Page History

There are a couple of ways on how Other Charges are added to either Inventory Receipt or Bill Voucher based on different scenarios. Here are items we will use in all of the scenarios.

...

| Expand | ||

|---|---|---|

| ||

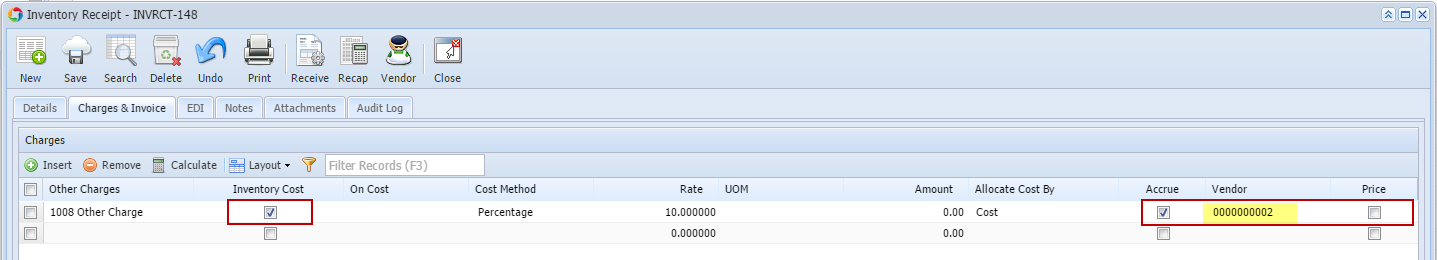

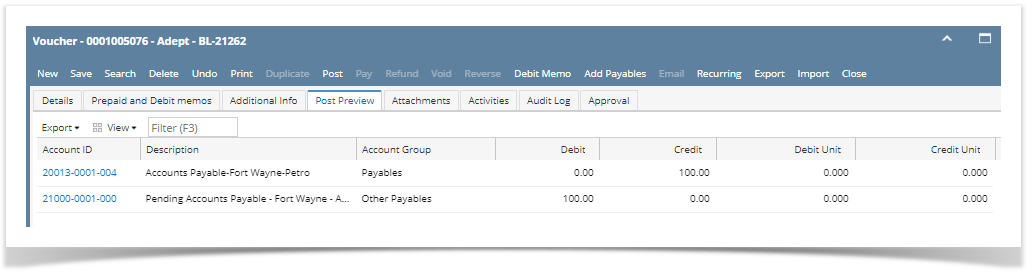

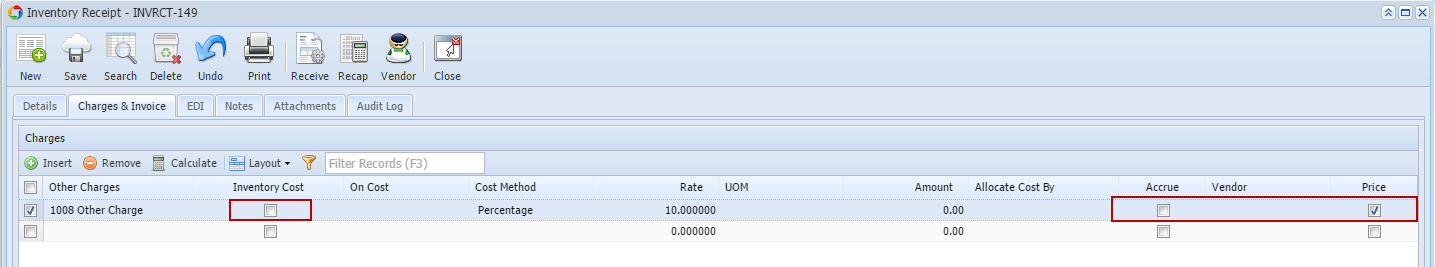

This scenario should not be allowed since Price = checked and Accrue = checked for receipt vendor is same as cost did not occur.

|

...

