Page History

...

- From the Main Menu, expand Purchasing and click Pay Voucher Details to open Search Pay Bill Voucher Details screen.

- Click New toolbar button to open blank Pay Voucher Details screen.

- Fill in fields.

- Click on Vendor No. combo box button and select vendor with withholding setup.

- Date Paid will default to today’s date. Change date if necessary by selecting from the mini calendar dropdown or by entering the date manually.

- All posted bill transaction for the selected vendor will be displayed on the grid. Payment Method set for the selected vendor as well as the Vendor Credit will automatically be displayed.

- In any case that payment method is set to Check, the Print toolbar button will be enabled to allow printing of checks.

- If not, then Print button will be disabled.

- On Bank Account field, click combo box and select a bank account from the list where payments will be deducted. Currency and Bank Balance set for the selected Bank Account will be displayed.

- Select detail from the grid. Payment will be computed.

- if there's no discount nor an interest, Payment will be the same as Amount Due.

- if there's a discount, Payment is Amount Due less Discount.

- if there's an interest, Payment is Amount Due plus Interest.

- If you wish to create partial payments, change the payment amount lower than the amount due.

- The entered payment amount will also appear in the Unapplied Amount field.

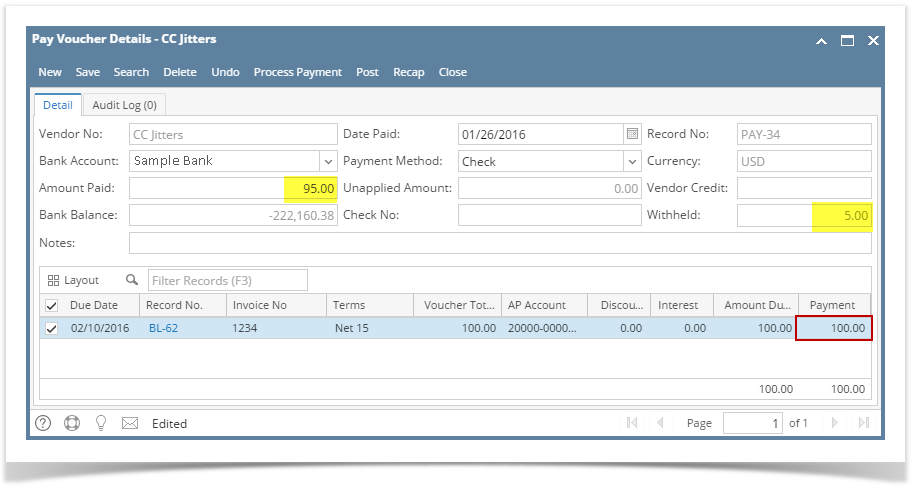

- Enter the same amount in the Amount Paid field but as you hit Tab or Enter, it will deduct the computed amount of the Withholding based on the percent entered on the Company Location used for the vendor and on Purchase tab. Amount will be displayed in the Withheld field.

- Unapplied Amount will change back to 0.00.

Save record by clicking Save toolbar button. A system-generated ID will be displayed in the Record No field.

Note You can skip saving the record if the transaction is to be posted right away. This will be catered in the Posting process since it automatically saves the record before posting. (See How To Post Pay Bills)

...

Overview

Content Tools