Future transactions will be recorded in i21. Later, when the broker statement is received, the trades are matched to mirror what broker has matched, the broker statement is uploaded and reconciliation process happens. The aim – Gross unrealized and realized P&L in i21 should match with broker statement

Work flow

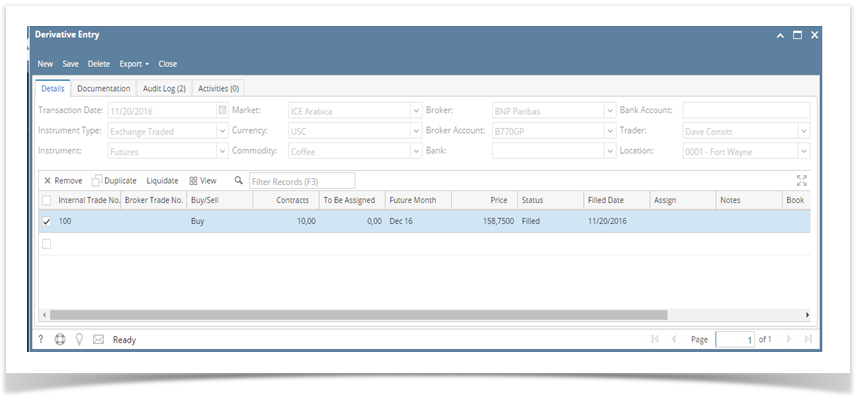

1- Long and short futures are recorded in i21 manually (in derivatives entry screen) as and when the orders /trades are placed with the broker

