Posting a transaction means recording the transaction to GL Account Details. This also locks up the transaction from being changed.

Under certain circumstances you may not be able to post a transaction due to a variety of reasons listed below.

- There is no Fiscal Year created for the date you are trying to post the transaction.

- You have closed your periods in the Fiscal Year screen for the date you are trying to post the transaction .

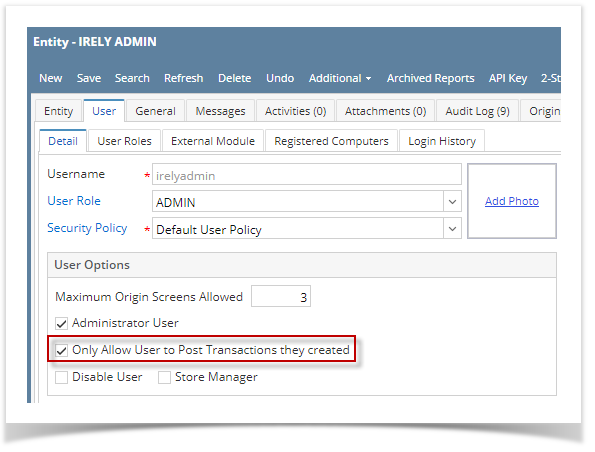

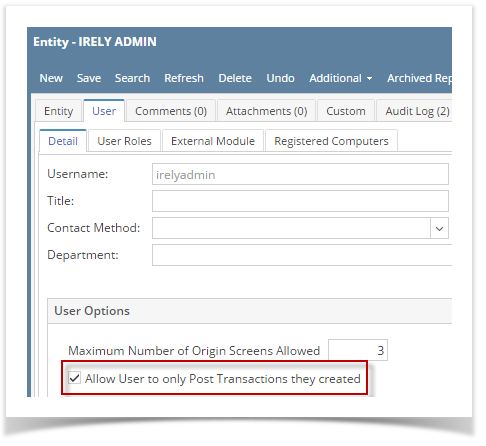

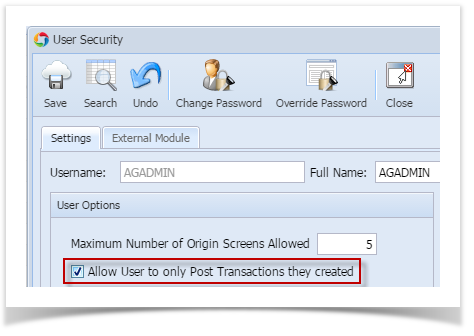

- The transaction you are to post is not originally created by you and Allow User to only Post Transactions they created checkbox is checked in the User Security screen.

