Page History

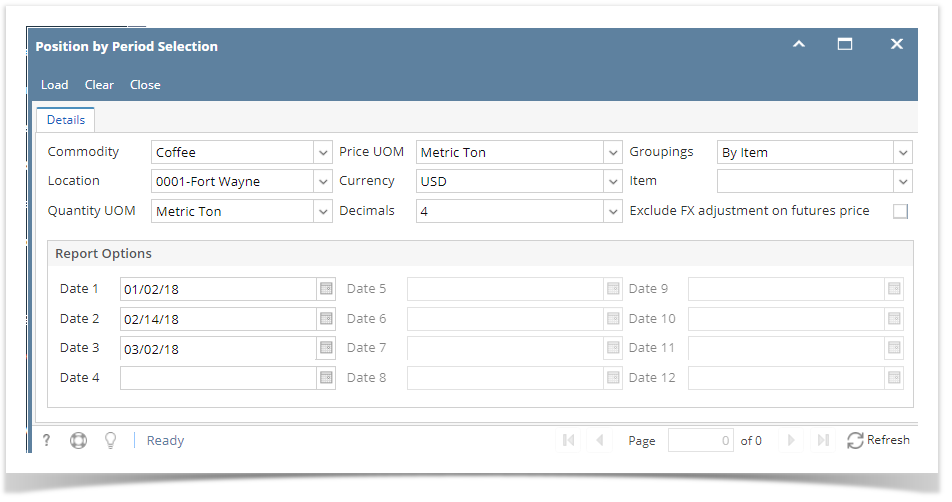

Basis position report shows the net physical position arrayed by user-defined time period. It is broken down by either market zone, freight terms, or both.

- We can select multiple commodities

- We can select multiple location also

- Groupings:

a. By items

b. contract Terms

c. Market Zone

d. Market zone and contract terms

Select any one of the grouping and enter the months in report options section

Here for the report it will consider only the Months of the date.

Click on load button

i t will open the screen as below

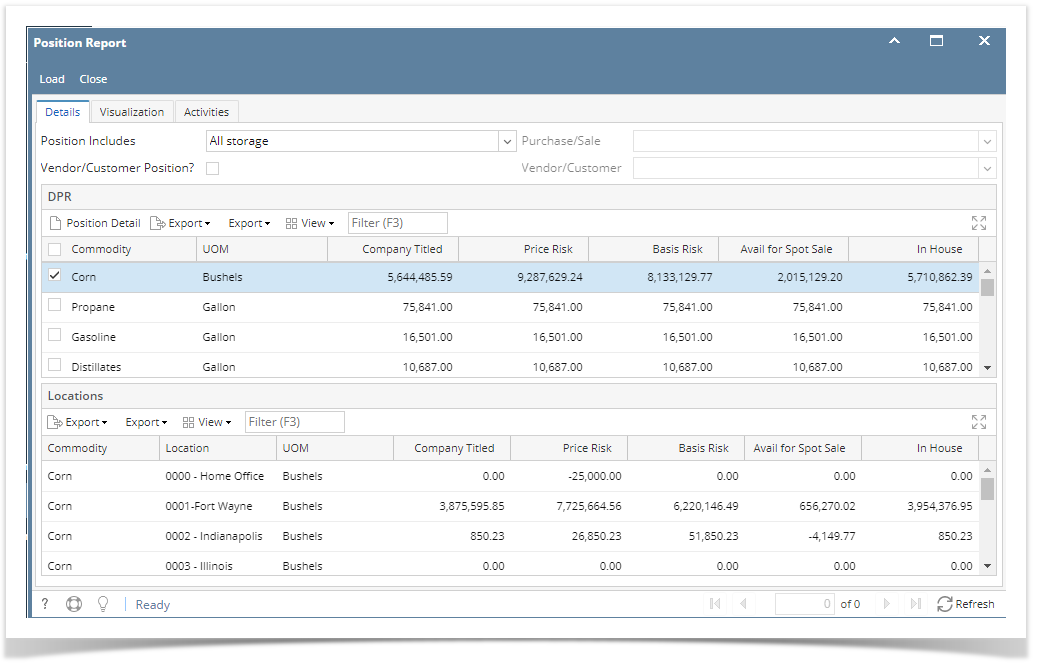

The purpose of the DPR is to provide a view of risk and inventory to the user.

- Exposure to the market – what is the impact on the user if the futures market starts to move? Are we long or short and by how much?

- Basis risk – what is the impact on the user if basis starts to move? Are we long or short and by how much?

- Quantity available for sale – considering what is on hand, what contracts are open, and what is stored for third parties, how much product is available to sell?

Position Report.

This first screen is a summary of company titled inventory, risk (cash) exposure, basis exposure, and quantity available for sale. Each column is a different commodity. This data is extracted and summarized from details so we will focus on those details and create the Live DPR summary last.

Commodity: As each commodity is a row in the report, this selection will determine how many columns will appear.

UOM: UOM of the commodity. This will be overwritten with the default UOM from the risk management company preference.

Company Titled:

For each commodity, this is the quantity of inventory owned by the user.

on hand + company owned storage type + DP + difference between purchase and sales collateral+sales basis delivery

In-House

includes company titled and whatever is stored for customers like grain bank/open storage, Excludes in transits.

On Hand + On Storage + DP+ On hold

Price Risk

Company titled(inhouse)- purchase basis belivery + Collateral Sales+Futures + delta options+open purchases quantities* that are priced or HTA -open sales quantities* that are priced or HTA

Basis Risk

Company titled +open purchase quantities* that are priced or basis - open sales quantities* that are priced or basis

Available for spot sales

Basis exposure - Priced and Basis open* purchases.

When we select the commodity on the Live DPR grid. and it should be displayed the location wise details in the bottom location grid.

Position include Drop down : THis will show Licensed and Non licensed type . To configure the licensed and non licensed storages

Open the company location from common info module and set "Licenced location " as checked. for any one location .