Page History

The Underscore row is used to show a double underscore (or double rule) on Beginning Balance, Budget, Column Calculation, Credit, Credit Units, Debit, Debit Units, Ending Balance, GL Amounts, GL Trend, Percentage and Units columns in your financial report.

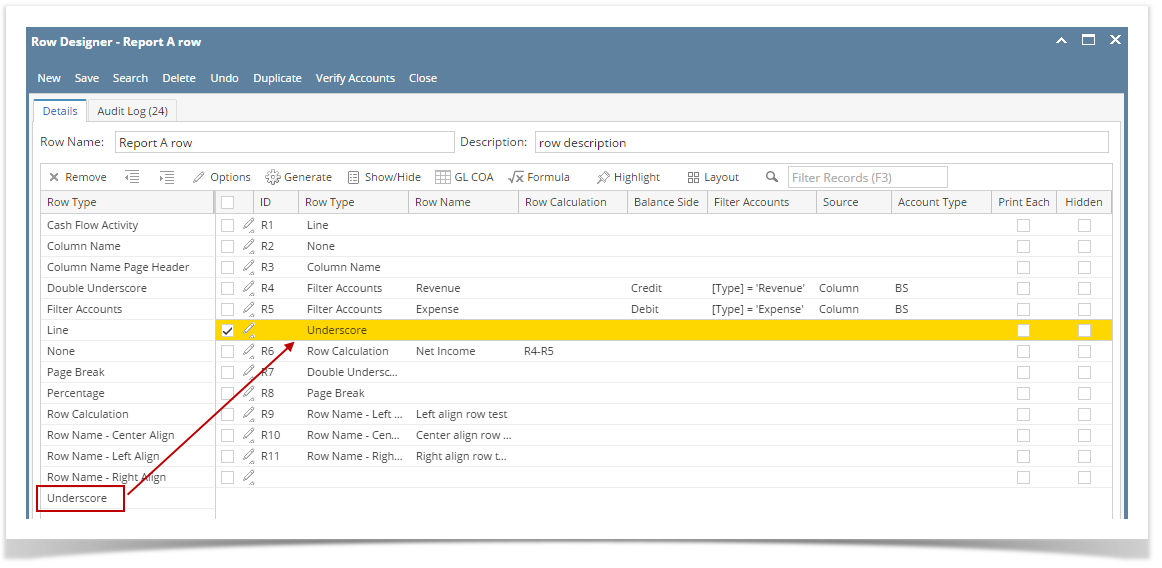

Follow these steps to add an Underscore row.

- From the Row Type section select Underscore and drag it to the grid area, in the position you want that row be added.

- The Row Name field can be blank.

- All other fields are not anymore necessary so you can leave those out.

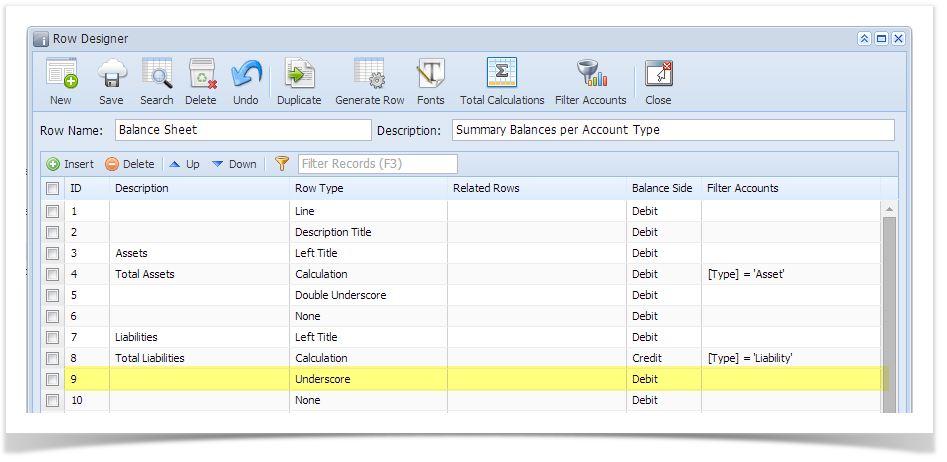

This is how Underscore row will look like when you follow the above steps.

