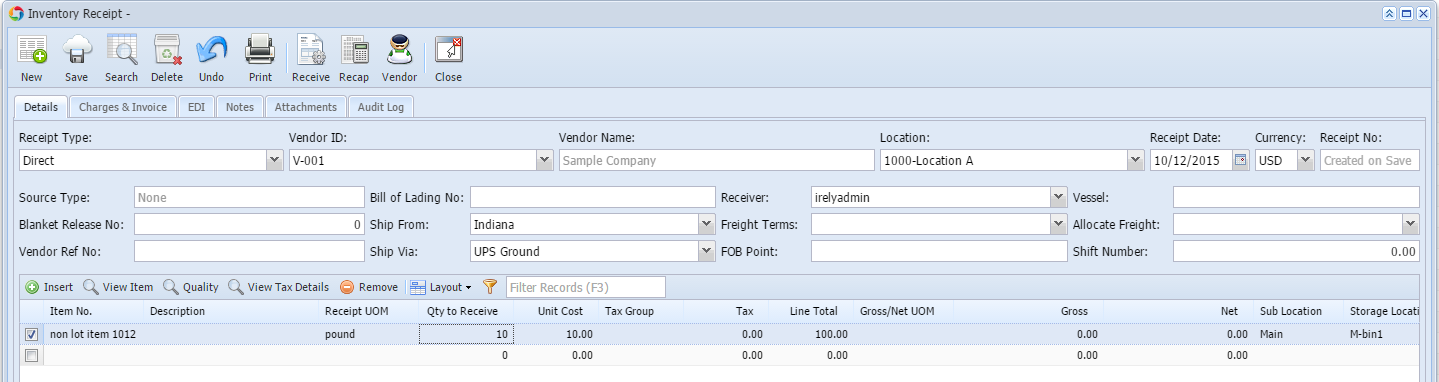

The following will detail Other Charge recorded as other charge and is payable to another vendor (not the vendor where the item is purchased). - Create Inventory Receipt. Select an item.

