Before you can start creating foreign transactions, follow the steps on How to Setup Multi-Currency.

The following will guide you on how to create Inventory Receipt for foreign customer.

Example 1: This example will show you when forex rate is below 1.

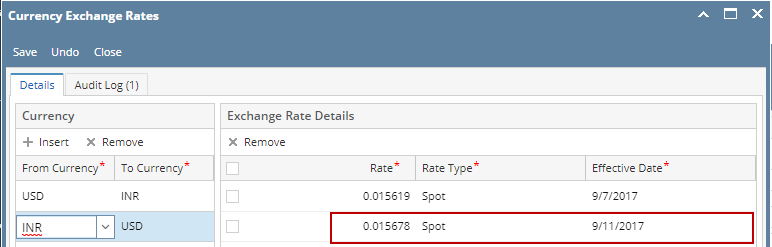

1 INR = 0.015678 USD

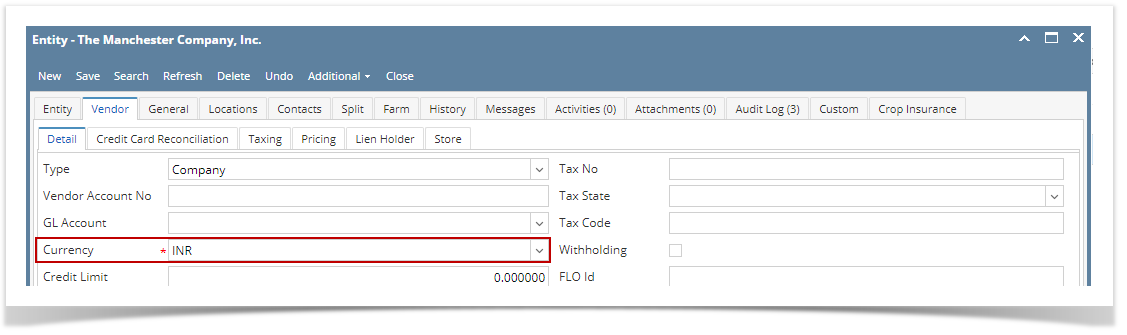

- Say this is your foreign Vendor. In this example, Currency field is setup as INR (Indian Rupee). You can open Vendor screen from Purchasing (Accounts Payable) > Vendors.

- Create Inventory Receipt.

