- Created by Brian Kay, last modified by Steve Palm on 12-15-2021

More to come... on ORIGIN Payroll and 1099 EOY Procedures.

Pre-quisitie: 16.1 Patch Date after 11/1/16

Processes:

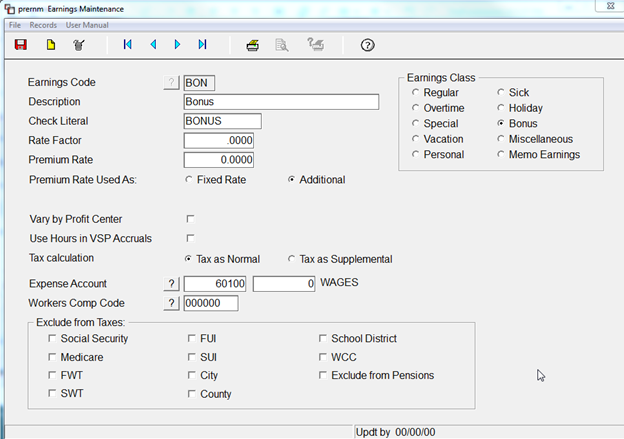

First, Validate Earnings Code is setup correctly

Payroll -> Setup -> Earnings Code Setup

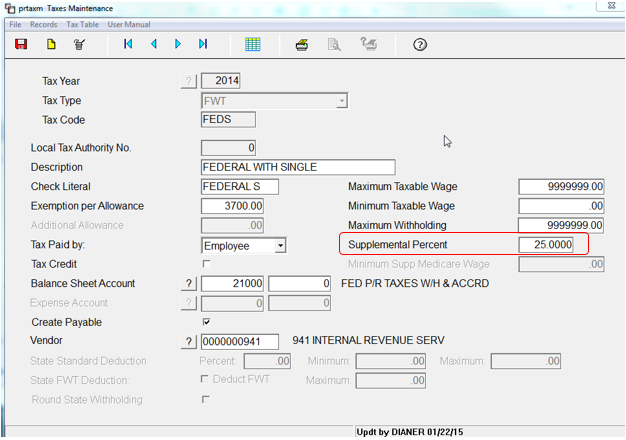

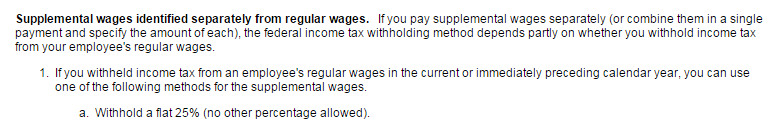

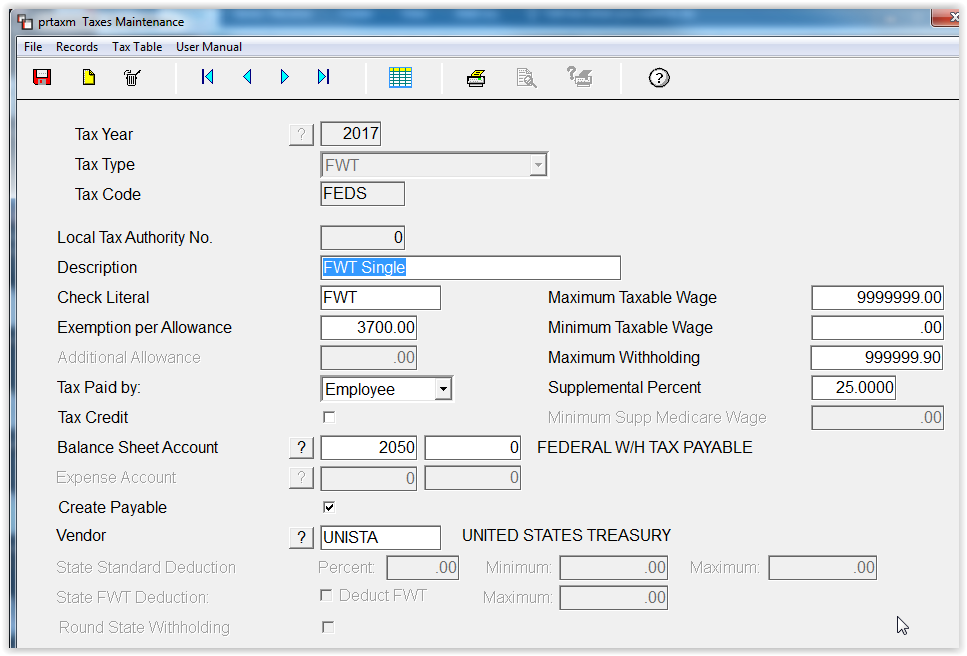

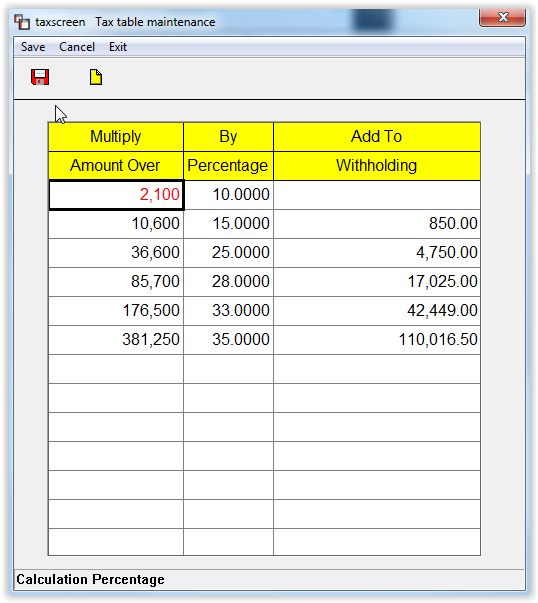

If you are Taxing as Supplemental, make sure that Tax is Setup

Payroll -> Setup -> Taxes Maintenance

Supplemental Tax Rate for 2015

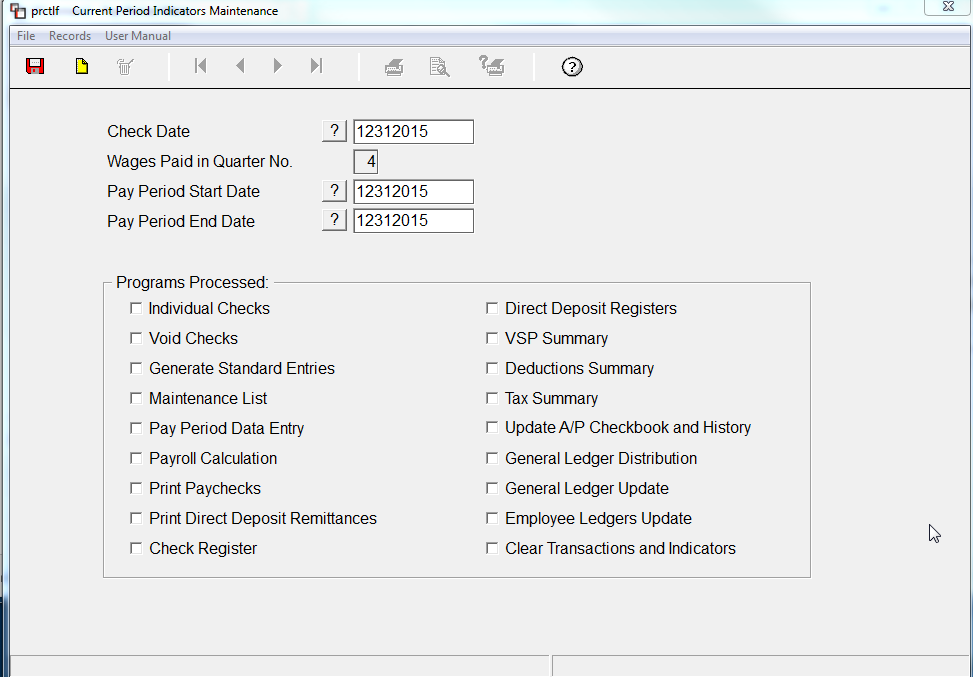

Payroll -> Pay Period Menu -> Current Period Indicators Maintenance

