Unposting a transaction means reversing the previously posted transaction and such reverses the entries posted in the GL Account Details. This allows you with a way to make a correction on the posted transaction at a later time. In essence, this backs out the transaction from your GL Account Details like it was never there to begin with. The difference is that the GL Account Details will still keep a record of the posted and unposted transactions so that you have a type of audit trail showing the history of that transaction.

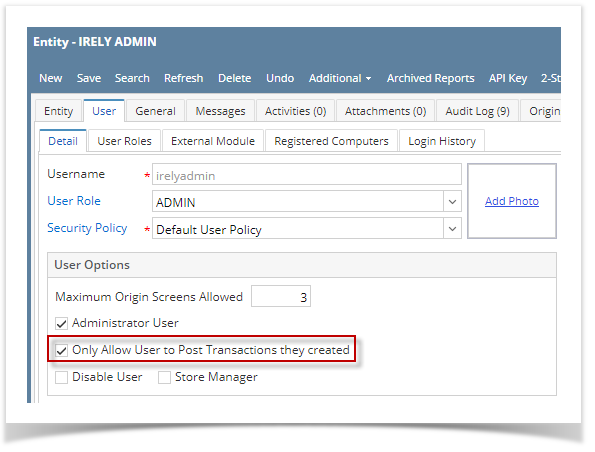

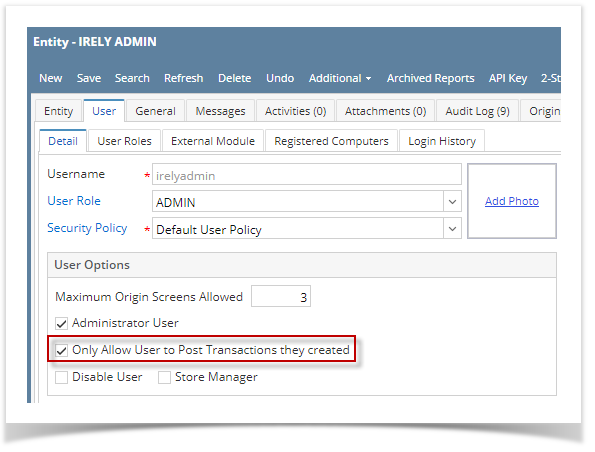

Under certain circumstances you may not be able to unpost a transaction due to a variety of reasons listed below.