- Inventory > Inventory Receipts > click New

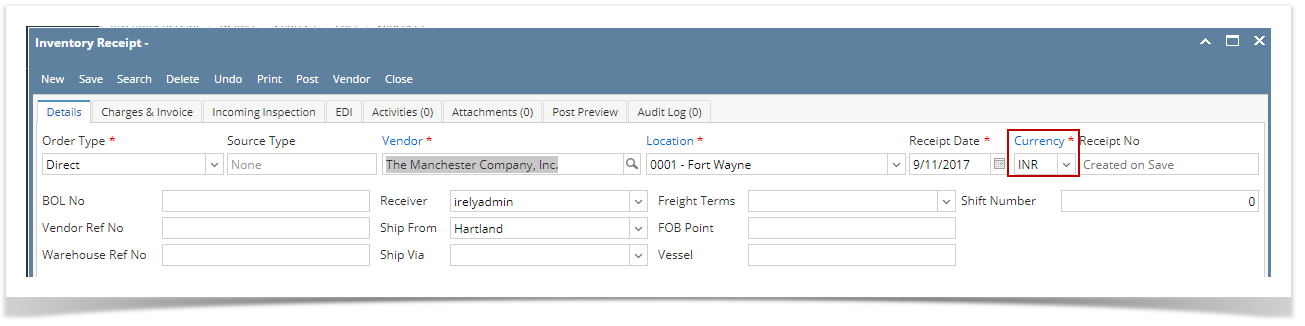

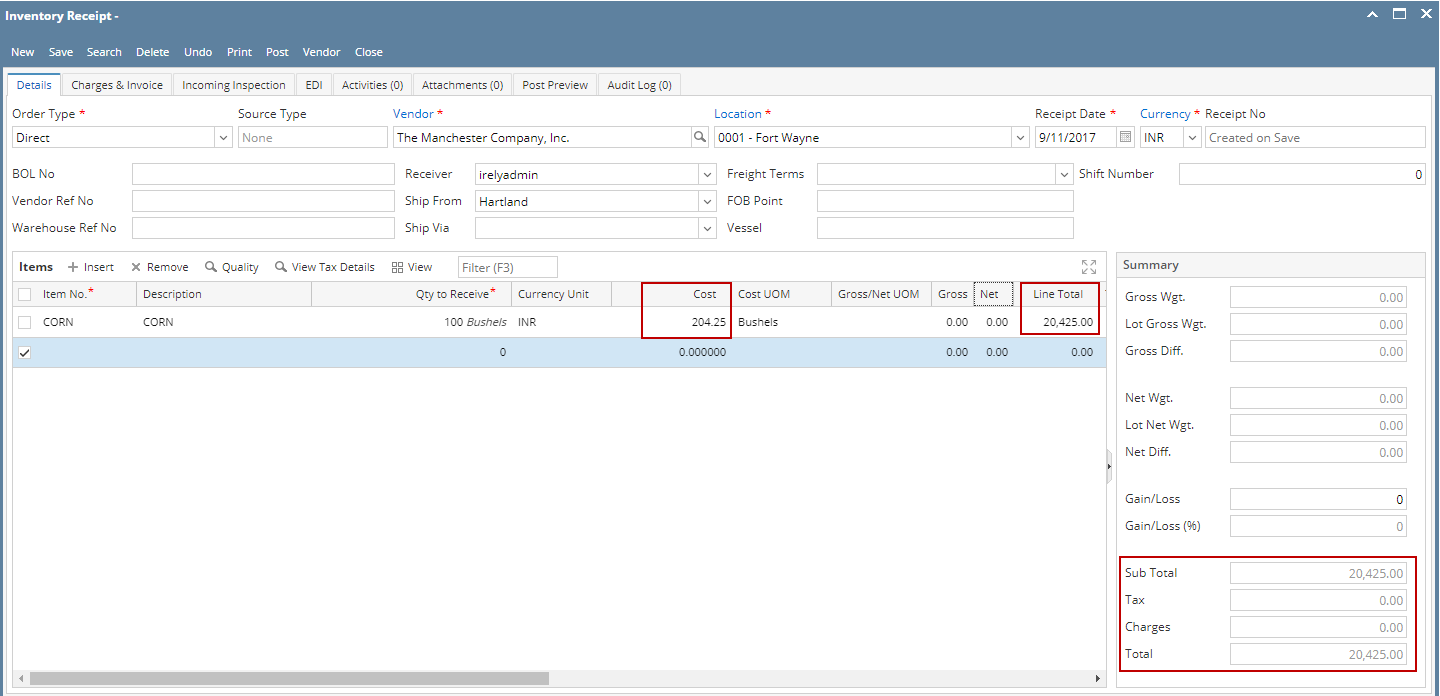

- Details tab

- In the Order Type field select Direct.

- In the Vendor field select the Vendor with foreign currency setup.

- Notice that Currency field will automatically show the Currency set for the selected Vendor.