Set Check Date

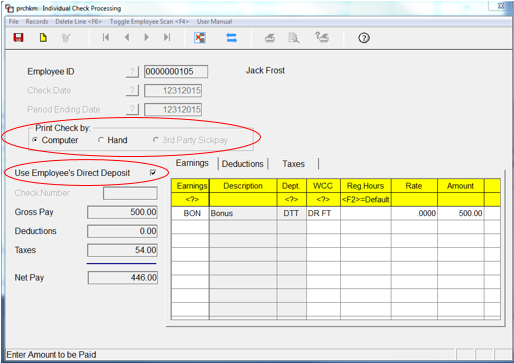

Payroll -> Individual Check Processing

Print Check by - Computer if you want to print a Check or ACH advice. If you are hand writing checks, Select Printed by Hand.

If you wish to Direct Deposit the bonus, check the Box Use Employee's Direct Deposit.

Bonus amount may be based on an hourly rate or a flat amount.

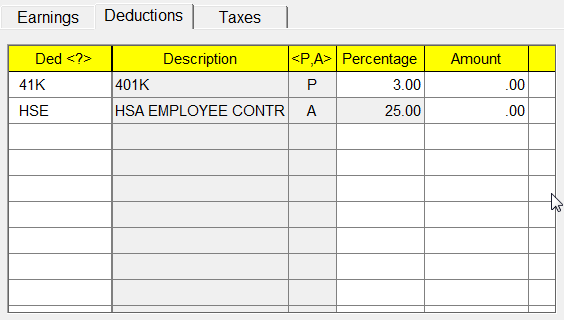

Validate information on Deduction Tab

System will zero out Deductions - you may adjust if needed.

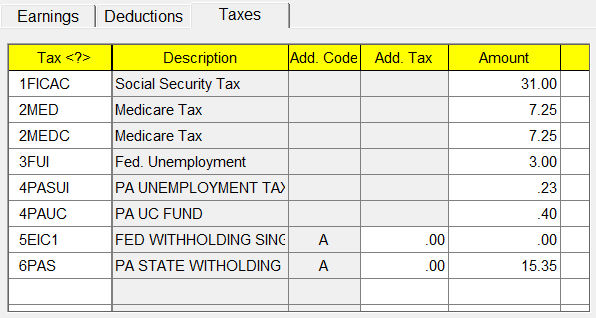

Tax Tab should be validated as well. These amounts are also adjustable.

- Enter All Individual Check Earnings Amounts for each Employee in Individual Check Processing