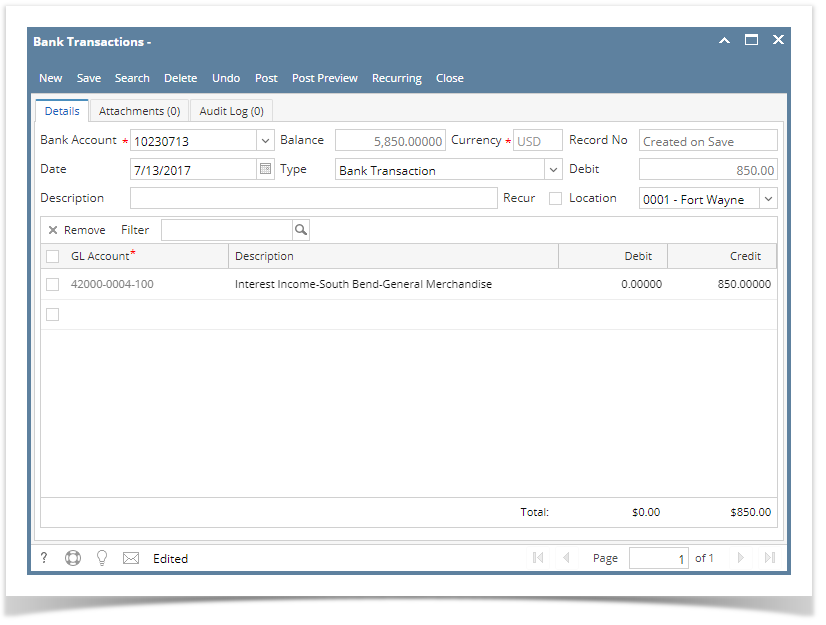

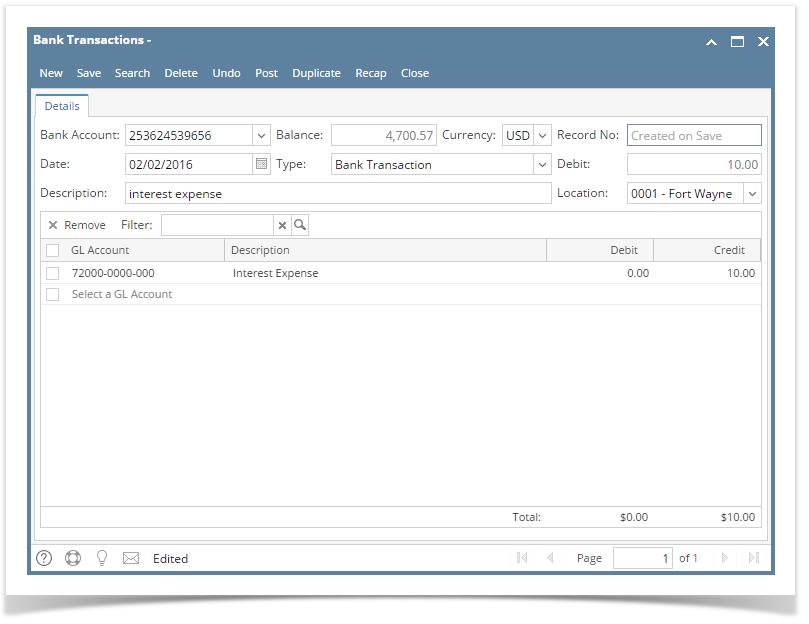

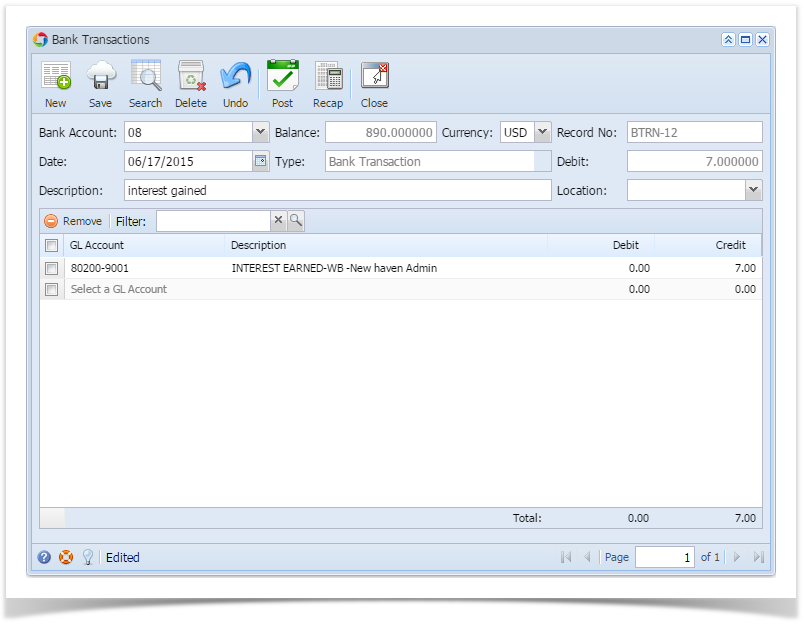

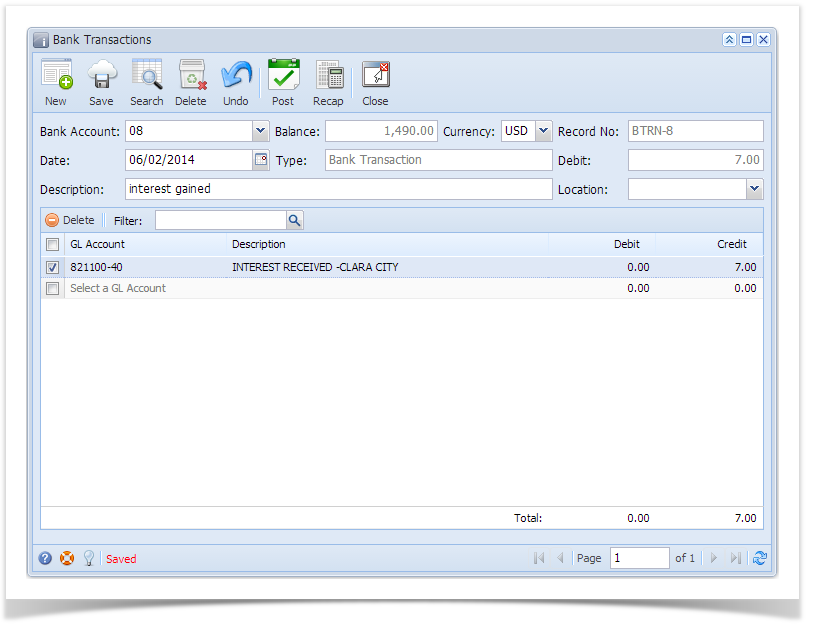

The following will guide you on how to post a bank transaction - miscellaneous credits like Interest Gained.

- Open the bank transaction you want to post.