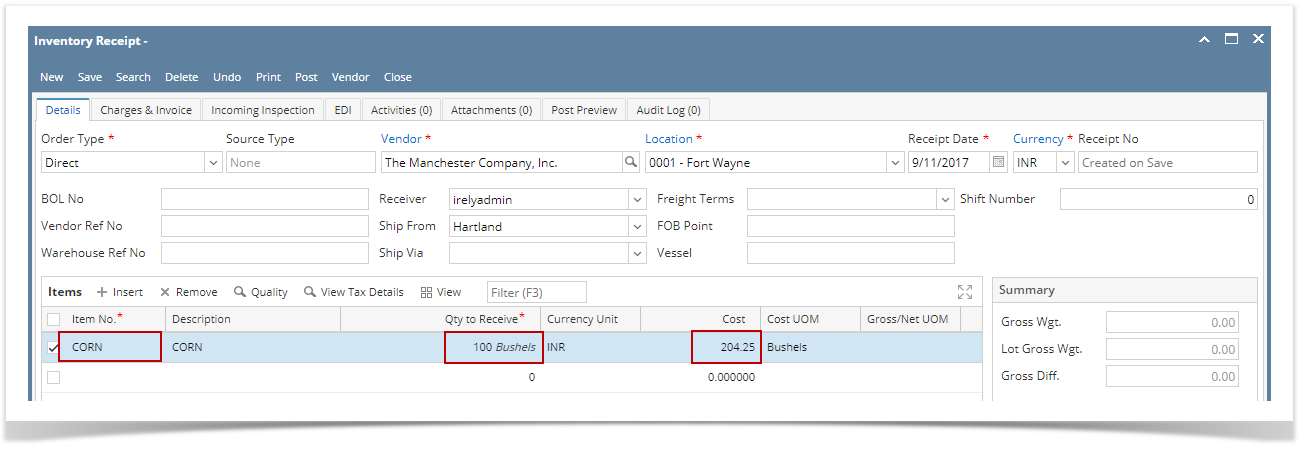

- In the Items grid area,

- Select Item from Item No. field.

- Enter Qty to Receive and UOM.

- Notice the Currency Unit will also show as INR. This field will default to the Currency assigned in the Inventory Receipt > Currency field.

- In the Cost field enter the Cost of the item.

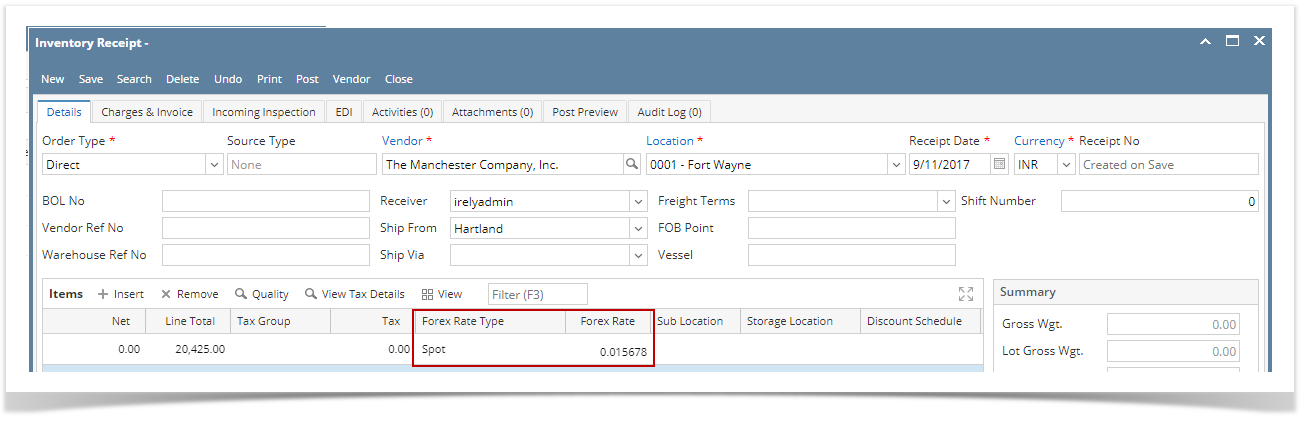

- The Forex Rate Type and Forex Rate fields are defaulted based on your Multi-Currency setup. That is why it is recommended that you have your multi-currency setup prior to doing foreign transactions. This will make the transaction entry easier than having to select Foreign Rate Type in every transaction.

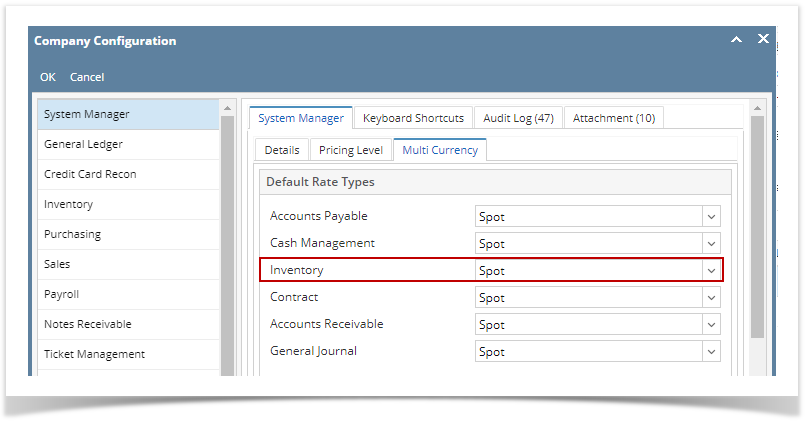

- The Foreign Rate Type is showing Spot since default setup for Inventory > Rate Type is Spot.

