Page History

Here's how the posting of audit adjustment affects the General Ledger when created and posted after Fiscal Year is closed:

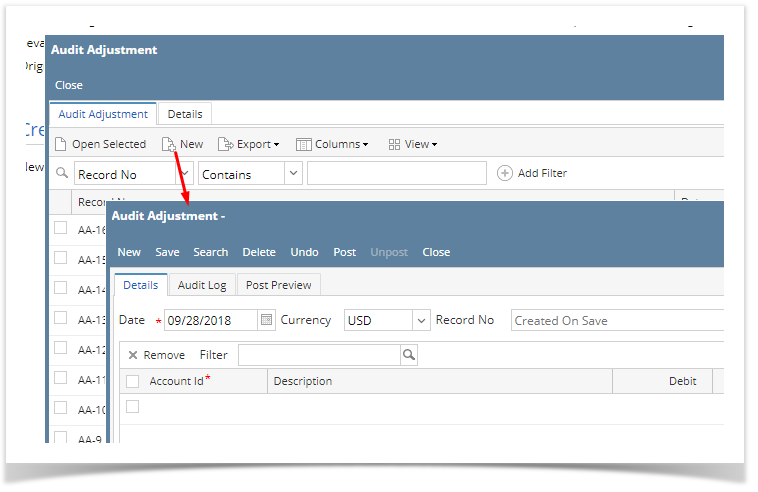

- Go to GL > Audit adjustment

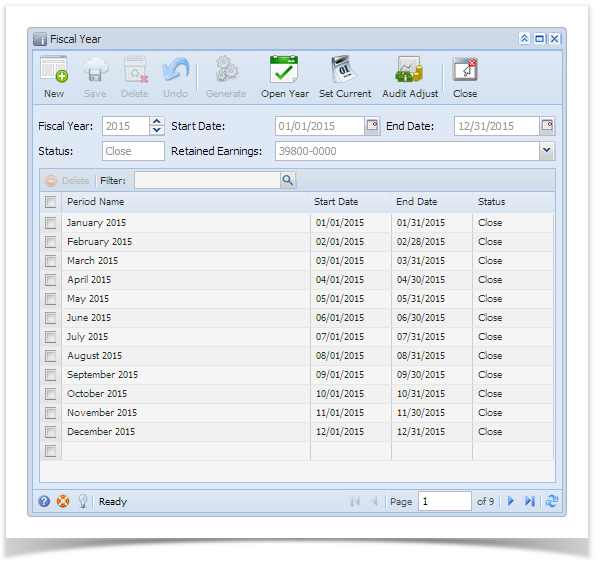

- Click Open a Fiscal Year record that is still already 'Closed'.

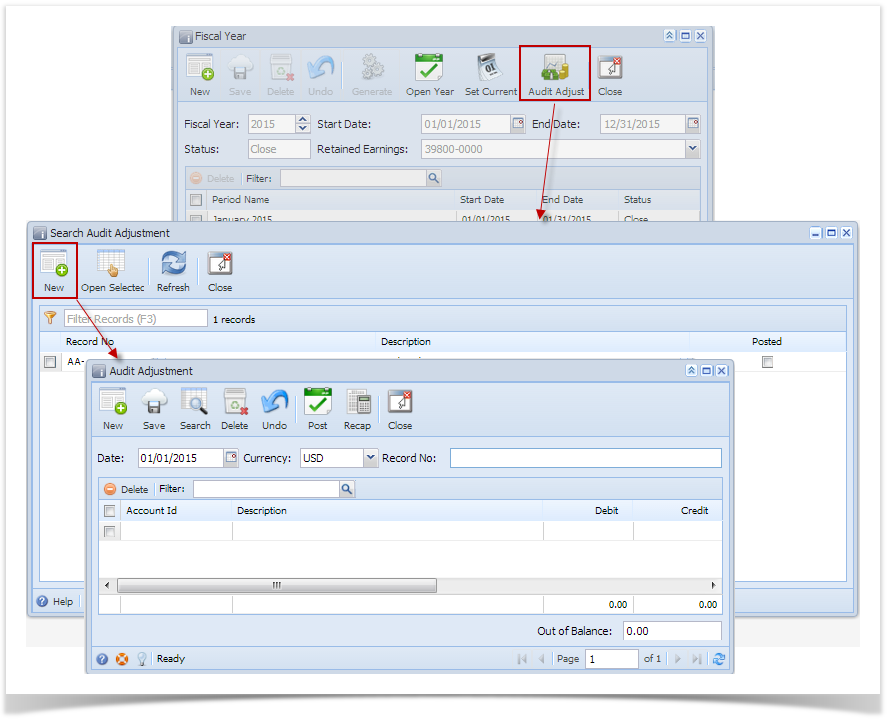

Click Audit Adjust toolbar button and click New from the Search Audit Adjustment screen to open a blank Audit Adjustment screen. - Create new Audit Adjustment.

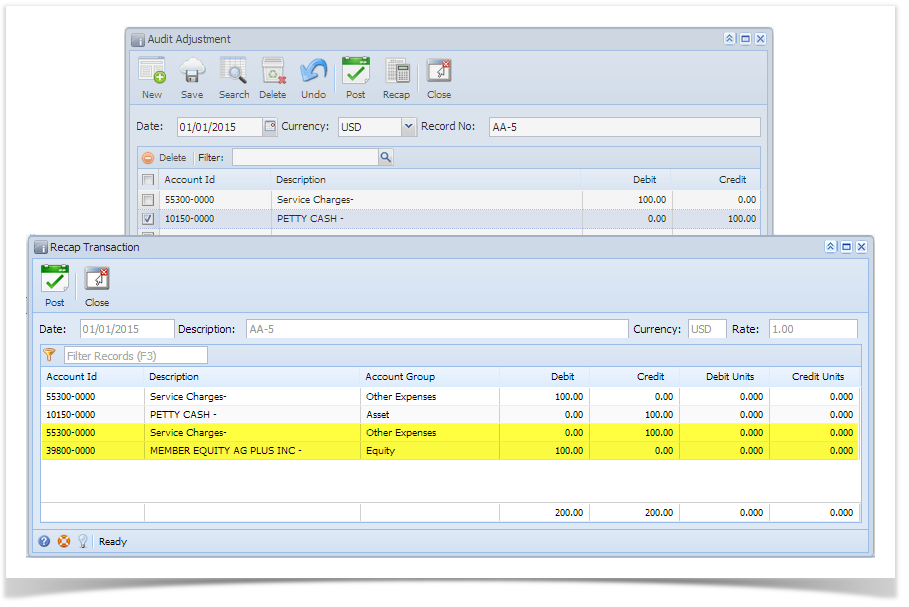

- Once the transaction is balanced, click Recap Post Preview button to view the accounts affected by this transaction. Since Fiscal Year is already closed, additional entry that zeroes out nominal accounts and a Retained Earnings entry to close that amount will be shown.

...

Click Post

...

toolbar button on Recap Transaction or Audit Adjustment screen to post the transaction.

Expand title 16.4 below - Open a Fiscal Year record that is still already 'Closed'.

- Click Audit Adjust toolbar button and click New from the Search Audit Adjustment screen to open a blank Audit Adjustment screen.

- Create new Audit Adjustment.

- Once the transaction is balanced, click Recap button to view the accounts affected by this transaction. Since Fiscal Year is already closed, additional entry that zeroes out nominal accounts and a Retained Earnings entry to close that amount will be shown.

- Click Post toolbar button on Recap Transaction or Audit Adjustment screen to post the transaction.

- Open a Fiscal Year record that is still already 'Closed'.

Overview

Content Tools