- Go To Pay Period Menu

- Calculate Wages/Print Calc Reports

- Print Payroll Checks

- Complete Payroll Run as Normal

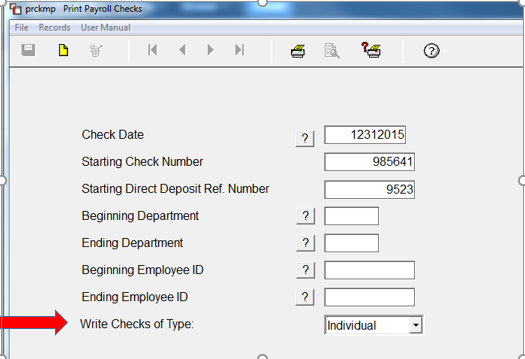

- NOTE: If you are printing actual CHECKS, the the "Write Checks of Type" drop down, select "Individual" or your checks will not print.

Complete Payroll Process

- Enter Bonus Information in the Individual Check Screen

- Process Payroll as Normal for the Current Pay Period

- Calculate Wages/Print Calc Reports

- Print Payroll Checks

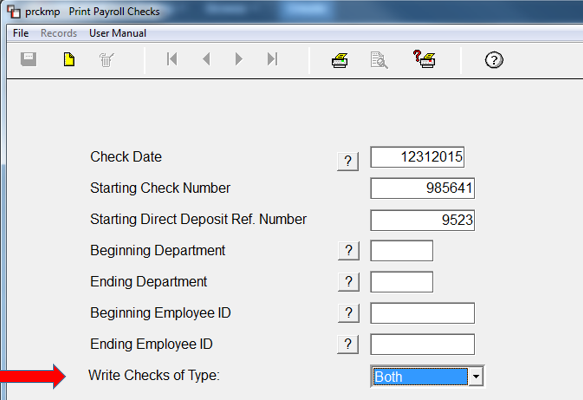

- NOTE: If you are printing actual Checks, in the "Write Checks of Type" drop down, select "Both" as this will print Regular and Individual Checks

