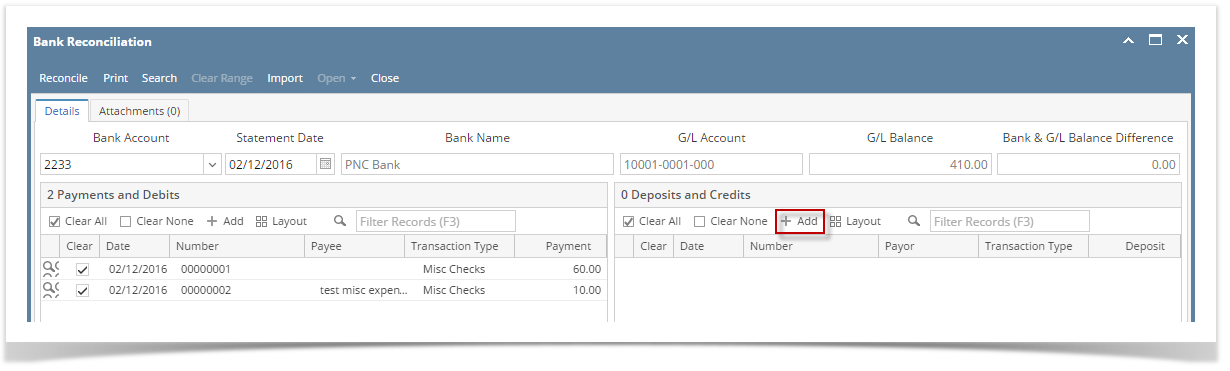

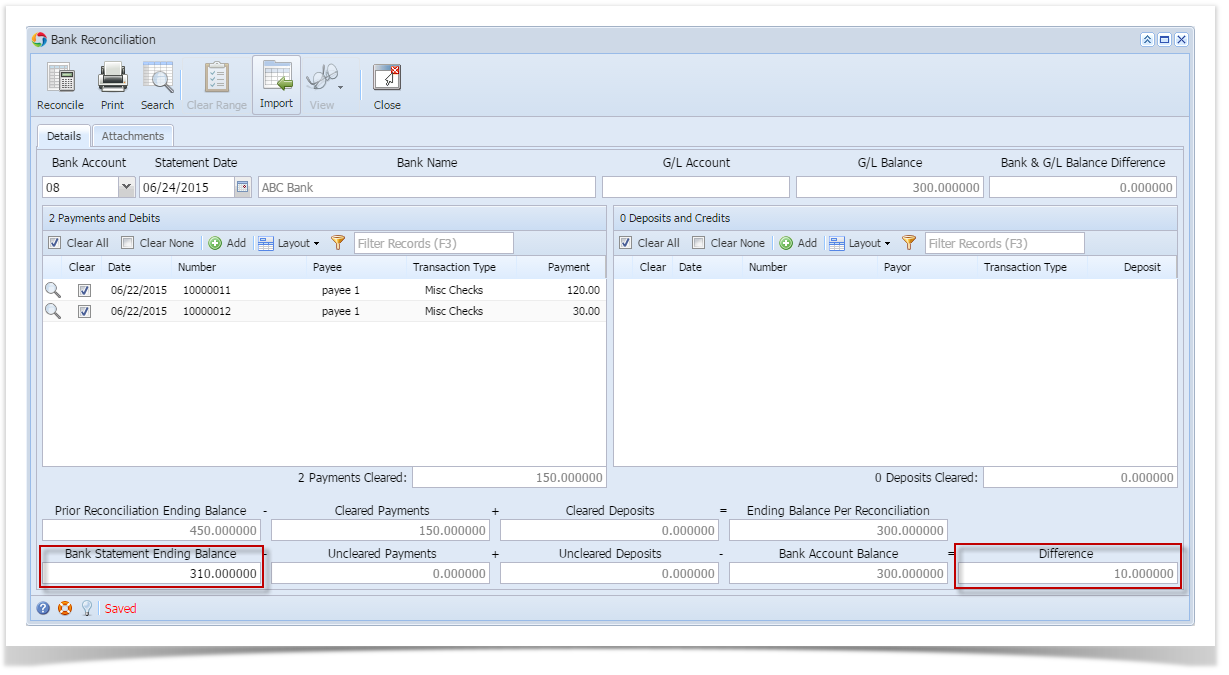

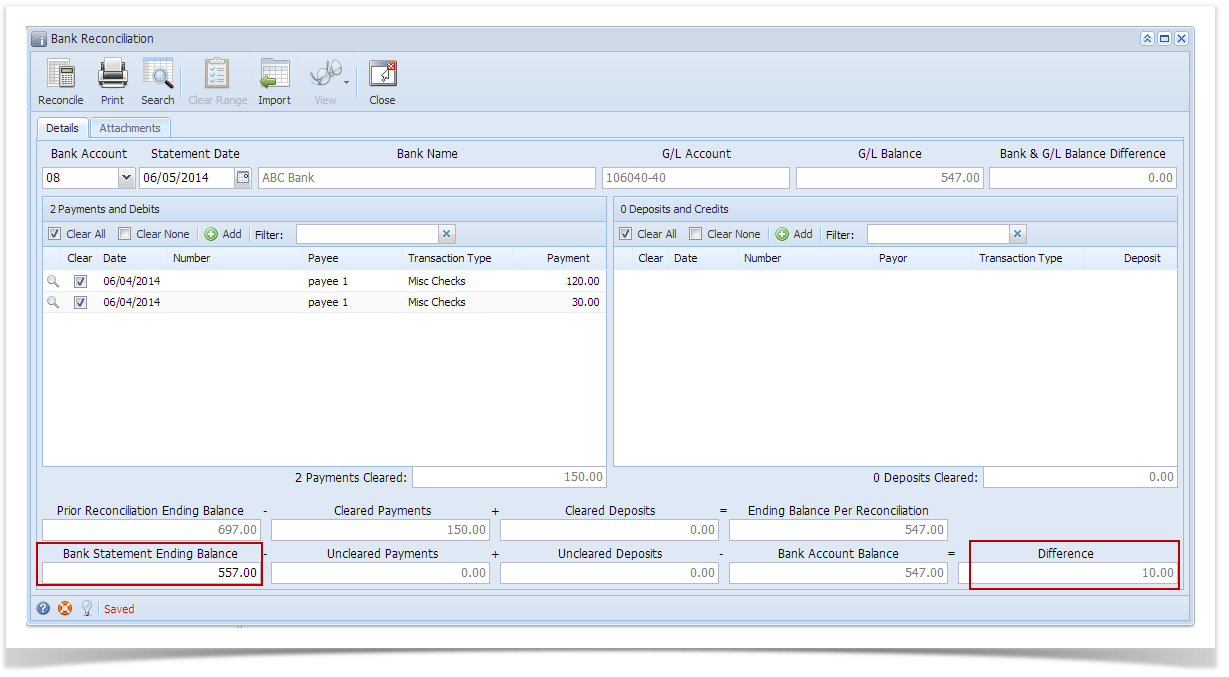