| Expand | ||

|---|---|---|

| ||

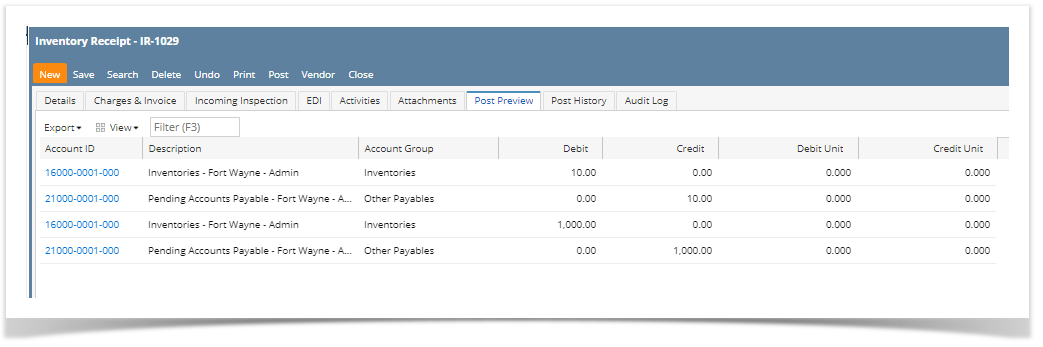

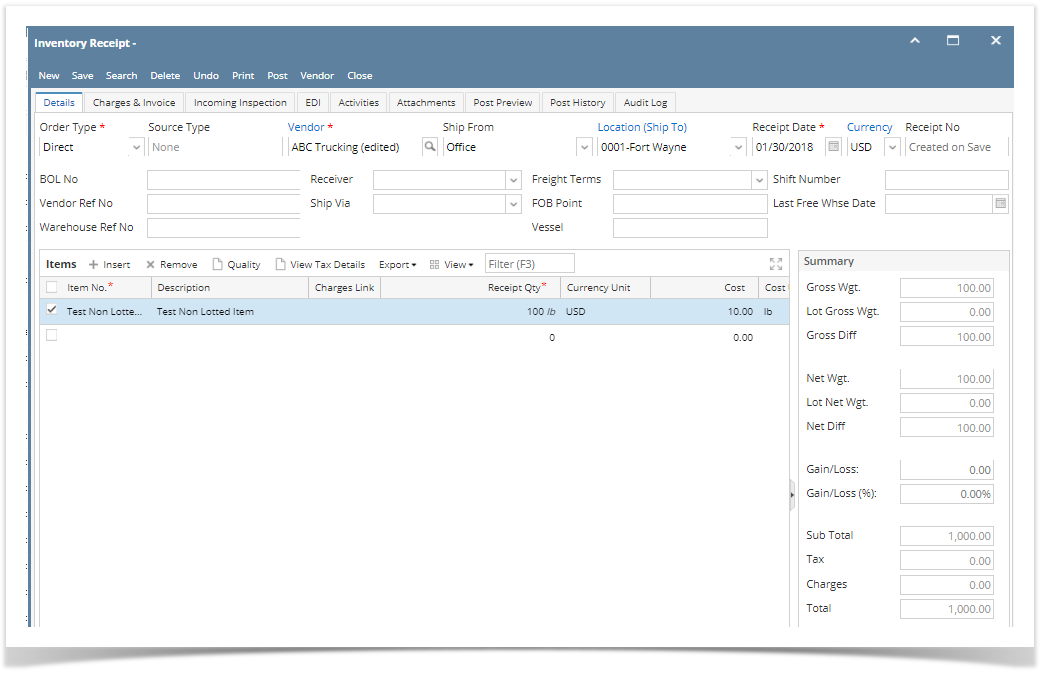

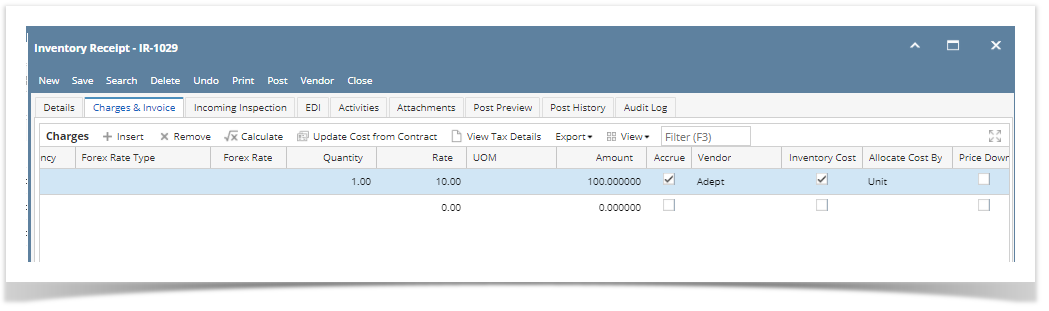

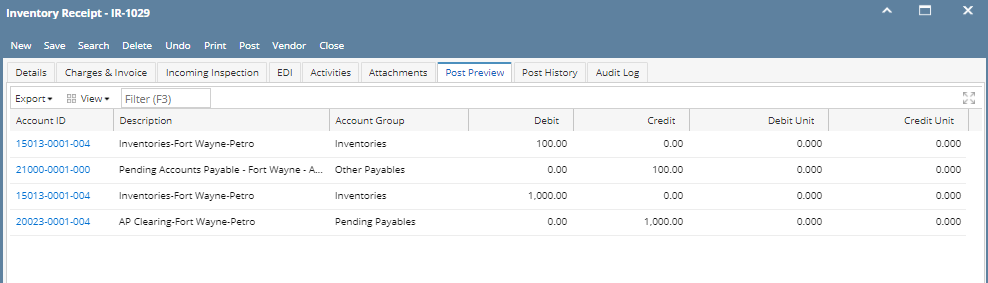

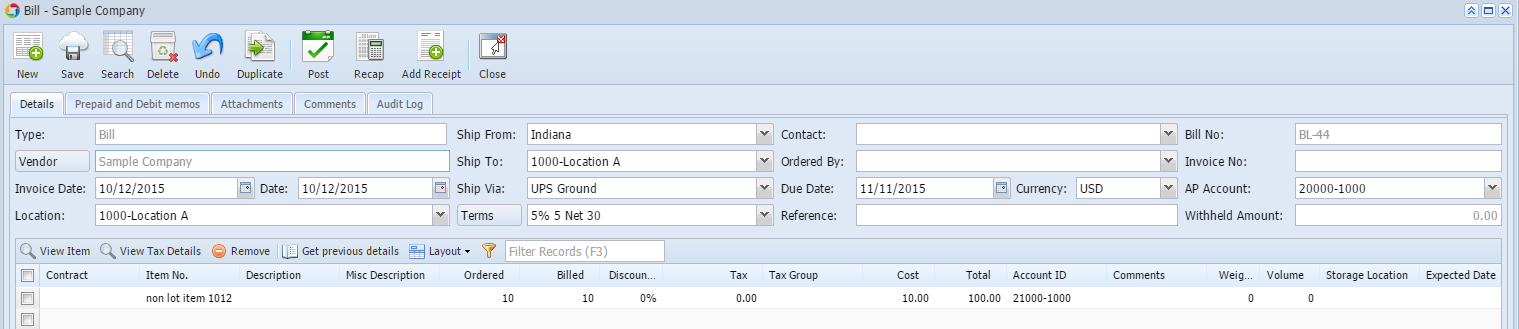