Complete Payroll Process

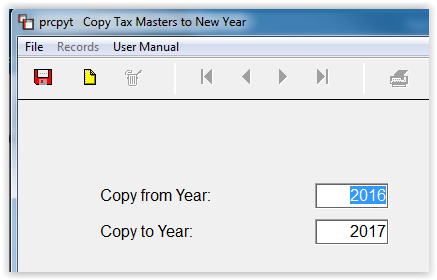

Payroll -> End of Year -> Copy Tax Masters to New Year

It will come up with the Current Year in the Copy From field and put Next Year in the Copy To Year

Enter through the fields for Save Button to become active

Click the Save Button

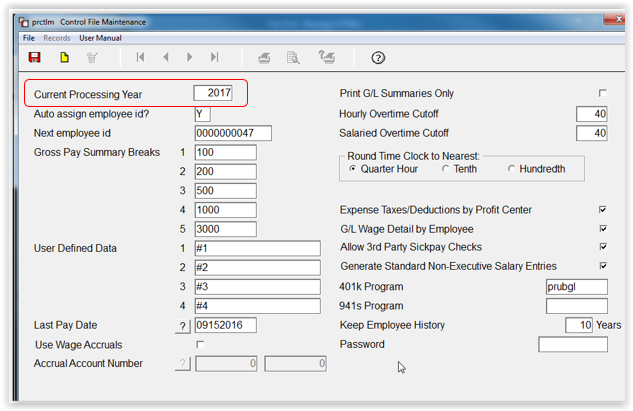

NOTE: This will change the Current Year in the Control File. Any Payroll run after this will be in the New Year.

Payroll → Setup → Control File Maintenance

Individual Taxes can then up updated

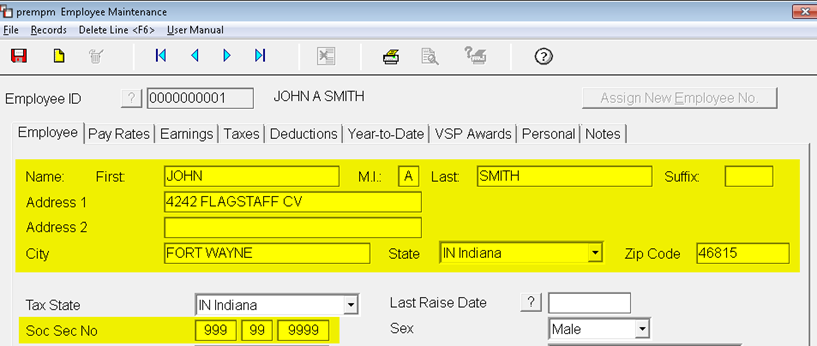

Employee Info - (Name, Address, Social Security Number)

