Page History

...

The Item No field is used to select Item Items available based on Location field selected.

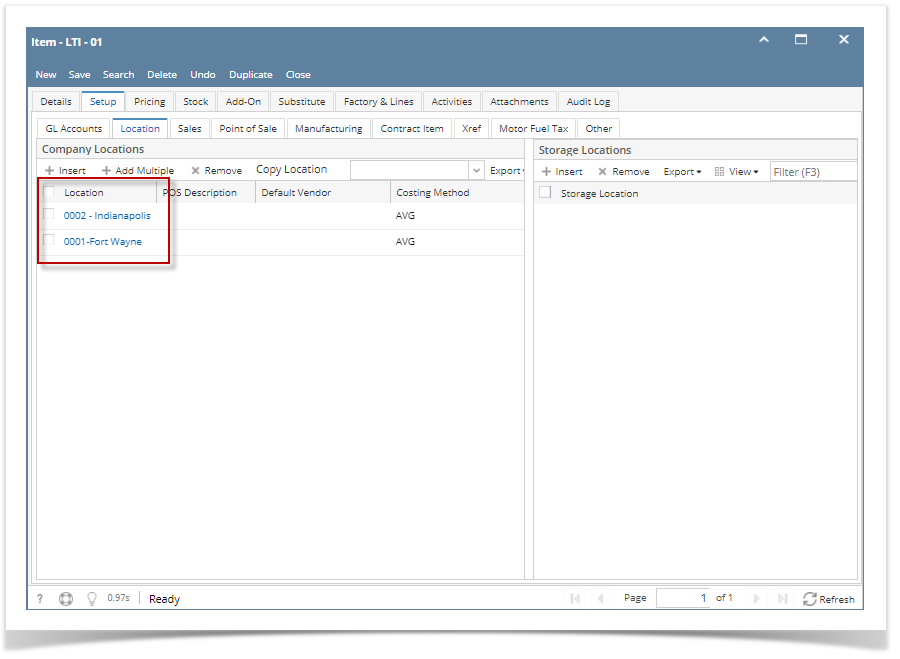

Expand title Note: For an item to be available in Inventory Receipt > Item No. combo box, make sure that the location selected in Inventory Receipt > Location field was added to the item (Item screen > Setup tab > Location tab).

The Description field will show the item description entered from Item screen.

- Charges Link Field - is used to link and identify the other charges for the line item.

In the Receipt UOM fieldQty Field, specify the Quantity and UOM when receiving the item.

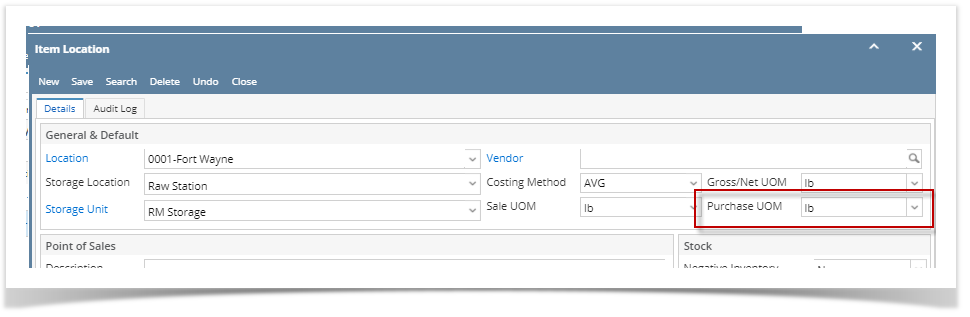

In the Qty to Receive field, enter quantity of item to receiveExpand title By default It will get the UOM setup from Item screen > Setup tab > Location tab > select the Location used in the Inventory Receipt and click View to open the Item Location screen > Purchase UOM.

- Currency Unit field - identify the currency used for the line item.

- The Cost will default to a cost from Last Cost field of Item screen > Pricing tab > Last Cost field. Enter a new cost if necessary.

The Cost UOM will default to the selected Receipt UOM. Change this if necessary.

Expand title Note: Changing the Cost UOM will update the Cost field since these 2 fields are directly connected. The cost to show in the Cost field is the cost per UOM selected from Cost UOM.

The

Tax field will show the tax computed for the item. In this example, since no tax is assigned from the Tax Group field then it will show 0.00.The Gross/Net UOM will default to blank. Select a UOM on this field if you would like to use Gross and Net weights and calculate Line total using the Net weight. Else leave it blank.

Then Gross and Net fields will be computed automatically. See How Gross and Net Quantities are computedComputed.

The Line Total field is computed automatically.

- Tax Group field - will show the tax group used for the item. Depending on the tax setup of the item.

- The Tax field will show the tax computed for the item. In this example, since no tax is assigned from the Tax Group field then it will show 0.00.

- Forex Rate Type field - used for receipts using foreign currency (currency which is not the functional currency of the company). will display automatically from company info setup.

- Forex Rate field - will display the rate from forex rate type setup.

Select Sub Location and Storage Location for the item to receive.

- Discount schedule field - will display the discount schedule from item setup. Grade field

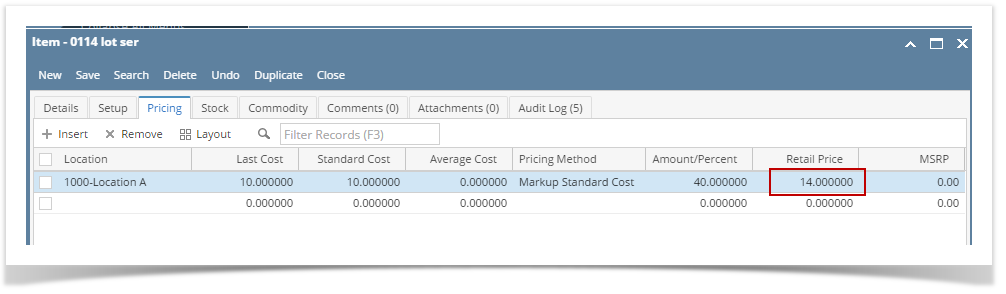

- The Unit Retail field will show the value entered for the item from Item screen > Retail Price for the selected Location.

- The Gross Margin field will show a number computed as (Unit Retail - Unit Cost) / Unit Retail.

- The Ownership Type field is shown only when Receipt Type is Direct. This field is defaulted to Own. Change this field as needed.

- The Lot Tracking field will show whether the item is:

- No for Non-lot item

- Yes- Serial Number for Lot Item that generates serial number when receiving item.

- Yes- Manual for Lot Item that asks you to manually enter the serial number when receiving item.

...