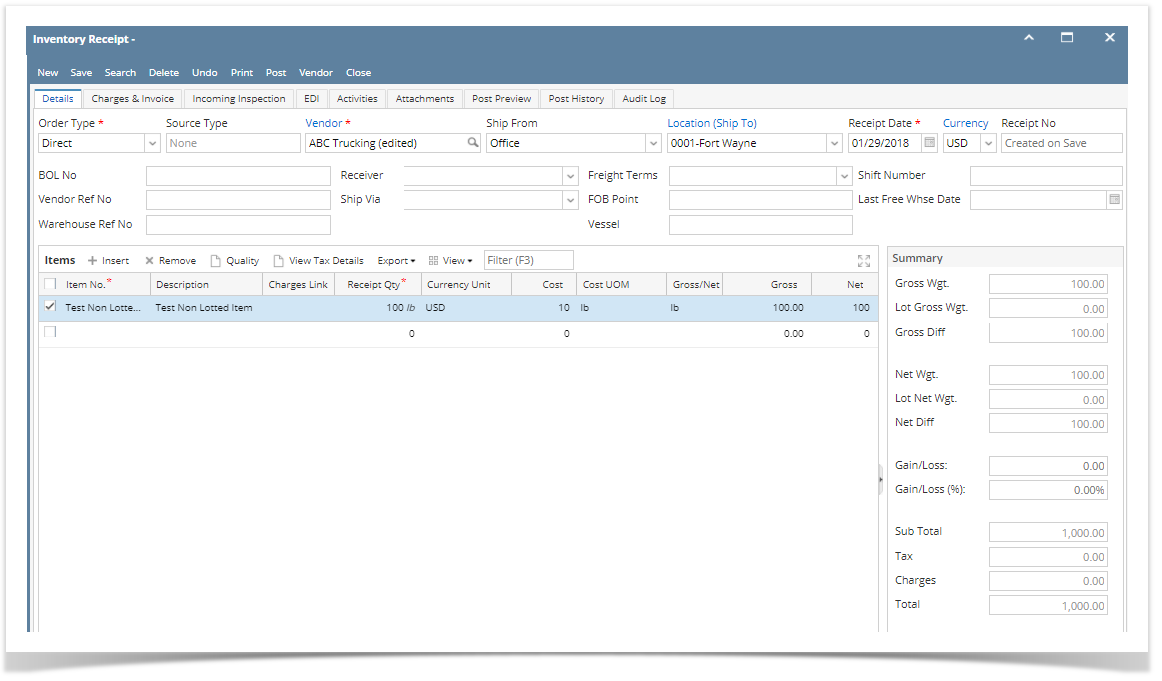

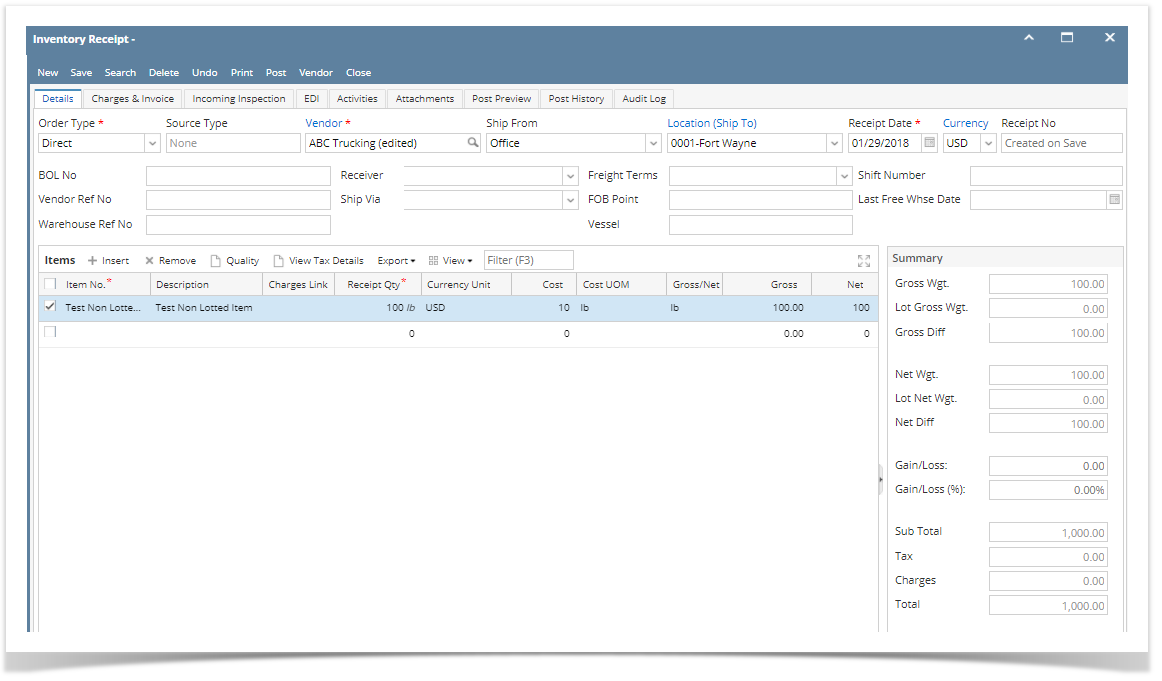

The following will detail Other Charge added as Other Expense to the item purchased and be payable to the Vendor where item is purchased. - Create Inventory Receipt. Select an item.

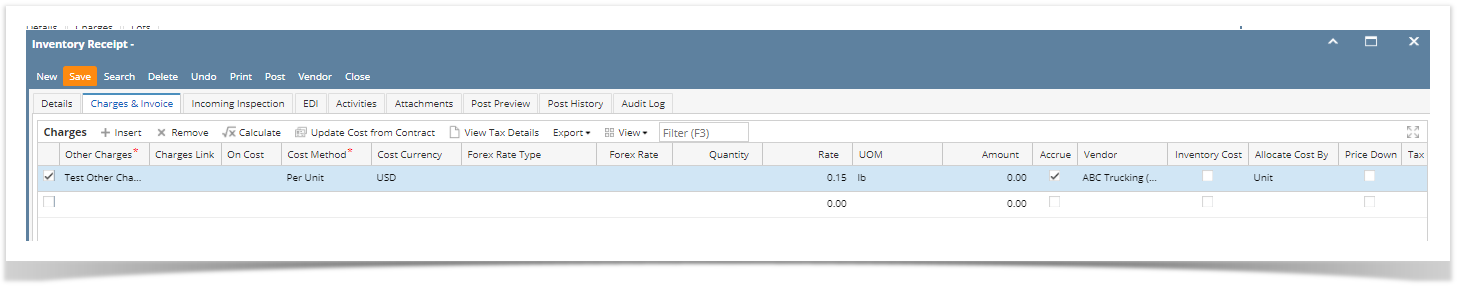