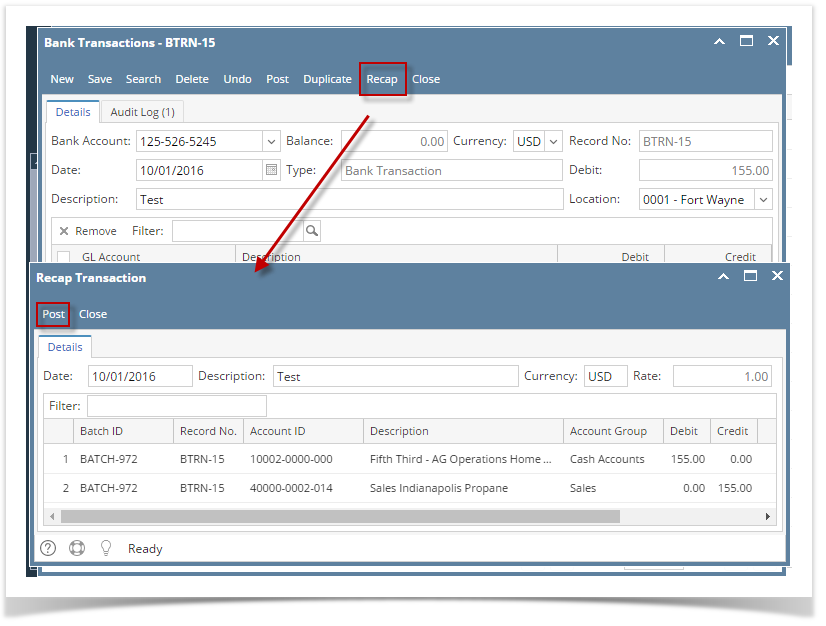

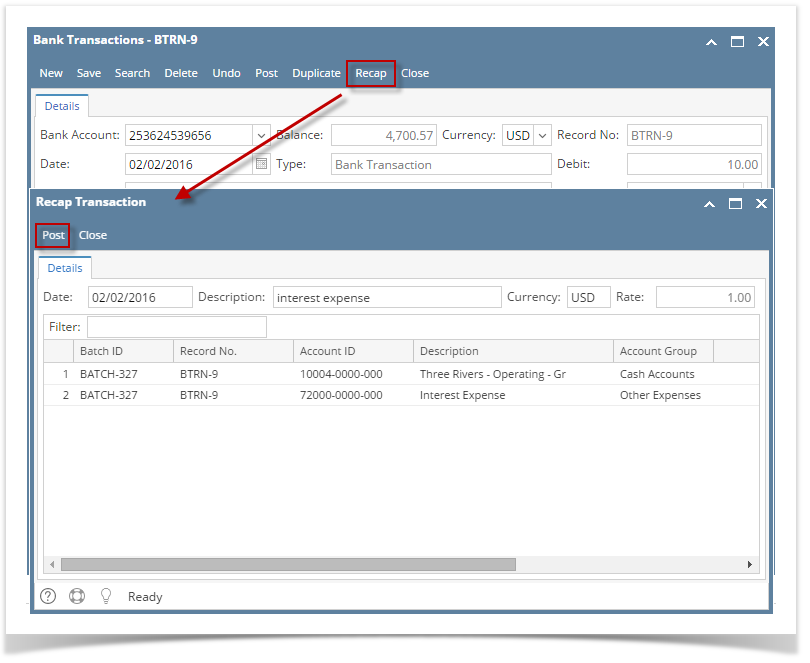

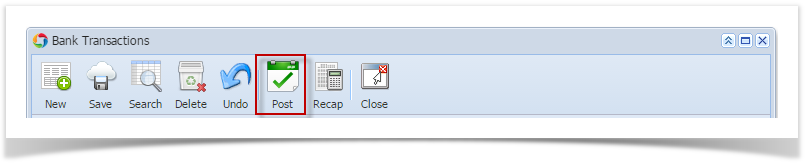

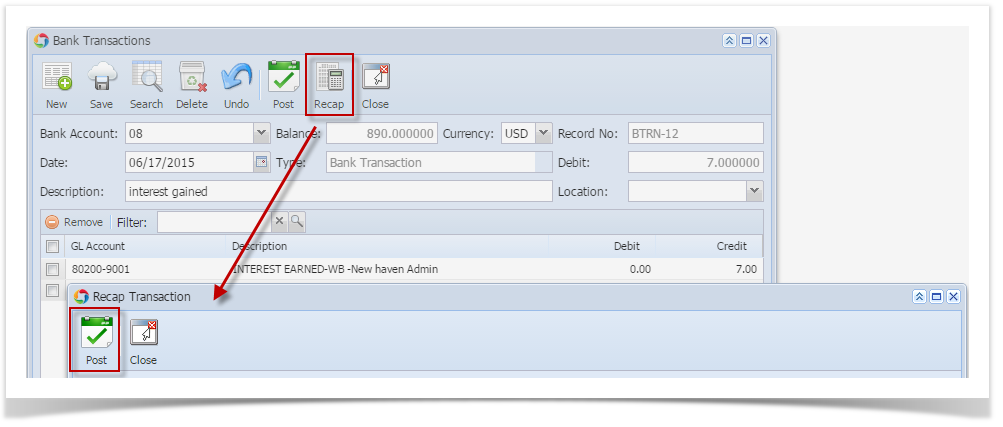

- Post the transaction. There are 2 ways to post a bank deposit.

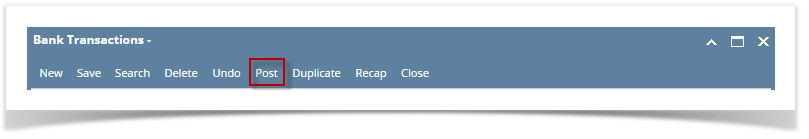

- On Bank Transactions screen, click Post toolbar button.

