Follow the below steps to create a options life cycle

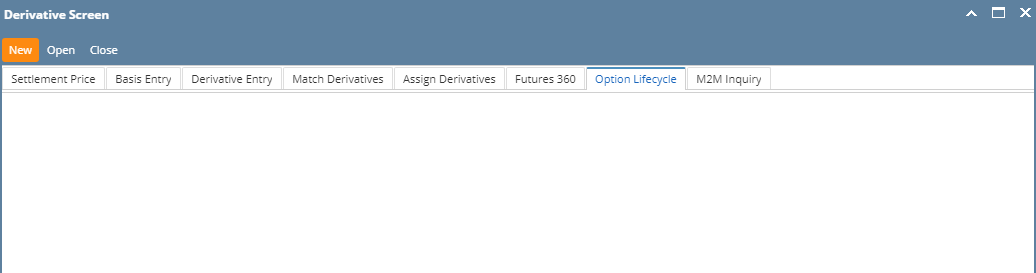

- Open the Derivative screen and click on the tab Options life cycle .

- Click on New button

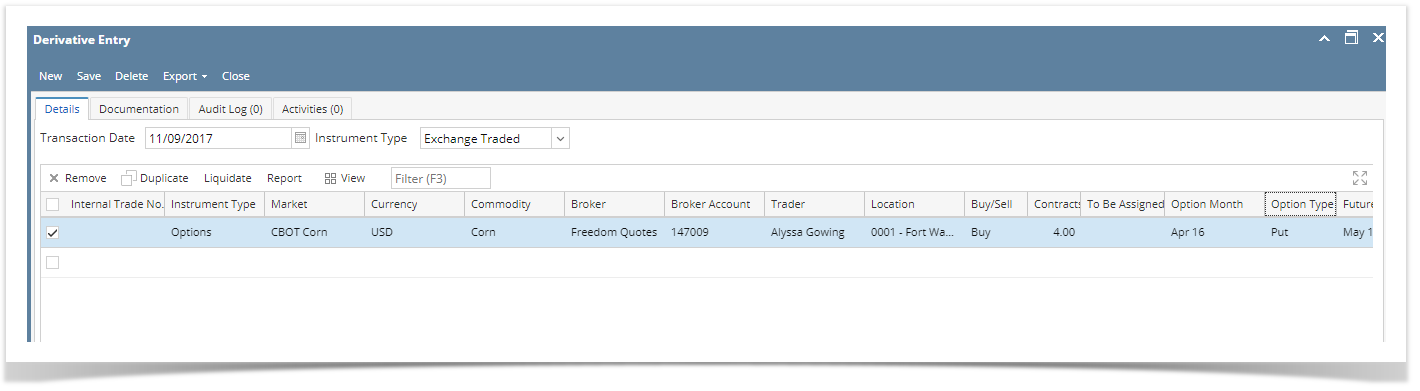

- Create an option transaction in the Derivative screen.