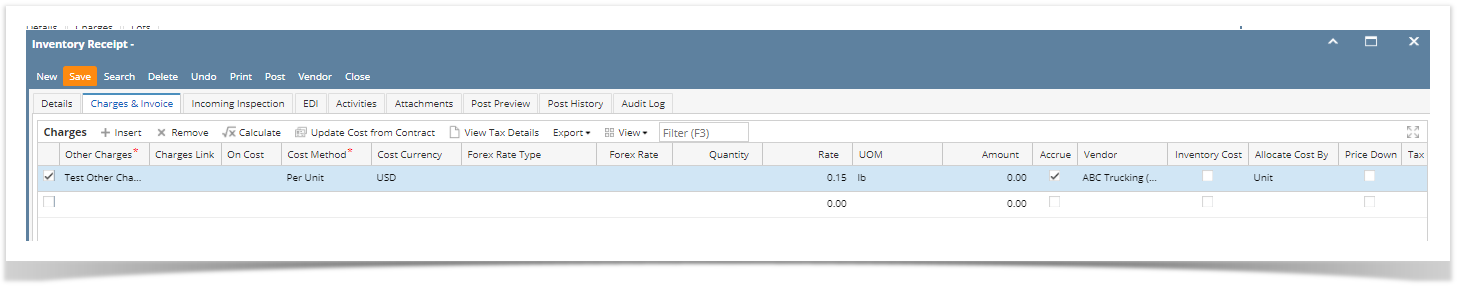

Image Removed Image Removed Image Added Image Added - Go to Charges & Invoice tab and select an other charge item. Setup the other charge item to have:

- Inventory Cost is unchecked

- Accrue checkbox is checked and vendor selected is the same vendor where the item will be coming from.