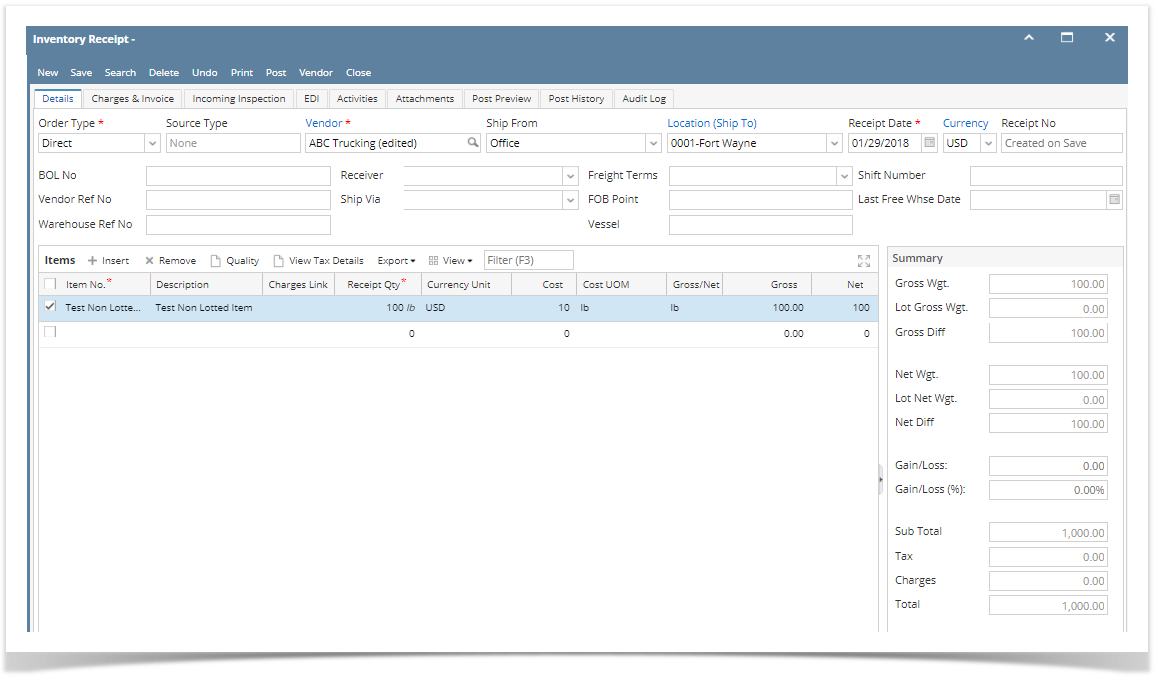

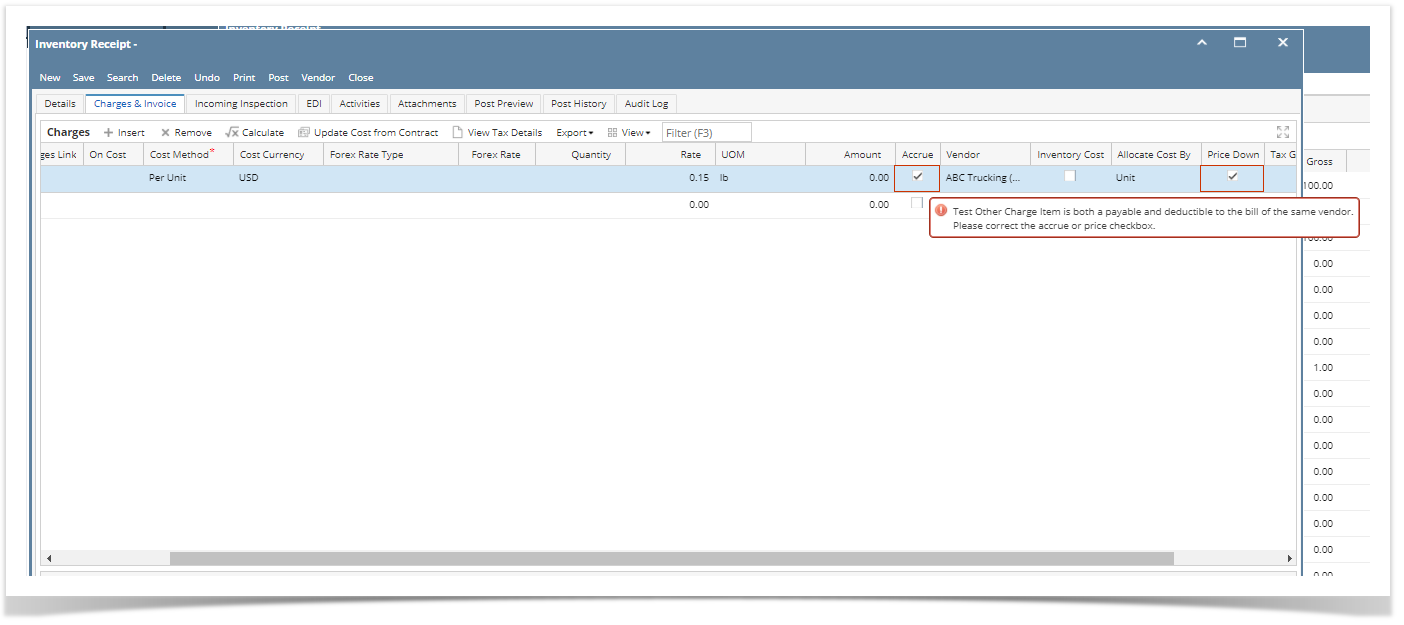

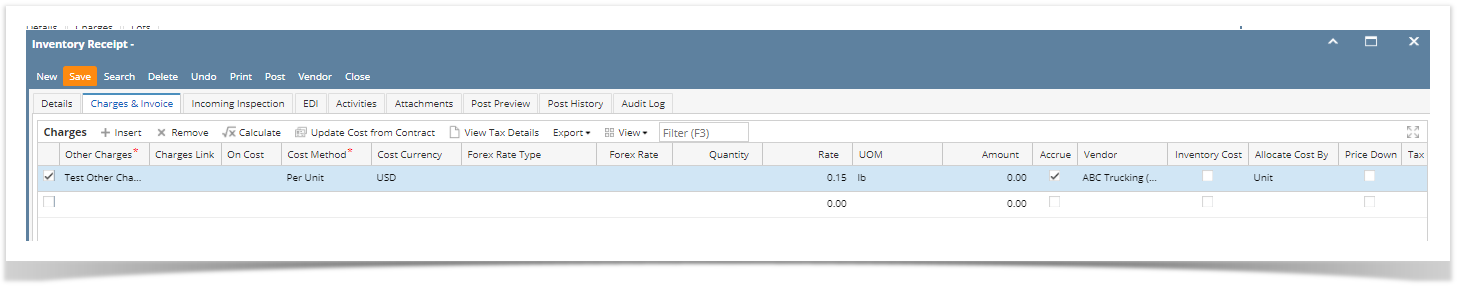

- Go to Charges & Invoice tab and select an other charge item. Setup the other charge item to have:

- Inventory Cost is unchecked

- Accrue checkbox is checked and vendor selected is another vendor (third-party vendor).

