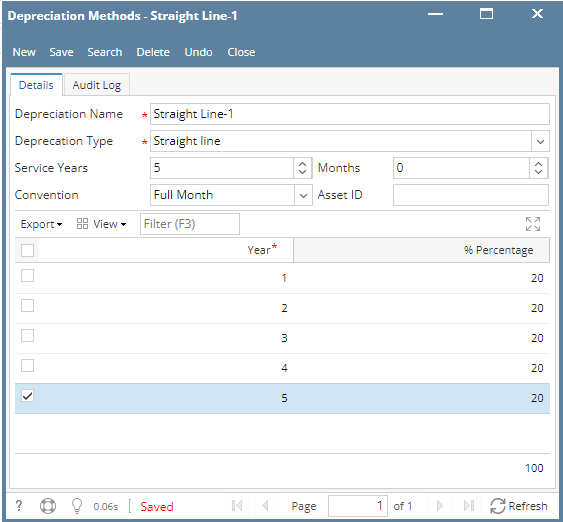

1. Go to Fixed Assets > Maintenance > Depreciation Methods "Should open Search Depreciation Methods" screen.

2. Click New button "Should open Depreciation Methods" screen.

3. Enter these information

- Depreciation Name: Straight Line-<unique no.>

- Depreciation Type: Straight Line

- Service Years: 5

- Months: blank

- Convention: Full Month

4. In the grid

- enter these % Percentage (20%)

5. Click Save button

Overview

Content Tools