You are viewing an old version of this page. View the current version.

Compare with Current

View Page History

Version 1

Next »

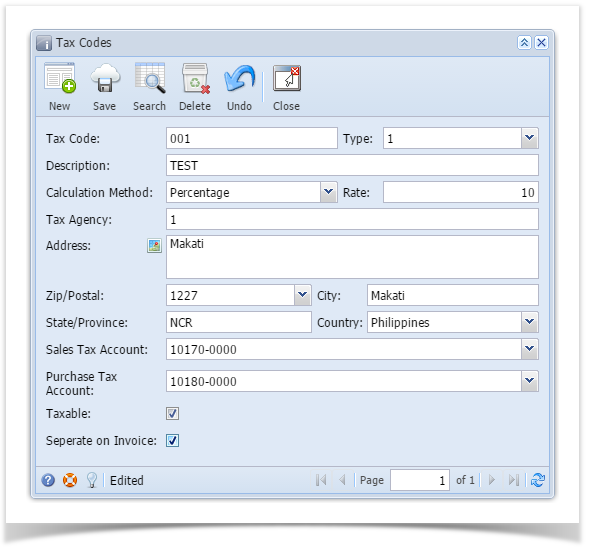

- From Common Info folder, double click Tax Code

- If there are existing records, Search Tax Codes screen will open

- If there is no existing record, the new Tax Codes screen will open

- From Search Tax Codes screen click New toolbar button

- Enter necessary details on the form

- Click Save toolbar button

| Label | Description |

|---|

| Tax Code | User gives tax code a name (ie. Indiana Sales Tax) |

|---|

| Description | User can describe the tax (optional) |

|---|

| Type | User can select from different tax types created in Tax Types screen. Type is needed to create templates from tax schedule. |

|---|

| Calculation Method | Either % of total or an amount per dollar |

|---|

| Rate | Enter either the percentage or the amount per dollar |

|---|

| Tax Agency | This is who the tax check will be written to when payment is issued. This tax will be tracked to the tax agency. |

|---|

| Address | User enters address of tax agency. |

|---|

| State | User can define the state associated with the tax. Needed to create templates from tax schedule. |

|---|

| County | User can define the county associated with the tax. Needed to create templates from tax schedule. |

|---|

| City | User can define the city associated with the tax. Needed to create templates from tax schedule. |

|---|

| Sales Tax Account | Select from accounts under Sales Tax Account category |

|---|

| Purch G/G Account | Select from accounts under Purchase Tax Account category |

|---|

| Taxable | Yes or No? If yes, this tax will be included in the total item amount for tax calculation on the whole invoice |

|---|

| Seperate on Invoice | Yes or No? If yes, tax will show as its own item. If no, tax will be included with the item total. |

|---|