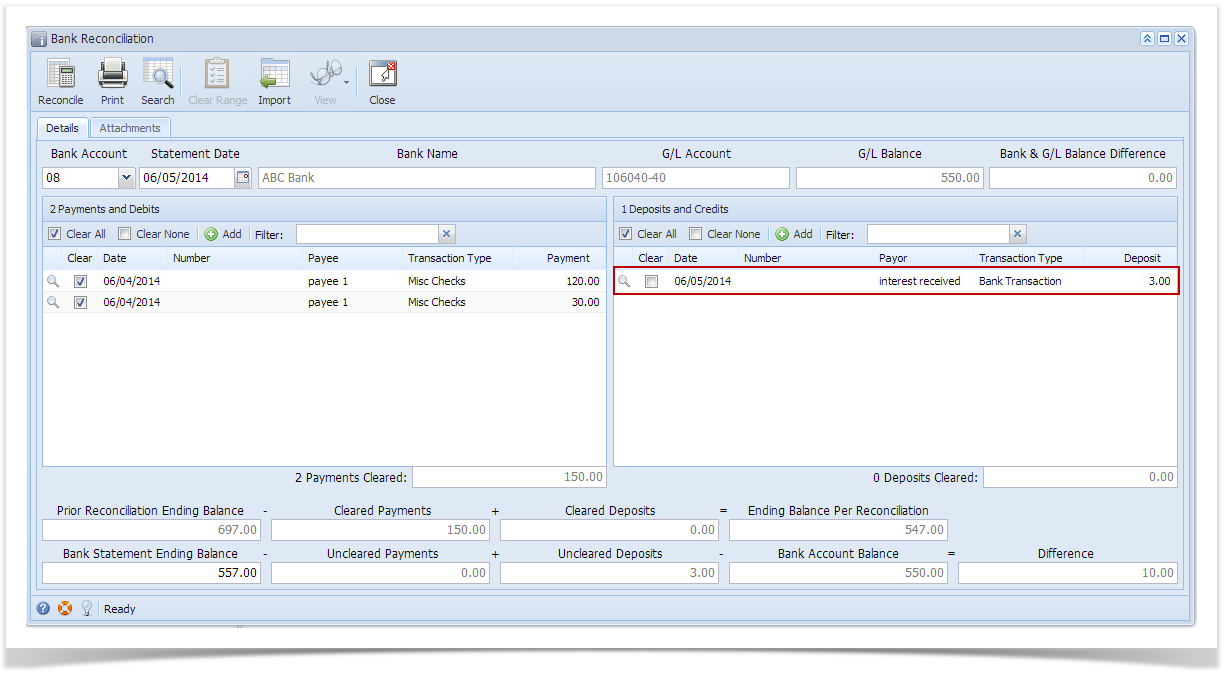

- In the Bank Reconciliation screen, Difference field shows -100.00. This amount is appearing on your Bank Statement as Interest gained, which is recorded by the bank but is not recorded in your book.

