Although many states don't require the prior month's MFT return be turned in until the 15th of the following month (or later), it is strongly recommended that you start the verification process early. i21 MFT uses data entries from other processes, such as Inventory Receipts, Sales Invoices, and Transports Loads. Starting verification sooner means potential programming and/or data entry errors can be caught and addressed sooner, which in turn ensures timely filing of the finalized return.

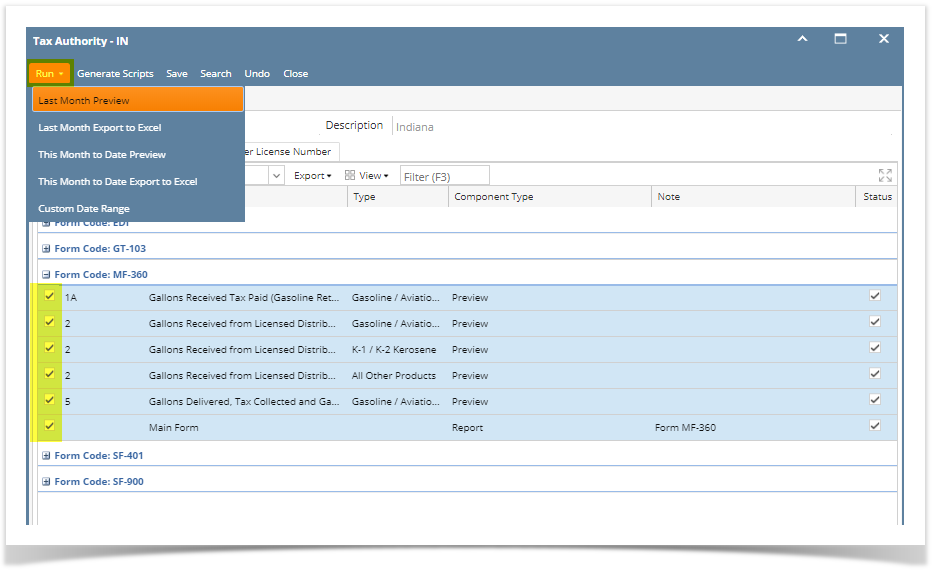

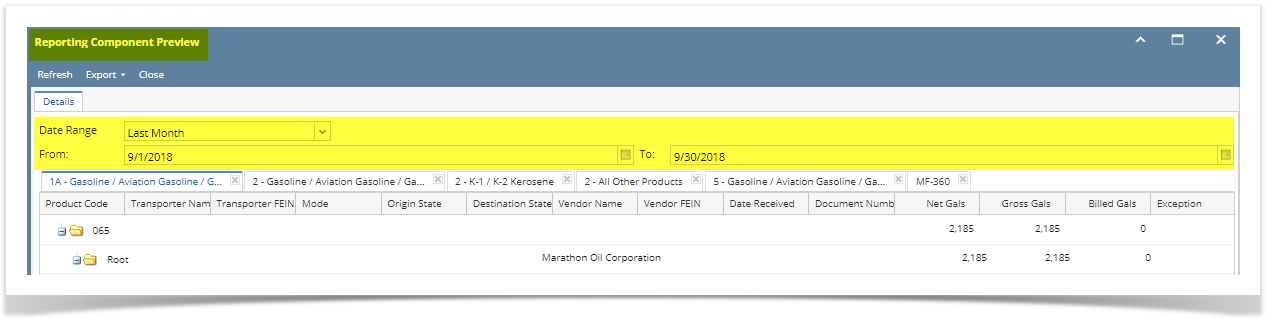

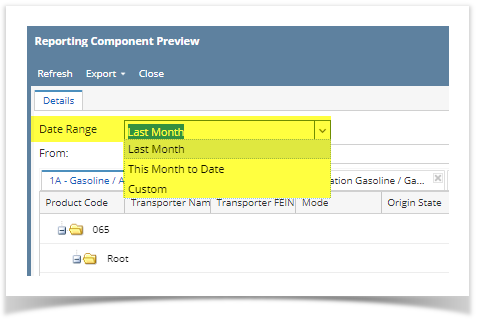

