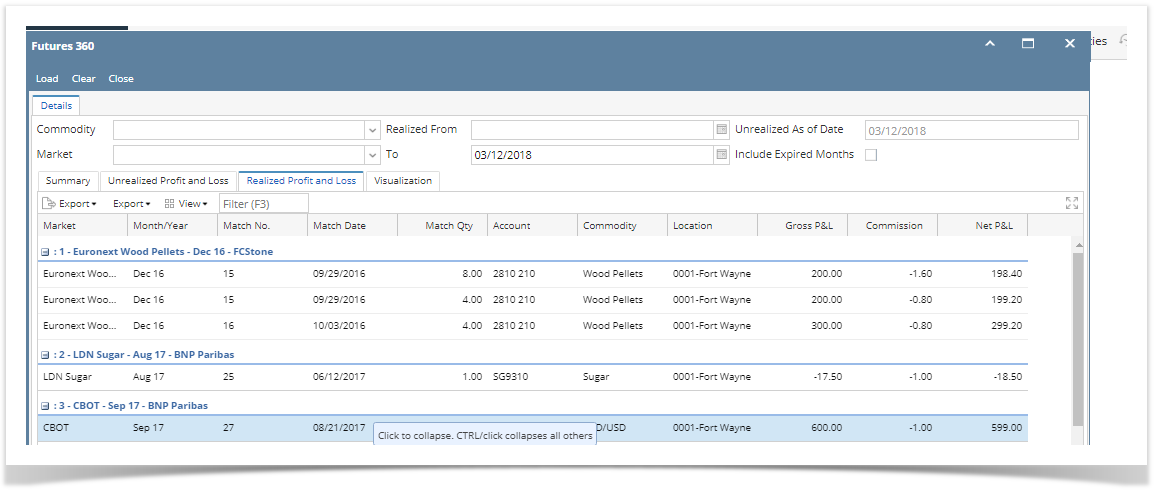

Realized Profit/Loss

This screen provides user with realized gains (or losses) on futures transactions in the time period defined in the header. - Each row represents a record from the Match Futures Purchase & Sale screen. Each row contains at least one long and short transaction but we will not show those here – user can check the Match screen for further details.

- Create a Derivative Long and short entries in derivative screen .

Market- ICE coffee , - Lots -10

- price -120 for long and 121 for short;

Open Match derivative screen and select the same transaction and click on match .

ie. 10 Long and 10 short lots are matched.

Open future 360. select the Realized tab . - We can see that the same match number is populated here.It will show the matched quantity as 10 lots and gross pnl and Net pnL. and this will be grouped by Broker and month and market.

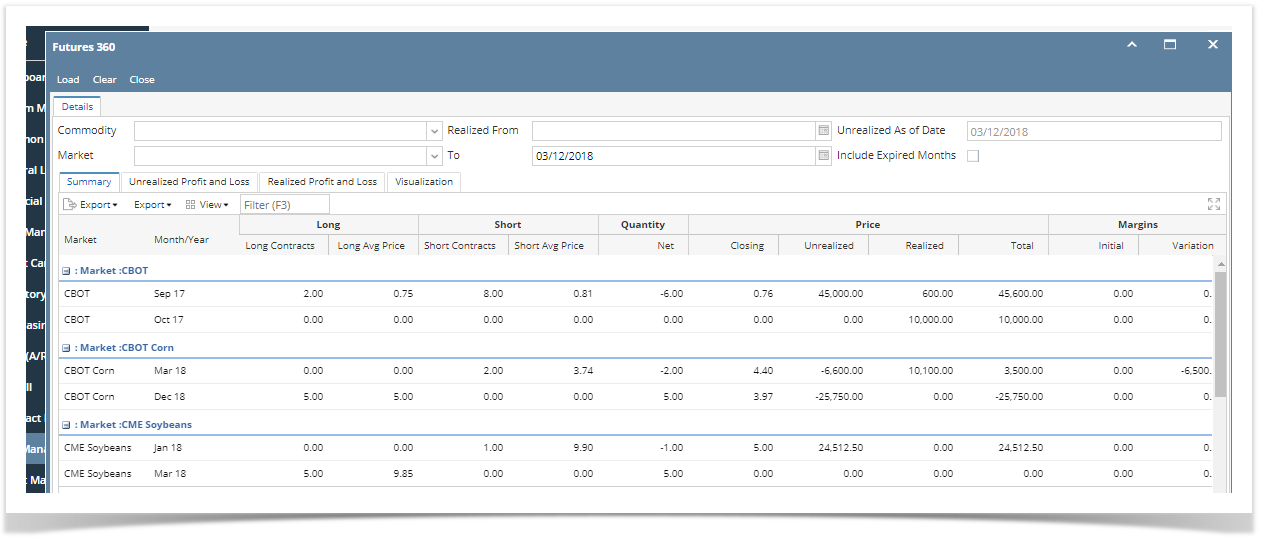

Summary Tab

This tab provides the detail for complete P&L in the user defined time period - including both realized (transactions that have been matched/P&S during the time frame) and unrealized (transactions that are still open or unrealized as of the end date of the time frame).

Long Contracts will show :- For unrealized (open) contracts as of the end date (or as of date), this is the number of long open contracts, placed on the appropriate market/month line

- Long Avg Price.

This calculation can come from next tab. The transactions that comprise it must be unrealized as of the end (as of) date...ths is the weighted average of the long contracts in the previous column. - Short Contracts

For unrealized (open) contracts as of the end date (or as of date), this is the number of short open contracts, placed on the appropriate market/month line. - Short Avg Price

This calculation can come from next tab. The transactions that comprise it must be unrealized as of the end (as of) date...ths is the weighted average of the long contracts in the previous column. - Total

Realized Plus Unrealized Gains/Losses.

- Each line is a transaction that had an open (unmatched ) quantity as of the 'To' date, or per update below, may have a zero balance but would appear if half turn commission (with zero net amount but original quantity included)

Overview

Content Tools