- Price Down is unchecked

Image Removed Image Removed

- Posting Inventory Receipt with this scenario will only record the item purchased.

Image Removed Image Removed - Post the Inventory Receipt and process it to Bill by clicking the Bill toolbar button.

Image Removed Image Removed

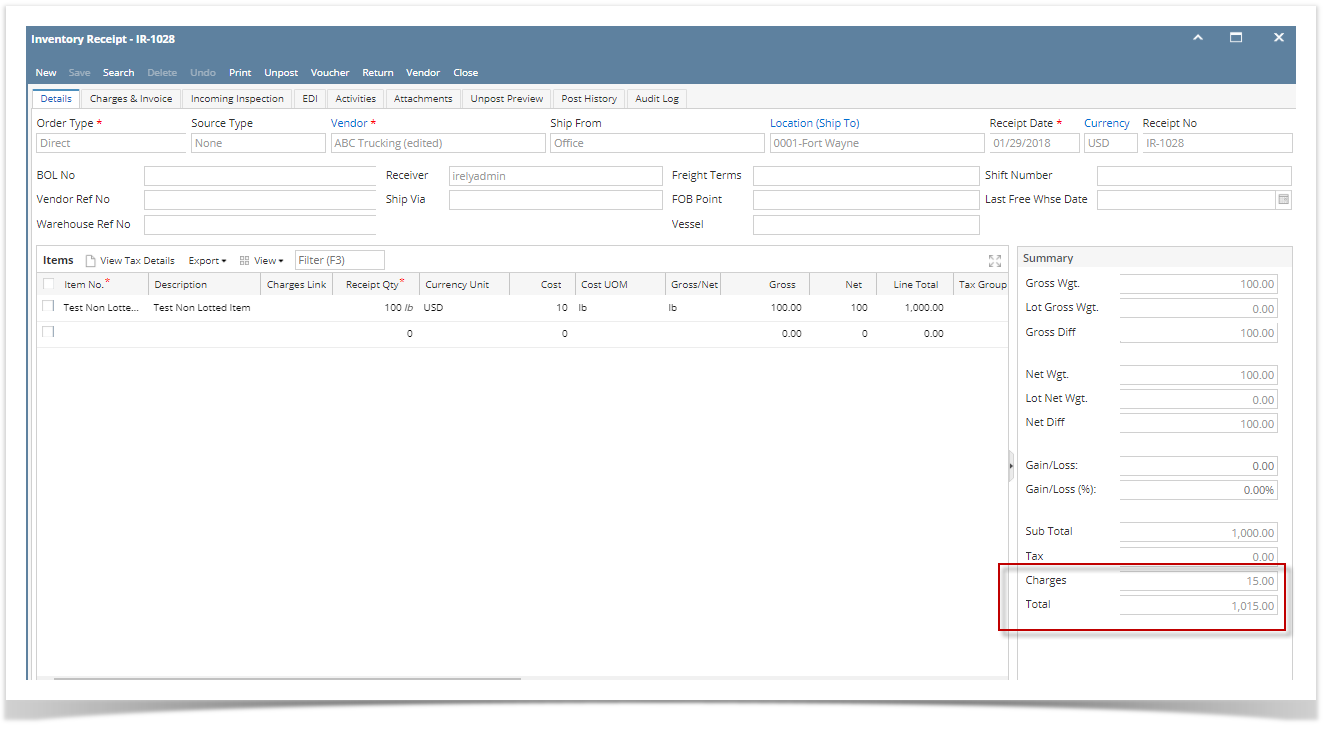

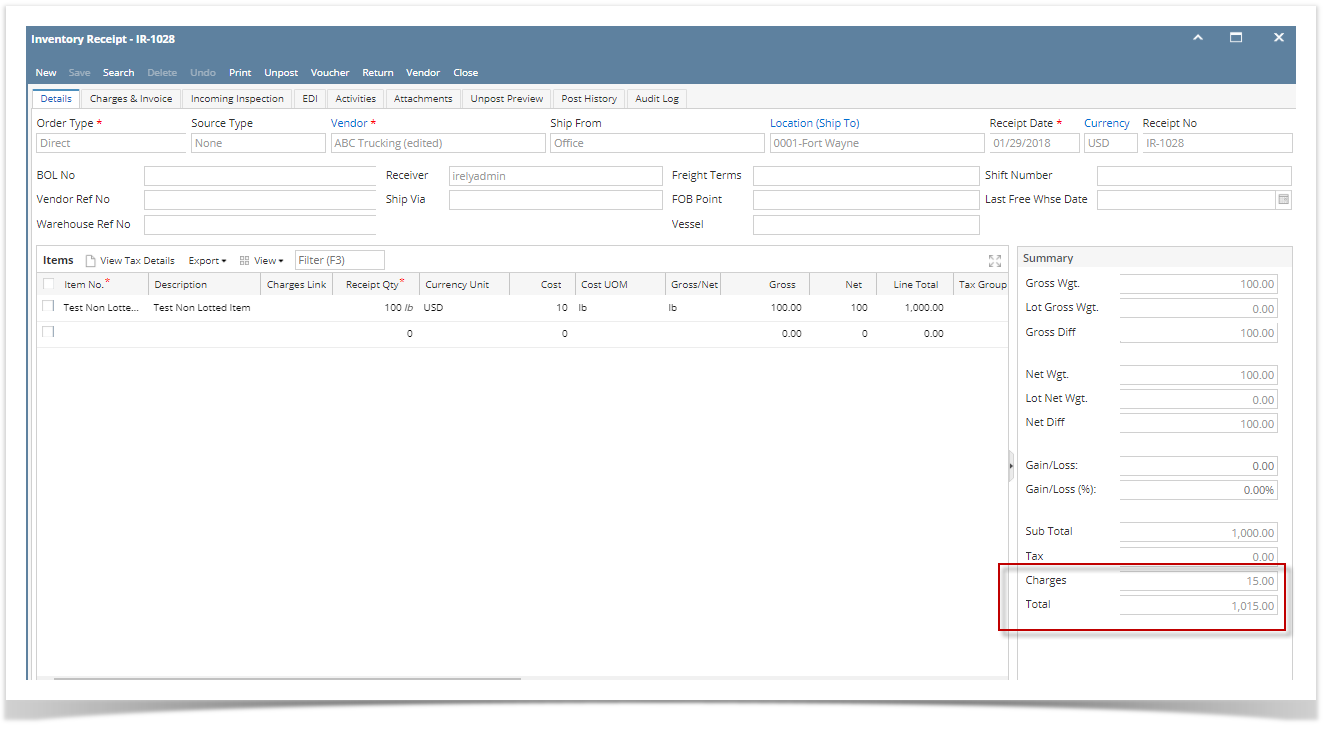

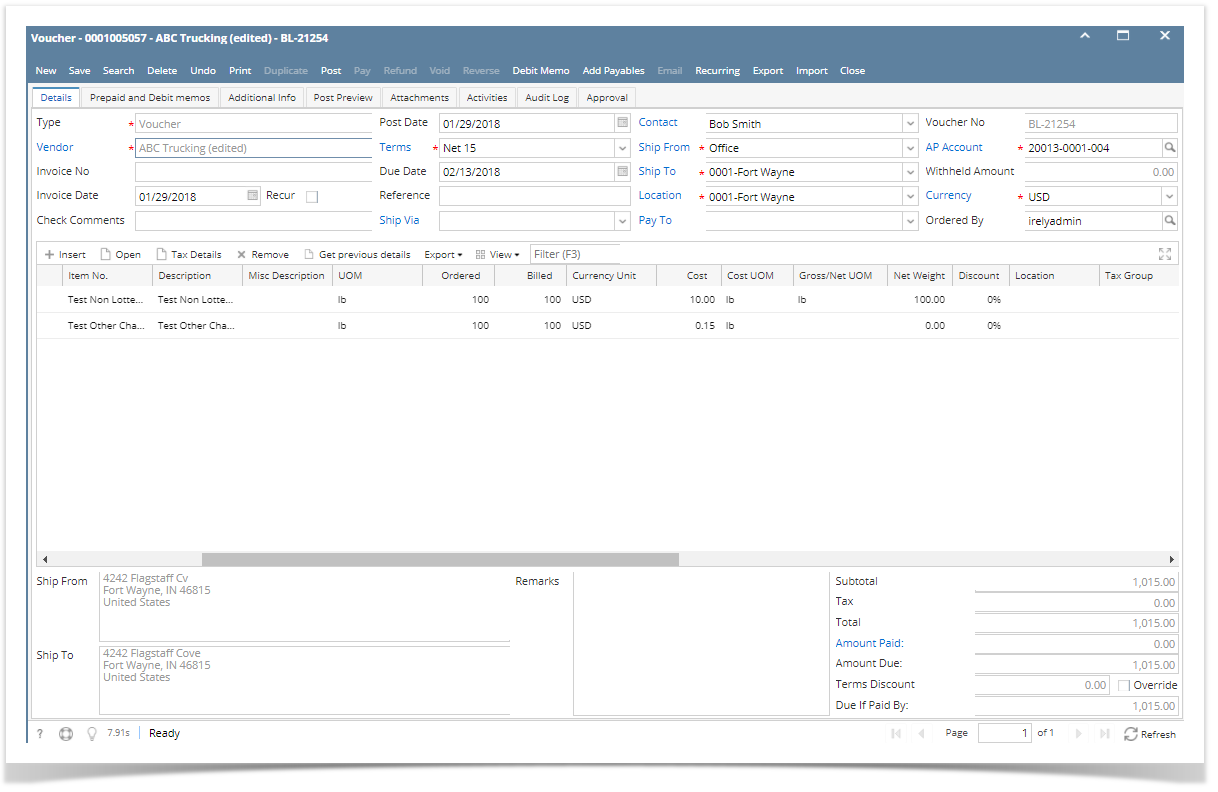

Notice also that in the Detail tab, there is the Total Charges shown. That same amount is the total Charges added in the Charges & Invoice tab. - This is the Bill created. Notice that the Other Charge is added as a separate line to record the Other Charge incurred.