- Price is checked

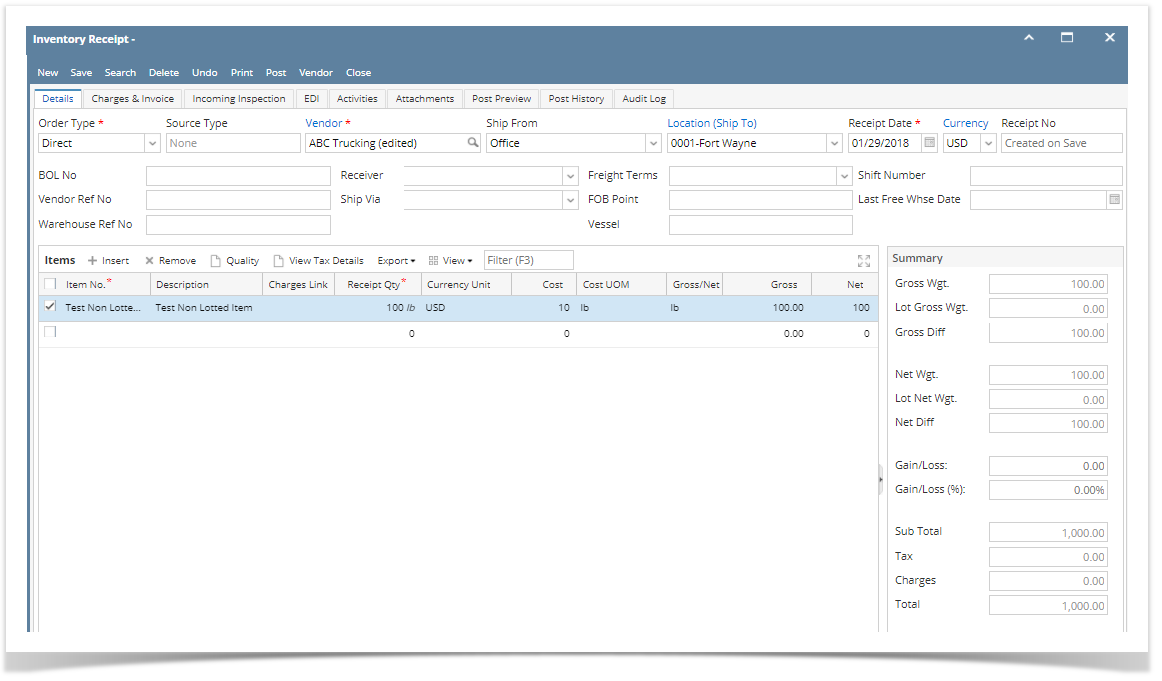

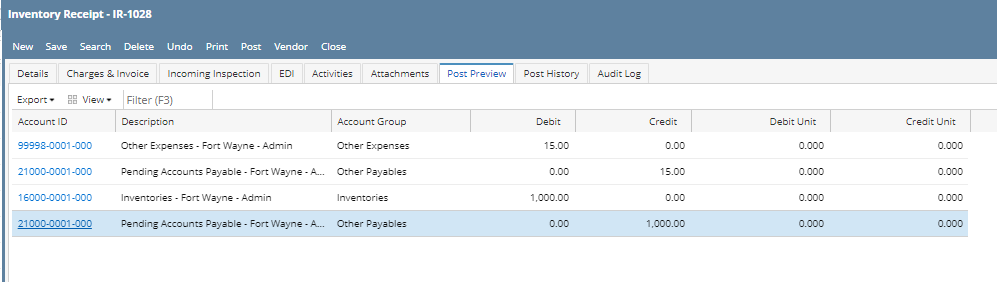

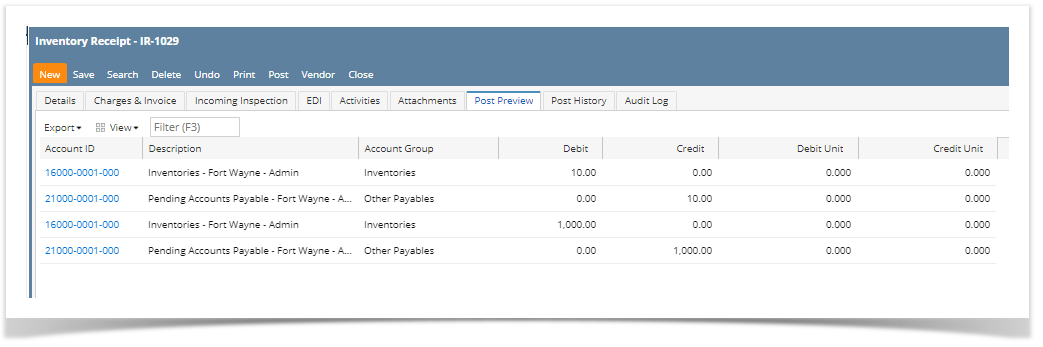

- Posting Inventory Receipt with this scenario will only record the item purchased.