- Create an options with buy - Call or buy put

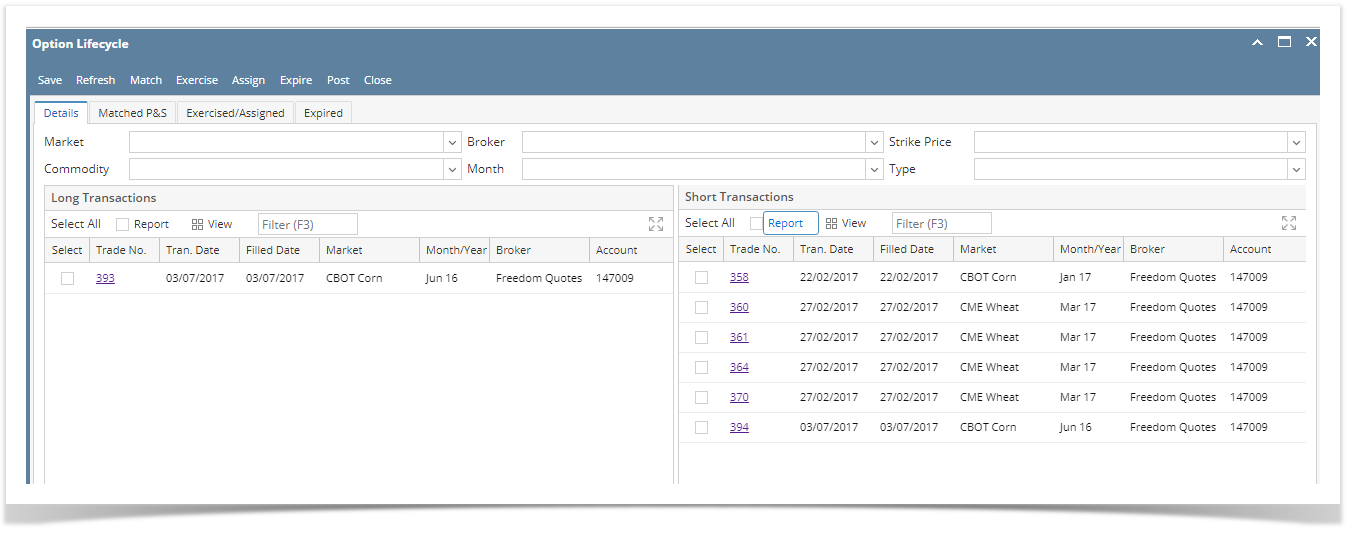

We can see the above trades in the Long side of the grids.- Create an options with sell- Call or sell put, we can see those in the short side of the grid

How to Match the options

Select the Long transaction and short transaction

system will have to validate that upon clicking Match P&S button that user selected transactions of the same market, month, location, commodity, broker, account, type, and strike price.

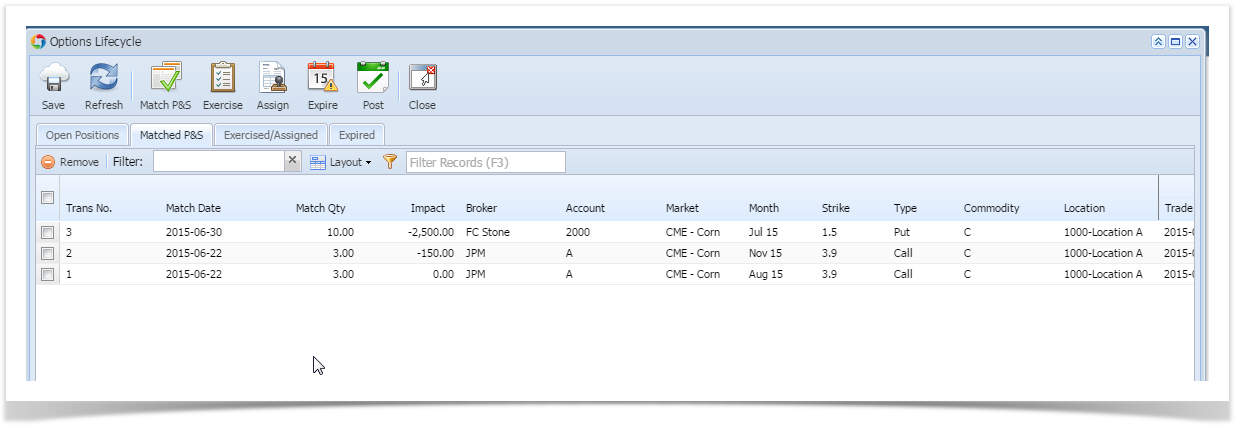

After success full match pns , the transactions selected will be removed* from this screen and placed on the Match P&S tab

If user has selected less than all of the Open Lots on a specific transaction, then the transaction will remain on this screen but open lots will be reduced by the quantity that has been matched. The transaction will also appear on the P&S screen for the amount of P&S'd lots.

How to Exercise / Assign an option .

From a system standpoint, exercise and assign processes are fundamentally the same - removing an options transaction from the position and replacing it with a futures transaction. If that option is a long option, it is called "Exercise;" if the option is a short option, it is called "Assign."Rules for Creating Futures when options are Exercised or Assigned

- Transaction number for futures = next number in the sequence with a prefix O (o for option)

- Price of futures equals strike price of the option

- Date of futures transaction equals date of exercise or assign

- Number of futures lots or contracts = number of options lots of exercised/assigned transaction

- Commodity, Location, Broker, Account, Book, Ssub-Book of futures all equal same as original option

- The futures market is the one that the options market is linked to

- The futures month/year is

- Same as the option month/year if it exists for the futures market

- If it doesn't exist, it is the next month (into the future) that does exist

- Reference field (a text or notes comments field) of the created futures transaction should contain information pertaining to the options exercise/assign: "This futures transaction was the result of Option No. (Options Transaction number) being exercised on (date)." Substitute the word "assigned" for "exercised" if the option was assigned (that is, a short option).

- The futures direction, long (buy) or short (sell) depends upon the option particulars....see table below

The Long and Short of it:

Option DirectionOption TypeTransaction NameFutures DirectionLong Call Exercise Long Short Call Assign Short Long Put Exercise Short Short Put Assign Long

How to Expire an optionsWhen an option expires, it basically goes away - no futures are created.

- Create an options with sell- Call or sell put, we can see those in the short side of the grid

Overview

Content Tools