The following will explain in detail how to generate Trial Balance report and how the Trial Balance is designed.

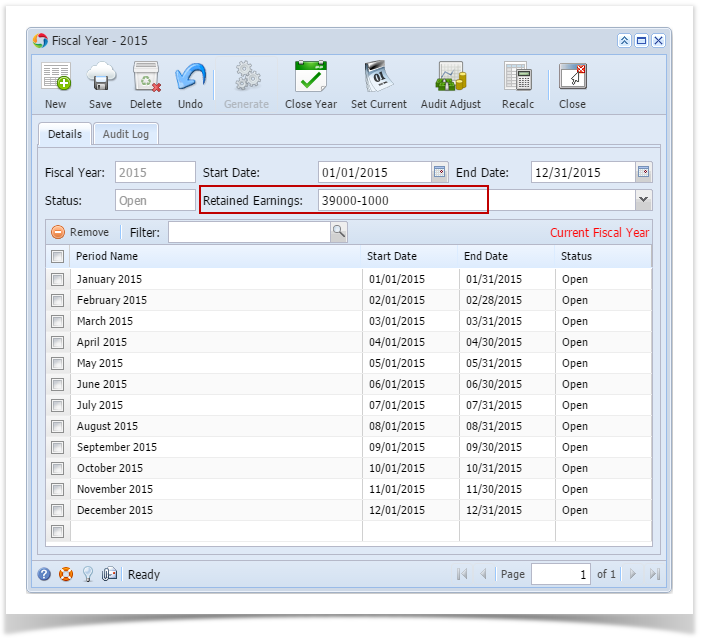

- First and foremost, make sure that Retained Earnings field in the Fiscal Year screen has been setup with a Retained Earnings account. This is the account where the Net Income from previous year/s be rolled over.

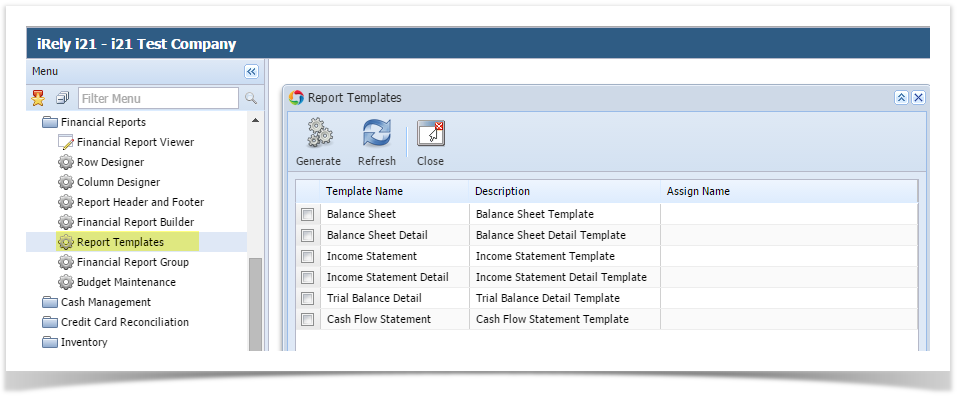

- Generate Trial Balance Detail report from Report Templates. To open Report Templates, go to Financial Reports module > Report Templates.

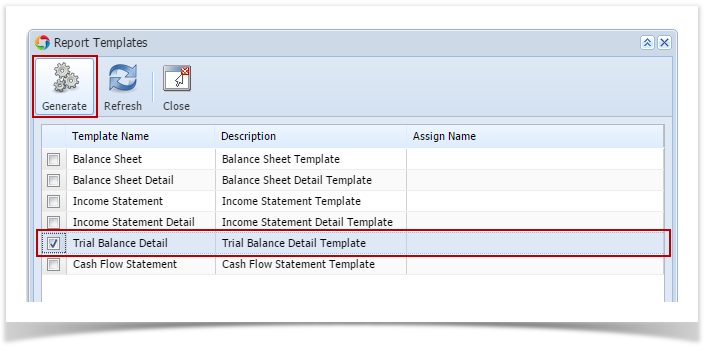

Select Trial Balance Detail and click Generate toolbar button.

You can assign a name for the Trial Balance Detail report by entering the name of the report in the Assign Name field. If this field is left blank, i21 will automatically provide a name for the report with this format: Trial Balance Detail - <Date and Time the report template is generated.

Ex: Trial Balance Detail - November 10, 2015 16:24:5

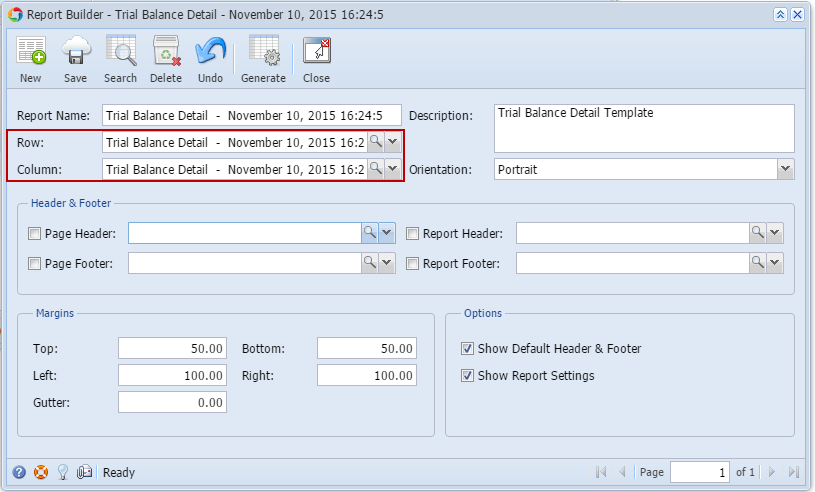

- The Report Builder record with Rows and Columns designed for a Trial Balance will automatically open.

