Page History

Overview

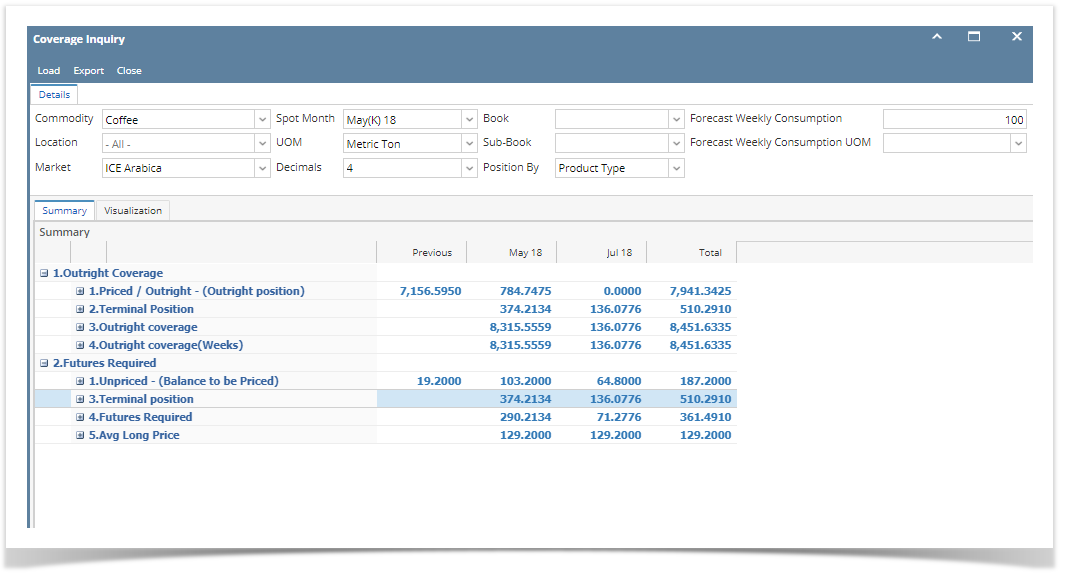

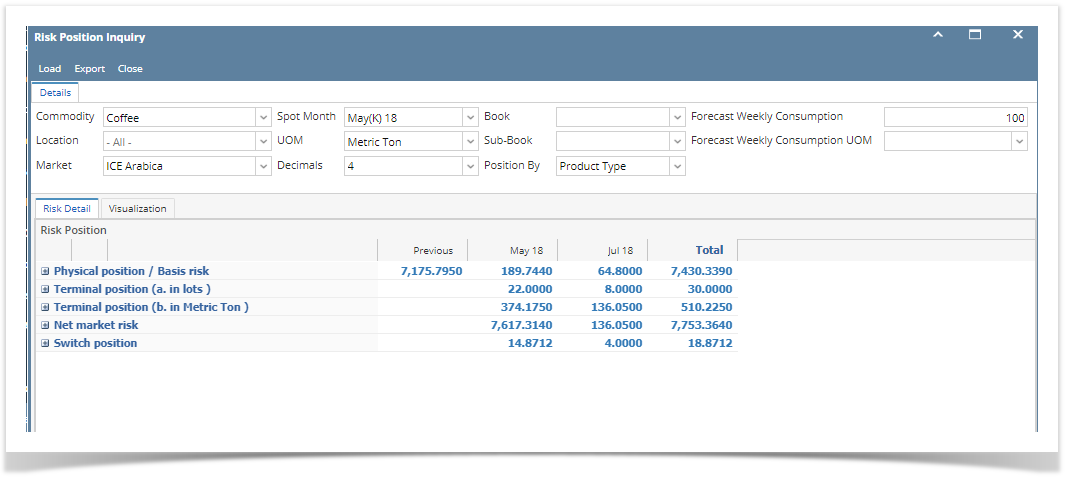

Risk position inquiry helps users to analyse their price and basis exposure.

At a high level risk inquiry will have 4 sections. Physical section, Futures section, Risk (Market and Basis) computation, Switch Position computation

We have 3 Tabs :