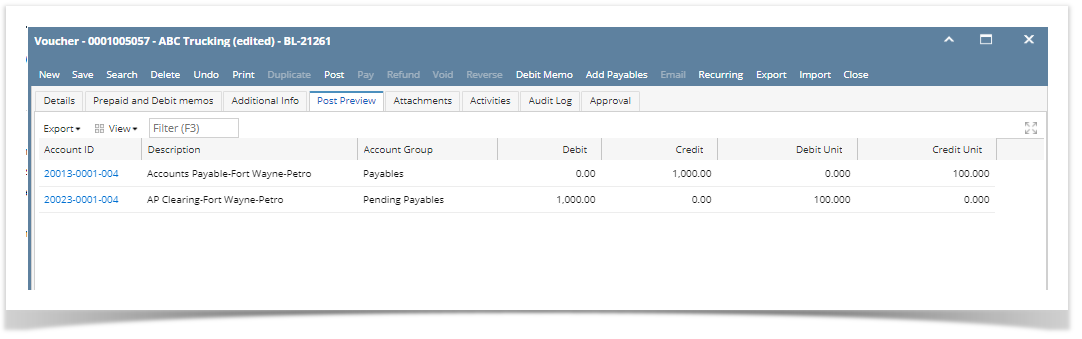

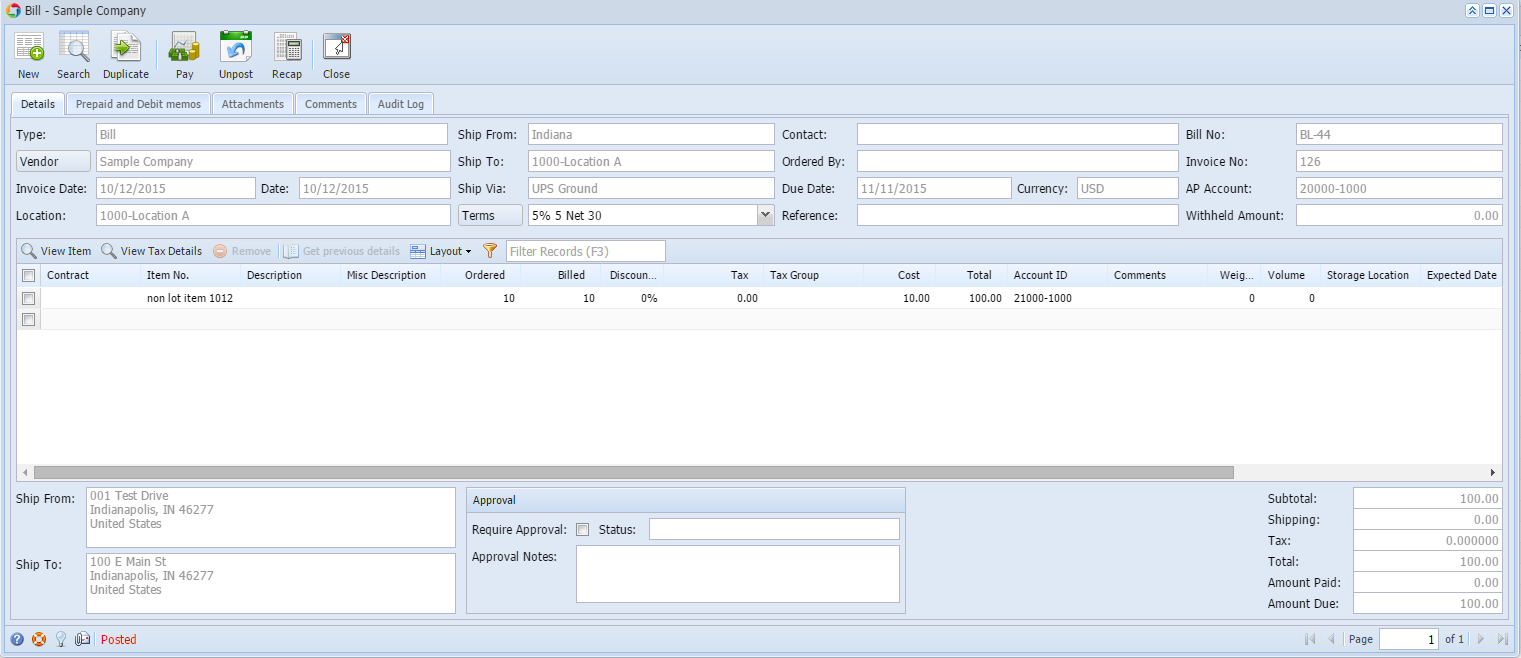

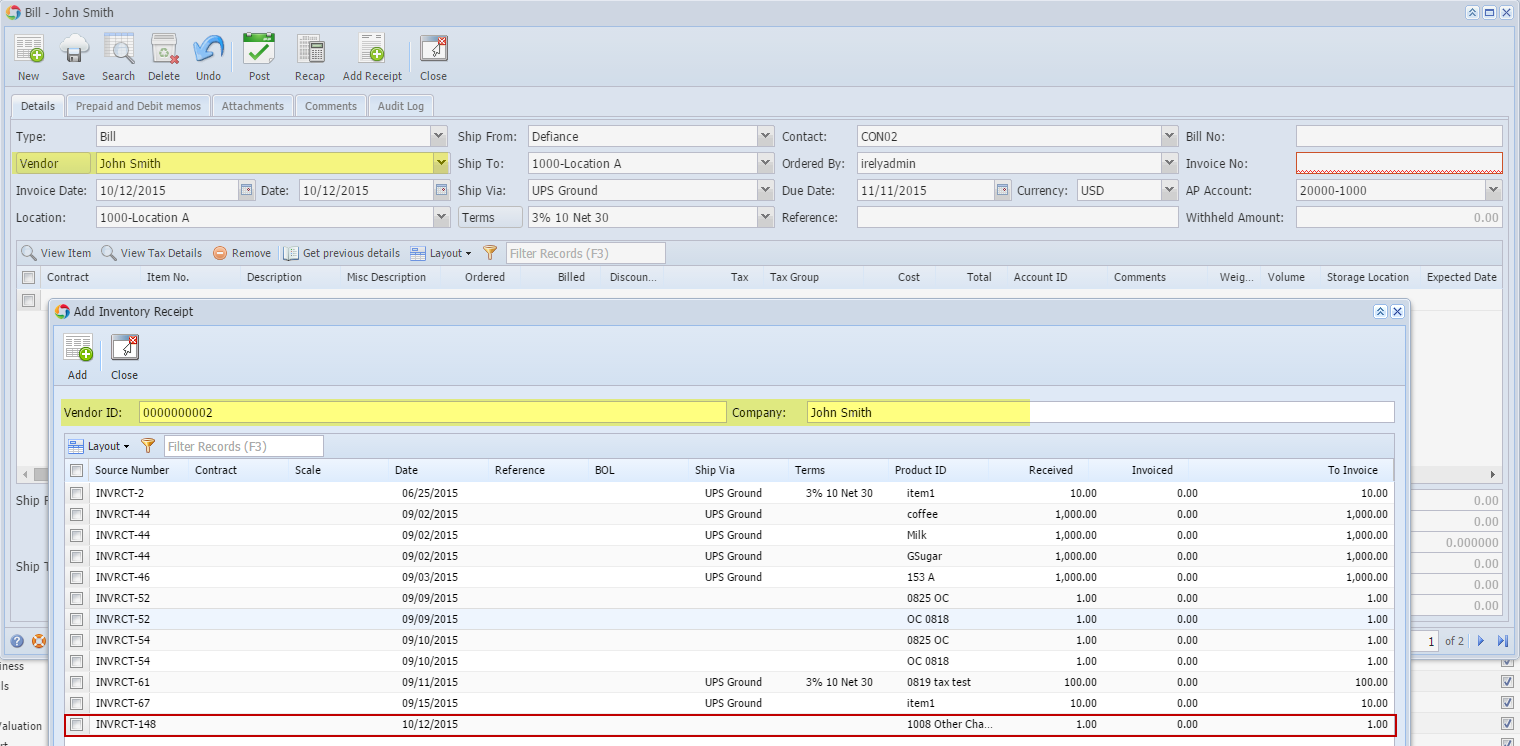

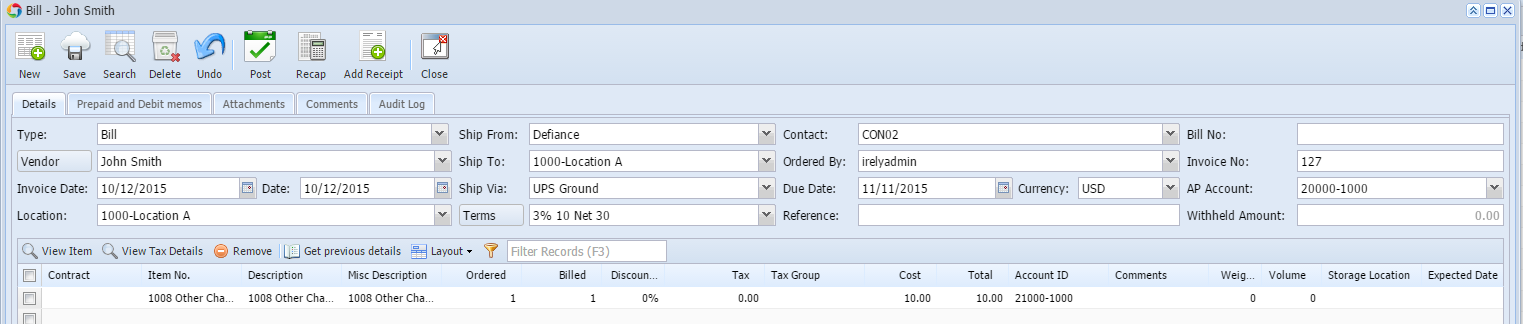

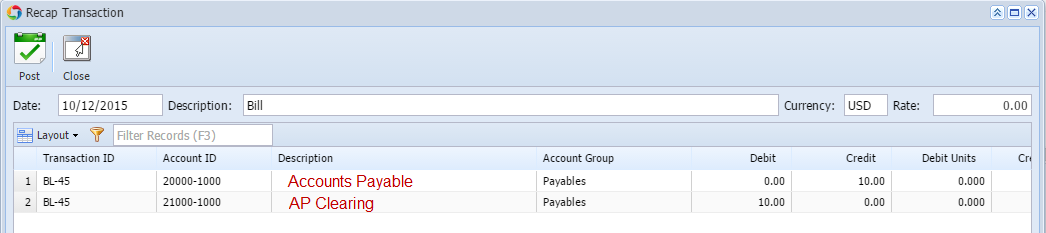