- Payroll - Employee Menu - Employee Maintenance

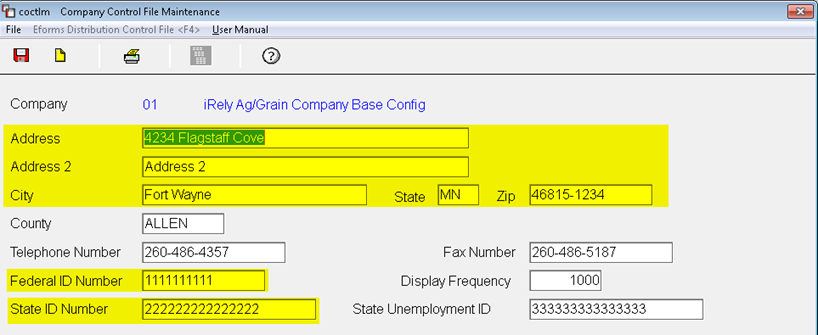

Corporation

- Company Setup Menu - Company Control File

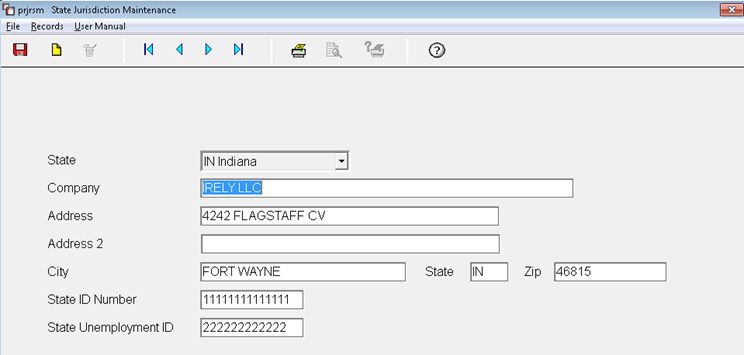

Multi States (Optional)

- Payroll - Setup Menu - State Jurisdiction

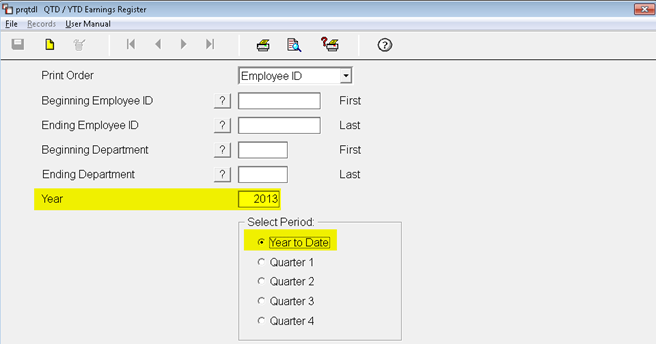

YTD Pay History

- Payroll - End of Quarter - QTD/YTD Register

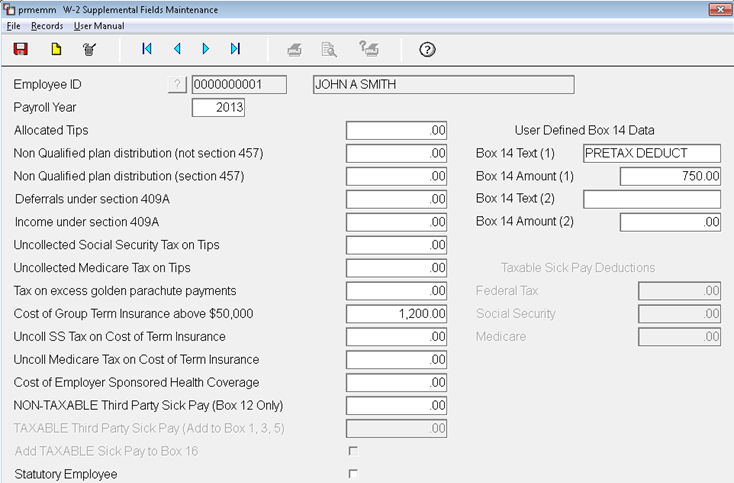

Purpose -

- Enter additional data to show on W2 that is not part of the base Payroll System

- Common Uses:

- Insurance above $50,000

- Tips

- Miscellaneous Box 14

- Payroll - End of Year Menu - Supplemental Maintenance

Purpose -

- To distribute official copies of the W-2 to your employees

- Due by January 31st to employees

- Due by February 28, for Paper Filings to Federal Government

- Due by March 31 for Electronic Filing to Federal Government

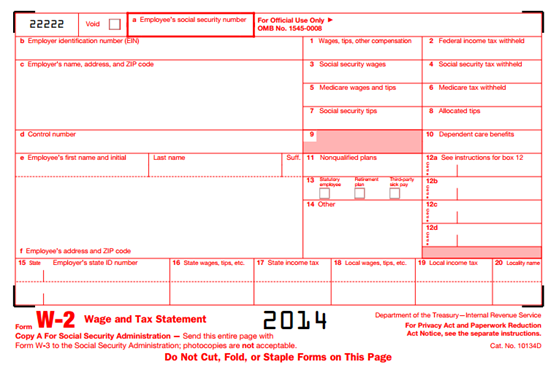

- Make sure you have purchased W-2 forms

- Make sure you have a W2 printer setup in iRely to ensure proper print alignment