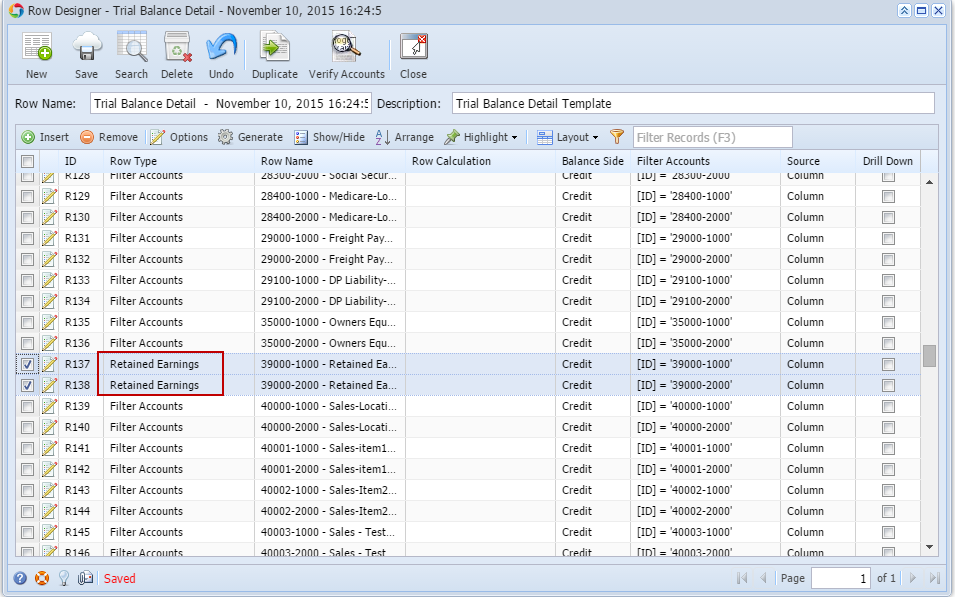

- Click on the magnifying glass button in the Row field of the Report Builder screen to open the Row Designer record. Most of the rows have Filter Accounts row type and are filtered per Account ID.

- Look for the Retained Earnings account/s and assign Retained Earnings row type to them. This row type will tell the row/s to compute for the Net Income from the prior year/s and roll it over to the next fiscal year.

- Close the the Row Designer screen to bring you back to the Report Builder record.

- Look for the Retained Earnings account/s and assign Retained Earnings row type to them. This row type will tell the row/s to compute for the Net Income from the prior year/s and roll it over to the next fiscal year.

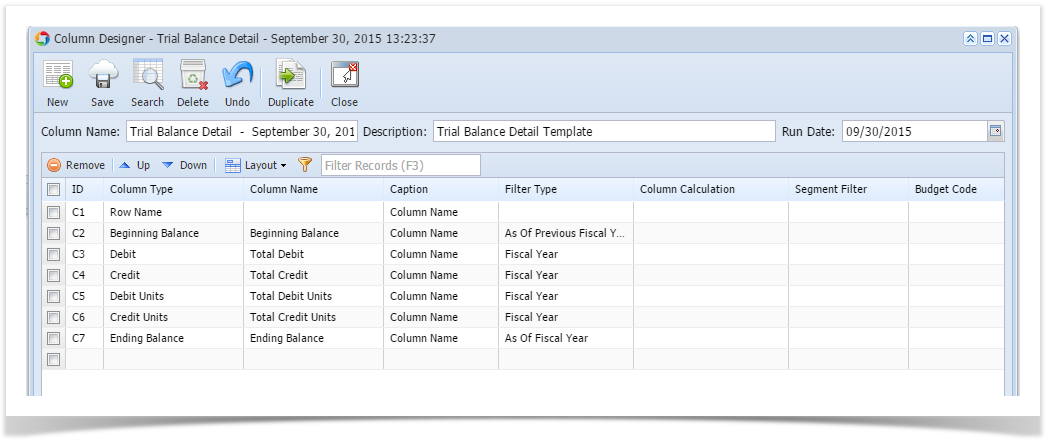

Click on the magnifying glass button in the Column field of the Report Builder screen to open the Column Designer record. Here is how each columns are setup.

If you will want to create your own Trial Balance report, make sure that you define the columns properly as detailed below.> For your Beginning Balance column, you will have to use Beginning Balance column type and match it to either As of Previous Fiscal Year or As of Previous Year.> For your Debit and Credit columns (if you use units, then Debit Units and Credit Units too), you will have to match it with Filter Type of Fiscal Year.> For your Ending Balance column, you will have to use Ending Balance column type and match it to either As of Fiscal Year or As of This Year.

Overview

Content Tools