Page History

...

- This is the fiscal year setup.

- FY2014 - 1/1/2014 to 12/31/2014

- FY2015 - 1/1/2015 to 12/31/2015

- FY2016 - 1/1/2016 to 12/31/2016

- This is the Income Statement Detail report with Net Income per fiscal year.

- This is the Balance Sheet Detail report with As Of End of Fiscal Year setup per fiscal year.

- Print Trial Balance Detail As of Date = 12/31/2014. No Retained Earnings yet on the first year.

Print Trial Balance Detail As of Date = 12/31/2015. Retained Earnings amount here was came from 2014 Net Income(Loss), which is 1,200.00.

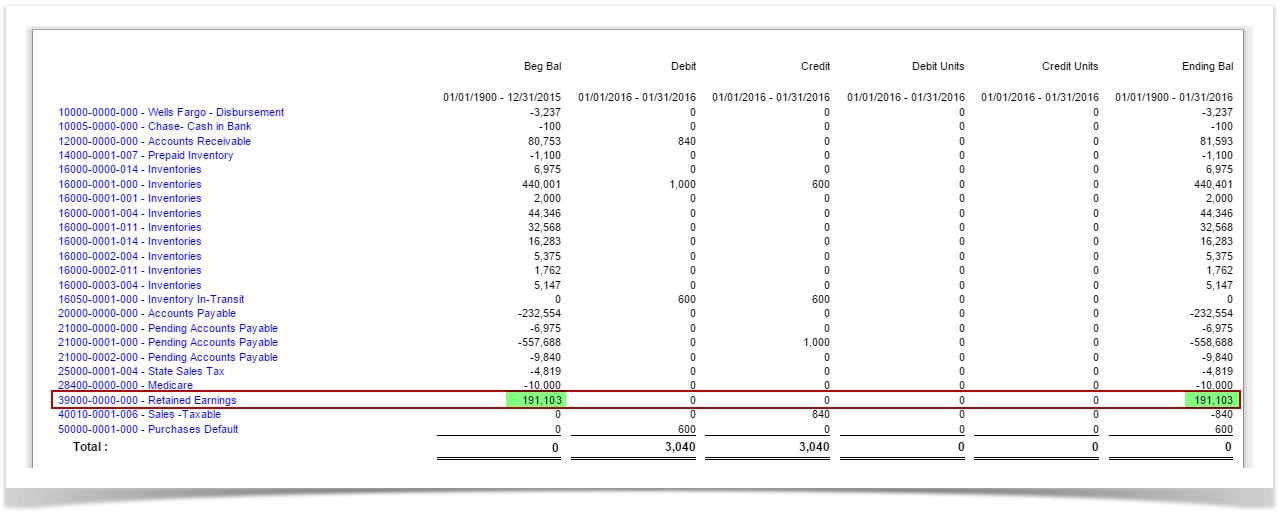

Print Trial Balance Detail As of Date = 1/26/2016. Retained Earnings amount here was came from 2014 and 2015 Net Income(Loss), which are 1,200.00 -192,303.00 = 191,103.00

To further explain, Income Statement accounts (Revenue and Expense type) are zeroed out and are rolled over to Retained Earnings account as Beginning Balance for the current year. In the case where there are transaction/s created that use Retained Earnings account, then that same will be added if posted on the credit side and deducted on the debit side to the Total Income or Loss to get the Retained Earnings Balance.

...

Overview

Content Tools