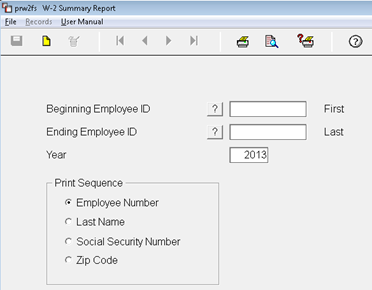

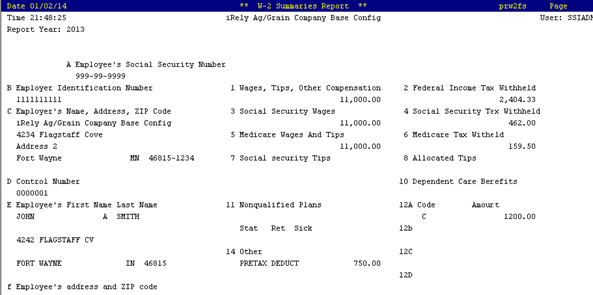

Payroll Menu - End of Year - Print W-2 Summary report

- This is a plain paper version that can be verified by your accountant prior to printing actual W-2s

Print multiple pages of W-2s on plain paper and compare alignment to actual forms prior to printing on the forms

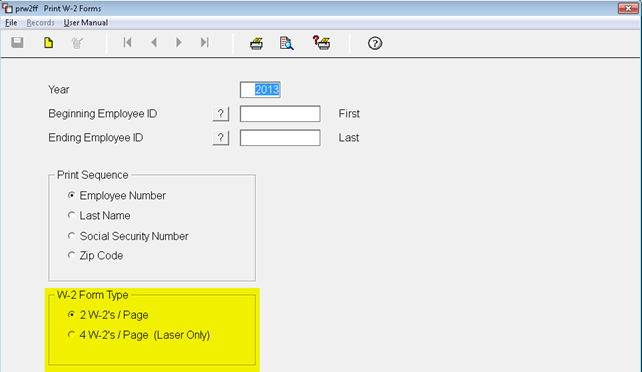

Payroll - End of Year Menu - Print W-2 Forms

- Select number per page

- For 2 per page, you will need to print separate W-2 runs for each Schedule/Packet of forms

- For 2 per page, you will need to print separate W-2 runs for each Schedule/Packet of forms

Send Electronic File to the IRS and other Government Agencies

- Due by March 31st, required if you have more than 250 employees

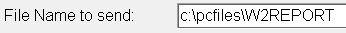

Payroll - End of Year Menu - W-2 magnetic Media Creation

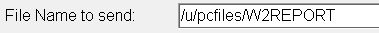

Update File Name to send Pathing to your shared pcfiles folder on your server to find your W-2 file quickly

EXAMPLES:

Windows Server

Unix/Linux Server

Validate your file for errors by downloading AccuWage from the IRS website

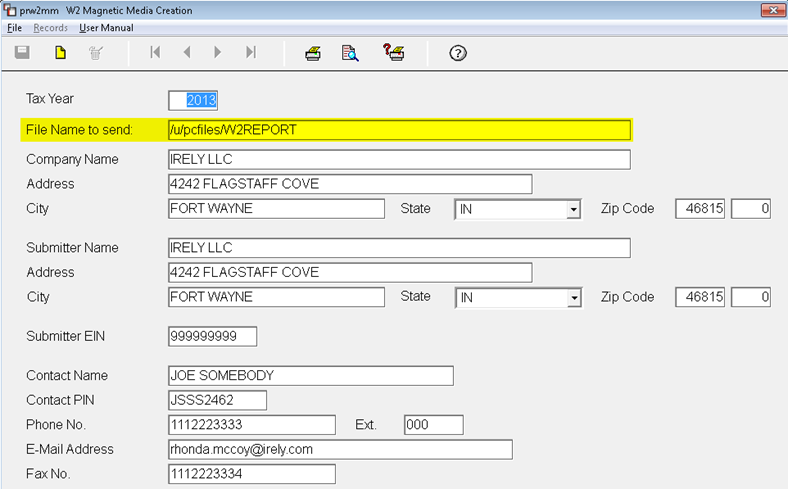

Not all states have a unique W-2 Magnetic media format.

The following is an example when the software does not have an state specific program.

