These are the needed setup for appropriate tax computation.

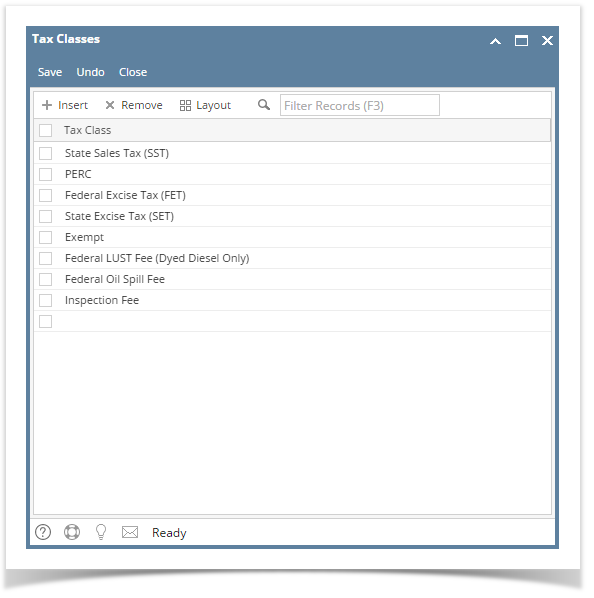

- Add a Tax Class.

A Tax Class group tax codes together under a common classification. These Tax Classes are also assigned to the item categories to identify what taxes the item will be taxed by in the tax group.

Here is a sample Tax Class setup. - Add a Tax Code.

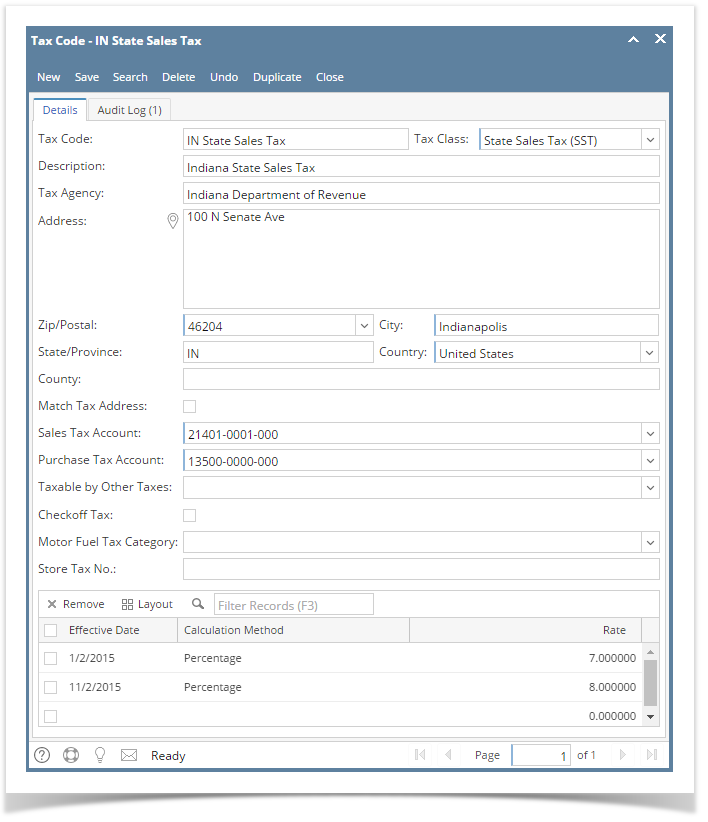

Tax Codes serves as the building block for the tax system.

Here is a sample Tax Code setup. - Add a Tax Group.

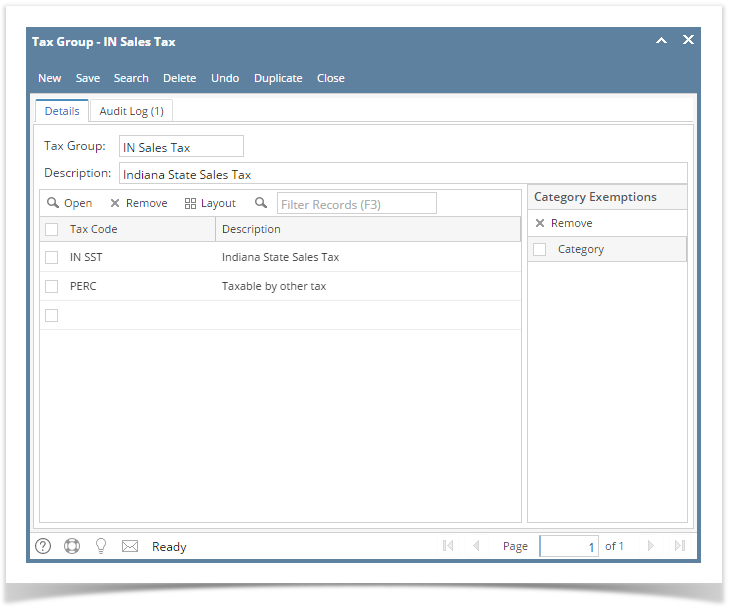

Tax Group is comprised of a set of tax codes. A tax group is made up of all possible tax codes that could be taxed at a location. A tax group can be assigned to each customer location or vendor location and should include all possible taxes that could be taxed at that location.