Image Removed Image Removed  Image Added Image Added

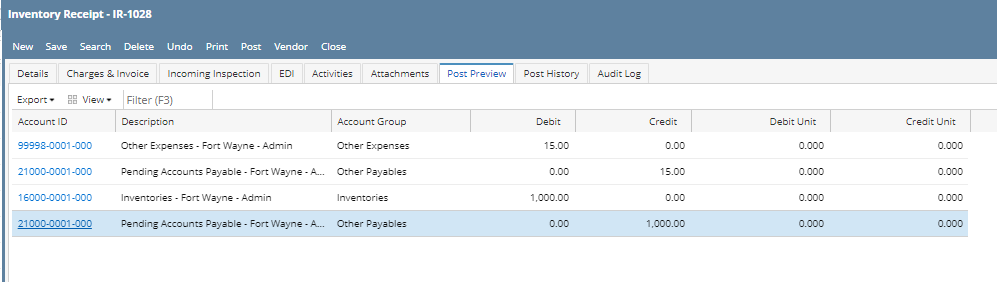

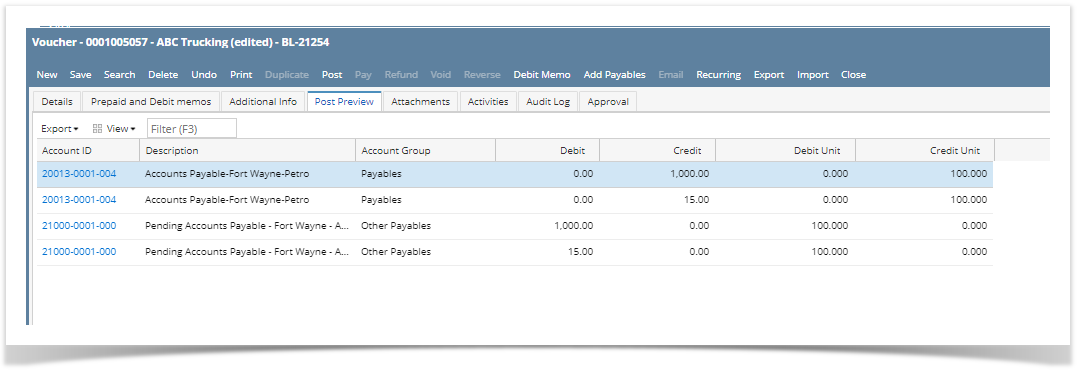

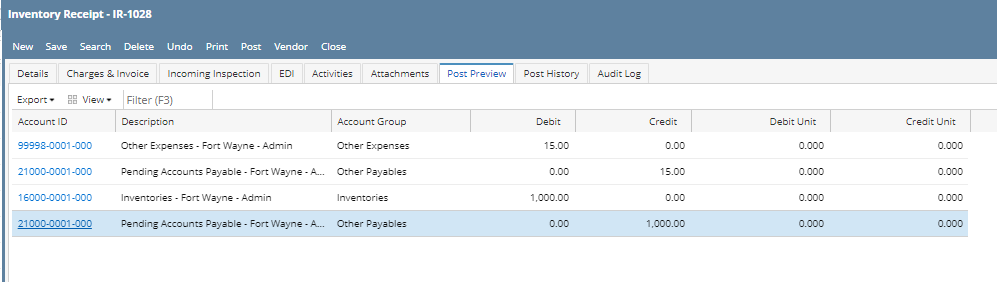

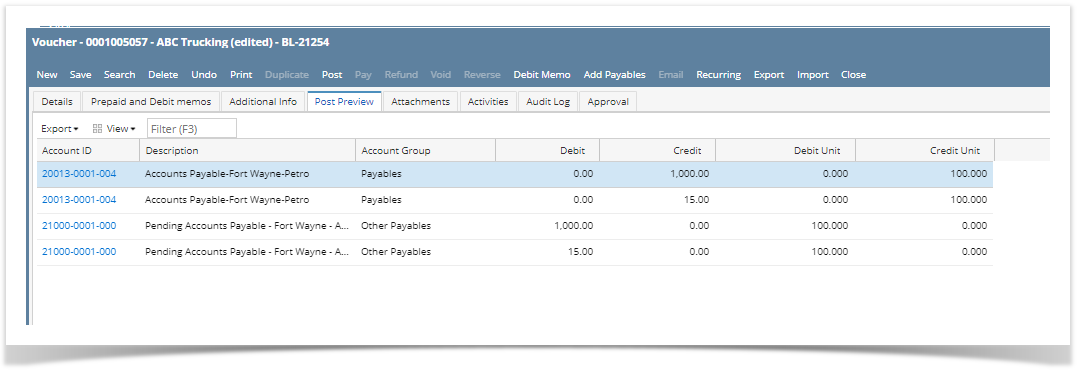

- Click Post Preview. GL Entries should look like this.

Image Added Image Added - Post Inventory receipt. Go back to details tab, other charge should be included in the total of the receipt.

