Here are the steps on how to create a bill batch entry:

- From the Main Menu, click Accounts Payable Activities > Bill Batch Entry. If there's an existing record, Search Bill Batch Entry screen will open. Otherwise, Bill Batch Entry screen will open automatically.

- If Search Bill Batch Entry screen opens, click New toolbar button to open blank Bill Batch Entry screen.

- By default, AP Account is populated by the AP account set in Company Preference > Account Payable. Click AP Account combo box button and select different AP account if necessary.

- Enter Reference if necessary.

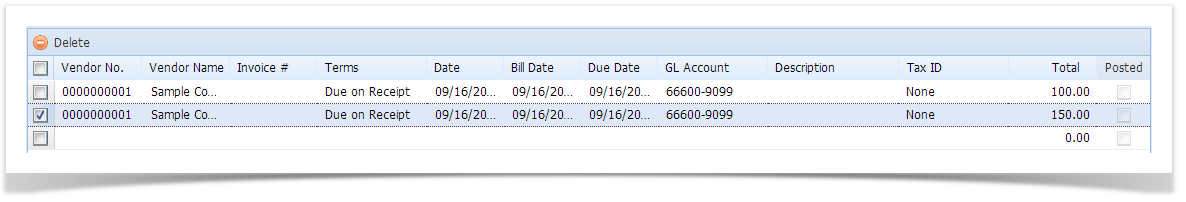

- Add details on the grid.

- Click Vendor combo box button and select existing Vendor from the combo box list. Name of the selected vendor will be displayed on the Vendor Name field.

- Terms will be automatically filled in by the Terms assigned to the selected vendor. If change is necessary, click on the combo box button and select different terms from the combo box list.

- Date will be filled in automatically with today's date, but can be changed to reflect a different date if necessary. Click the drop down button next to this field to open the mini calendar screen where you can select a different date. Manual entering of date is also allowed.

- Bill Date will be filled in automatically with today's date, but can be changed to reflect a different date if necessary. Click the drop down button next to this field to open the mini calendar where you can select a different date. Manual entering of date is also allowed. This is the date where due date will be based depending on the terms selected in the Terms field.

- Due Date field will be automatically filled in based on the terms you have selected in the Terms field.

- Click GL Account combo box button and select account from the combo box list.

- Enter Description if necessary.

- Select Tax ID to indicate what type of Sales tax will be applied to the specific vendor.

- Enter total amount of the vendor’s bill in the Total field.

- The over-all total of the bills added in the grid will be displayed on the Batch Total field.

Click Save button. Bill Batch Number field will now be filled in with a unique, system-generated ID automatically.

You can skip saving the record if the transaction is to be posted right away. This will be catered in the Posting process since it automatically saves the record before posting. (See How To Post Bill Batch Entry)

Overview

Content Tools