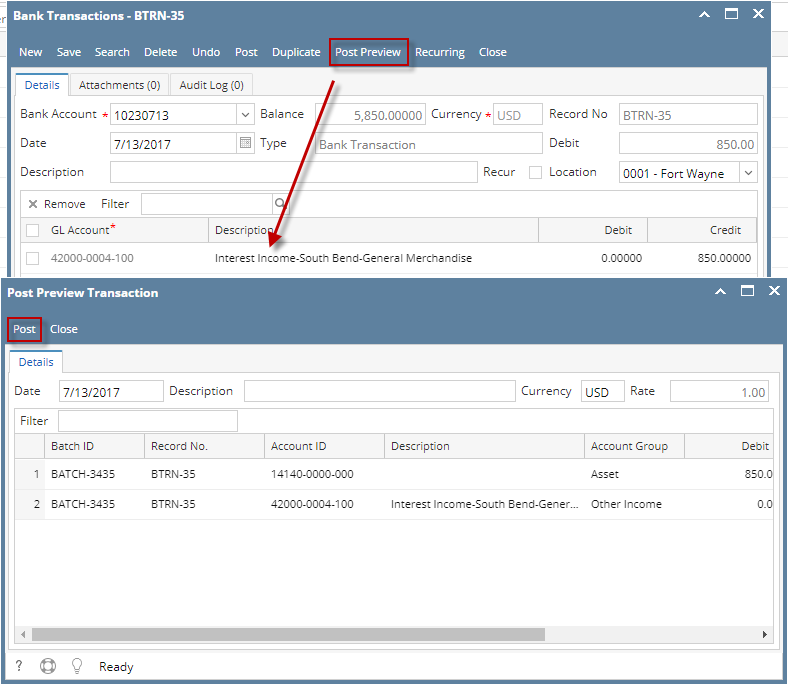

- On Bank Transactions screen, click Post Preview toolbar button to open Post Preview Transaction screen and upon click of Post Preview toolbar button, transaction will be saved. Click Post toolbar button.

- On Bank Transactions screen, click Post toolbar button.