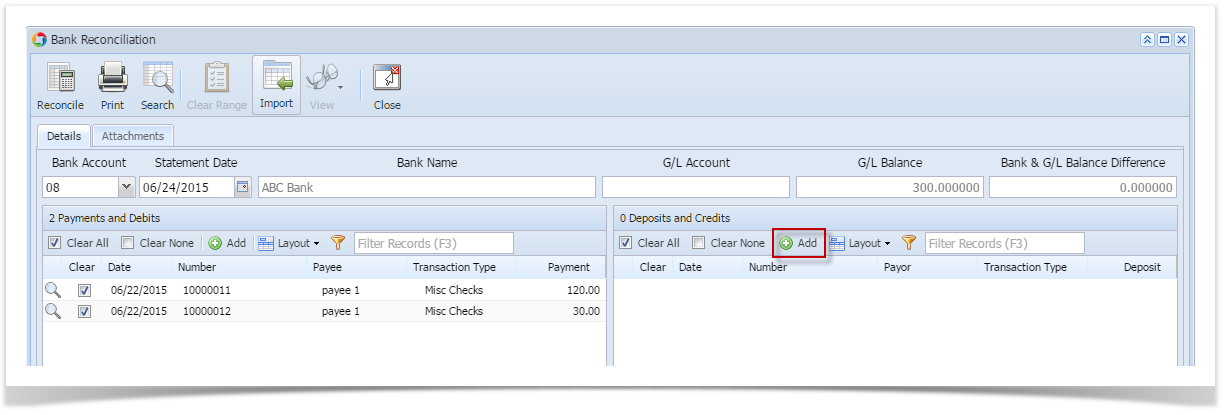

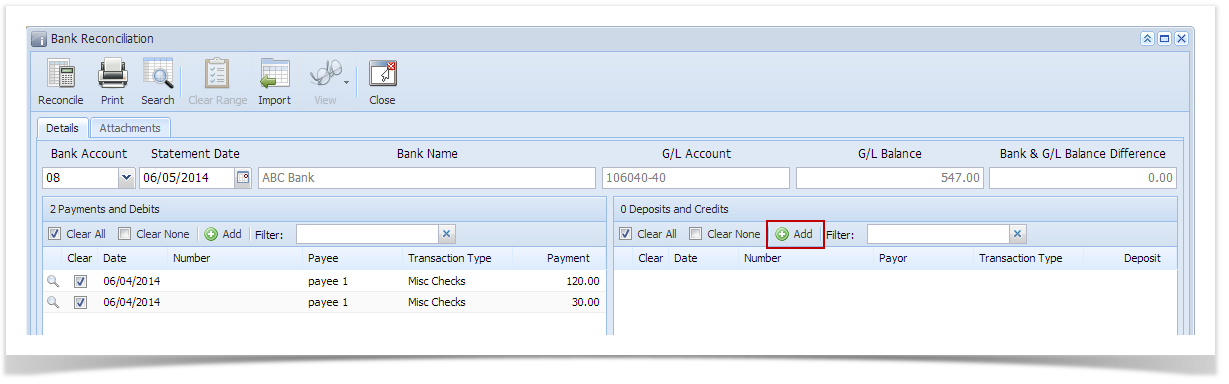

- To add this as additional credit for the bank account, click the Add button in the Deposits and Credits panel.

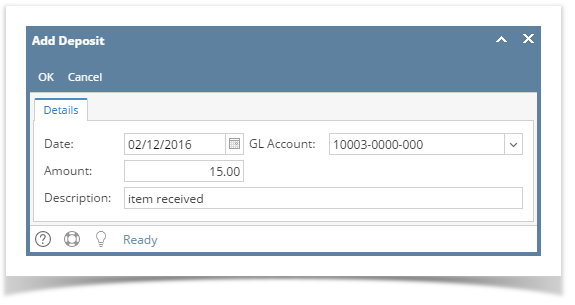

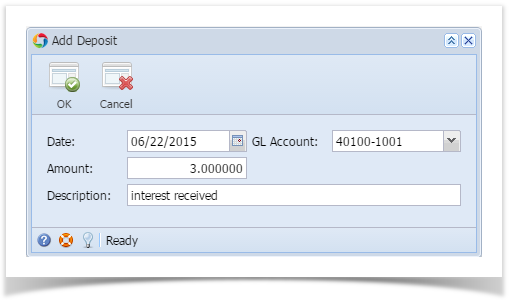

- The Add Deposit screen opens.

- Set the date of the transaction in the Date field.

- In the GL Account field, select the account that will be used as counter-entry for the bank account.

- Enter amount of deposit/credit in the Amount field.

- In the Description field, enter the description of this transaction.

- Click OK toolbar button.