- The Forex Rate is showing the forex rate that matches the Forex Rate Type selected and the Date of the transaction.

- Also, the number of decimals to show in the Forex Rate field follows that of the Company Configuration > System Manager tab > Details tab > Default Values section > Currency Decimals field setup.

- The Foreign Rate Type is showing Spot since default setup for Inventory > Rate Type is Spot.

- The following fields are shown in foreign currency value.

- Cost

- Line Total

- Sub Total

- Total

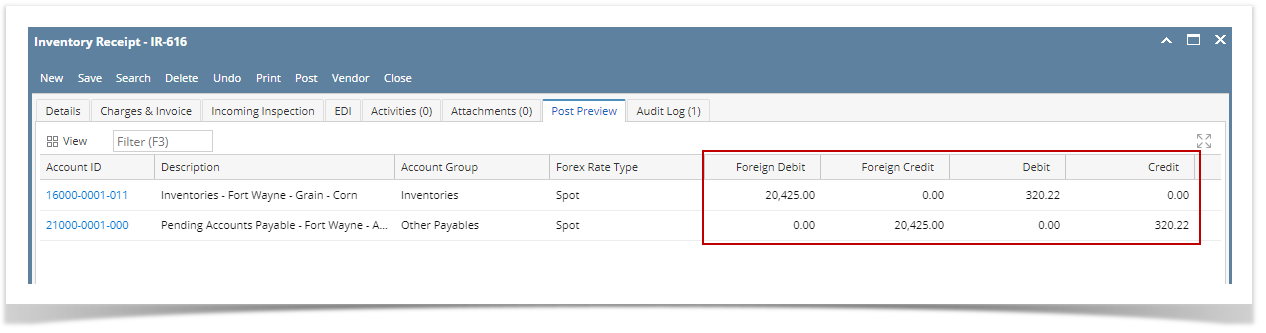

- Click on Post Preview tab.

- Foreign Debit and Foreign Credit will show the foreign value of the transaction. In this example, this is the INR value.

- Debit and Credit will show the value of the transaction in functional currency. In this example, this is the USD value. This is what get's posted to the General Ledger when the transaction is Posted.

- Click Post to post the transaction.