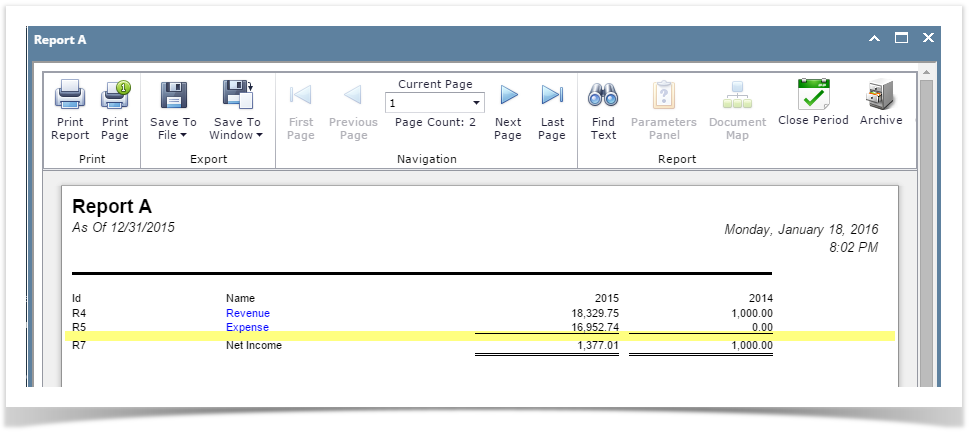

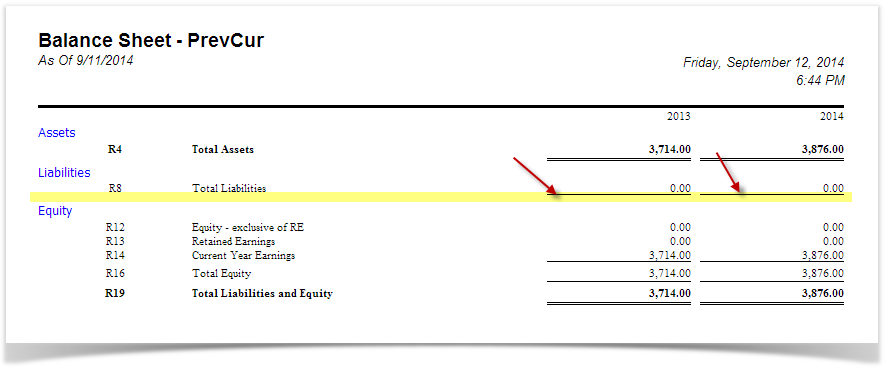

This is how it will be shown when you print your financial report.

| Expand | ||

|---|---|---|

| ||

The Underscore row is |

used to show a solid horizontal line on Budget, Calculation, Column Calculation, Debit, Credit, Debit Units, Credit Units, Units, Segment Filter, Ending Balance and GL Trend columns in your financial report.

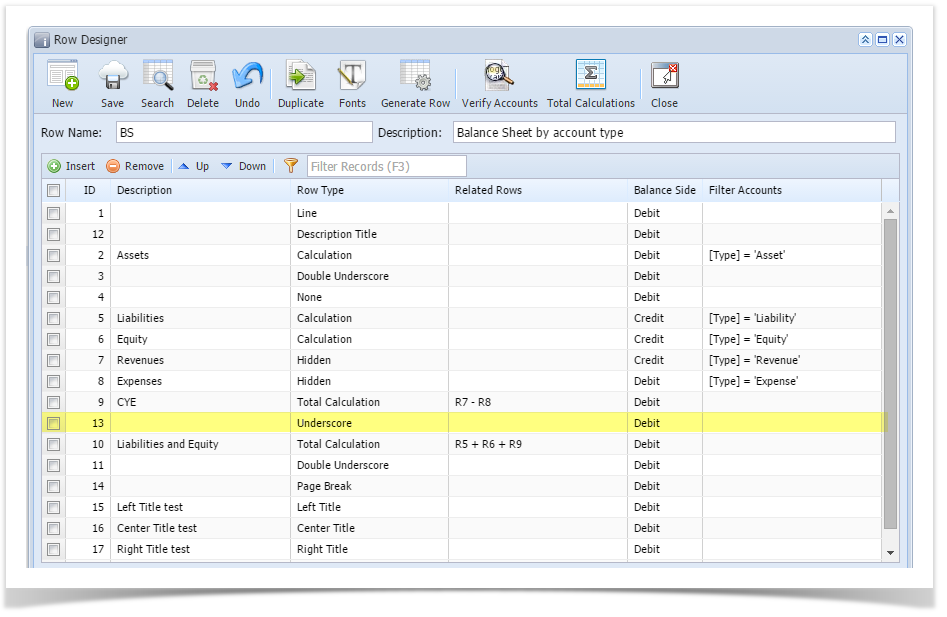

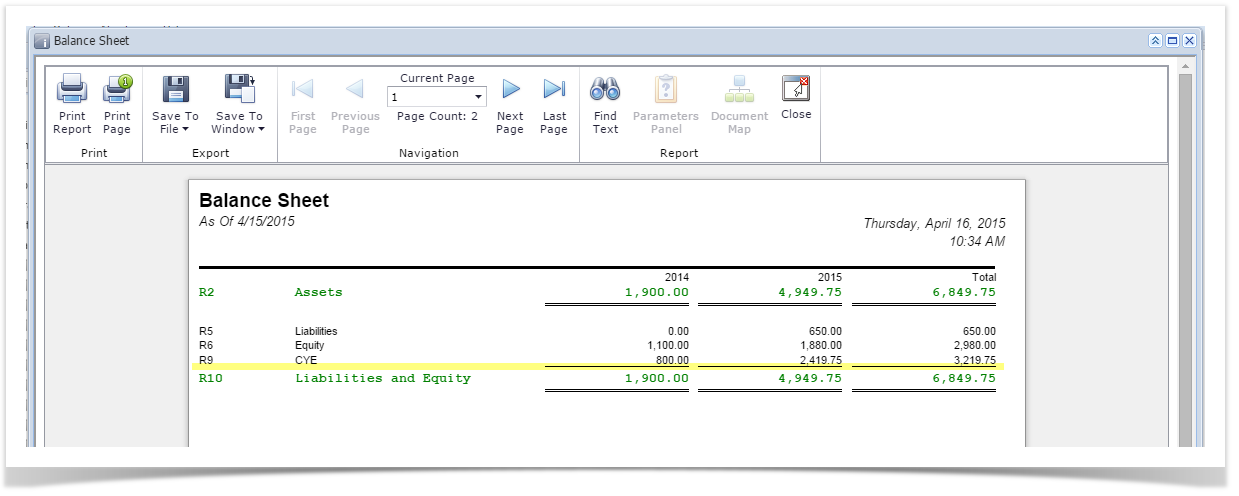

This is how Underscore row will look like when you follow the above steps. This is how it will be shown when you print your financial report. |

| Expand | ||

|---|---|---|

| ||

The Underscore row is used to show a solid horizontal line on Budget, Calculation, Column Calculation, Debit, Credit, Debit Units, Credit Units, Ending Balance and GL Trend columns in your financial report.

This is how Underscore row will look like when you follow the above steps. This is how it will be shown when you print your financial report. |

Overview

Content Tools