There are a couple of ways on how Other Charges are added to either Inventory Receipt or Voucher based on different scenarios. Here are items we will use in all of the scenarios.

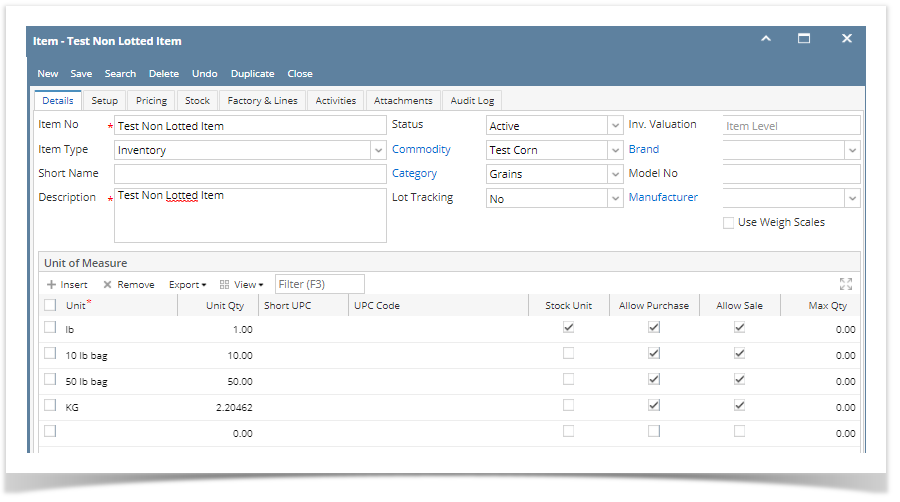

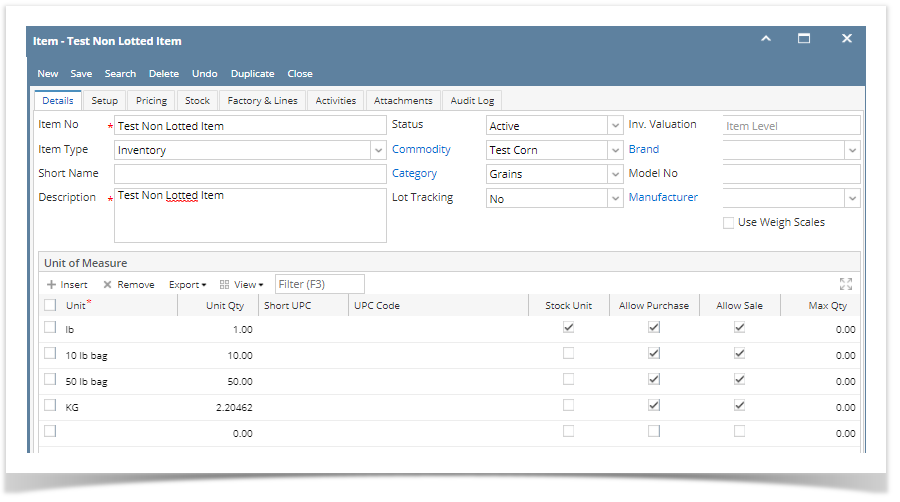

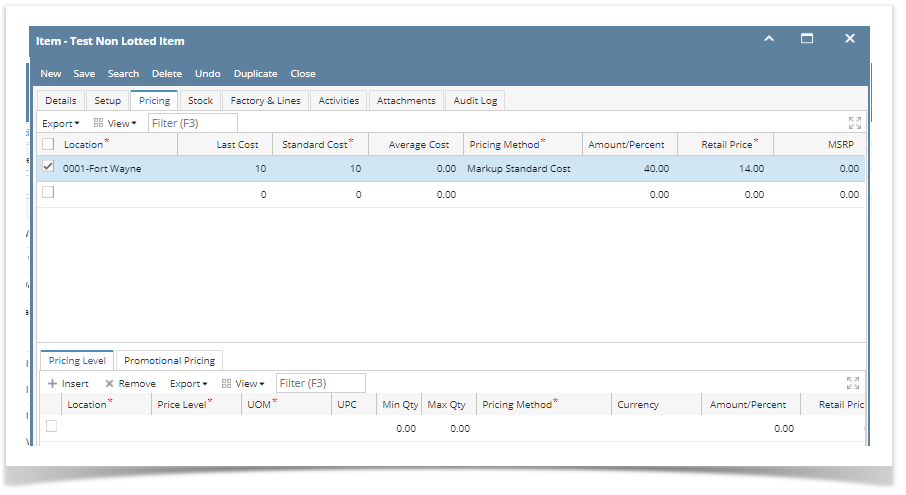

This is the item.

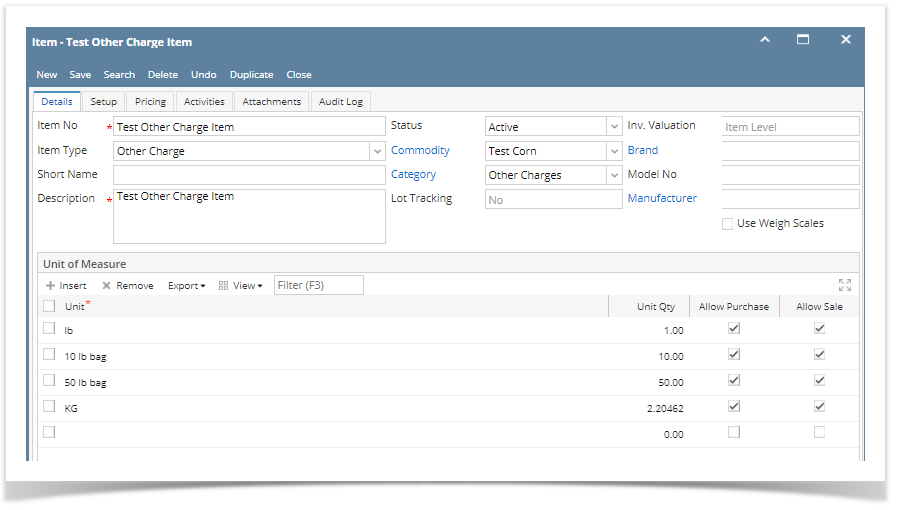

This is the Other Charge item.

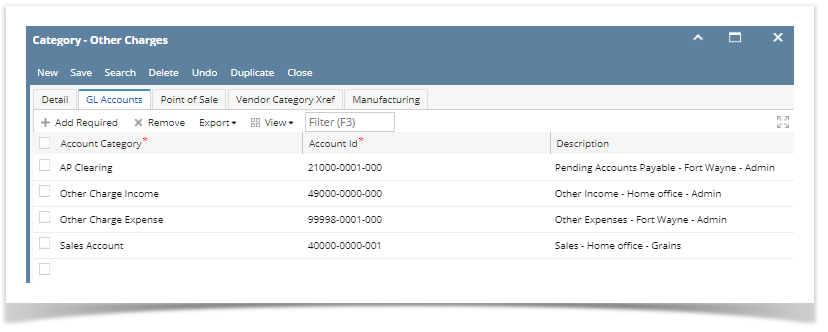

These are accounts setup for the Other Charge item.

This scenario should not be allowed since Price = checked and Accrue = checked for receipt vendor is same as cost did not occur.

|

The following will detail Other Charge added as Other Expense to the item purchased and be payable to the Vendor where item is purchased.

|

The following will detail Other Charge added to the Item Cost and is payable to the Vendor where item is purchased.

|

The following will detail Other Charge recorded as other charge and is payable to another vendor (not the vendor where the item is purchased).

|

This scenario should not be allowed as this is not possible. If cost is passed on to receipt vendor, it cannot be added to inventory cost.

|

The following will detail Other Charge recorded as other charge and is payable to another vendor (not the vendor where the item is purchased).

|

The following will detail Other Charge recorded as an Other Expense as well as an Other Revenue that will offset each other.

|

This scenario should not be allowed as this is not possible. If cost is passed on to receipt vendor, it cannot be added to inventory cost.

|