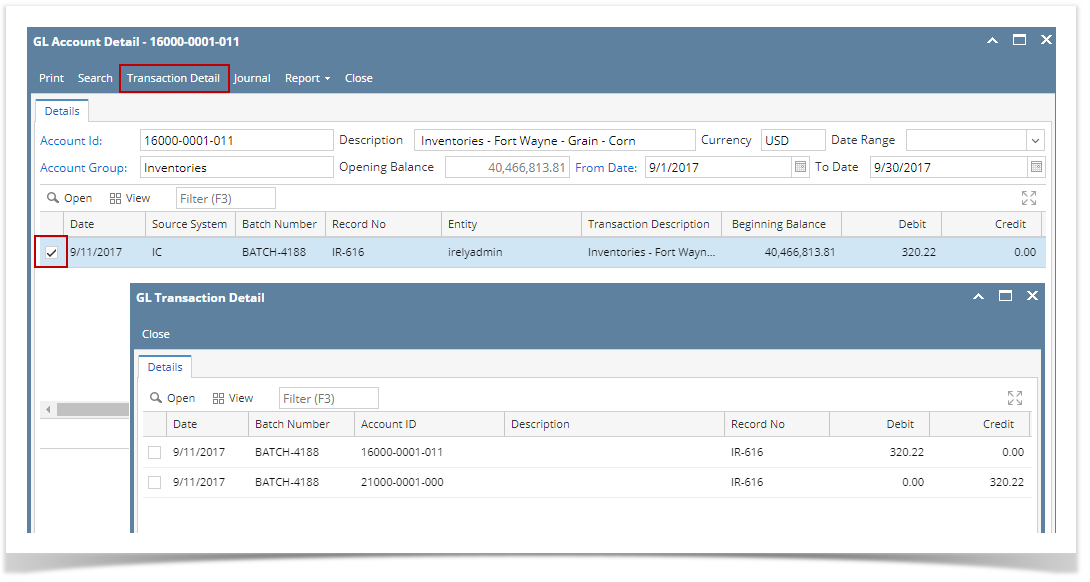

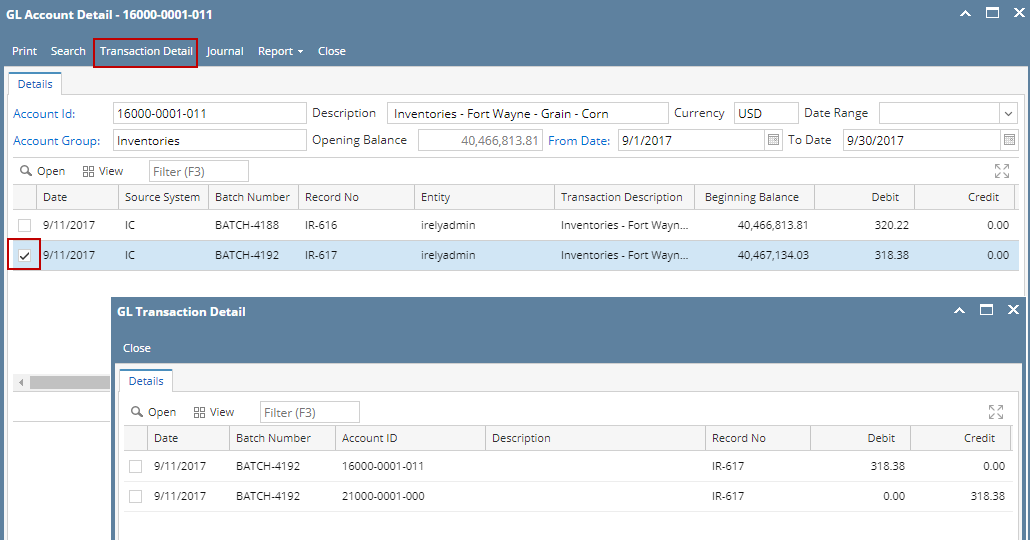

- Once transaction is posted, it will then be recorded in the GL Account Detail.

- GL Account Detail can be opened from General Leger > GL Account Detail > select to open any of the accounts used in Inventory Receipt transaction, in this example it is 16000-0001-001 or 21000-0001-000.

- To check the complete set of entries for the selected transaction, select for the transaction created (use the Record No. to look for the transaction) by checking the checkbox before the Date and click Transaction Detail.

Example 2: This example will show you when forex rate is higher than 1.