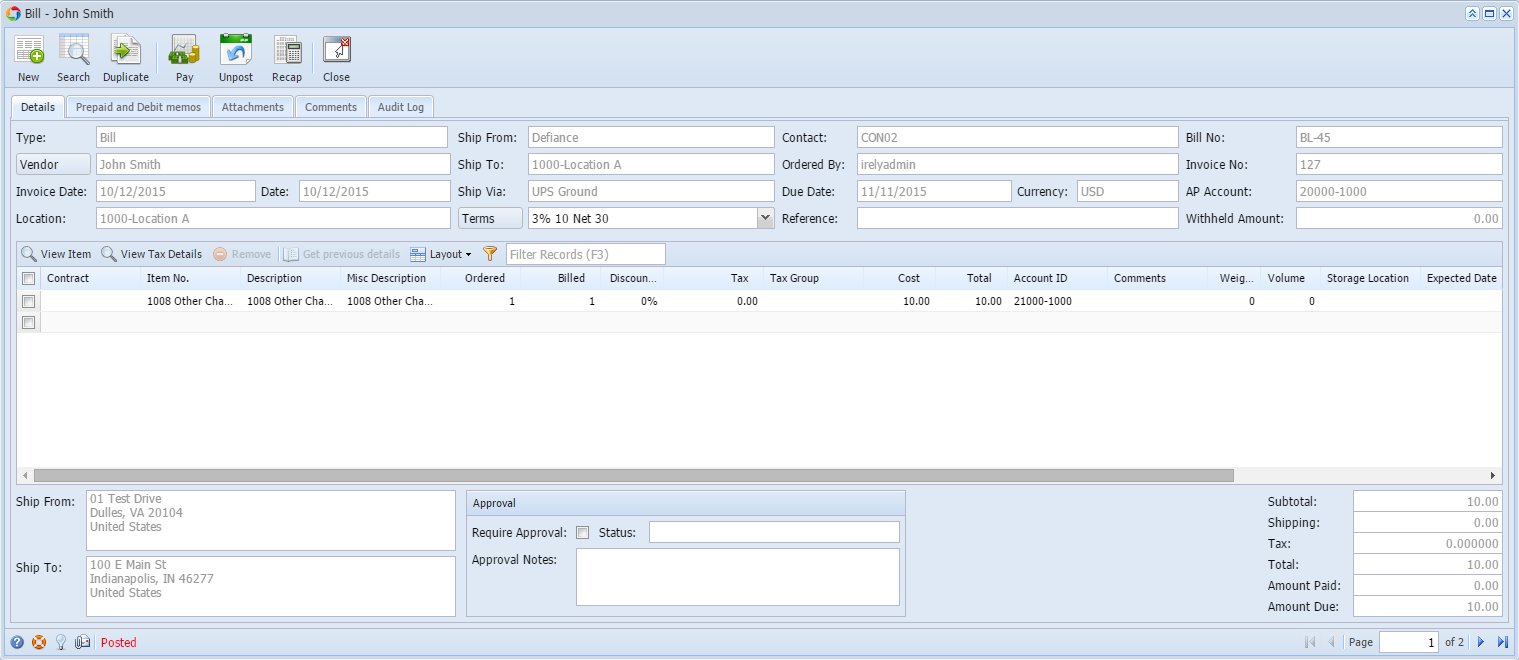

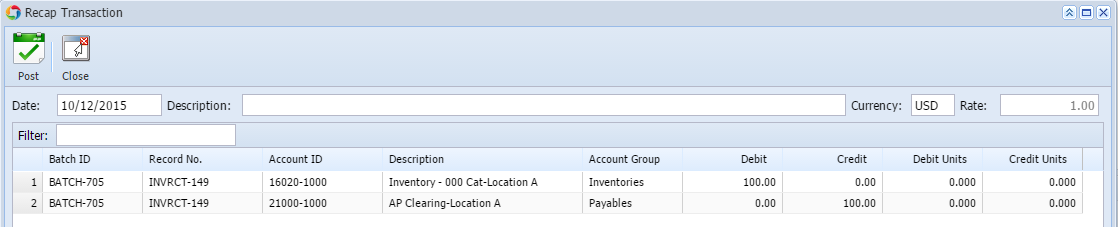

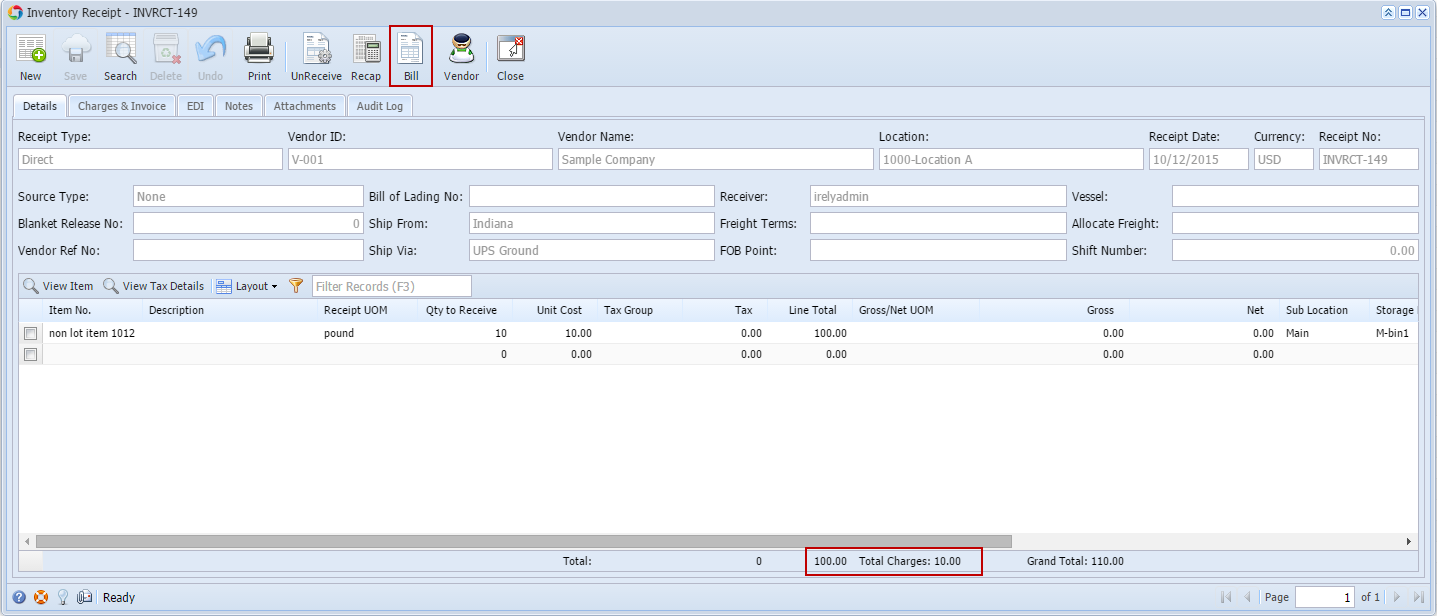

The following will detail Other Charge added to the Item Cost and is payable to the Vendor where item is purchased.