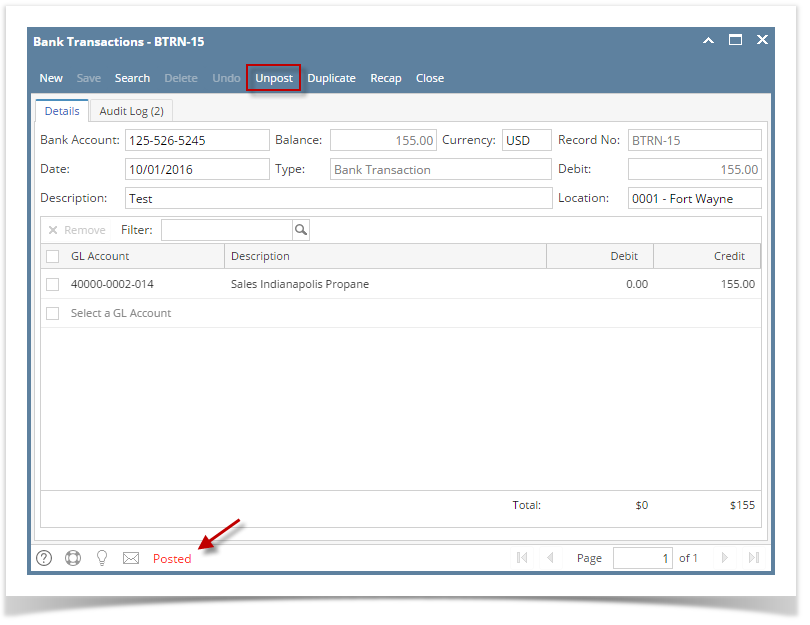

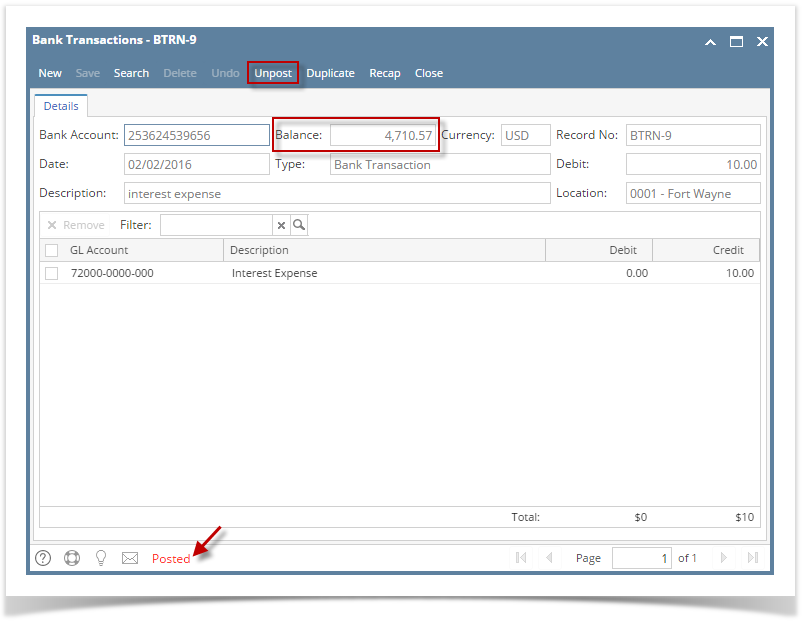

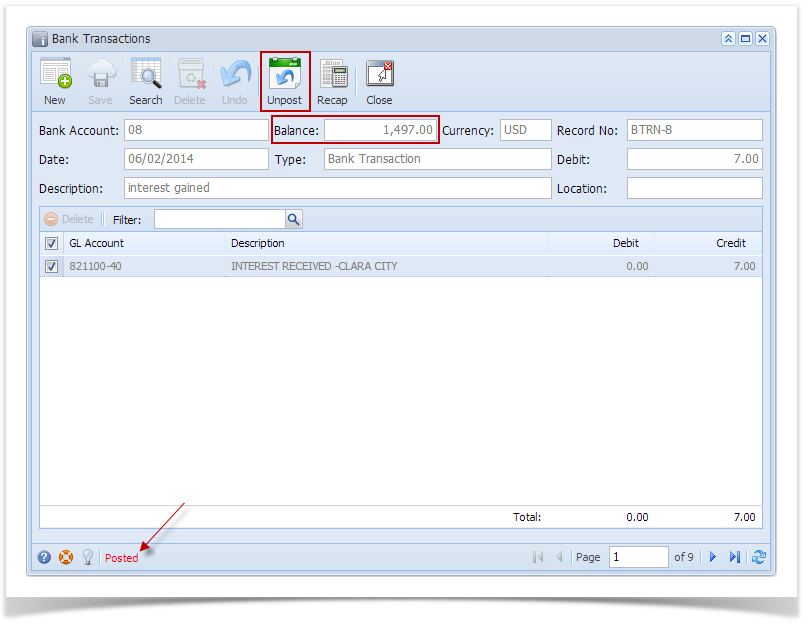

- The bank transaction is posted. These changes are then automatically applied to the bank transaction.