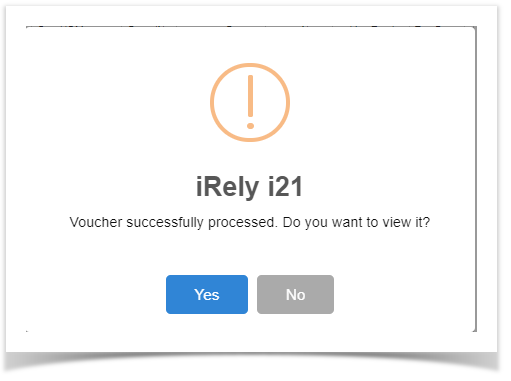

Image Added Image Added - Click Voucher Button to create voucher. This message will be shown.

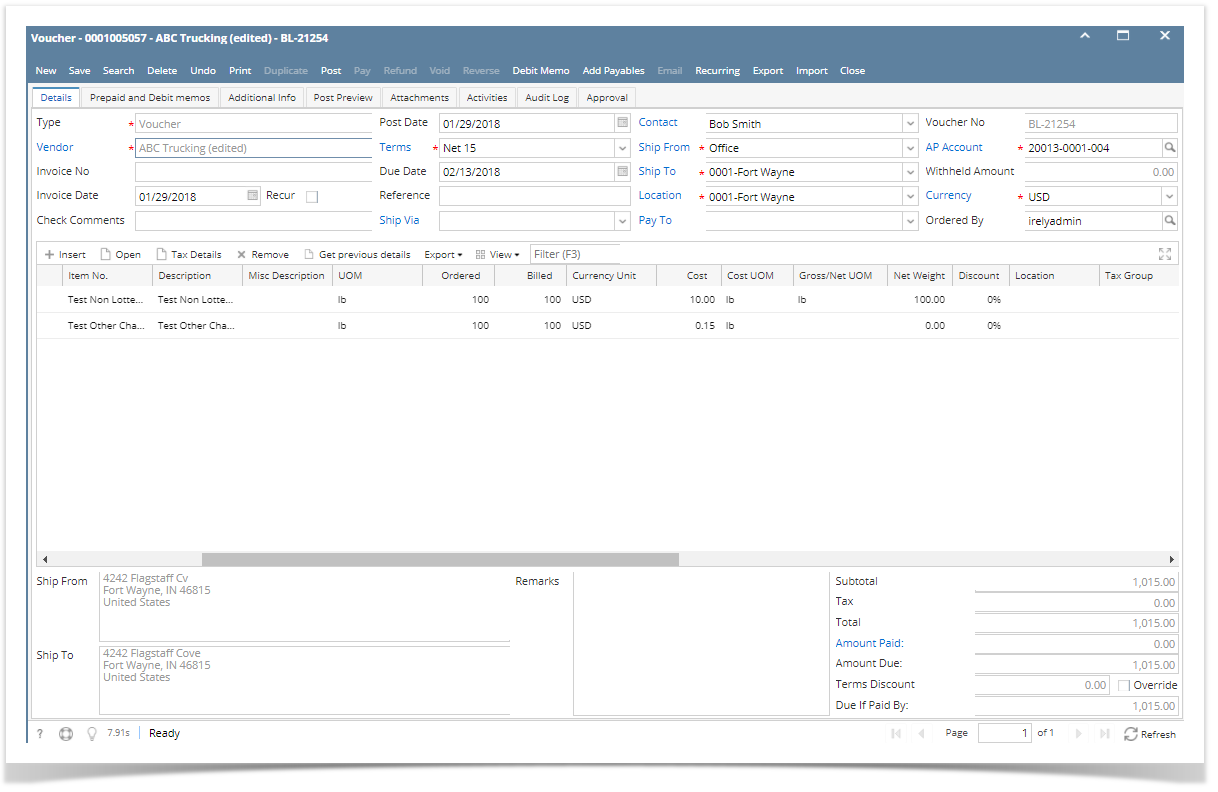

Image Added Image Added - Click Yes. Voucher will be created.

Image Added Image Added - Click post preview tab, this voucher Posting this Bill will record the Other Charges incurred in bringing the item to the company location. The amount of the Other Charge plus the amount credited to AP Clearing account from the Inventory Receipt is summed up and is passed to Accounts Payable.

Image Removed Image Removed Image Added Image Added - Click Post button to post the Billvoucher.

Image Removed Image Removed

|