- Summary tab

- Risk details tab

- Visualizations

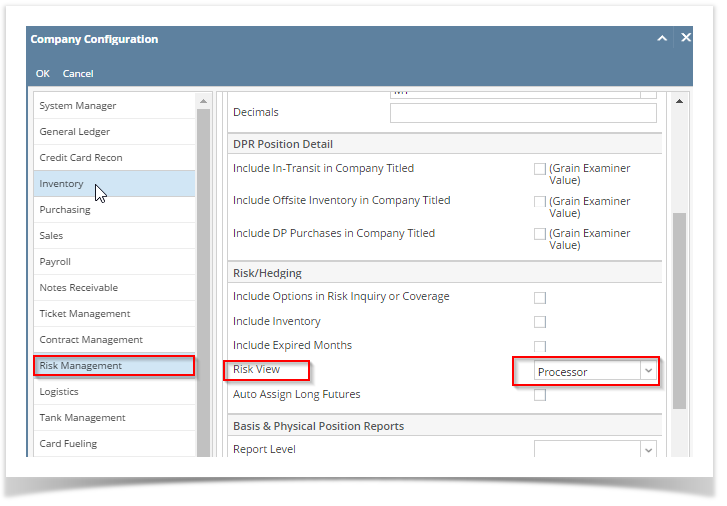

Summary Tab will be displayed only when the company preference set to Processor

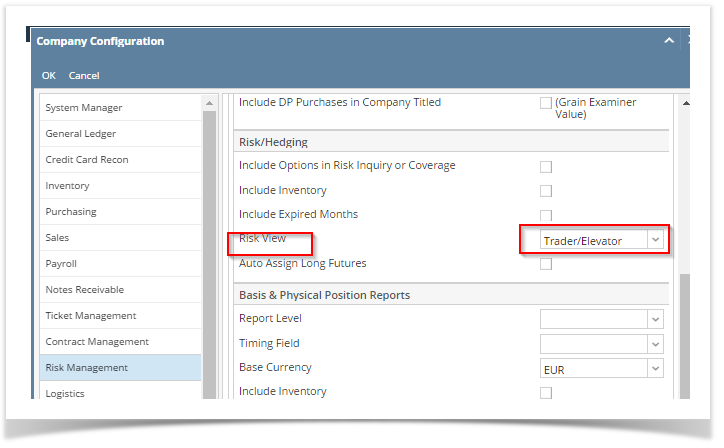

Risk Details tab will be populated only when the company preference set to Trader / Elevator

Physical section

The moment a sequence is created and saved, it will populate in this inquiry. There are 2 sections under physicals , Unfixed and Fixed.

If the sequence is unfixed it will be under unfixed section and when it starts getting price fixed (sequence with multiple lots could get fixed at once or in piecemeal) ,

the unfixed quantity reduces (to the extent of fixed qty) and the same is reflected under Fixed section.

Futures only (or HTA) contracts will also appear under Fixed section as a single line covering all product types selected in the filters.

On invoicing the sales contract, the invoiced quantity is removed from both purchase and sales.

Contract sequences associated with pricing type "Delayed" or "Cash" will not be included in this inquiry

Futures section

Long and Short futures transactions are displayed in this section.

Once the futures month is expired (user has to expire the month manually by going to configuration for futures month), the futures net position for the expired month is no longer displayed in the risk inquiry .

Market Risk (or Market Coverage) Computation

Fixed contract quantity is added to Futures position for a given futures month to arrive at exposure for a month.

Exposure in all the individual months is added to compute exposure for the Futures Market.

Differential Risk (or Differential Coverage) Computation

- Fixed contract quantity, excluding any Futures only (HTA) contracts, plus

- Differential/basis contracts

Switch Position Computation

Switch position looks at the unfixed quantity for a given futures month and computes what the futures position will be if the unfixed quantity gets fixed.

Example- Unfixed physical position is worth 10 lots coffee, Futures position is 8. If the unfixed position gets fixed , 10 short lots will be added to the futures position. So the switch position will be -10 +8= -2

Physicals

Contract sequence quantity will be grouped based on Product types (Y Axis) and Futures month (X Axis).

Under commodity configuration user can create Product types for a commodity.

Product types are linked to an item and each sequence will have an item or category (either this will serve the purpose of basket or a new configuration for basket will be created. Category/Basket will also be linked to a product type).

Lets say type "Robusta Unwashed" is created and linked to an Item. This item is selected in purchase contract sequence 123 -1 with futures month October 15,

Futures market- LIFFE, quantity -100 MT or 10 Lots and the sequence is unfixed

In the grid, the cell that corresponds to Purchase Robusta Unwashed and October 15, 100 MT will be displayed.

If there is more than one contract for the same type and futures month combination, this number will be the sum of quantities of all pertinent contracts.

Purchase sequence quantity is displayed with a +ve sign and Sales sequence quantity is displayed with a -ve sign.

Please note, inside the drilldown the quantity against each sequence is shown as a absolute value. The sum of all such quantities is shown with a -ve sign.

If the net unfixed quantity is displayed with a -ve sign, it does not indicate that only sales contracts are there but it indicates sales quantity is more than purchase quantity.

Under unfixed section, purchase and sales contracts will be grouped separately. The name of the group will be derived from Purchase /Sales + Type . So, in the above example, the group name will be

Purchase Unwashed Robusta

Quantities of all unfixed Purchase/Sales + types will be added to compute the net unfixed quantity for a given futures month.