- Post the Inventory Receipt and process it to Bill by clicking the Bill toolbar button.

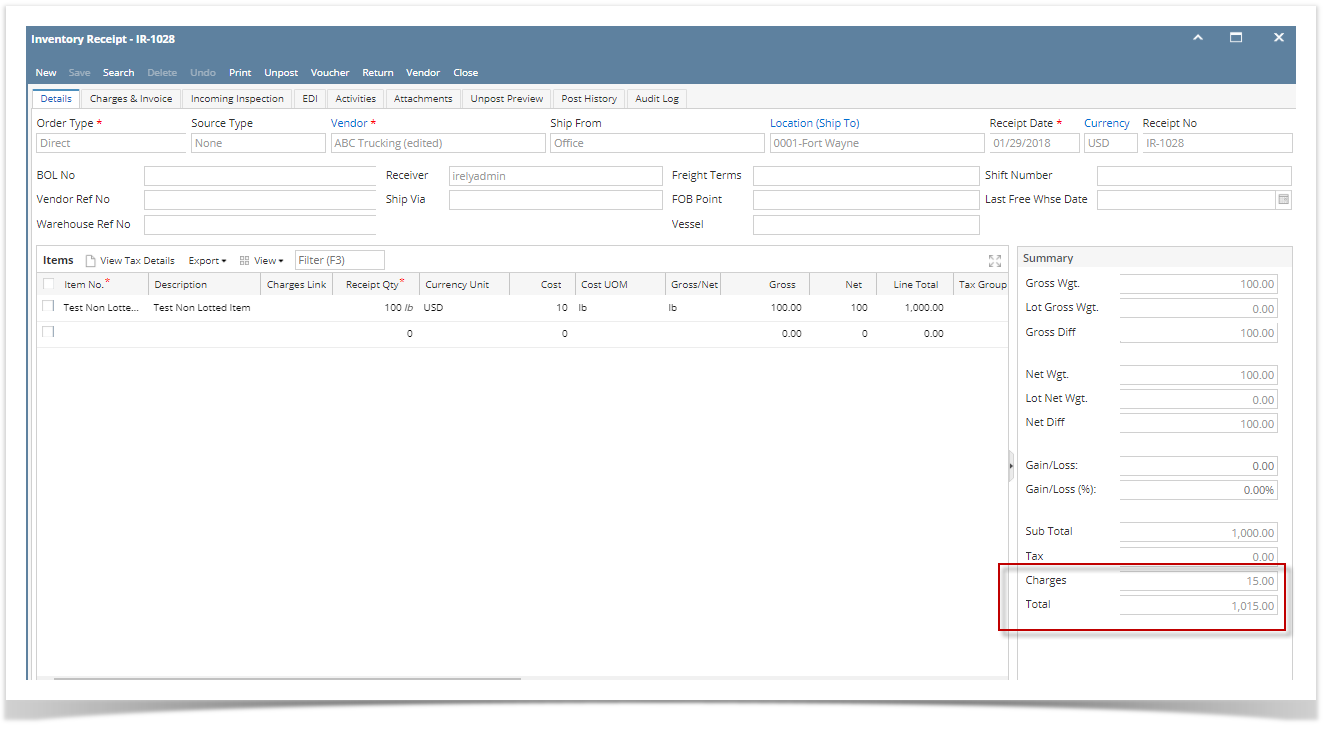

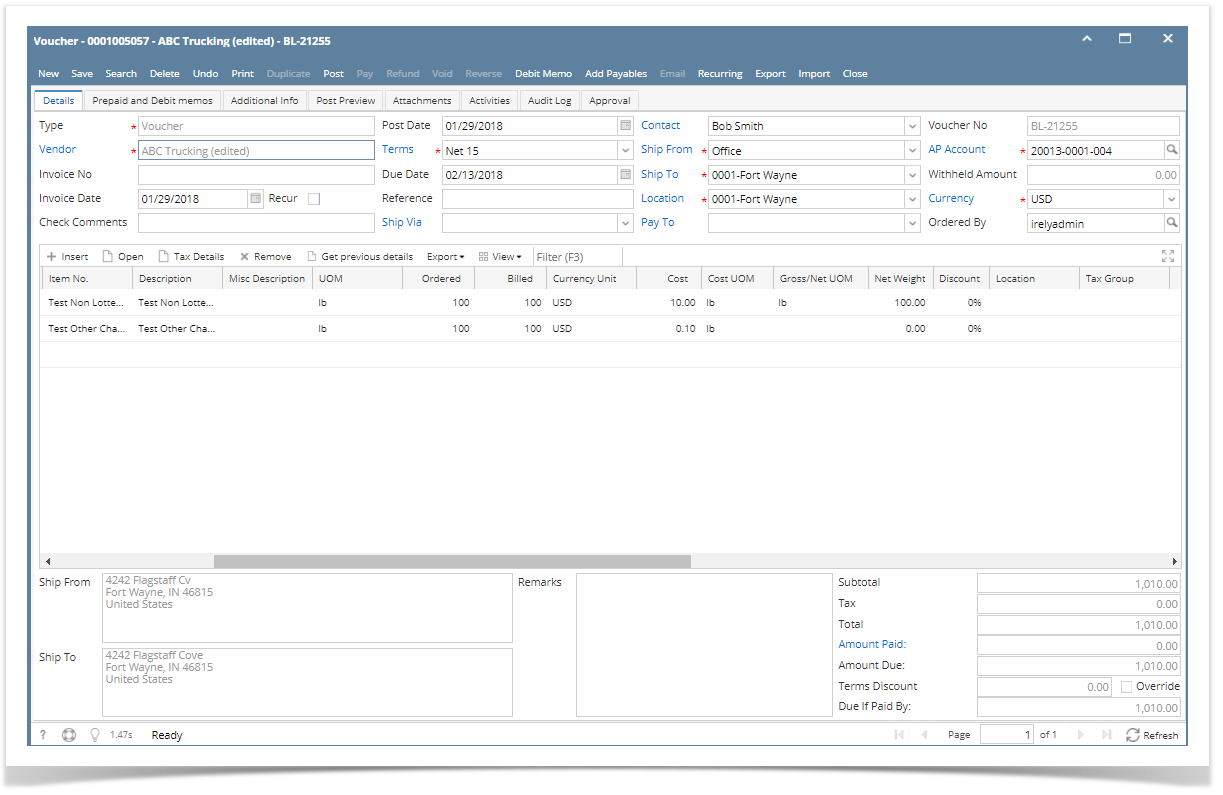

Notice also that in the Detail tab, there is the Total Charges shown. That same amount is the total Charges added in the Charges & Invoice tab. - This is the Bill created. Notice that only the item purchased is added in the grid. This is because the Other Charge is charged by a third party vendor.

- Posting this Bill will zero out the AP Clearing account and pass that same amount to Accounts Payable for the amount of the Item cost only.