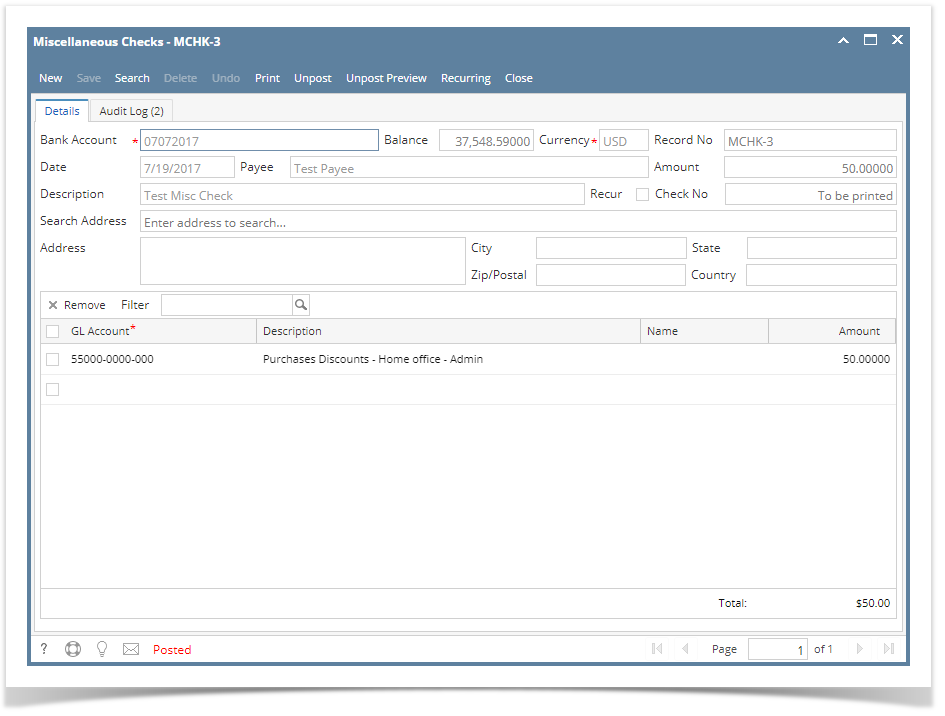

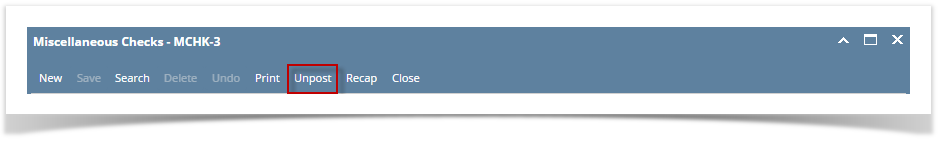

The following will guide you on how to unpost a previously posted Miscellaneous Check.

Unposting a transaction means reversing the previously posted transaction and such reverses the entries posted in the GL Account Details. This allows you with a way to make a correction on the posted transaction at a later time. In essence, this backs out the transaction from your GL Account Details like it was never there to begin with. The difference is that the GL Account Details will still keep a record of the posted and unposted transactions so that you have a type of audit trail showing the history of that transaction. Under certain circumstances you may not be able to unpost a transaction due to a variety of reasons listed below.

The following will guide you on how to unpost a previously posted Miscellaneous Check.

|

Unposting a transaction means reversing the previously posted transaction and such reverses the entries posted in the GL Account Details. This allows you with a way to make a correction on the posted transaction at a later time. In essence, this backs out the transaction from your GL Account Details like it was never there to begin with. The difference is that the GL Account Details will still keep a record of the posted and unposted transactions so that you have a type of audit trail showing the history of that transaction. Under certain circumstances you may not be able to unpost a transaction due to a variety of reasons listed below.

The following will guide you on how to unpost a previously posted Miscellaneous Check.

|

Unposting a transaction means reversing the previously posted transaction and such reverses the entries posted in the GL Account Details. This allows you with a way to make a correction on the posted transaction at a later time. In essence, this backs out the transaction from your GL Account Details like it was never there to begin with. The difference is that the GL Account Details will still keep a record of the posted and unposted transactions so that you have a type of audit trail showing the history of that transaction. Under certain circumstances you may not be able to unpost a transaction due to a variety of reasons listed below.

The following will guide you on how to unpost a previously posted Miscellaneous Check.

|

Unposting a transaction means reversing the previously posted transaction and such reverses the entries posted in the GL Account Details. This allows you with a way to make a correction on the posted transaction at a later time. In essence, this backs out the transaction from your GL Account Details like it was never there to begin with. The difference is that the GL Account Details will still keep a record of the posted and unposted transactions so that you have a type of audit trail showing the history of that transaction. Under certain circumstances you may not be able to unpost a transaction due to a variety of reasons listed below.

The following will guide you on how to unpost a previously posted Miscellaneous Check.

|

Unposting a transaction means reversing the previously posted transaction and such reverses the entries posted in the GL Account Details. This allows you with a way to make a correction on the posted transaction at a later time. In essence, this backs out the transaction from your GL Account Details like it was never there to begin with. The difference is that the GL Account Details will still keep a record of the posted and unposted transactions so that you have a type of audit trail showing the history of that transaction. Under certain circumstances you may not be able to unpost a transaction due to a variety of reasons listed below.

The following will guide you on how to unpost a previously posted Miscellaneous Check.

|