Number drilldown - each number (that is not a column or row total) is a link with a drilldown to the data which comprises it

When user clicks on the number/drilldown, the new window which populates has the following information

| Field Name | Field Type | Column Number | Is a Drilldown ?? | What the field pertains to | Impact of | Rules |

| Unfixed section | Table | 1 | Indicates dominion of unfixed contracts.

| Purchase sequence qty is displayed with a +ve sign and sales sequence qty is displayed with a -ve sign. | ||

| Types | Table | 2 | Yes | Types as configured by user in commodity master | Type name is a combination of Purchase/Sales + Type. A type is shown only when there are open contracts for the same. (Sequence tonnage - invoiced tonnage) > 0 Each type will be displayed as a new row. Show all Purchase types followed by sales type. Arrange them alphabetically For all purchase types, the first word purchase is common, check for the next sets of words to determine order. Any contract which is Unfixed , open and belongs to a type and futures month will become part of this section. | |

| Futures months | Table | 3 onwards | Futures months as configured by user | List all active futures months chronologically (Left to right). Previous, will be placed in the column prior to any active futures month. Any open physical position for an expired futures month will be displayed here. | ||

| Total | Table | Place this column immediately after the last active futures month | For a type, sum of quantity for all active futures month. It may be unfixed qty , fixed qty or futures. | |||

| Total Unfixed | Table | Total unfixed of all types for a given futures month. | ||||

| Fixed section | Table | Yes | Indicates dominion of fixed contracts Type name is a combination of Purchase/Sales + Type.

| A type is shown only when there are open contracts for the same. (Sequence tonnage - Invoiced tonnage) > 0 Each type will be displayed as a new row. Show all Purchase types followed by sales type. Arrange them alphabetically For all purchase types, the first word purchase is common, check for the next sets of words to determine order. Any contract which is fixed, open and belongs to a type and futures month will become part of this section . NOTE- In Price contract, user has an option to fix one Robusta coffee lot yet overwrite the fixed quantity to say 14MT. So in this case 14MT should be displayed as fixed qty. Under fixed section, after all the item names, there should be an option to show all the contracts associated with pricing type "HTA" The name would be "Futures only (HTA) | ||

| Total Fixed | Table | Total fixed of all types for a given futures month. | ||||

| Basis Risk | Table | Total Unfixed + (Total Fixed for a given futures month- HTA positions) | ||||

| Delta hedge section | Table | All open contracts associated with product line where delta is defined are displayed in this section.

| Type name is a combination of Purchase/Sales + Product line name (Delta = X %) So, if "Fairtrade" type has a delta 50% and is associated with type Robusta unwashed, the name would be Purchase Fairtrade (Delta =50%) or Sales Fairtrade (Delta=50%). Speciality section has 2 sub sections Unfixed and Fixed | |||

| Unfixed | Table | Yes | All open unfixed contracts associated with product line where delta is defined are displayed in this section. | |||

| Total Delta Hedge Unfixed | Table | Total unfixed of all types for a given futures month. | ||||

| Delta Hedge fixed | Table | Yes | All open fixed contracts associated with product line where delta is defined are displayed in this section. | |||

| Total Specialty fixed | Table | Total fixed of all types for a given futures month. This number is adjusted for delta % . So, as an example, against Purchase Fairtrade (Delta =50%), 500 MT is available , when the same is populated against "Total speciality fixed" delta is computed on 500 , 500 X 50% =250 MT. 250 MT is shown | ||||

| Overall Physical Position | Table | Sum of Basis Risk, Total Speciality unfixed and Total Speciality fixed | ||||

| Futures Position | Table | Yes | Futures positions held under different broker accounts pertinent to different futures months is displayed here Account numbers are placed on the Y axis and Futures month on the X axis. The number shown on the grid is the net of Long and short futures. | Only confirmed futures transactions will be displayed here Long is +ve and Short is -ve . If the number on the grid is +ve it could mean 1- Only Long positions 2- Long positions are more than short positions | ||

| Futures net position in Lots | Table | Add all individual positions held in different broker accounts for a futures month. UOM= lots. | ||||

| Delta options | Table | Yes | Find all Confirmed, active (not expired, exercised or assigned) options, apply delta to it and the number should be reflected here. Calculations provided in the text above this grid | If delta is zero , don't display the option | ||

| Total F&O | Table | Add "Futures net position in lots" and "Delta options". UOM= lots | ||||

| Total F&O (in UOM name ) | Table | Show the above in UOM selected in the filter options (in the header) | ||||

| Net Market Risk | Table | Total Fixed + Total speciality delta fixed + Total F&O , displayed in UOM selected in the filter options (in the header).

| If there are any fixed positions under column "Previous" while computing risk for the month placed on the immediate right of column "Previous", add this number. | |||

| Switch Position | Table | Switch position looks at the unfixed tonnage for a given futures month and computes what the futures position will be if the unfixed tonnage gets fixed. Example- Unfixed physical position is worth 10 lots coffee, Futures position is 8. If the unfixed position gets fixed , 10 short lots will be added to the futures position. So the switch position will be -10 +8= -2 If there is any open unfixed position for an expired month, add it to the unfixed position of the next active month to compute switch for the active month. |