|

| Expand | ||

|---|---|---|

| ||

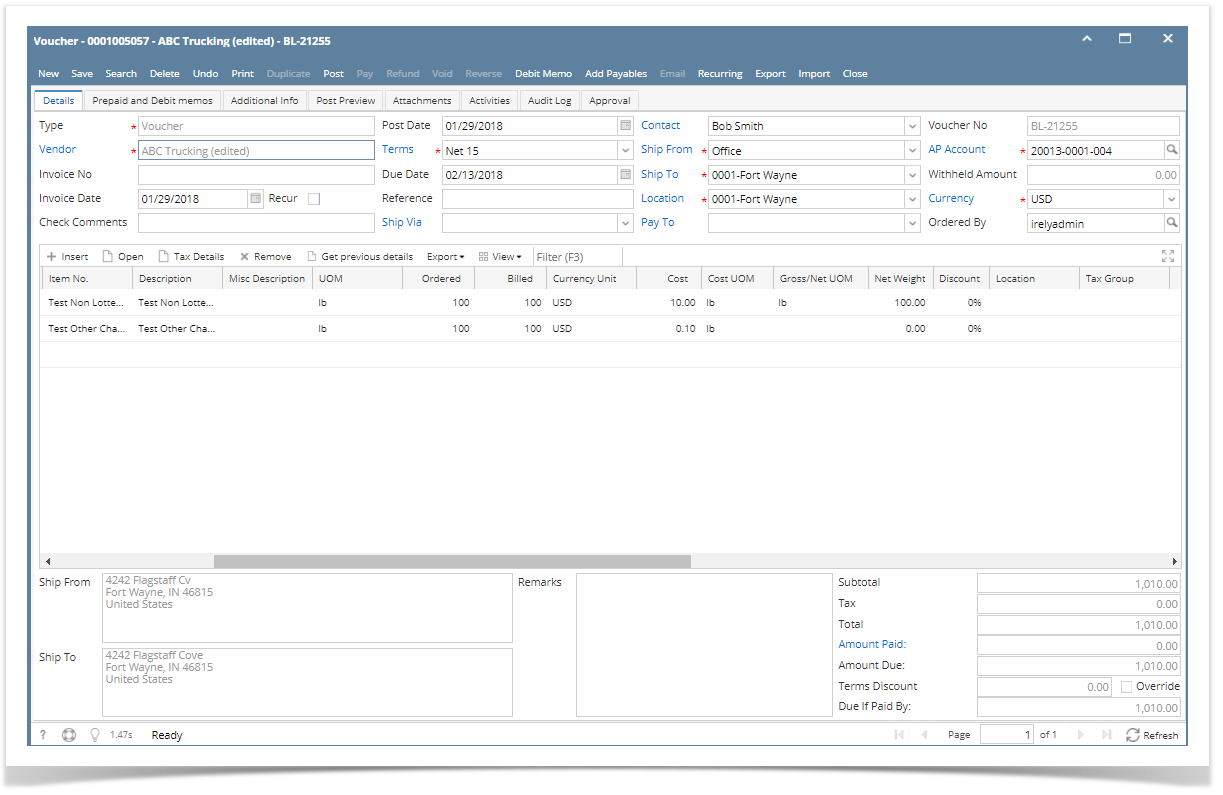

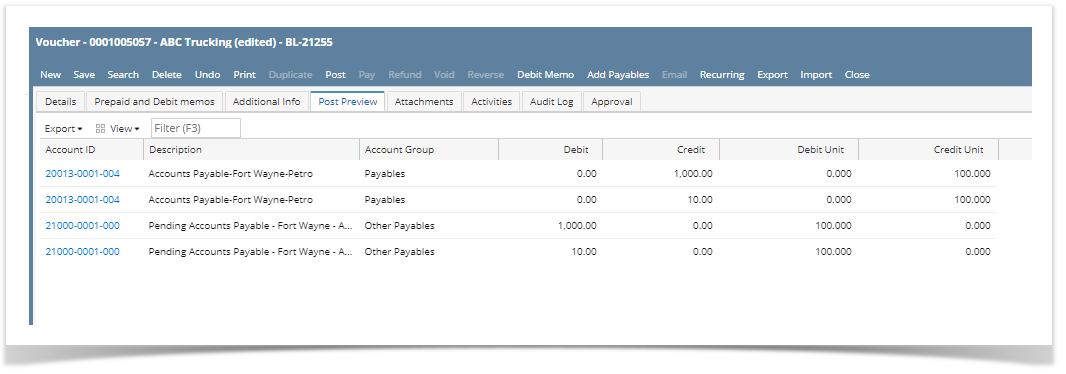

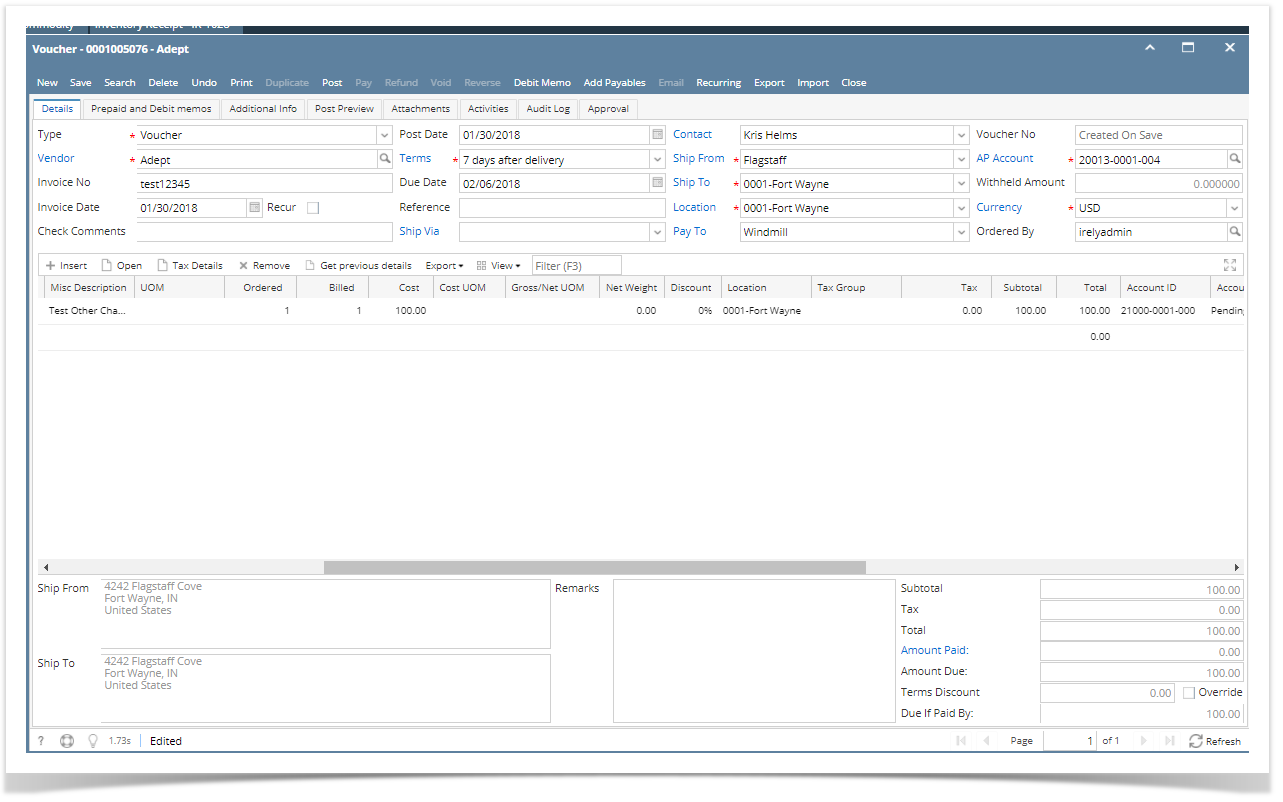

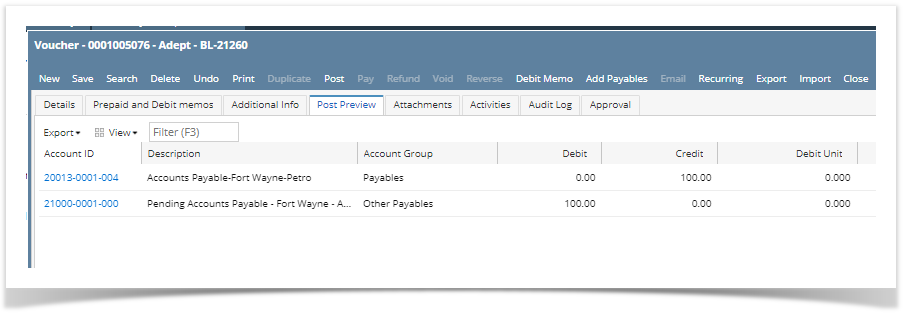

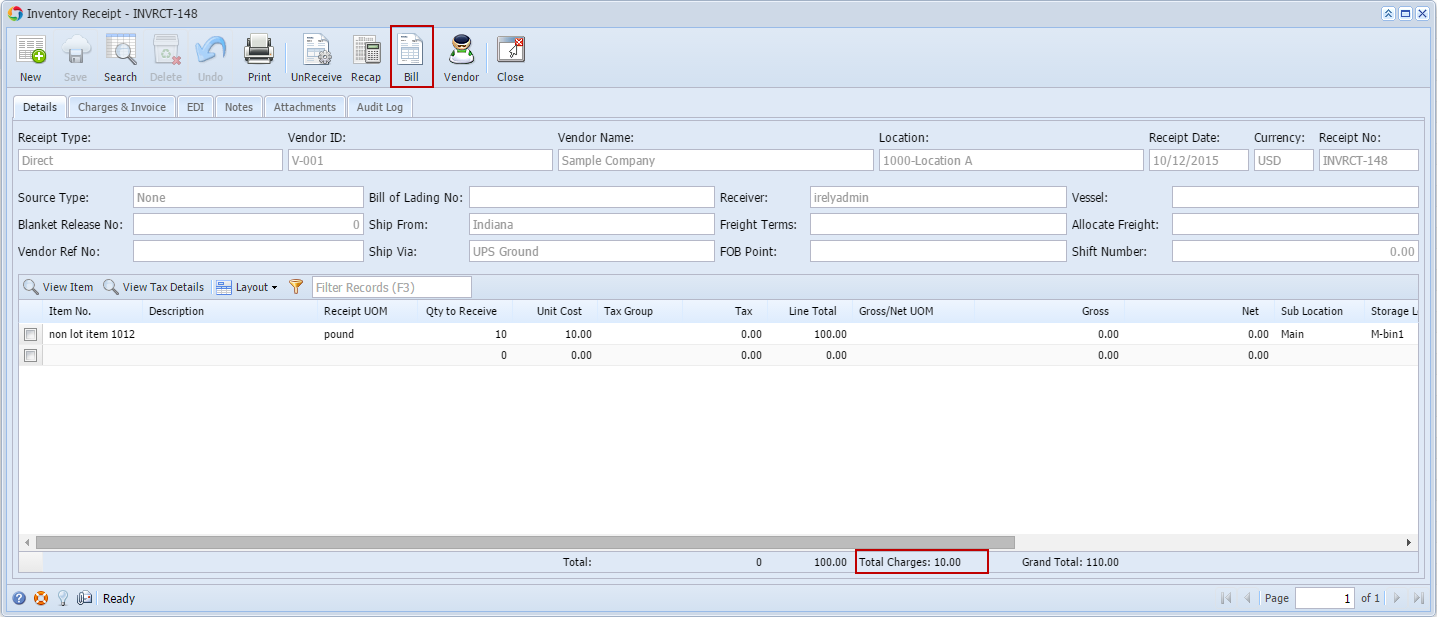

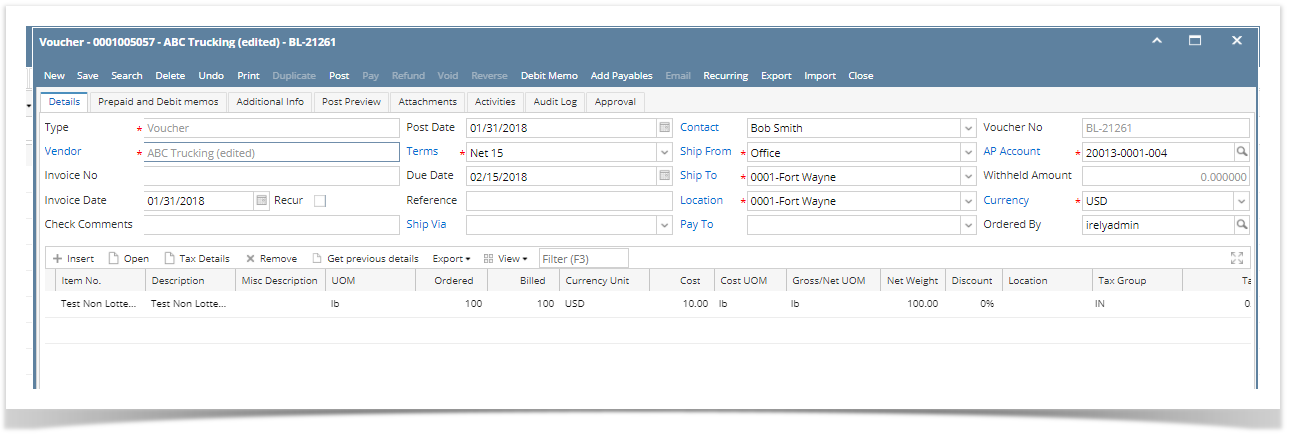