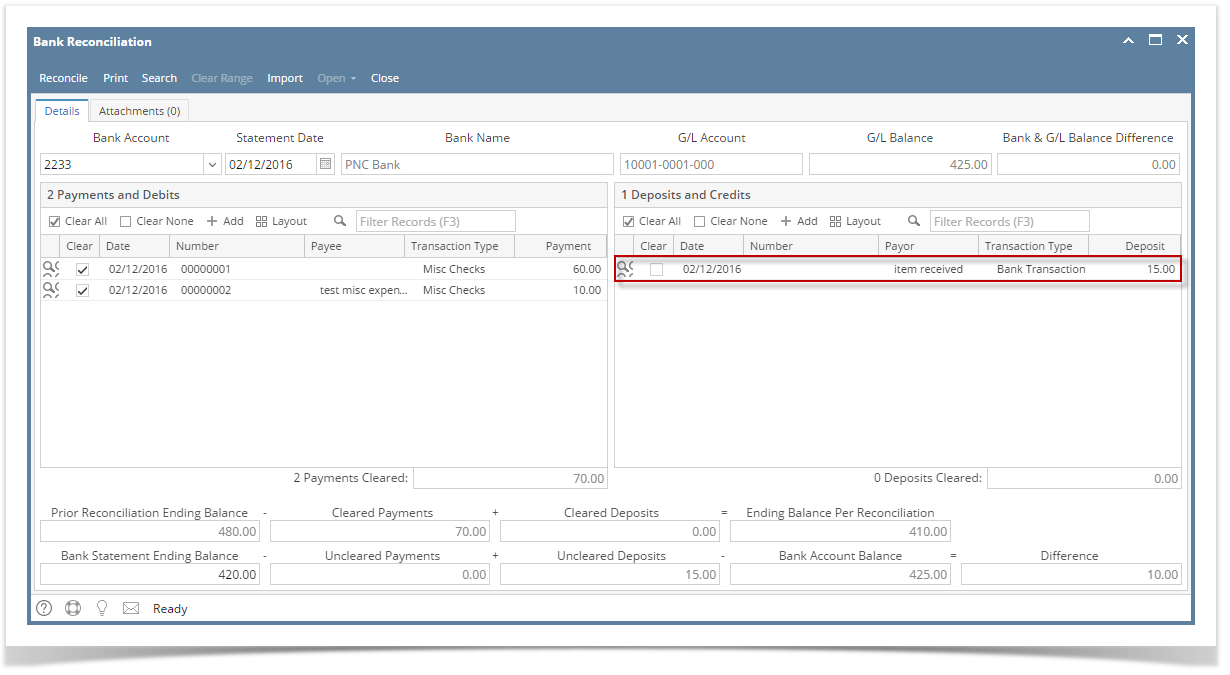

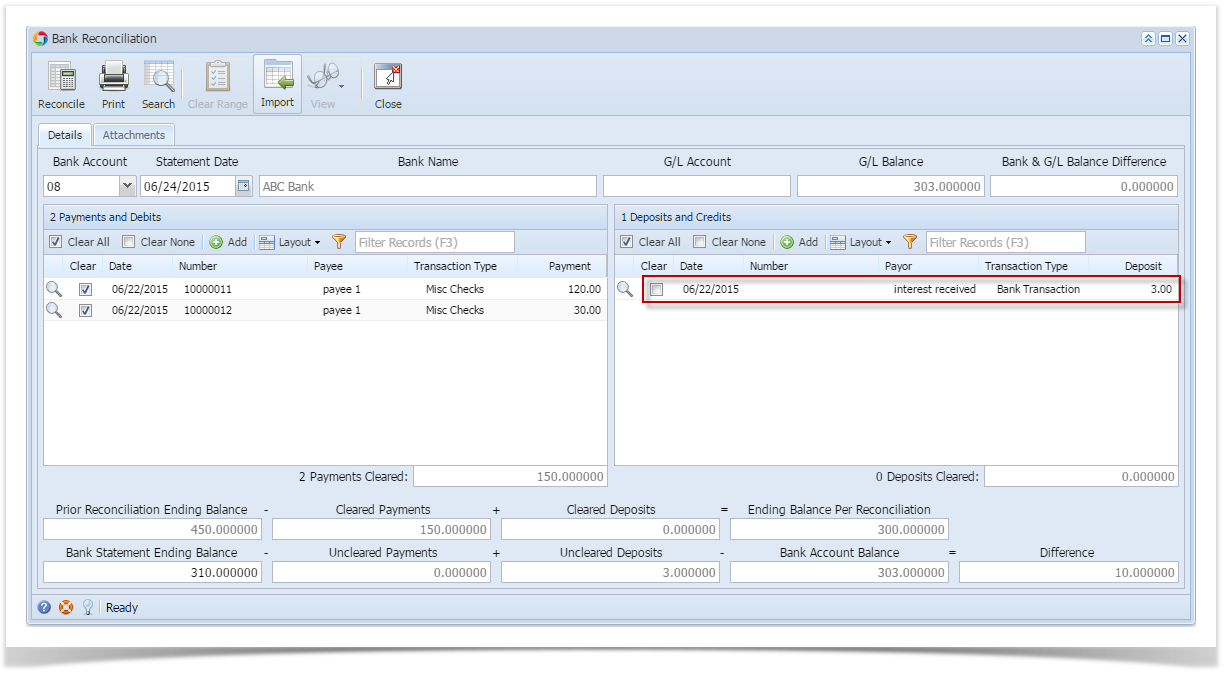

- The Add Deposit screen will be closed bringing you back to the Bank Reconciliation screen. The added deposit/credit transaction will then be shown in Deposits and Credits panel.