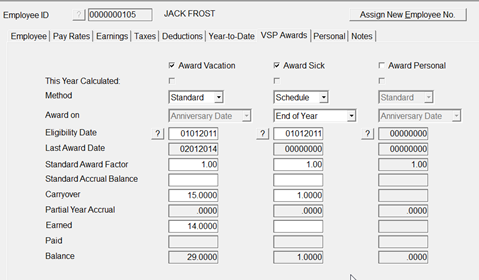

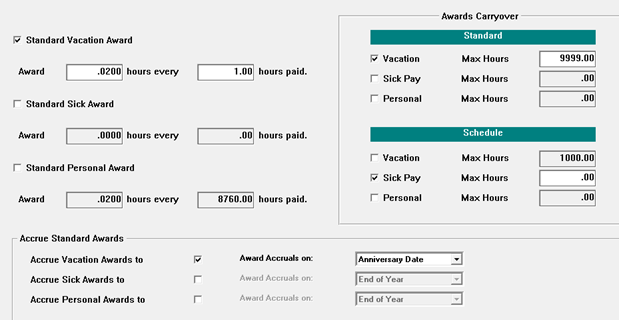

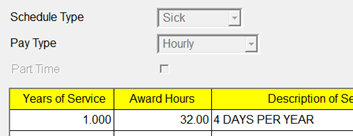

- VSP Program being used (Scheduled vs. Standard)

- Award Frequency (End Of Year vs. Anniversary Date etc.)

- Process should be run before First Payroll of New Year

- Standard Method Vacation with an award on Anniversary Date

- Scheduled Method Sick Time with award at End of Year

- •Payroll Setup Menu -•VSP Standard Awards Maintenance•VSP Scheduled Awards Maintenance

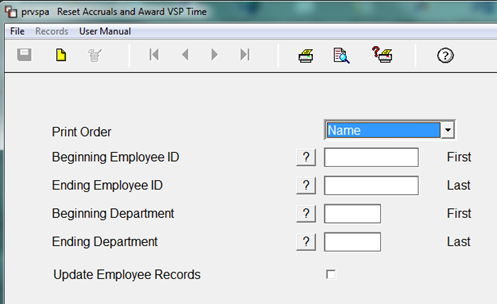

- First, Run Report without checking the Update Employee Records Box

- This will allow you to verify information without updating

- This will allow you to verify information without updating

- Payroll End of year

- Reset Accruals and Award VSP Time

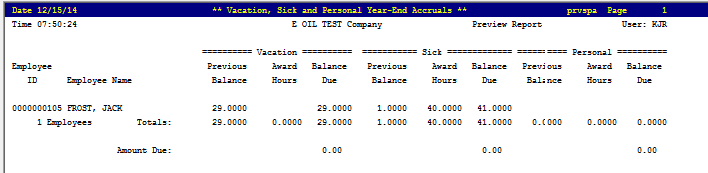

Verify Employee Information

- Vacation Time will not change, as it is awarded on Anniversary Date

- Sick Time will reset

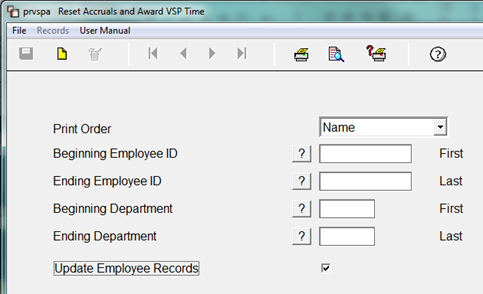

- Run process again, checking update box

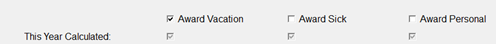

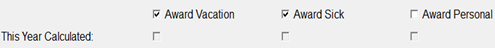

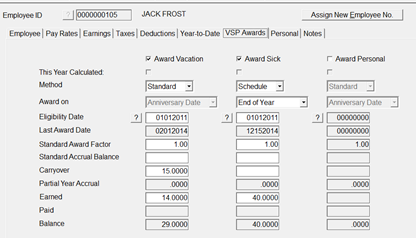

- This Year Calculated is now “Unchecked”

- Vacation Time remains the same – as it is awarded on Anniversary Date

- Sick Time has been changed to 40 hours

- No labels