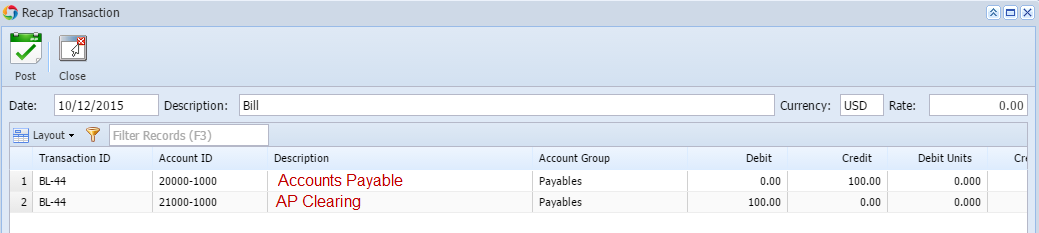

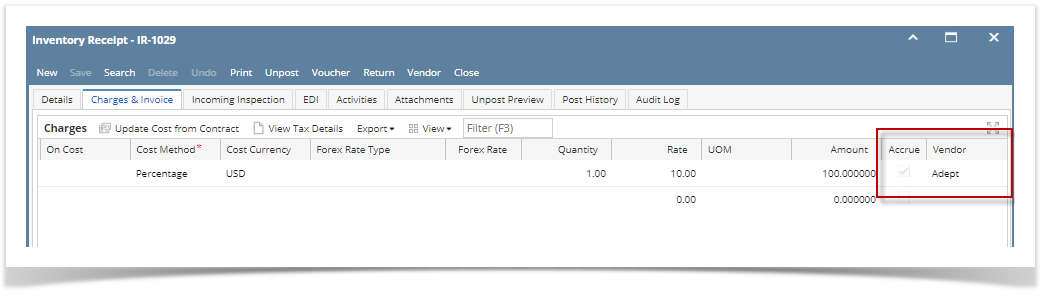

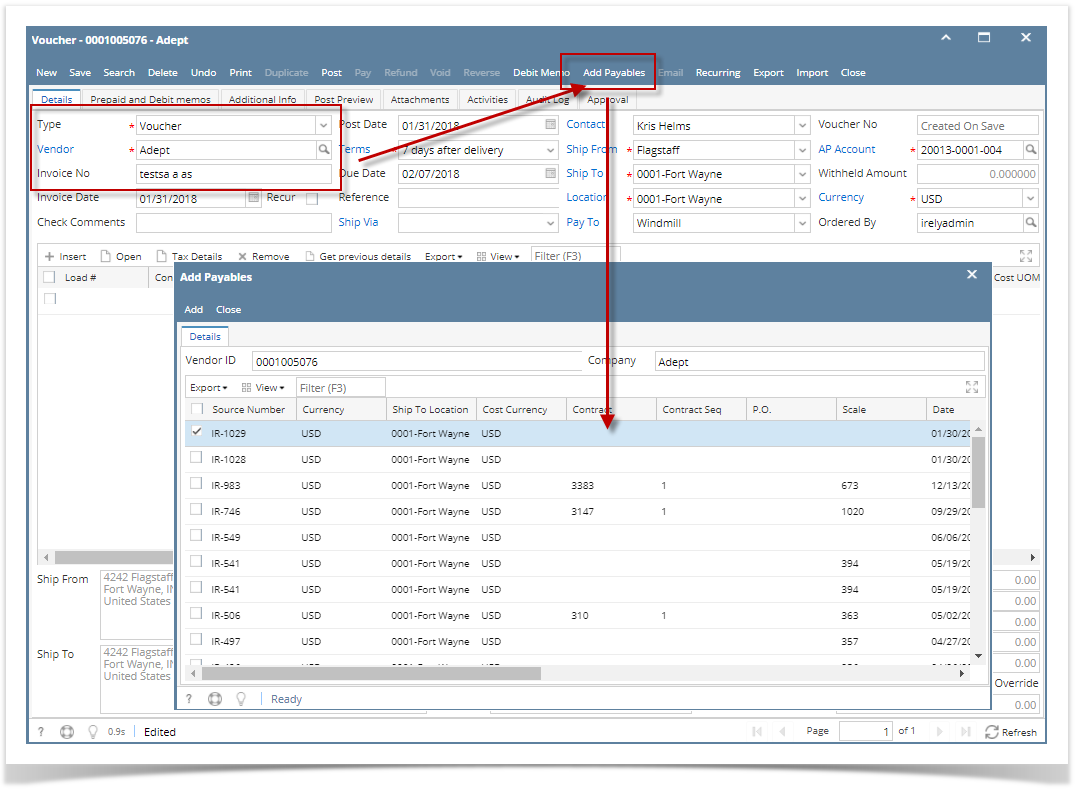

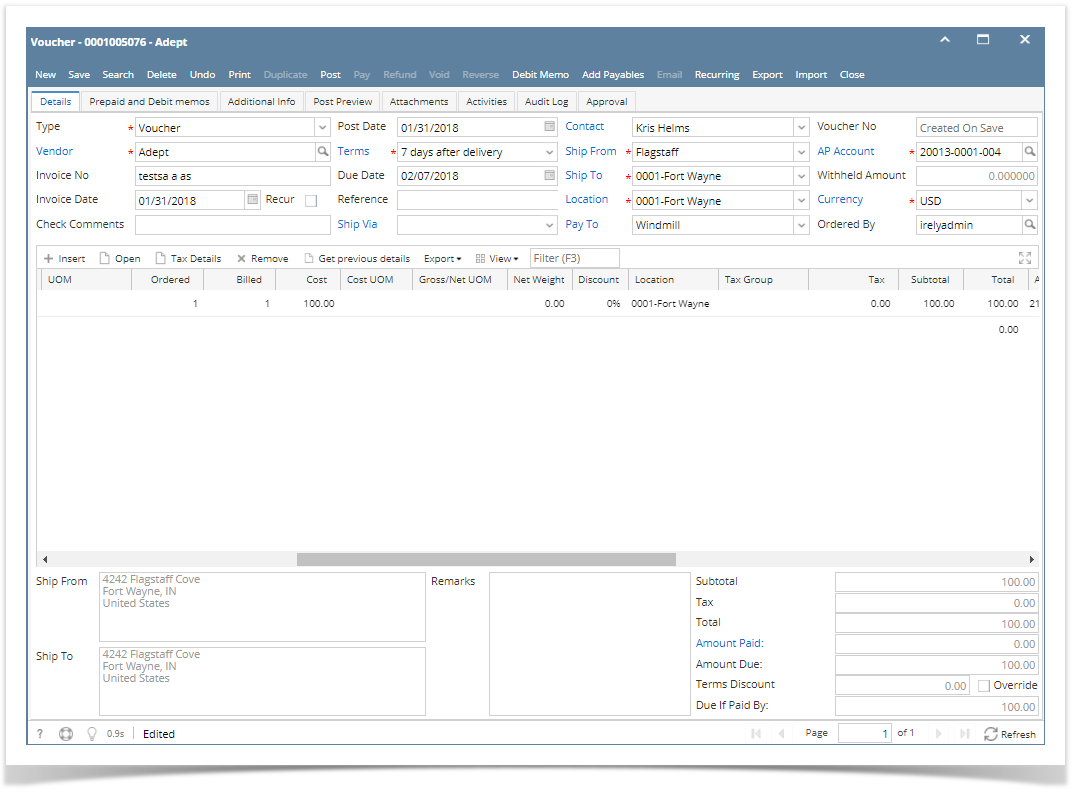

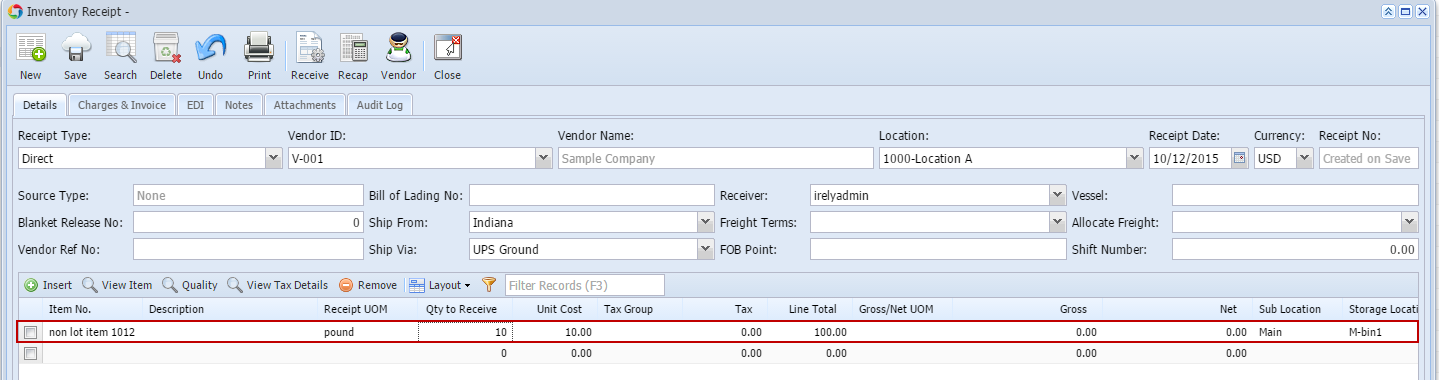

The following will detail Other Charge