Page History

- From Cash Management module > Maintenance folder > double-click Bank Accounts.

- If this is the first record you are to create, it will open directly on new Bank Accounts screen where you can then add the bank account information. Otherwise, it will open the Search Bank Accounts screen where existing bank accounts are displayed. Click the New toolbar button to open the new Bank Accounts screen.

- In the Bank Accounts screen > Bank Name field, select the Bank where the new bank account has been opened.

- Once Bank had been selected, other bank related fields are automatically filled in by information entered in the Banks screen for the selected bank. The Transit No here is the Routing No entered in the selected Bank record.

- Enter EFT Information.

- Assign GL Account for the Bank Account.

- Click the dropdown combo box button in the GL Account field. The combo box will show all Accounts under Cash Account Group.

- Select the Account for the Bank Account.

- Click the dropdown combo box button in the GL Account field. The combo box will show all Accounts under Cash Account Group.

- Generate Check Numbers for the bank account. See : How to Generate Check Numbers

- If you would want MICR line printed in your checks, check the Enable MICR Printing checkbox in the Check Number Range panel. See: How to Configure and Show MICR line on checks

Setup Back up Check Number Range. See How to Setup and Apply Backup Check Number Range

Info You may or may not setup this at this point but this comes in very handy when you have used up all the checks configured in the Check Number Range panel as you will not anymore configure the check numbers. It just needs to click the Apply button and you will have those checks configured automatically.

- The Comments field is used to add any information related to the Bank Account. Use this field if you need to.

- Click the Origin tab and enter the Checkbook ID. This is used to match the origin key field for the selected bank account. This accepts up to two alphanumeric characters.

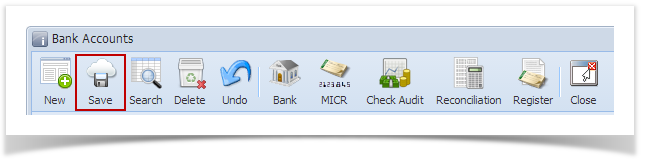

- Click Save toolbar button to save the record.

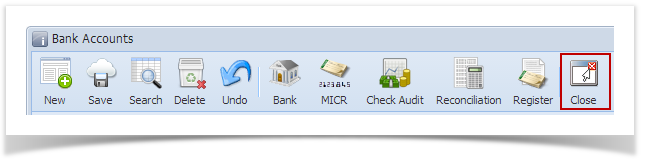

- Click Close toolbar button to close the screen.

Overview

Content Tools