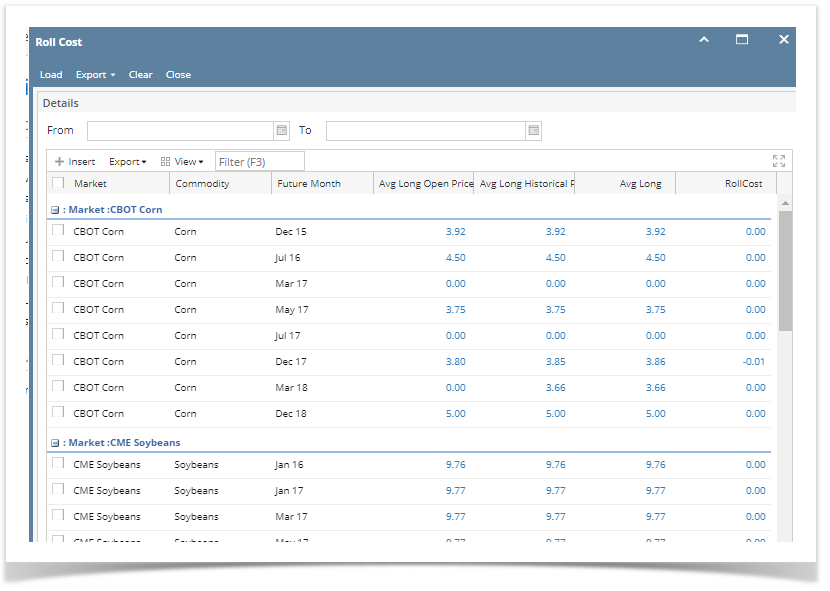

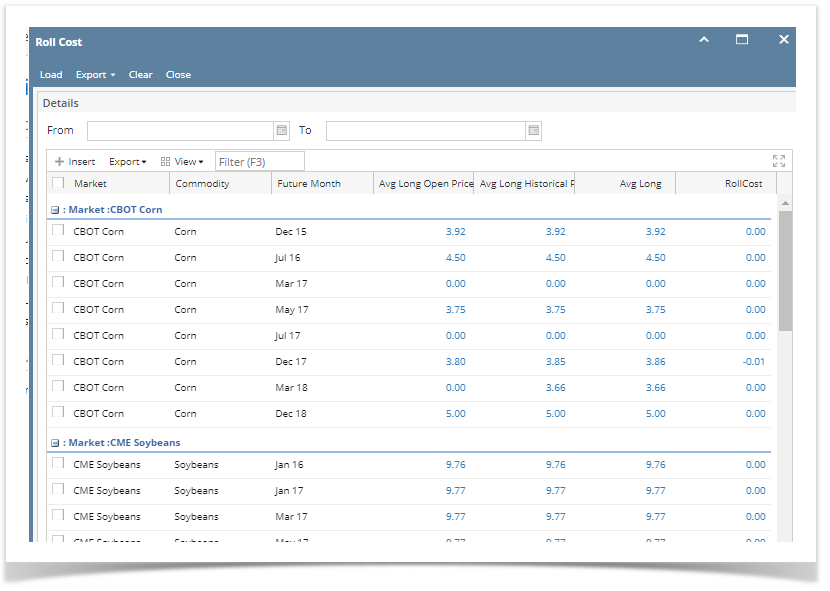

Future price will show the weighted average of open long derivatives .

For eg:

Create few long derivative

Buy Buy Sell | 10 20 20 | 155 153 157 | Sep-18 Sep 18 Sep 18 |

if we need to check average cost for the month of Sep-18 then Open Roll Cost screen and check the average of future long for the month of Sep - 18

In the above case ((155*10)+(20*153))/30 and the Average Long price Should be 153.66

Weighted average will not consider the matched long. If there is balance qty for the buy after matching then the average will consider the balance qty for the weighted average.

We can see the historical average price for a given month

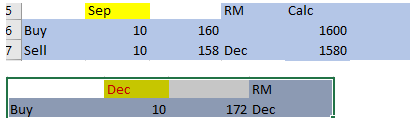

Create a Long trade for future month

Create a Short future trade against the same and give the roll month

Create a Long position for the next future month

Match the buy and sell

- To check the original spent agianst the Long -, We should consider only the open balance of Long trade.

,((172*10*37500)/100=645000 should be the original spent .

-To Find the P&L

Sell- Buy for the matched roll month . in this case

(((158*10)-(160*10))/10)*10*37500)/100= -7500

-To find the Find the adjusted spent