Create Depreciation Method

1. Fixed Assets > Maintenance > Depreciation Methods

2. Click New button

3. Enter these information

Header:

- Depreciation Name: SL-T45-<unique no.>

- Depreciation Type: Straight Line

- Service Years: 1

- Months: blank

- Convention: Actual Days

*Take note of Depreciation Name

4. In the grid, enter these % Percentage

- % Percentage: 100

5. Click Save button

6. Click Close button

7. Click Close button

Create Fixed Asset

1. Fixed Assets > Activities > Fixed Assets

2. Click New button

3. Enter these information

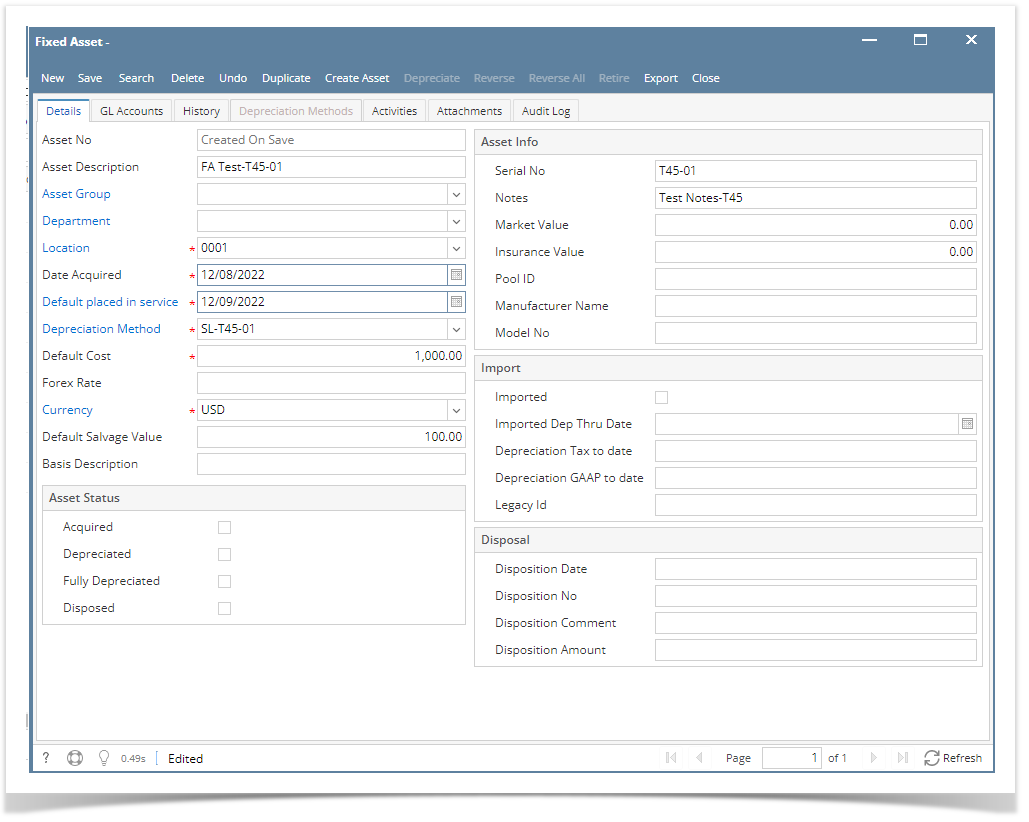

Details tab:

- Asset Description: FA Test-T45-<unique no.>

- Location: ADMIN LOCATION

- Serial No: T45-<unique no.>

- Notes: Test Notes-T45

- Date Acquired: Yesterday

- Default placed in service: Today

- Depreciation Method: <Depreciation Name noted in Step 3>

- Default Cost: 1,000.00

- Default Salvage Value: 100.00

*Take note of Asset No

*Take note of Asset Description

*Take note of Serial No.

