The following will explain in detail how to generate Trial Balance report and how the Trial Balance is designed.

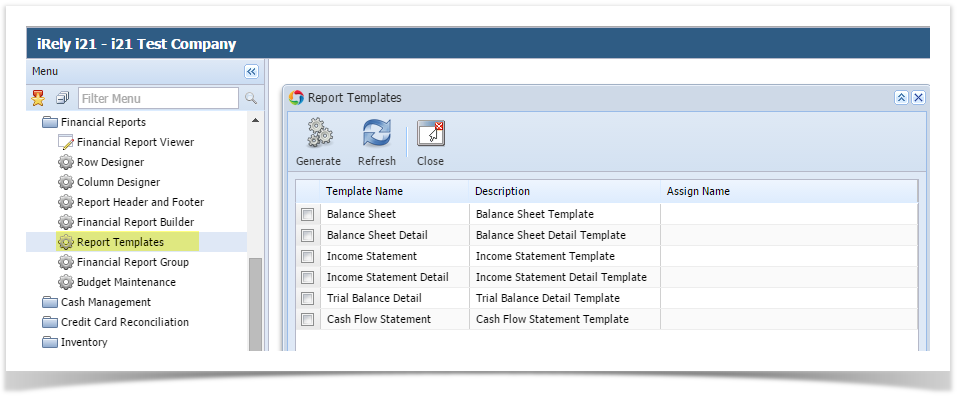

- Generate Trial Balance Detail report from Report Templates. To open Report Templates, go to Financial Reports module > Report Templates.

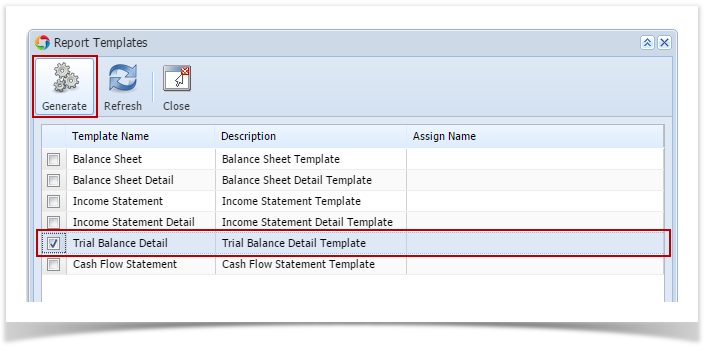

Select Trial Balance Detail and click Generate toolbar button.

You can assign a name for the Trial Balance Detail report by entering the name of the report in the Assign Name field. If this field is left blank, i21 will automatically provide a name for the report with this format: Trial Balance Detail - <Date and Time the report template is generated.

Ex: Trial Balance Detail - September 30, 2015 13:23:37

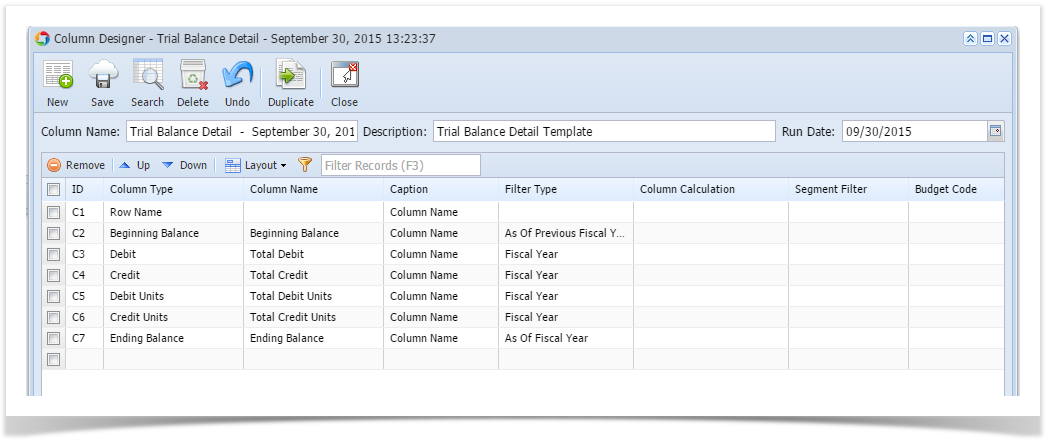

- The Report Builder record with Rows and Columns designed for a Trial Balance will automatically open.

- Click on the magnifying glass button in the Row field. It will show how rows are designed. Rows are designed to show GL Accounts per row.

Click on the magnifying glass button in the Column field. It will show how columns are designed.

If you will want to create your own Trial Balance report, make sure that you define the columns properly as detailed below.> For your Beginning Balance column, you will have to use Beginning Balance column type and match it to either As of Previous Fiscal Year or As of Previous Year.> For your Debit and Credit columns (if you use units, then Debit Units and Credit Units too), you will have to match it with Filter Type of Fiscal Year.> For your Ending Balance column, you will have to use Ending Balance column type and match it to either As of Fiscal Year or As of This Year.- Let us say that 2014 is the previous year and 2015 is the current year.

- Print Trial Balance Detail report. Make sure that Show Report Settings checkbox is checked. Click Generate toolbar button.

- The Report Settings screen will open. In here set As of Date field with a date equal to that of end of previous fiscal year.

- Click Print toolbar button to preview the report.

For this illustration, here is the Trial Balance figures As of previous fiscal year. - Now Print a report with As of Date of end of the current fiscal year.

To further explain, the Retained Earnings account's Beginning Balance will take the previous year's Total Income or Loss, which is computed as Total Revenue - Total Expenses. That is why Income Statement accounts (Revenue and Expense type) is zeroed out and is rolled over to Retained Earnings account as Beginning Balance for the current year. In the case where there are transaction/s created that use Retained Earnings account, then that same will be added if posted on the credit side and deducted on the debit side to the Total Income or Loss to get the Retained Earnings Beginning Balance.

Take a look at the screenshot on Step 9. The highlighted rows are what composed the Retained Earnings account Beginning Balance.

Overview

Content Tools