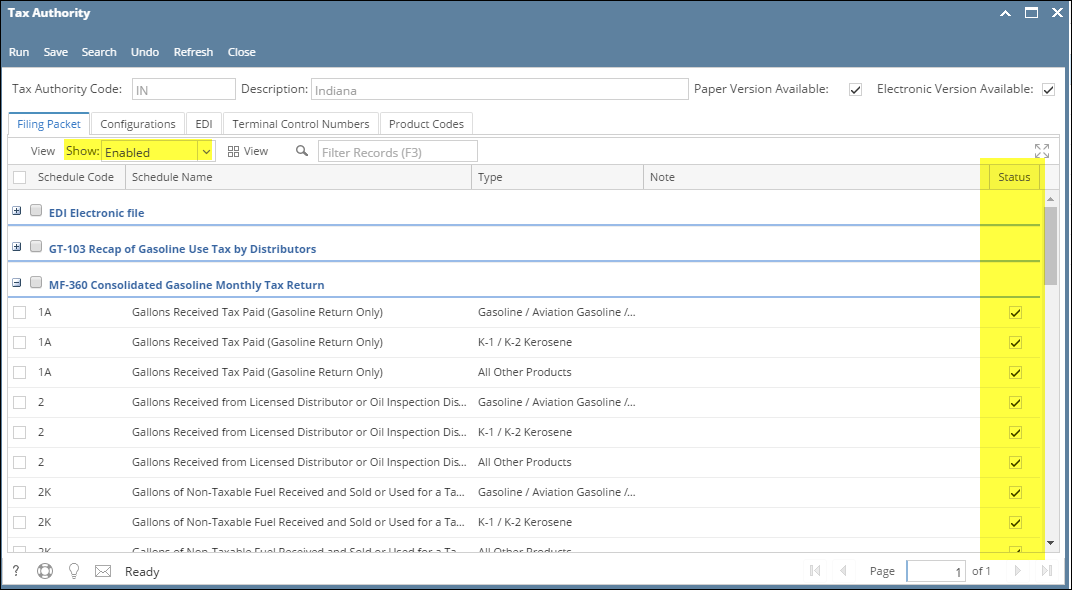

Each available state in i21 MFT has several Schedules and Forms, not all of which you may need. To reduce clutter, you can enable only the needed ones for your business, and disable unwanted ones so they are out of sight. When your business changes and you need to file new Schedules and Forms, simply re-Enable them and they will become available.

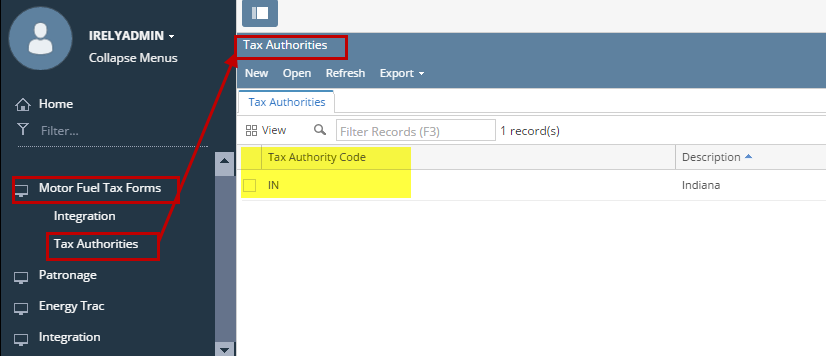

- Go to Motor Fuel Tax Forms menu, then Tax Authorities screen, select the state you file for, then click Open

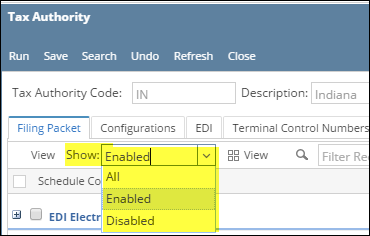

- By default, all Enabled Schedules and Forms are displayed. You can use the Show dropdown to display only Disabled ones, only Enabled ones, or All of them. The Status checkbox on the far right indicates if the Schedule or Form is Enabled (checked) or Disabled (unchecked).

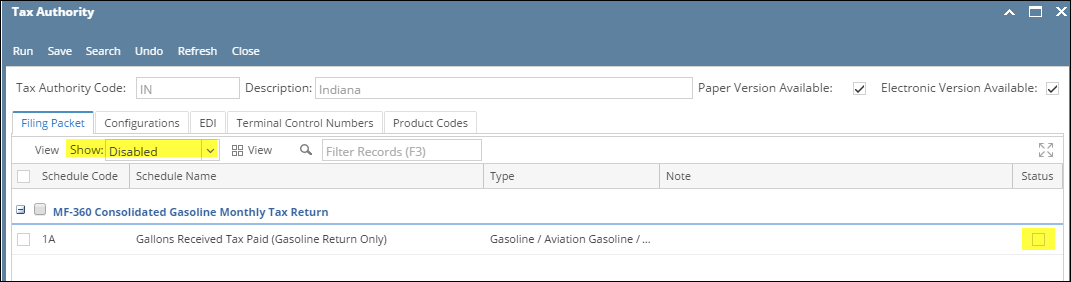

- To Disable a Schedule, uncheck its Status box, then click Save.

- To Enable a Schedule, first choose Disabled from the Show dropdown, check its Status box, then click Save.

Overview

Content Tools