recorded as other charge and is payable to another vendor (not the vendor where the item is purchased).

|

...

| Expand | ||

|---|---|---|

| ||

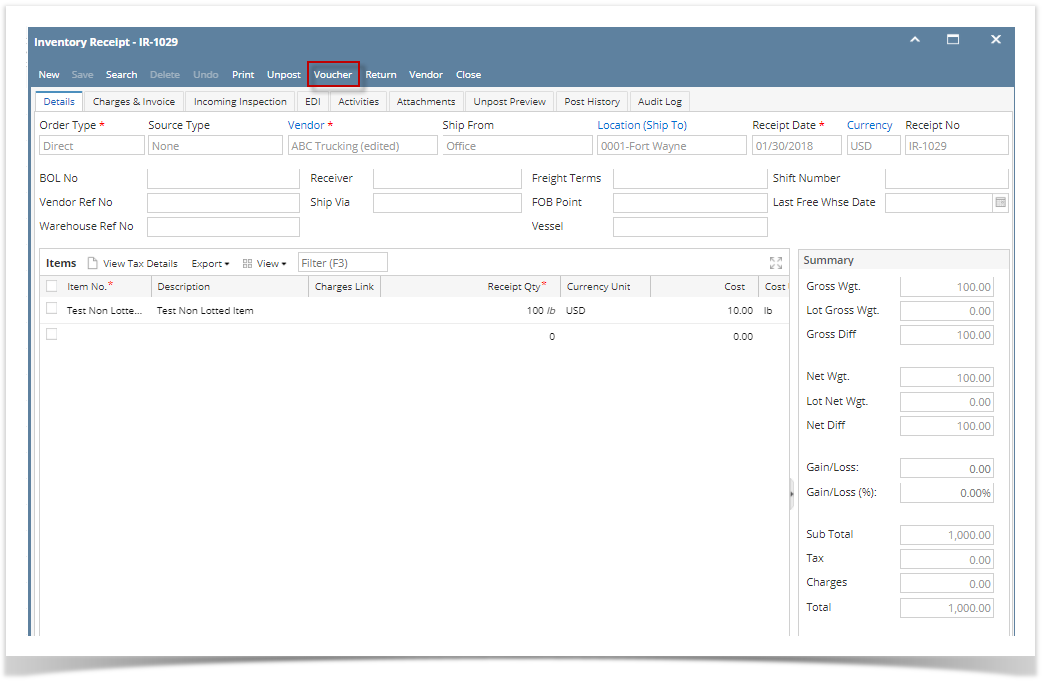

The following will detail Other Charge recorded as other charge and is payable to