Page History

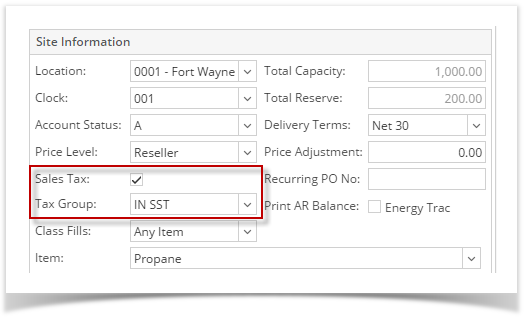

Sales Tax is computed in Call Entry when Sales Tax option in Consumption Site is checked. The computation will be based on the Tax State selected on the Tax Group field.

Sales Tax

- If Check if Sales Tax option is checked. If No, Total Field will be computed as:

- TOTAL = Calculated Qty x Price

- If Yes, Total Field will be computed based on the Sales Tax ID assigned for the site.

- AG Sales Tax = Total * Sales Tax Rate / 100

- PT Sales Tax = Total * Sales Tax Rate

- TOTAL = Total + AG/PT Sales Tax Computation

Note for i21: Total Tax will be taxes with 'Sales Tax' on desc + other taxes of item. When Sales Tax Calculation Method = Unit, the item's location > Sales UOM should have a value.

Special Pricing

Special Price computation in PT is being placed through ssparam. While Special Price in AG is being computed based on the Price Basis assigned for the customer.

...

- A = cost + deviation amount = correct

- S = sell – (sell * deviation/100)

...

Cost will be based on the selected Cost to Use - Last, Standard or Average

Sell will be based on the customer's price level

| Expand | ||

|---|---|---|

| ||

Sales Tax is computed in Call Entry when Sales Tax option in Consumption Site is checked. The computation will be based on the Tax State selected on the Tax State ID field including Tax Locale 1 and 2 . Sales Tax

Special Pricing Special Price computation in PT is being placed through ssparam. While Special Price in AG is being computed based on the Price Basis assigned for the customer. If customer has Special Pricing where Price Basis is NOT equal to Fixed(F) or Maximum(M), computation should be:

Cost will be based on the selected Cost to Use - Last, Standard or Average Sell will be based on the customer's price level |