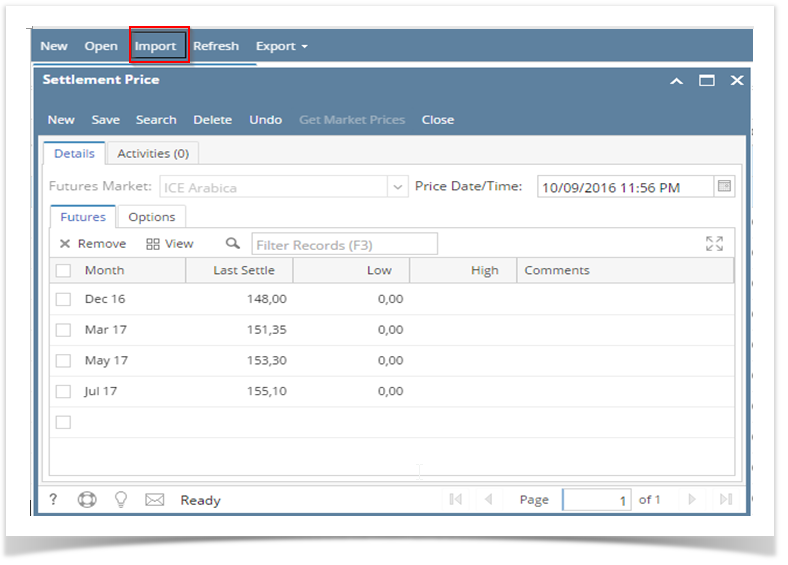

2- Settlement prices are uploaded in i21 via excel

3- The trading ends and next day the broker statement is received

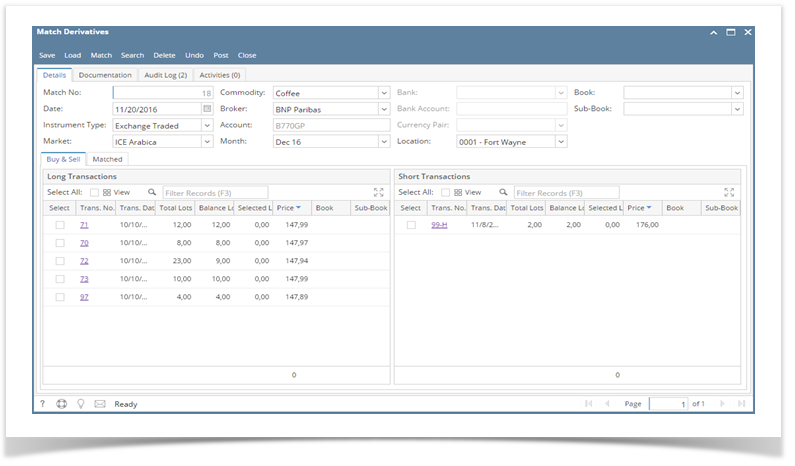

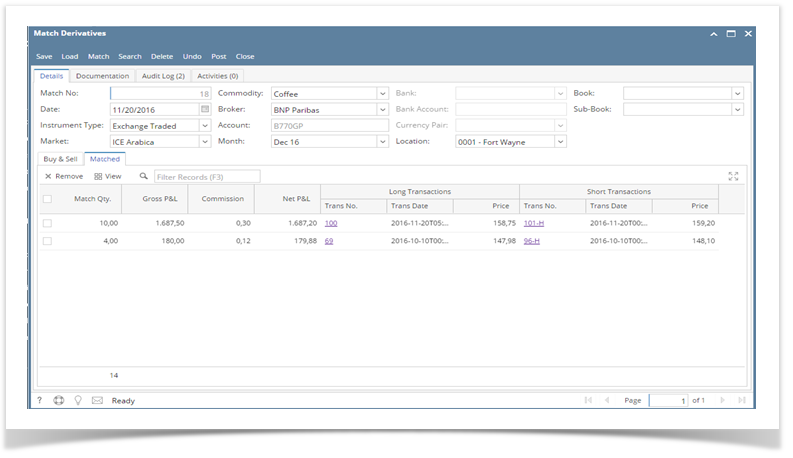

4- Looking at the broker statement, the user matches the long and the shorts using the match derivatives screen

- Here there are 2 sections (longs and shorts). The user can select the longs and shorts and click on match button. The transactions become realized and the result can be seen in the second tab “matched” and futures 360 in realized tab and realized column in summary tab.

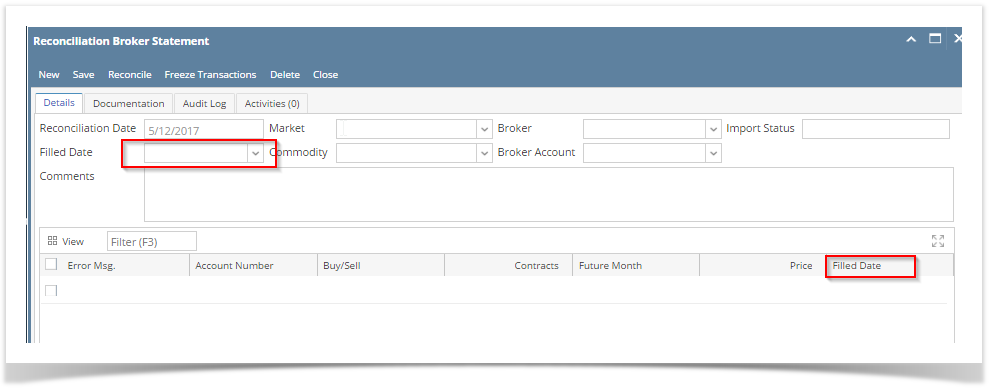

5- The reconciliation process begins. There will be a new button “Reconcile” in the derivative entry screen. User selects the date for which reconciliation should happen, upload the broker statement and i21 will make a comparison between trades in i21 vs trades in broker statement.

Note: Reconciliation done on a daily basis refers to all the transactions recorded in the previous working day

If the reconciliation is happening for 28th November, i21 will look at all unrealized transactions as of that time (not just unrealized transactions with filled date as 28th November) and for matched transactions, the match date should be 28th November (dates highlighted below for both the screens).

6- What gets compared

- For a, given market, month, broker name and account

- i. Number of transactions, level at which the trade was taken (matched)

- ii. The settlement price which was used to compute m2m for realized transactions

- iii. The gross profit (as we have agreed upon that no commissions will be recorded in i21, we will focus on gross only)