- Posted is shown at the left part of the Status bar.

- The previously Posted toolbar button is now labeled as Unpost.

- The Balance field is now updated by the amount of bank transaction.

- The entire screen is disabled preventing the user from changing anything to the posted transaction.

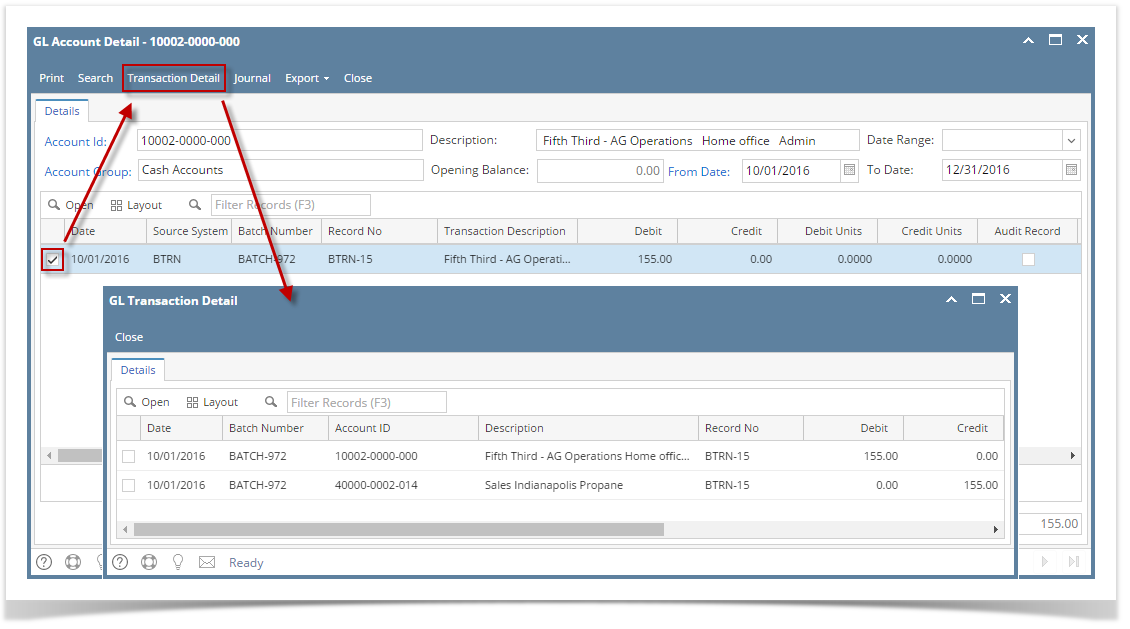

- The bank transaction is then recorded to the following areas in i21.