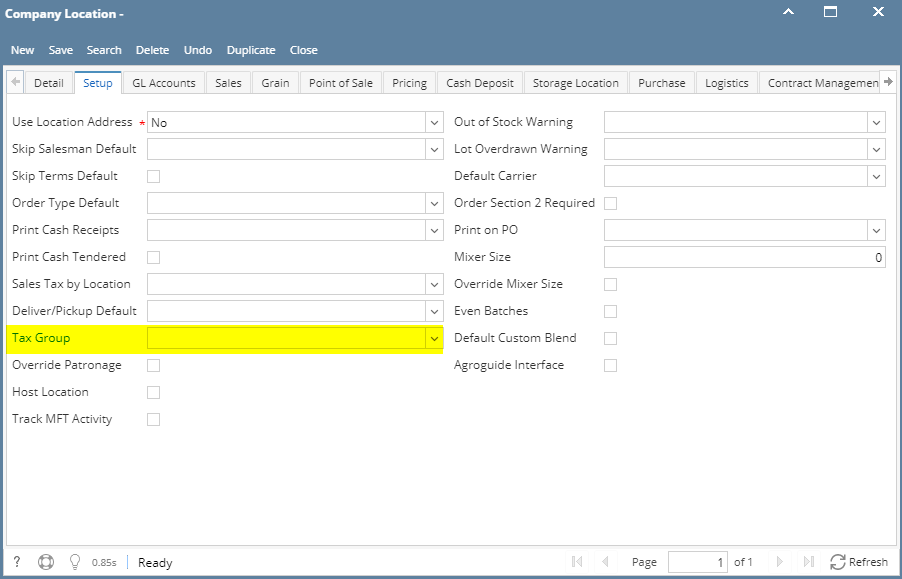

Here is a sample Tax Group setup. - Assign a Tax Group for each Company Location. This will be used as default tax group for either purchases or sales. This will be used depending on the Freight Terms indicator setup for the customer or vendor location. More information below.

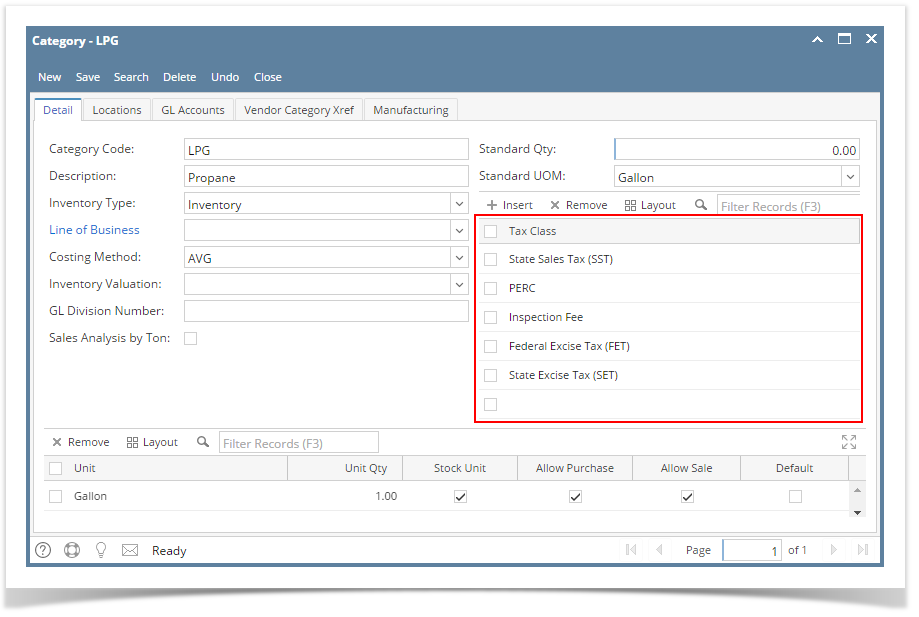

Common Info > Company Location > Setup - Assign appropriate tax classes to the Item Categories.

