Page History

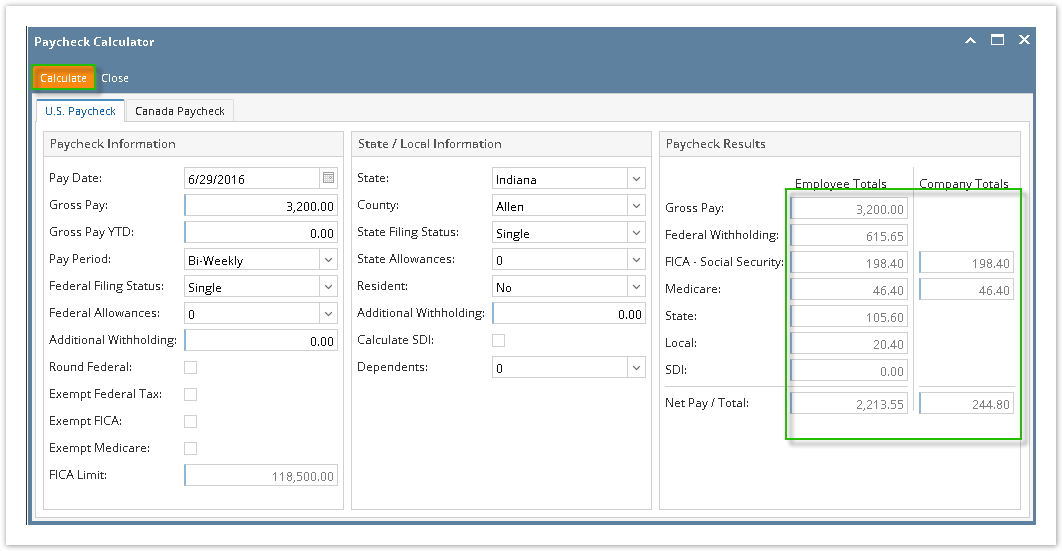

- Click Paycheck Calculator under Payroll module.

- Enter information on the following fields:

- Gross Pay

- Pay Period

- Federal Filing Status

- State

- County

- State Filing Status

Info Other fields can be entered with data as necessary. The State Information fields vary per selected State.

- Click Calculate toolbar button.

- Check the computed amounts.

| Expand | ||

|---|---|---|

| ||

|

In this screen, taxes and deductions can be calculated by selecting options from the fields like state, county or pay period. It also serves as counter checking for paychecks to determine if the amounts such as taxes or deductions are correctly computed in the paycheck.

The following topic/s will guide you on how to use this screen:

Children Display

Overview

Content Tools