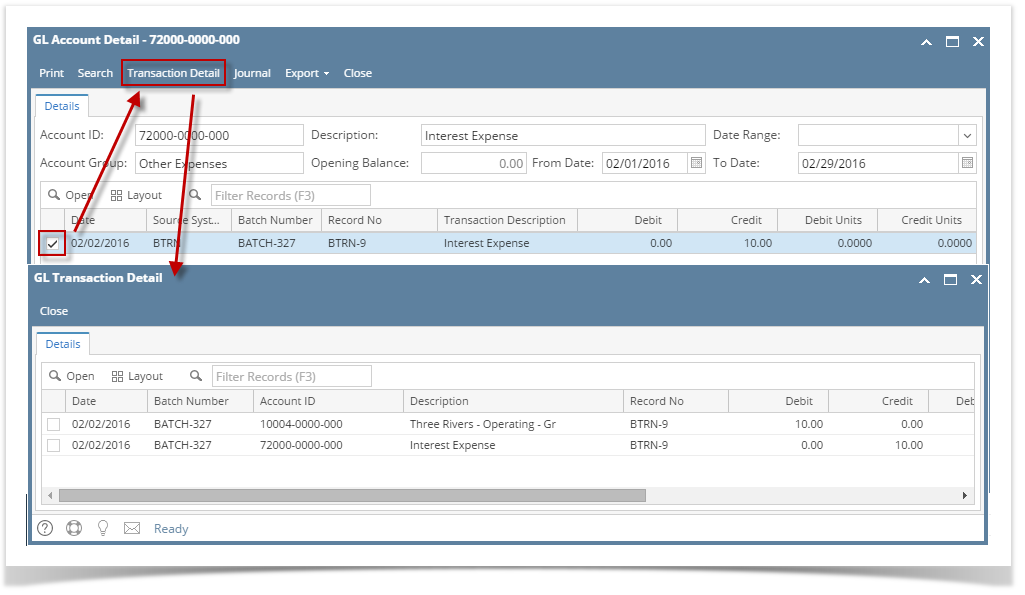

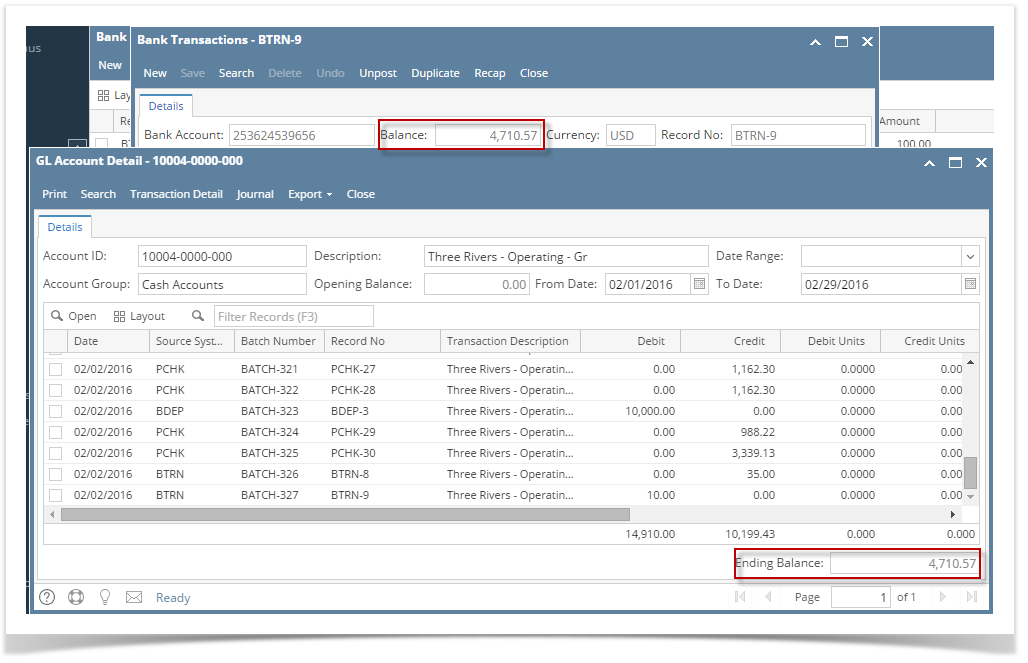

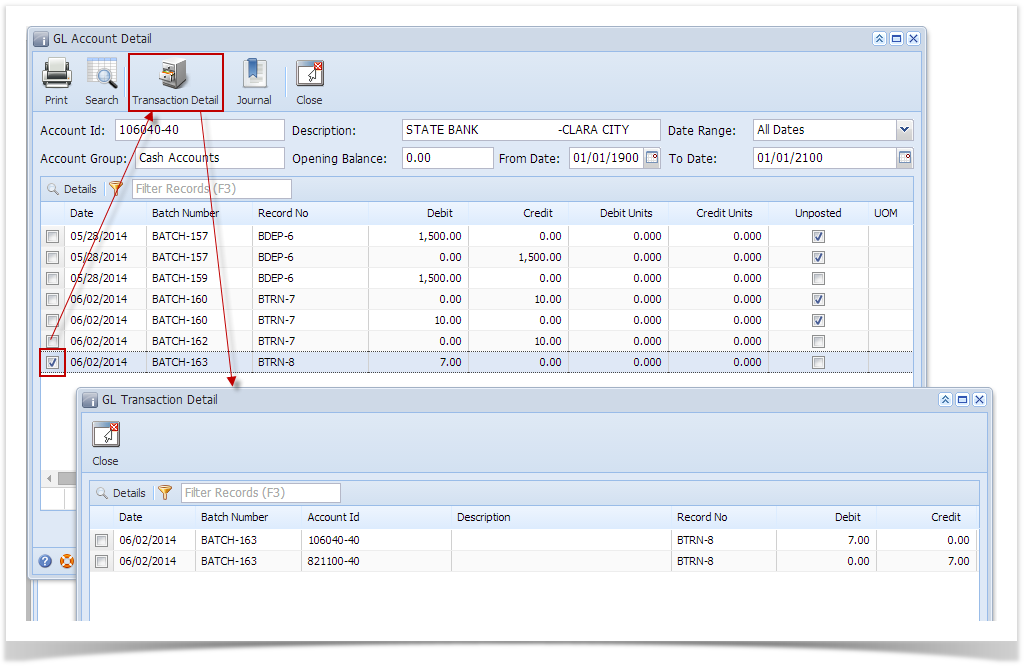

- In the GL Account Detail. You may open any account used from the bank transaction, then select the bank deposit transaction by clicking the