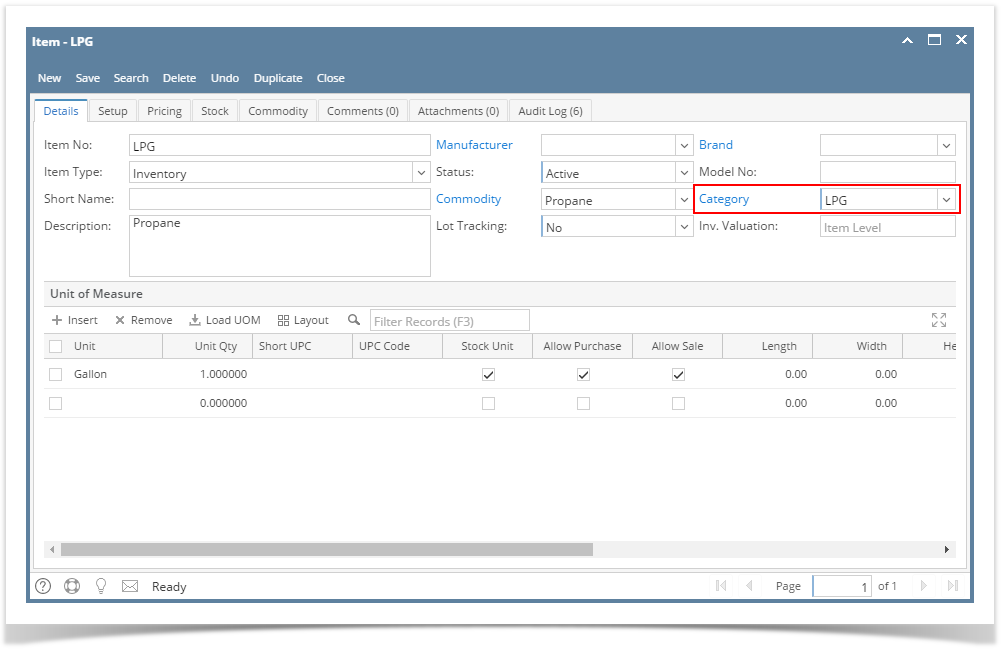

Item Categories are assigned Tax Classes to identify what classes of taxes the item will be taxed. Note that you can assign multiple tax classes to a category. - Assign the appropriate item Categories to the Item.

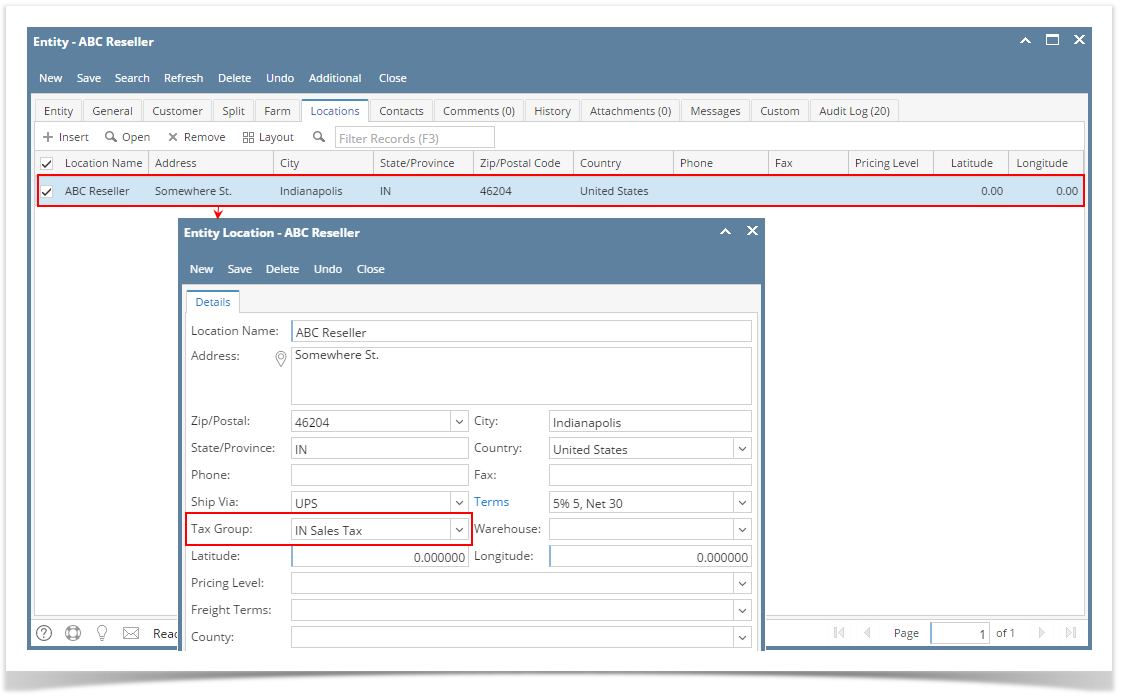

The Item will then be taxed the tax classes set on the item category. - Assign the appropriate Tax Group to the Entity Location (customer or vendor location).

Assign the correct tax group to each location based on location address.

To open the Entity Location, open the Customer record | navigate to Locations tab.

NOTE: Freight Terms field determines which tax group to use for the customer location or vendor location.

Customer Location- Freight terms = Origin Type = Charging company location tax group.

- Freight terms = Destination type = Charging customer location tax group. If blank customer location, no taxes will be charged.

Vendor Location

- Freight Terms = Origin type = Charging Zeeland the vendor locations tax group.

- Freight terms = Destination type = Charging Zeeland company location tax group.

Overview

Content Tools