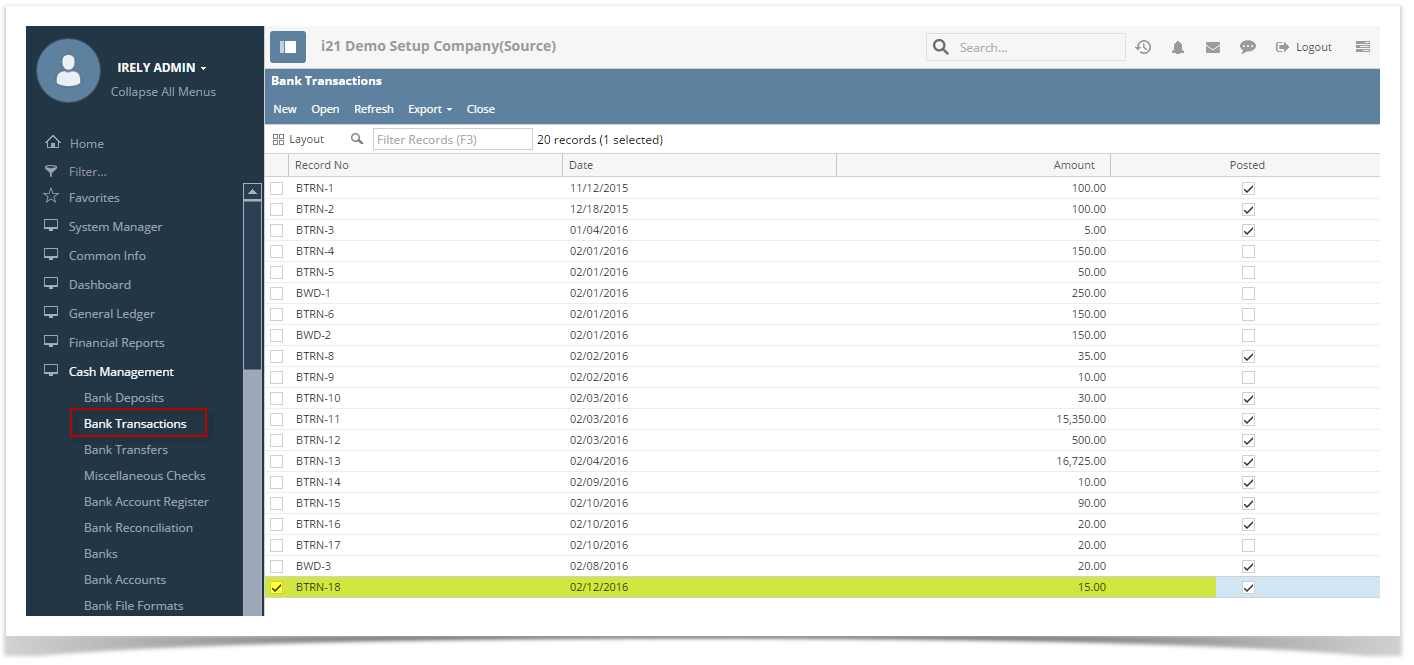

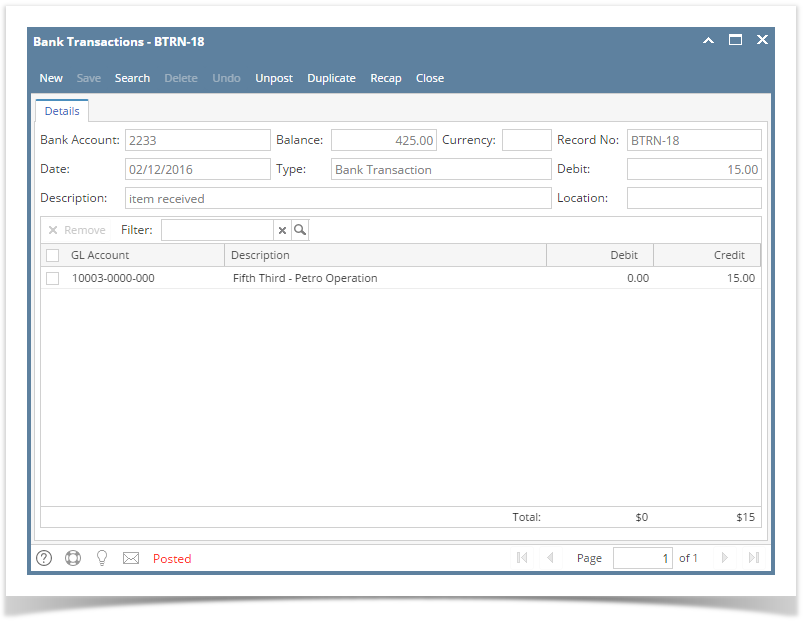

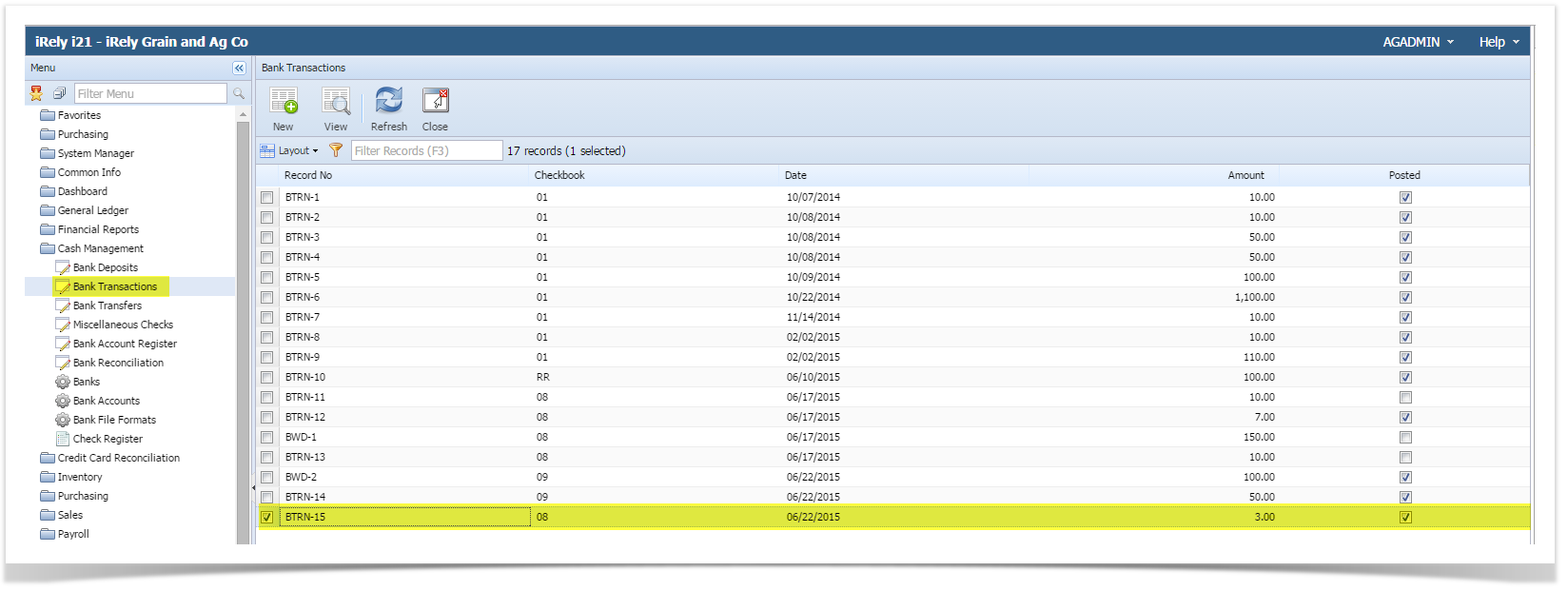