another vendor (not the vendor where the item is purchased).

|

| Expand | ||

|---|---|---|

| ||

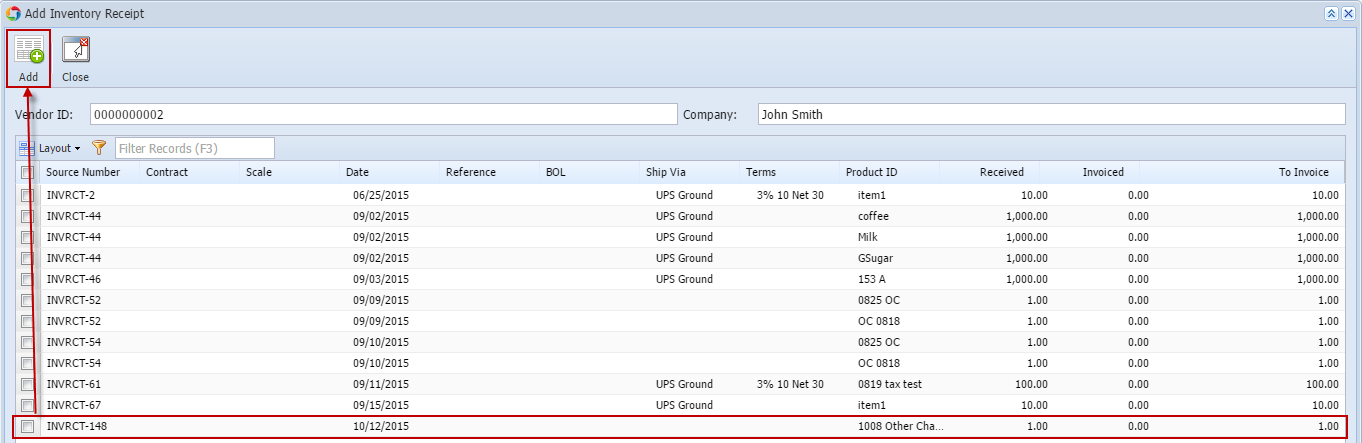

The following will detail Other Charge recorded as an Other Expense as well as an Other Revenue that will offset each other.

|

...