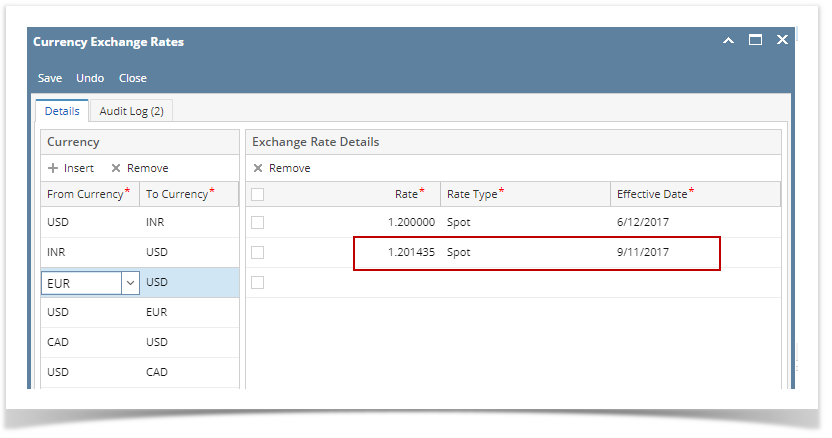

1 EUR = 1.201435 USD

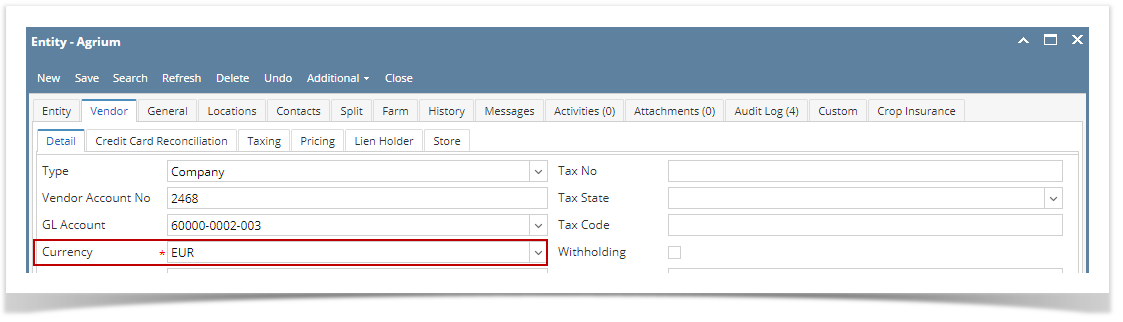

- Say this is your foreign Vendor. In this example, Currency field is setup as INR (Indian Rupee). You can open Vendor screen from Purchasing (Accounts Payable) > Vendors.

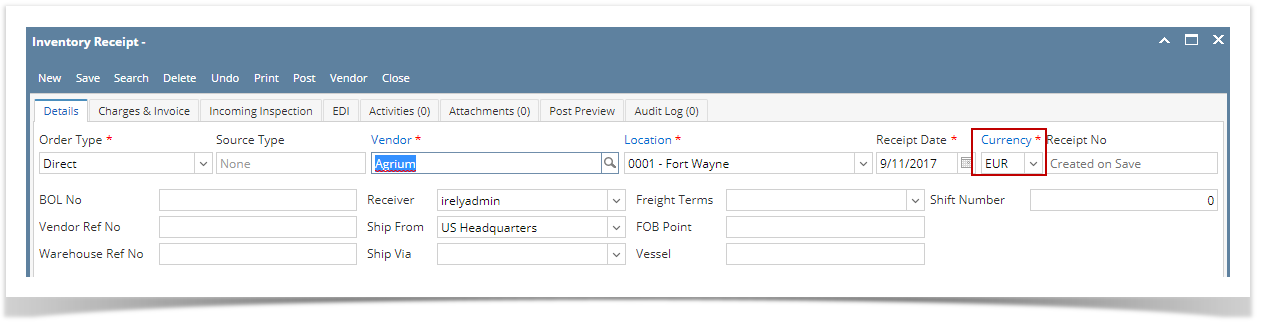

- Create Inventory Receipt.

- Inventory > Inventory Receipts > click New

- Details tab

- In the Order Type field select Direct.

- In the Vendor field select the Vendor with foreign currency setup.

- Notice that Currency field will automatically show the Currency set for the selected Vendor.

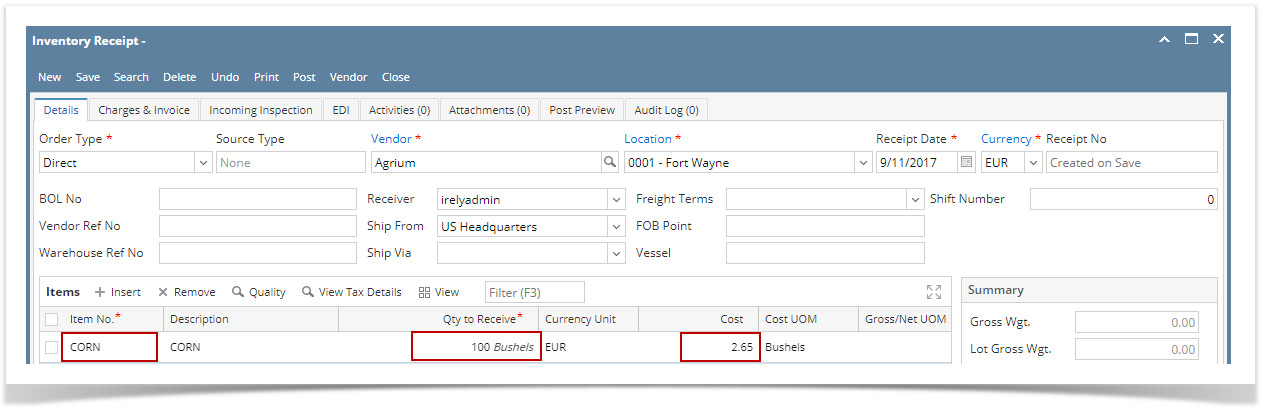

- In the Items grid area,

- Select Item from Item No. field.