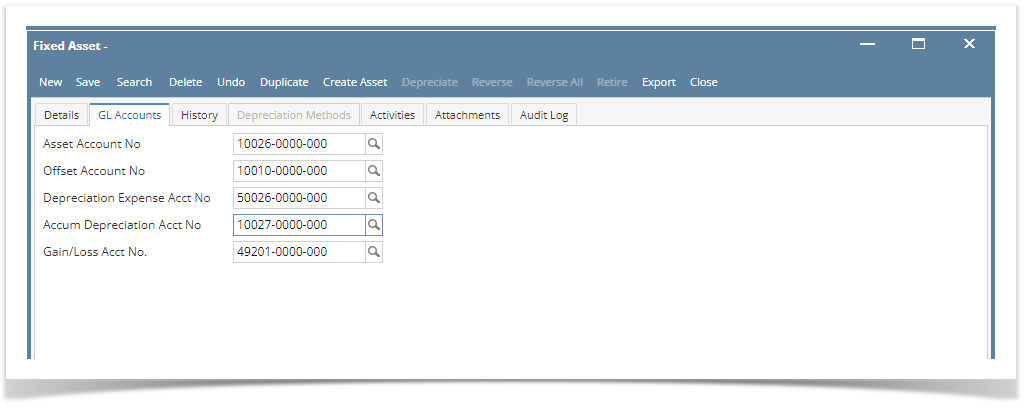

4. Go to GL Accounts tab and set GL Accounts <How to Create GL Accounts for Fixed Asset>

5. Click Save button

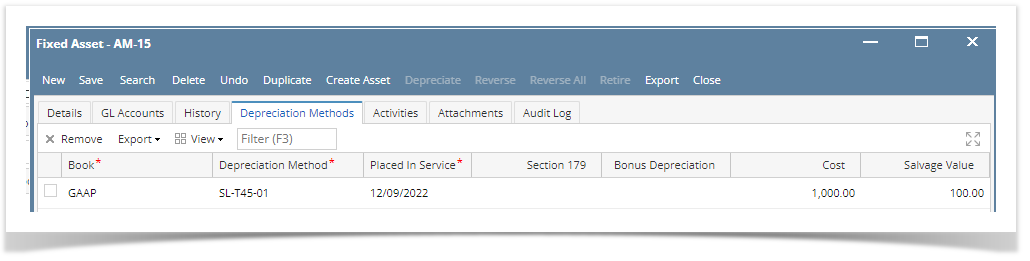

6. Go to Depreciation Methods tab and verify information

7. In Depreciation Methods tab, add a record for booking of Tax

8. In a new row, add this record

- Book: Tax

9. Click Save button

10. Click Close button

11. Click Close button

Acquire Asset

1. Fixed Assets > Activities > Fixed Assets

2. Filter for this record

- Asset No. = <Created Asset>

3. Click Create Asset button

*Take note of Transaction Id generated in the message.

4. Click OK

5. Click Close button

6. Click Close button

Depreciate Single Asset

1. Fixed Assets > Activities > Fixed Assets

2. Filter for this record and click Open Selected button

3. Click Depreciate button

*Take note of the Transaction ID for GAAP

4. Click Close button

5. Go to History tab and filter for this record

- Transaction = Place in service

6. Click Depreciate button

*Take note of the Transaction ID for GAAP

7. Click Close button

8. Go to History tab and filter for this record

- Transaction Id = <Transaction ID for GAAP noted is Step 6>

- Sample computation used these dates:

- Date Place in Service is 27, since today is 10/27

- The below numbers vary based on the date of Date Place in service.

- computed as:

- Actual Days = (End of This Month - Date Place in service) + 1

- = (31 - 27) + 1

- = 5

- Depreciation per Month = Basis /12

- = 900/12

- = 75

- Depreciation per Day = Depreciation per Month/No. of Days for This Month

- = 75/31

- = 2.419354

- Depreciation per Day x Actual Days

- = 2.419354 x 5

- =12.10

9. Click Close button

10. Click Close button