...

Pre-quisitie: 16.1 Patch Date after 11/1/16

| Attachments |

|---|

| preview | false |

|---|

| upload | false |

|---|

| old | false |

|---|

| patterns | .*pdf |

|---|

|

Processes:

| Expand |

|---|

|

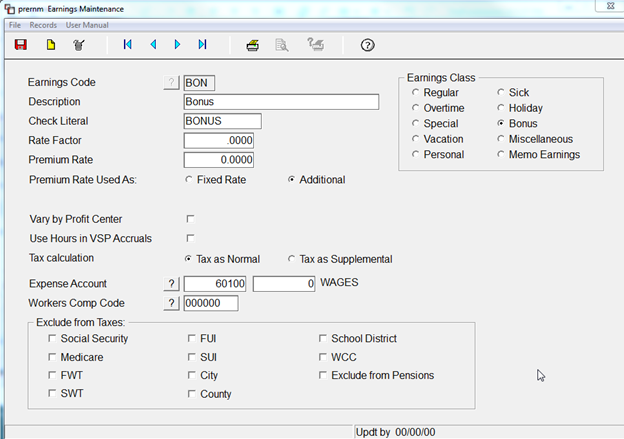

First, Validate Earnings Code is setup correctly | Expand |

|---|

| Payroll -> Setup -> Earnings Code Setup

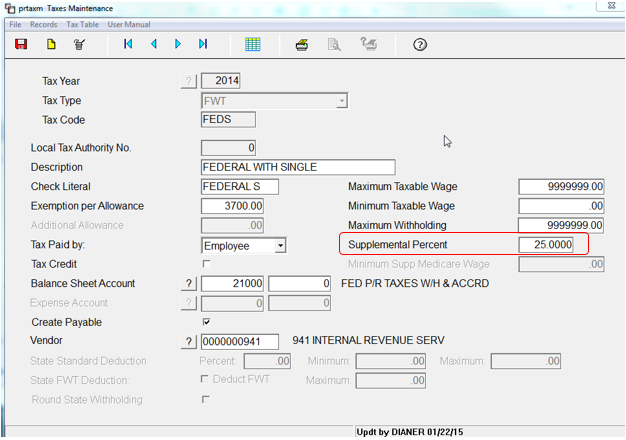

If you are Taxing as Supplemental, make sure that Tax is Setup Payroll -> Setup -> Taxes Maintenance

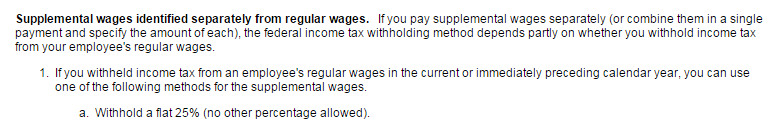

Supplemental Tax Rate for 2015 | Expand |

|---|

| title | 2015 Rate IRS Publication |

|---|

|

|

|

| Expand |

|---|

| title | Individual Check Processing |

|---|

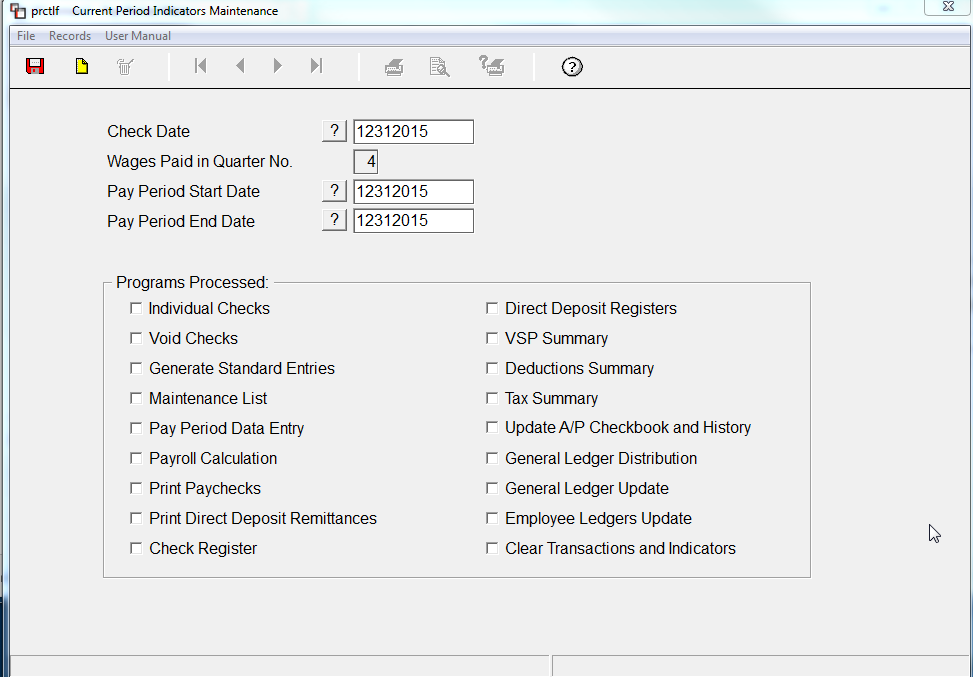

| Payroll -> Pay Period Menu -> Current Period Indicators Maintenance Set Check Date