- Enter Qty to Receive and UOM.

- Notice the Currency Unit will also show as INR. This field will default to the Currency assigned in the Inventory Receipt > Currency field.

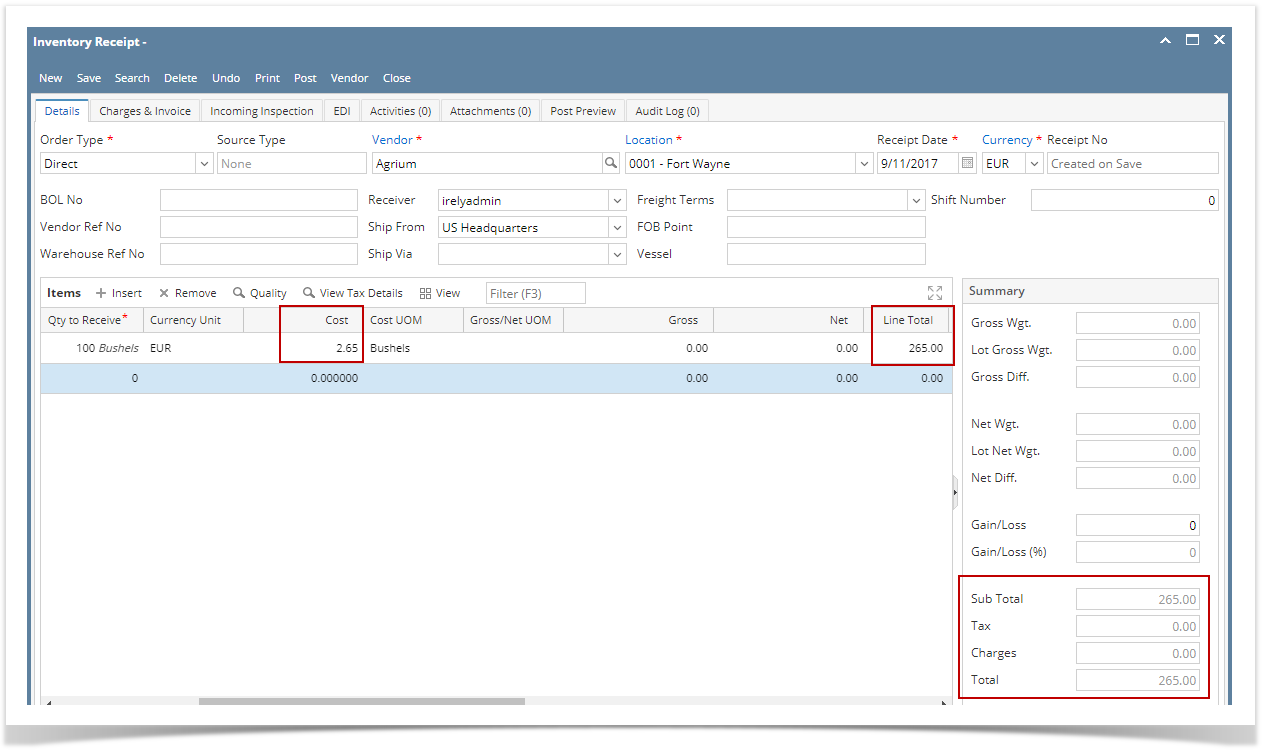

- In the Cost field enter the Cost of the item.

- The Forex Rate Type and Forex Rate fields are defaulted based on your Multi-Currency setup. That is why it is recommended that you have your multi-currency setup prior to doing foreign transactions. This will make the transaction entry easier than having to select Foreign Rate Type in every transaction.