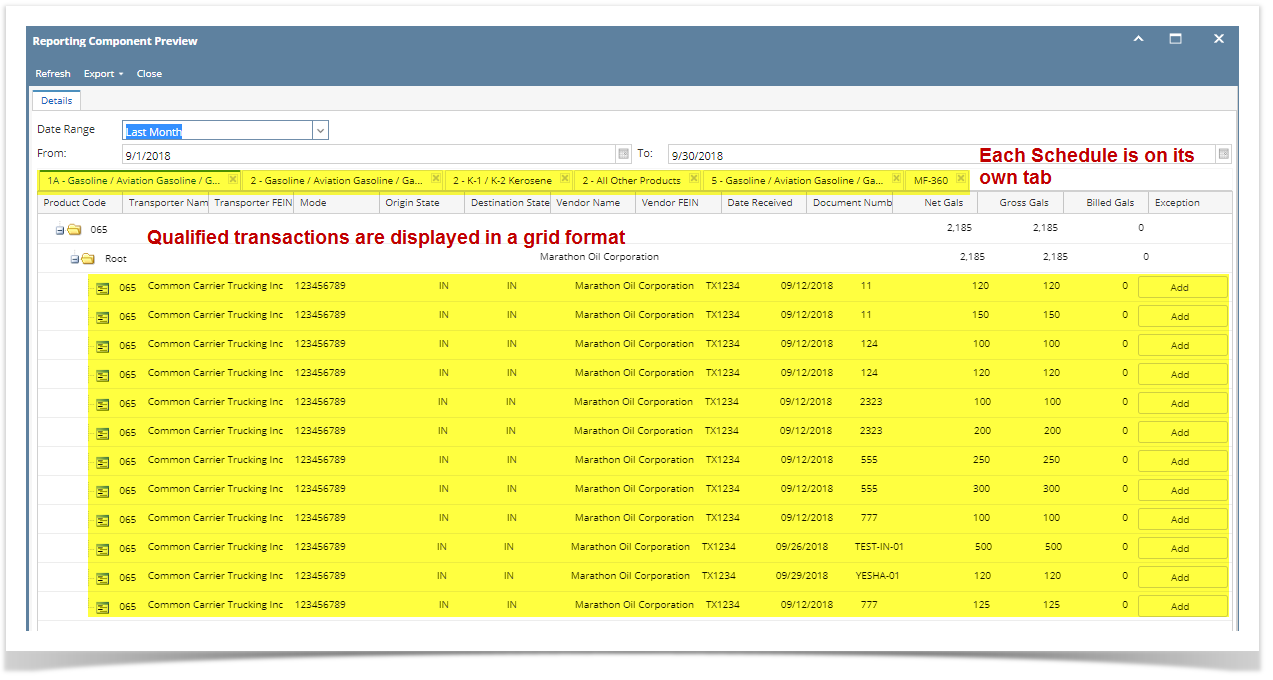

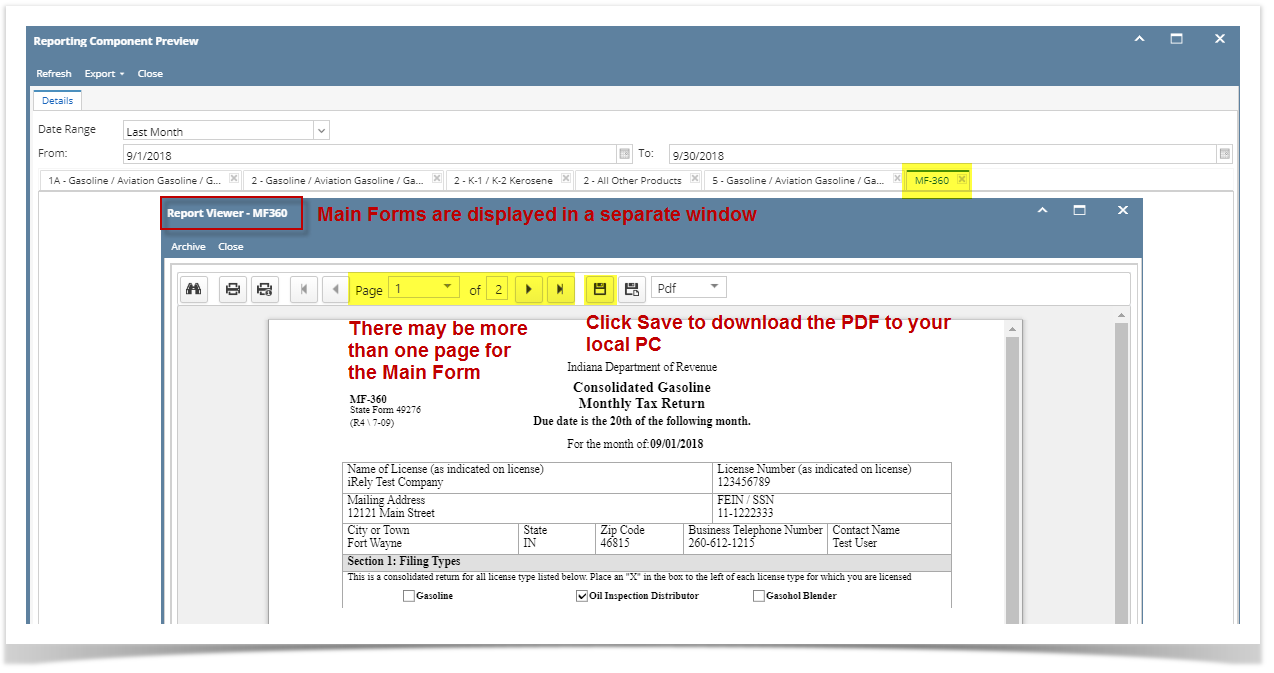

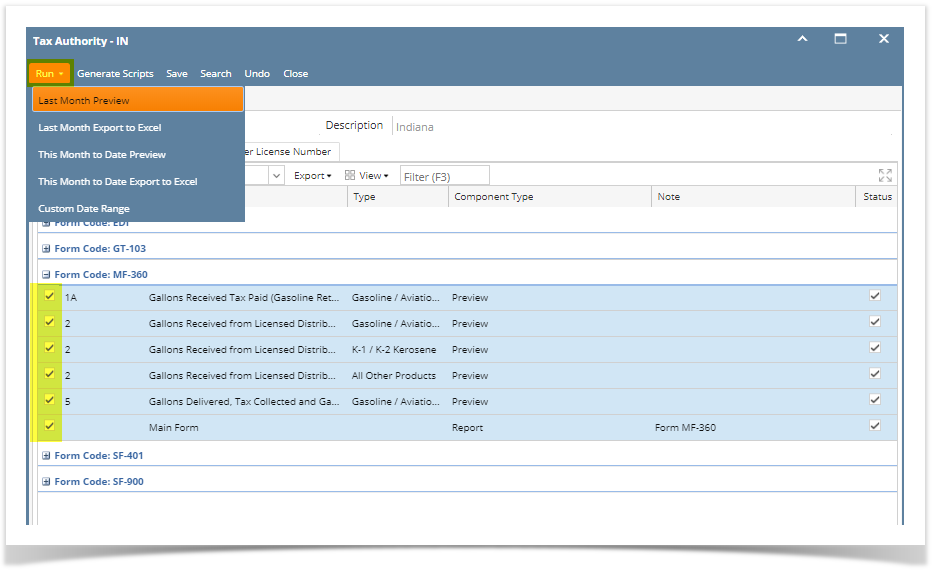

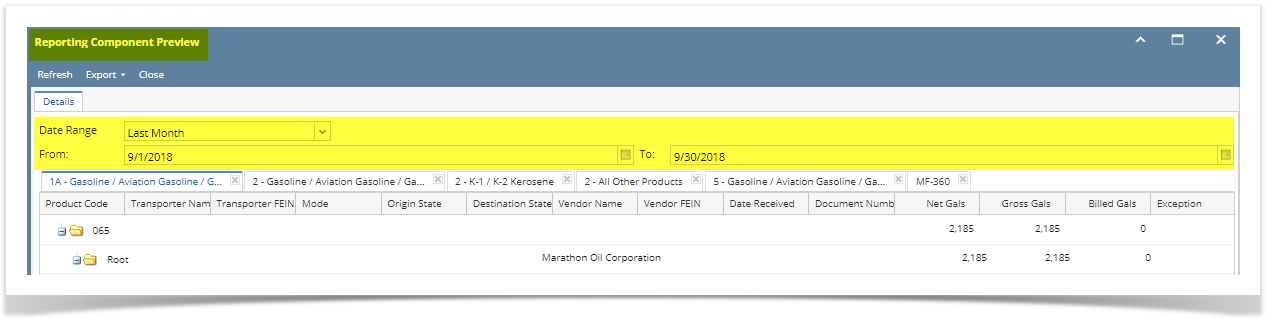

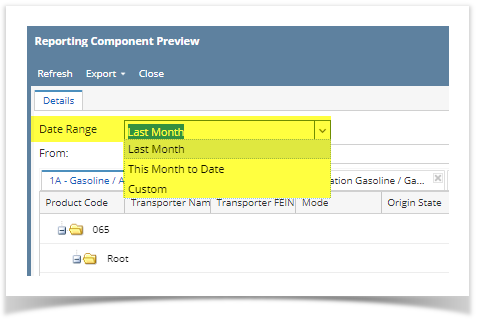

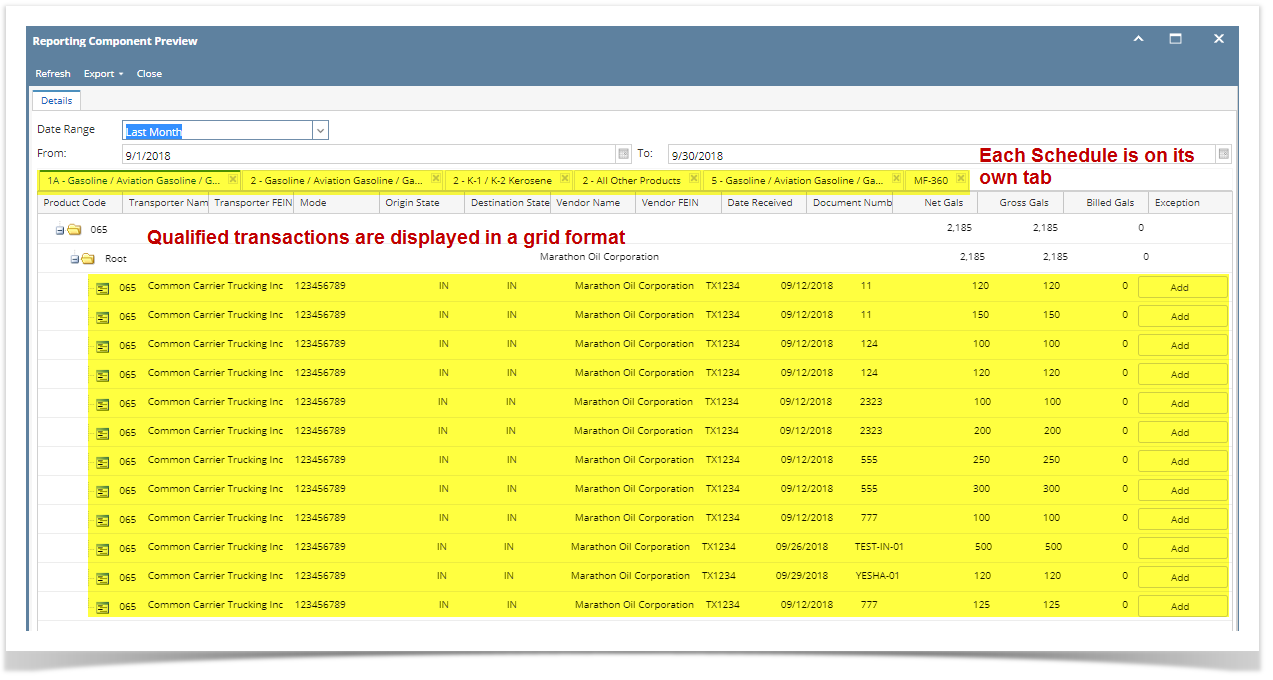

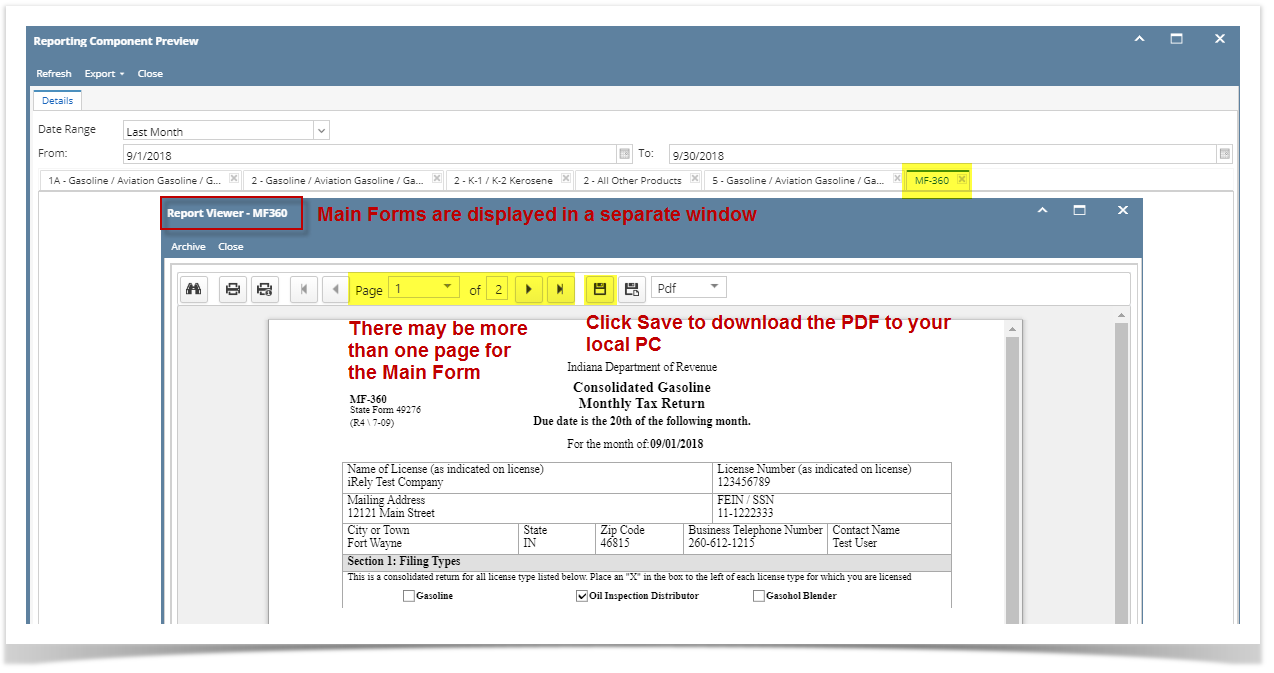

To run your Schedules and Forms for verification purposes, follow these steps:

Although many states don't require the prior month's MFT return be turned in until the 15th of the following month (or later), it is strongly recommended that you start the verification process early. i21 MFT uses data entries from other processes, such as Inventory Receipts, Sales Invoices, and Transports Loads. Starting verification sooner means potential programming and/or data entry errors can be caught and addressed sooner, which in turn ensures timely filing of the finalized return. To run your Schedules and Forms for verification purposes, follow these steps:

|