- Click Deduction Types from Payroll module.

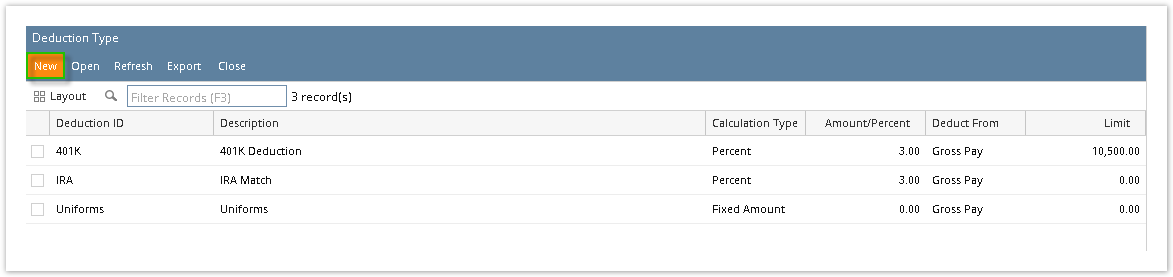

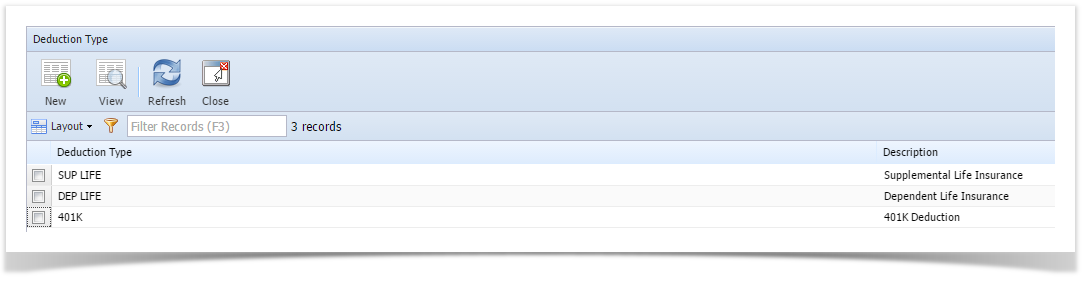

- If there are no deduction types yet, new Deduction Types screen will be displayed directly. Otherwise, a list of existing deduction types will be displayed.

- Click New toolbar button.

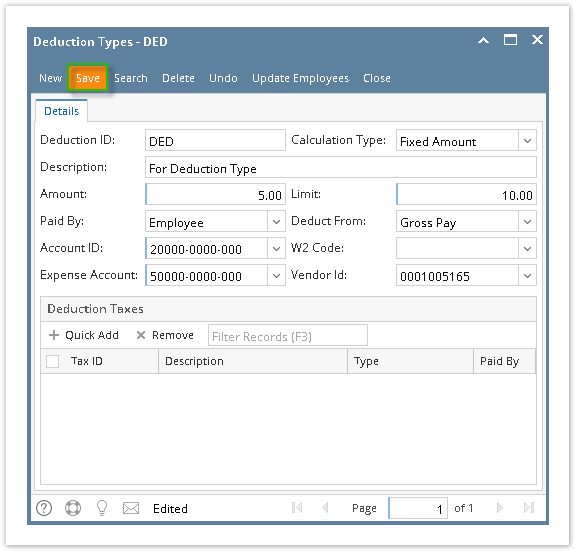

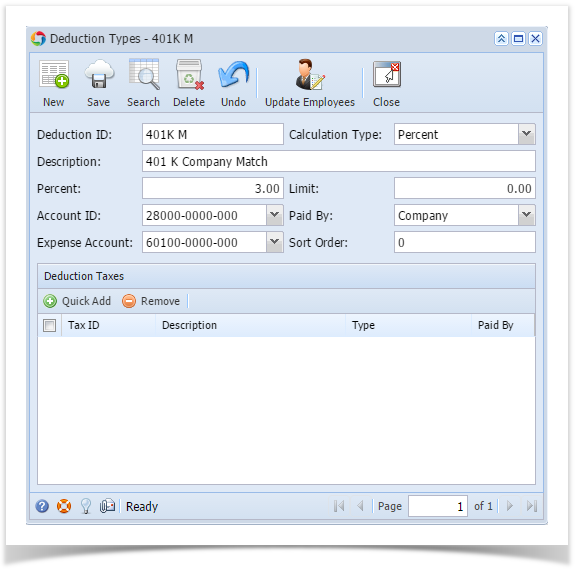

- Set the value for the following fields:

- Deduction ID

- Calculation Type

- Description

Amount

i. This field is enabled when the Calculation Type is:

>> Fixed Amount and Hourly Amount

ii. This field is renamed to "Percent" when the Calculation Type is:

>> Percent and Hourly Percent

Paid By

If Paid By is Employee, Expense Account is not required.

If Paid By is Company, Expense Account is required.

- Account ID

Expense ID

Account ID should display Liability Accounts only while Expense ID should display Expense Accounts only.

Limit

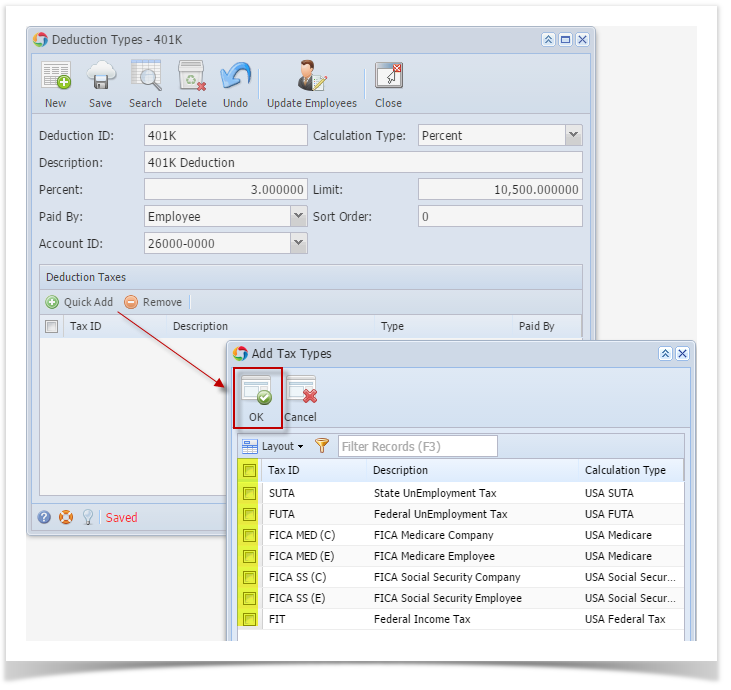

- Add Deduction Taxes.

- Click Save toolbar button to create deduction type.

- Newly created deduction type should appear in the grid.

Overview

Content Tools