- Post the Bill.

- To record the Other Charge, create a new Bill and select the third-party vendor. This is the Vendor selected in the Inventory Receipt > Charges and Invoice tab > Vendor (field next to Accrue checkbox).

The Add Inventory Receipt screen will be opened.

- Find for the Inventory Receipt transaction and select it. Then click Add toolbar button.

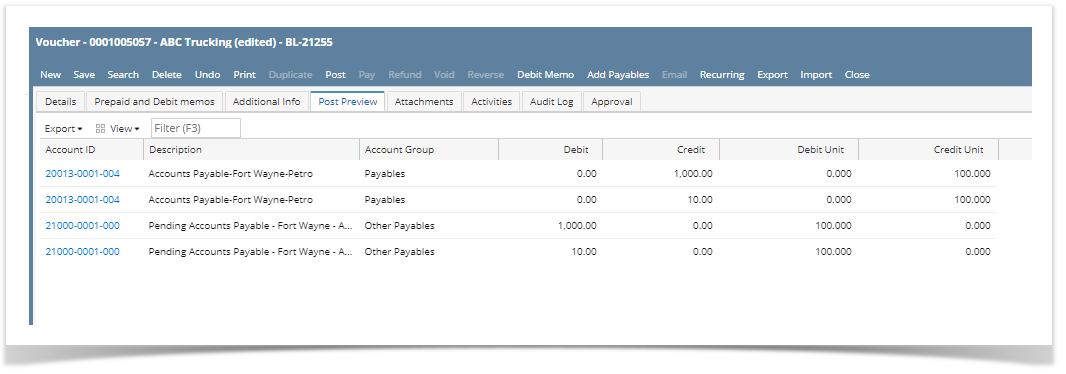

- The Other Charge is added in the Item grid. On this bill is where the Other Charge is recorded.

- Posting this Bill will record the Other Charge payable to another vendor (third-party vendor).

- Post the Bill.

|