Page History

...

| Expand | ||

|---|---|---|

| ||

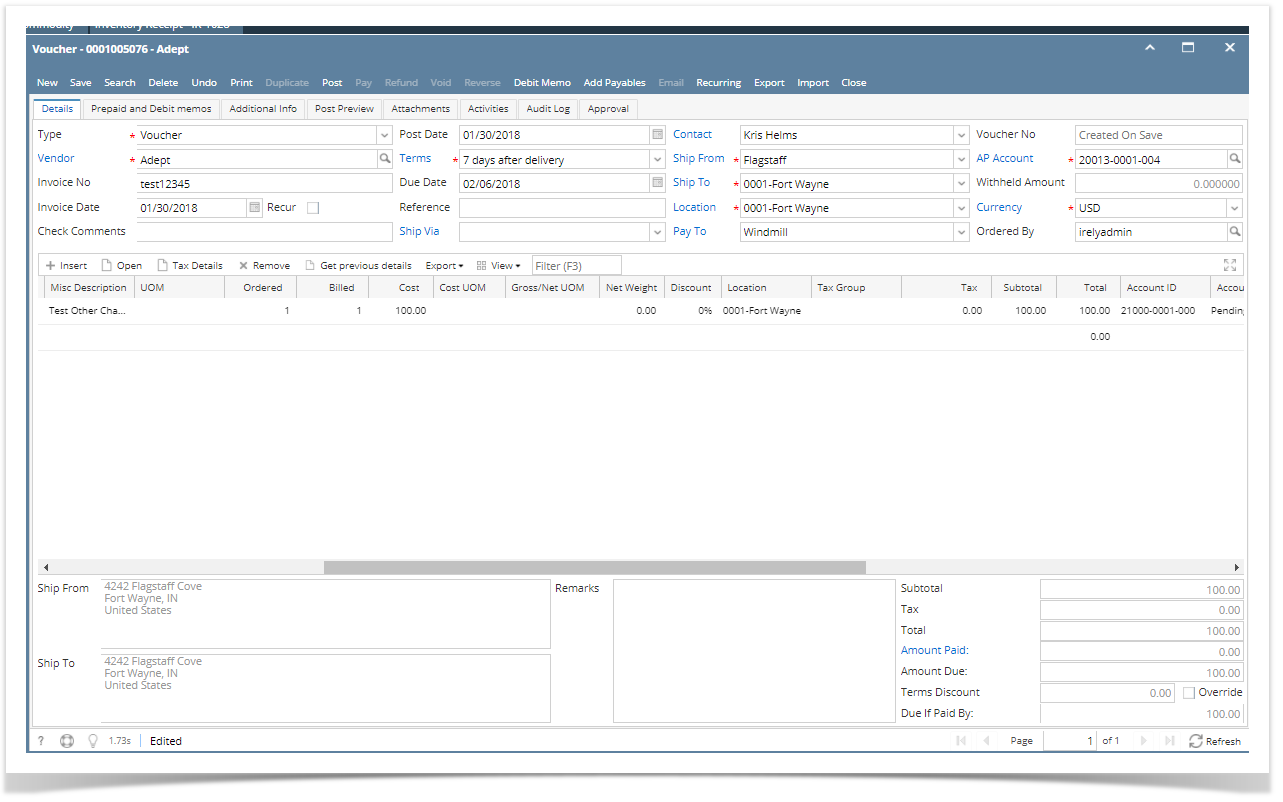

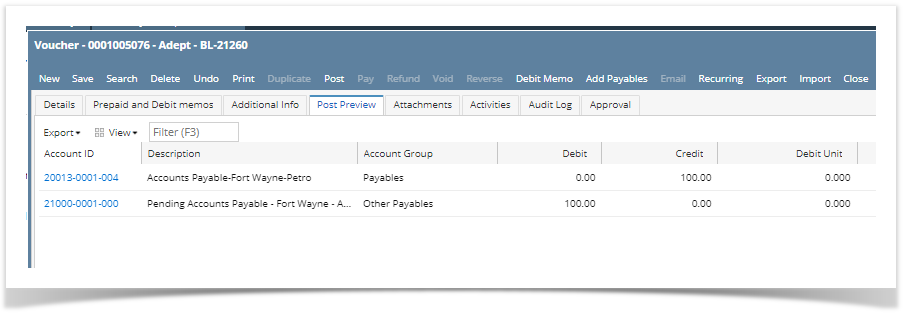

The following will detail Other Charge recorded as other charge and is payable to another vendor (not the vendor where the item is purchased).

|

| Expand | ||

|---|---|---|

| ||

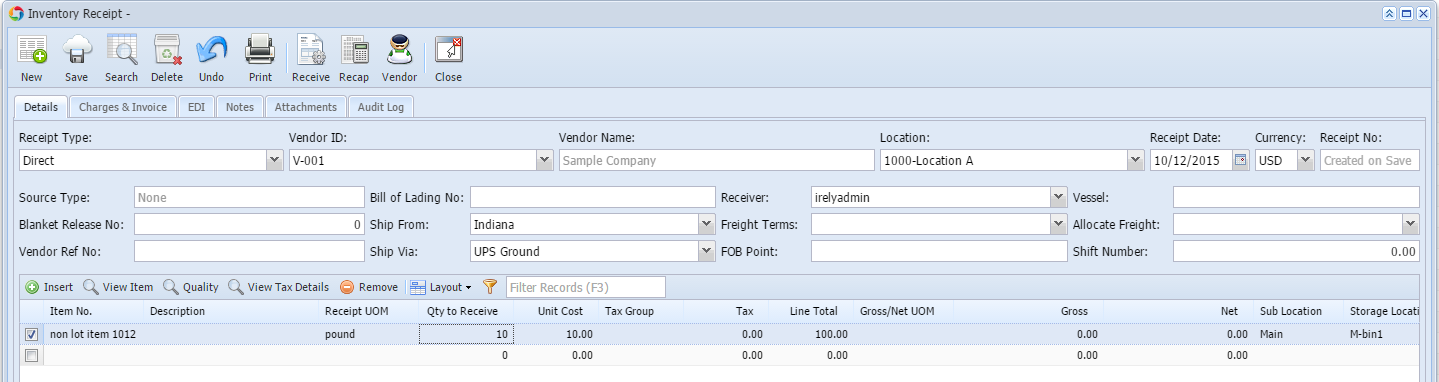

This scenario should not be allowed as this is not possible. If cost is passed on to receipt vendor, it cannot be added to inventory cost.

|

...

Overview

Content Tools