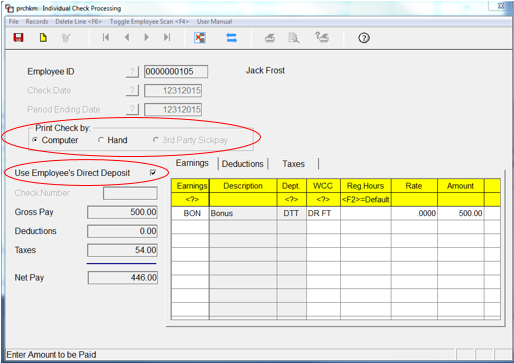

Payroll -> Individual Check Processing Print Check by - Computer if you want to print a Check or ACH advice. If you are hand writing checks, Select Printed by Hand. If you wish to Direct Deposit the bonus, check the Box Use Employee's Direct Deposit. Bonus amount may be based on an hourly rate or a flat amount.

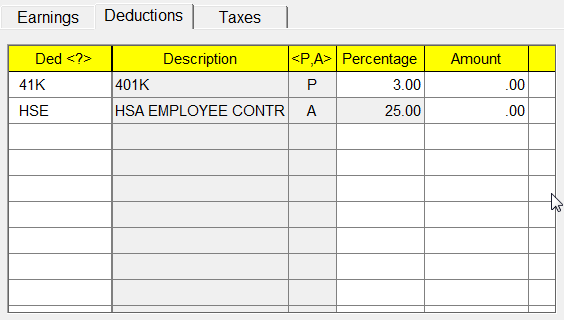

Validate information on Deduction Tab System will zero out Deductions - you may adjust if needed.

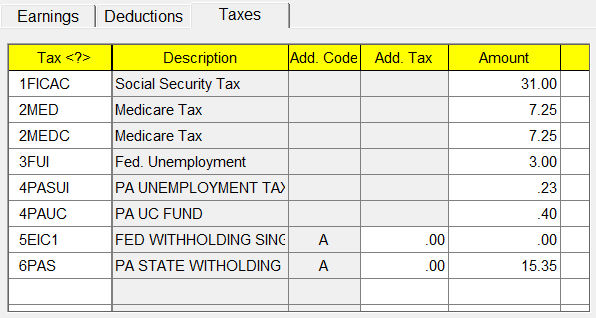

Tax Tab should be validated as well. These amounts are also adjustable.

|

| Expand |

|---|

| title | To Process as a Separate Check Run |

|---|

| - Enter All Individual Check Earnings Amounts for each Employee in Individual Check Processing

- Go To Pay Period Menu

- Calculate Wages/Print Calc Reports

- Print Payroll Checks

- Complete Payroll Run as Normal

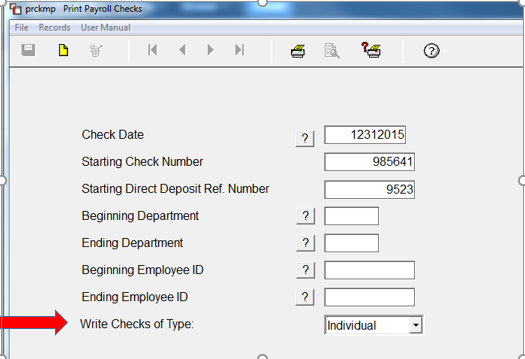

- NOTE: If you are printing actual CHECKS, the the "Write Checks of Type" drop down, select "Individual" or your checks will not print.

Complete Payroll Process |

| Expand |

|---|

| title | Include in Normal Pay Check Run |

|---|

| - Enter Bonus Information in the Individual Check Screen

- Process Payroll as Normal for the Current Pay Period

- Calculate Wages/Print Calc Reports

- Print Payroll Checks

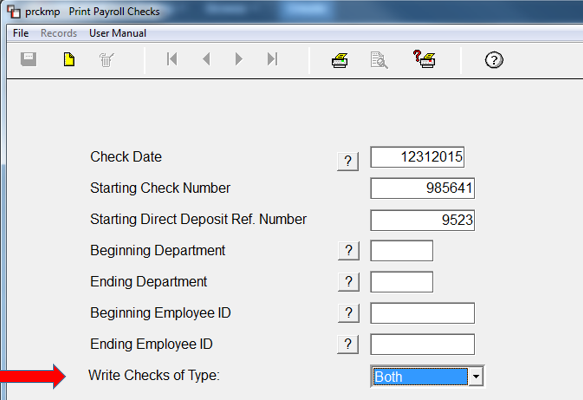

- NOTE: If you are printing actual Checks, in the "Write Checks of Type" drop down, select "Both" as this will print Regular and Individual Checks

Complete Payroll Process |

|

...