Page History

...

Create few long derivative

Buy Buy Sell | 10 20 20 | 155 153 157 | Sep-18 Sep 18 Sep 18 |

if we need to check average cost for the month of Sep-18 then Open Roll Cost screen and check the average of future long for the month of Sep - 18

...

We can see the historical average price for a given month

How Long historical price works.

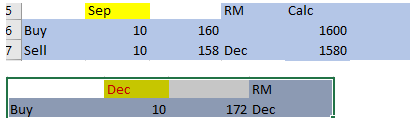

Create a Long trade for future month

Create a Short future trade against the same and give the roll month

Create a Long position for the next future month

Match the buy and sell

- To check the original spent agianst the Long -, We should consider only the open balance of Long trade.

,((172*10*37500)/100=645000 should be the original spent .

-To Find the P&L

Sell- Buy for the matched roll month . in this case

(((158*10)-(160*10))/10)*10*37500)/100= -7500

-To find the Find the adjusted spent

- If P&L is -ve then Original spent + P&L

- If P&L is positive then the Original spent - P&L

645000+7500=652500 - To find the adjusted price:

(Adjusted spent / matched qty /37500)*100

(652500/10/37500)*100=174