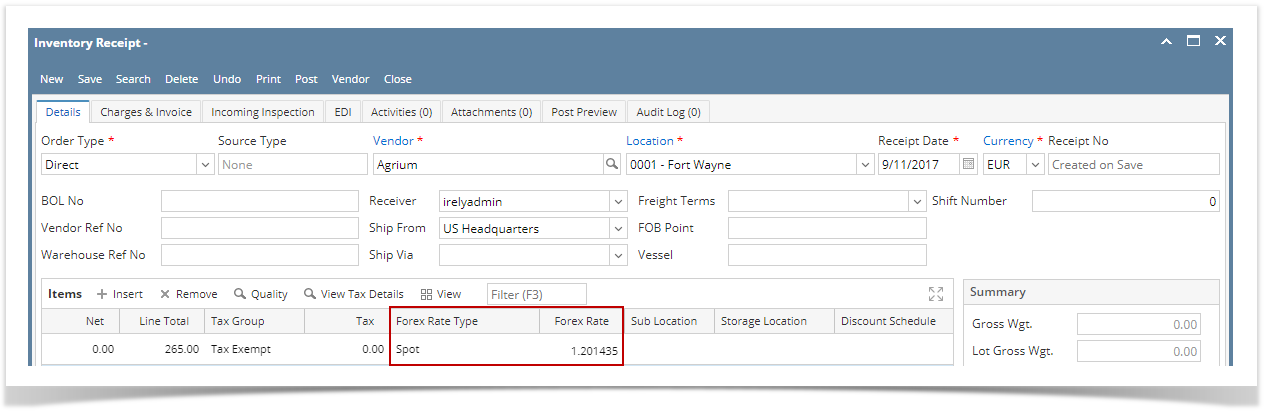

- The Foreign Rate Type is showing Spot since default setup for Inventory > Rate Type is Spot.

- The Forex Rate is showing the forex rate that matches the Forex Rate Type selected and the Date of the transaction.

- Also, the number of decimals to show in the Forex Rate field follows that of the Company Configuration > System Manager tab > Details tab > Default Values section > Currency Decimals field setup.

- The Foreign Rate Type is showing Spot since default setup for Inventory > Rate Type is Spot.

- The following fields are shown in foreign currency value.

- Cost

- Line Total

- Sub Total

- Total

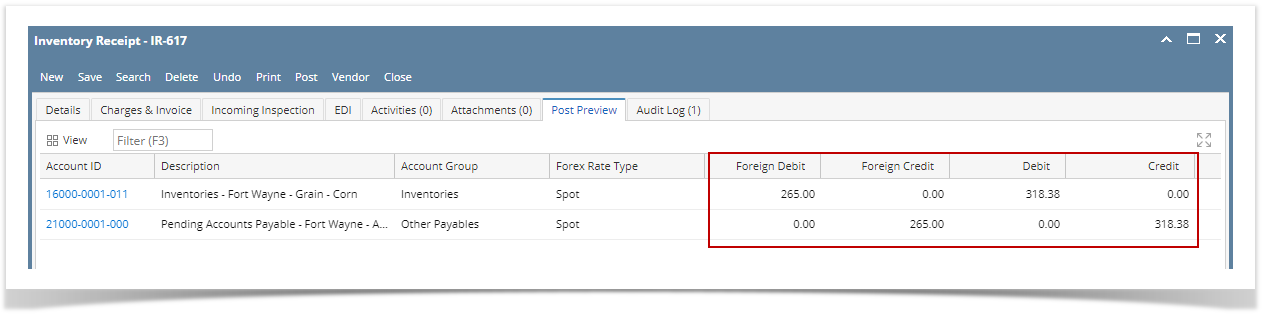

- Click on Post Preview tab.

- Foreign Debit and Foreign Credit will show the foreign value of the transaction. In this example, this is the INR value.

- Debit and Credit will show the value of the transaction in functional currency. In this example, this is the USD value. This is what get's posted to the General Ledger when the transaction is Posted.

- Click Post to post the transaction.

- Once transaction is posted, it will then be recorded in the GL Account Detail.

- GL Account Detail can be opened from General Leger > GL Account Detail > select to open any of the accounts used in Inventory Receipt transaction, in this example it is 16000-0001-001 or 21000-0001-000.

- To check the complete set of entries for the selected transaction, select for the transaction created (use the Record No. to look for the transaction) by checking the checkbox before the Date and click Transaction Detail.

Overview

Content Tools