Pre-requisite:

Steps:

- From the menu screen, go to Patronage > Dividends.

- Click New from the Search screen toolbar.

- Select a Fiscal year to process. After selecting a fiscal year, the system will calculate dividends for each issued stock. Stocks that were issued on or before the selected year will be included in the dividend calculation.

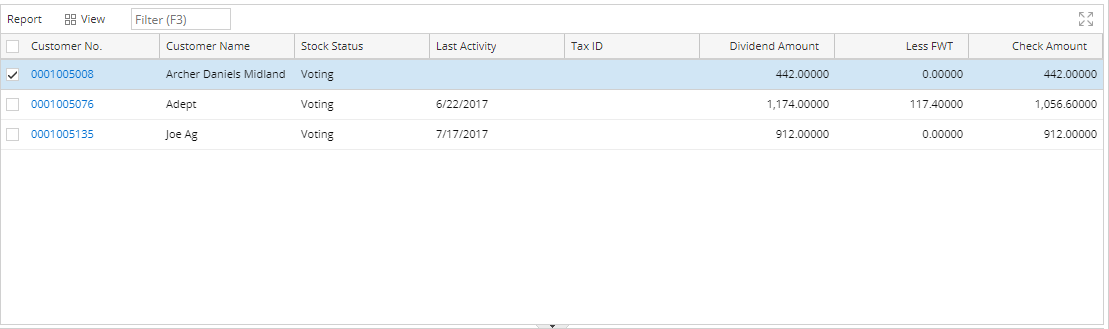

- Level 1 Grid shows the total dividends calculated for a customer:

- Customer No

- Customer Name

- Stock Status

- Last Activity

- Dividend Amount – the total dividends computed for a customer

- Less FWT – Dividend Amount x Fed. Withholding %

- Check Amount – the actual amount to be vouchered. (Dividend Amount - Less FWT)

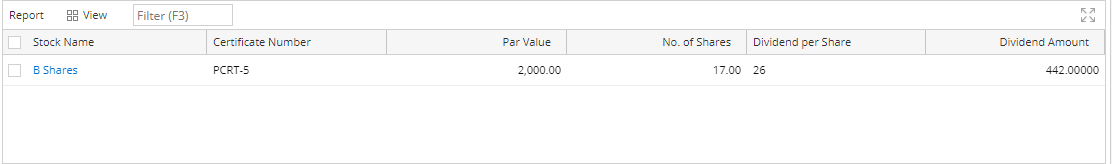

- Level 2 grid shows the details of the calculated dividends for a customer

- Stock Name

- Certificate Number – certificate number of the Issued stock

- Par Value – value of the stock name

- No. of Shares – shares qty of the stock

- Dividend per Share – quantity of dividend per share of the stock name

- Dividend Amount – the dividend computed for the specific stock

- If Prorate Dividends is unchecked – ((No of Share x Dividends Per Share)/365) x Processed Days

- If Prorate Dividends is unchecked and Cutoff Date is entered – ((No of Share x Dividends Per Share)/365) x (Processing Period To - Stock Issue Date)

- Level 1 Grid shows the total dividends calculated for a customer:

- Click Save.

- If successfully saved, click Post. GL entries will be created.

- To create vouchers, select records from the grid. Then click 'Voucher' from the toolbar.

Important Notes:

- Unposting the transaction will reverse GL entries. However, if there are already vouchered dividends, unposting is not allowed.

- Only the Stocks with 'Open' Activity status will be calculated for dividends.

Overview

Content Tools