Note: This feature is available from 21.2 onwards

Global/ Shared Configuration:

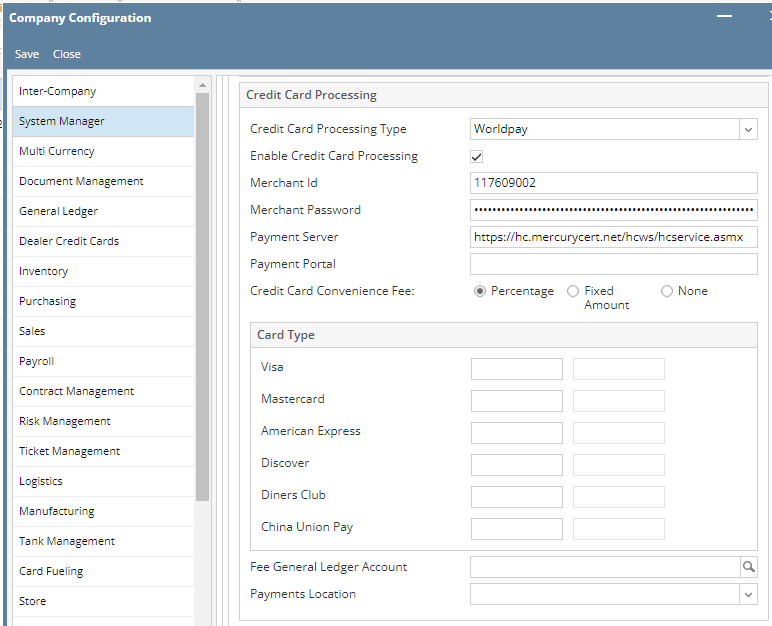

There are three (3) options in Credit Card Convenience Fee field. (Note: You may check first the page How to set up Credit Card Processing)

• Percentage

• Fixed Amount (Note: This is not currently available)

• None (Default)

When your customers make payments via credit cards, they may be charged a processing fee depending on the credit card type and the fee setup. This fee setup can be set up by percentage and may be configured by a personnel via System Manager | Company Configuration. On the other hand, he/she can select the None option (None is selected by default) if no processing fee will be charged to customers.

The Credit Card Convenience Fee is related to the next section which is Card Type. In Card Type, the credit cards accepted by the company are listed. Examples are the following:

• Visa

• Mastercard

• American Express

• Discover

• Diners Club

• China Union Pay

The use of the above cards in terms of processing fee is determined by the option selected in Credit Card Convenience Fee.

Percentage:

If Percentage is selected, the Percentage column will be enabled while the Fixed Amount column will remain disabled.

None:

On the other hand, if None is selected, Percentage and Fixed columns should be both disabled.

Customer Setup:

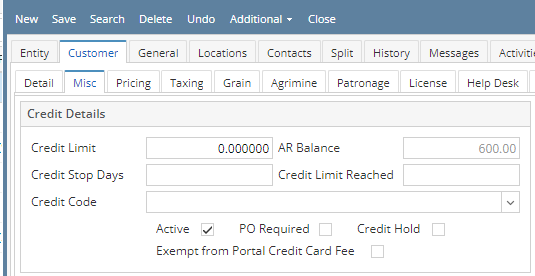

The global or shared configuration discussed above applies to all customers who are using credit cards for payments. However, that setup may be overridden if we want to exempt a customer or some customers.

To exempt a customer, check the Exempt from Portal Credit Card Fee checkbox located in Customer | Misc | Credit Details section. This checkbox is unchecked by default.

The Exempt from Portal Credit Card Fee, when checked, will override the shared configuration (System Manager) mentioned above and the customer will not be charged a convenience fee when performing credit card payments.