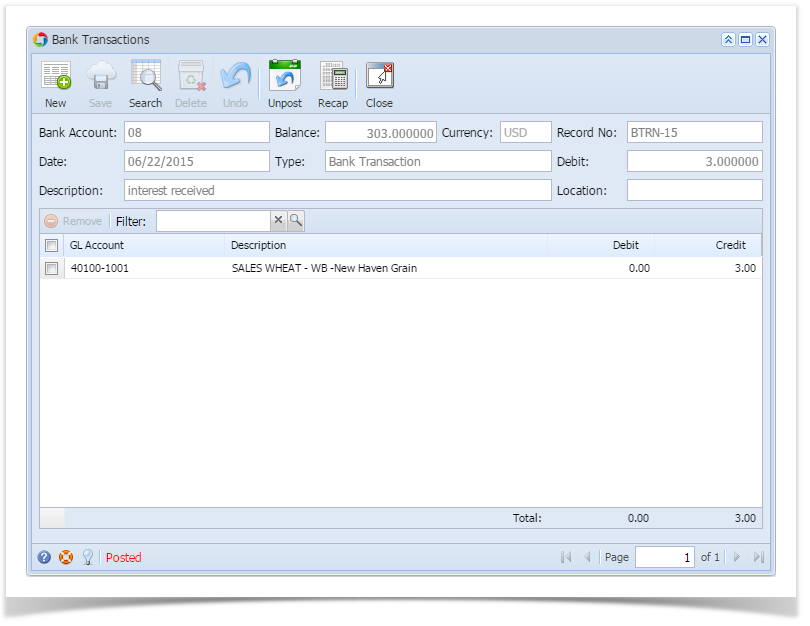

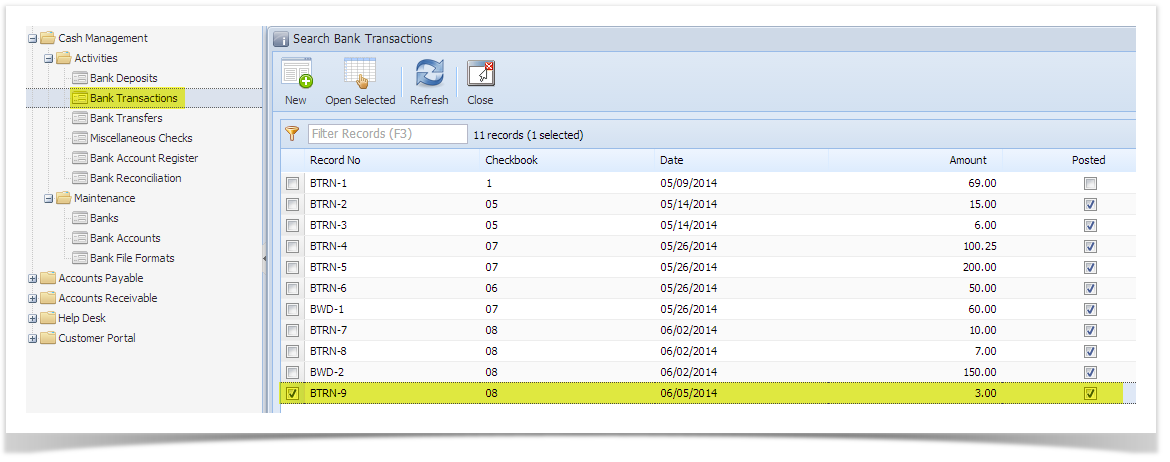

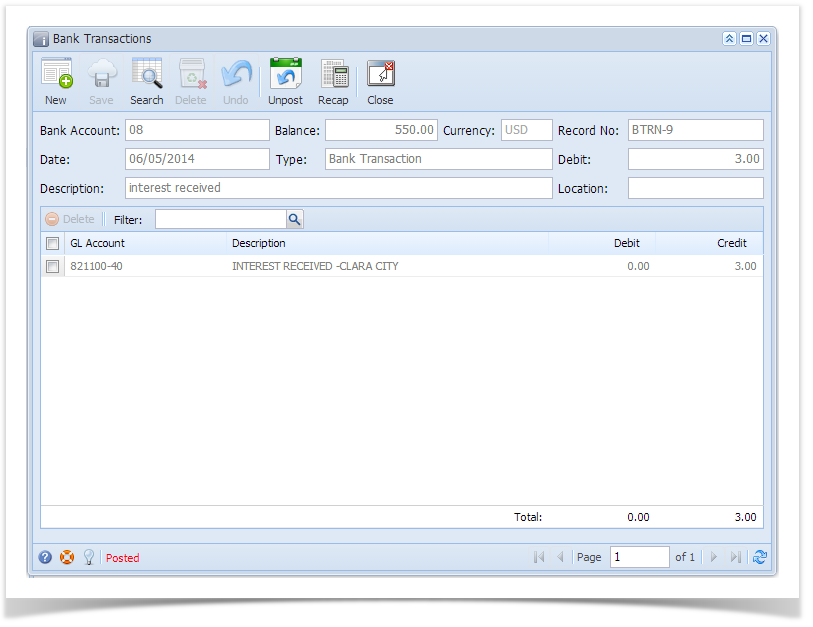

- Open Bank Transactions screen. It will show the added deposit/credit.

Overview

Content Tools