checkbox before the Date field and click Transaction Detail toolbar button. That will open the GL Transaction Detail screen, where accounts affected by the bank transaction are shown.

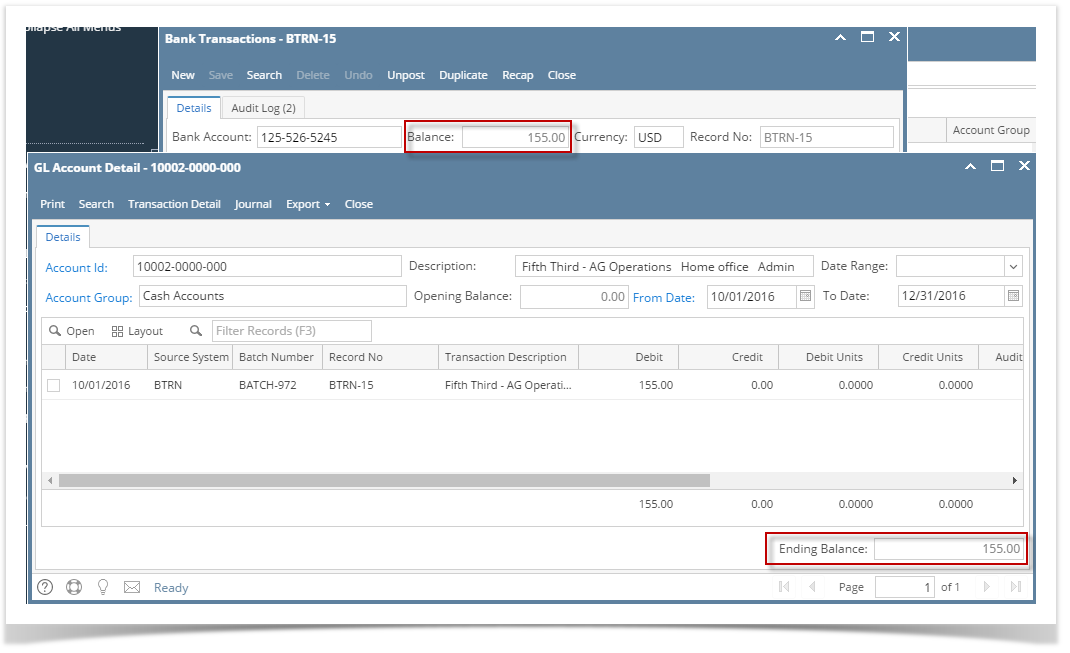

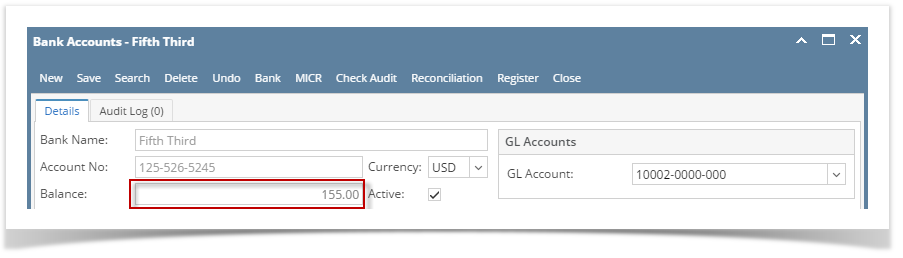

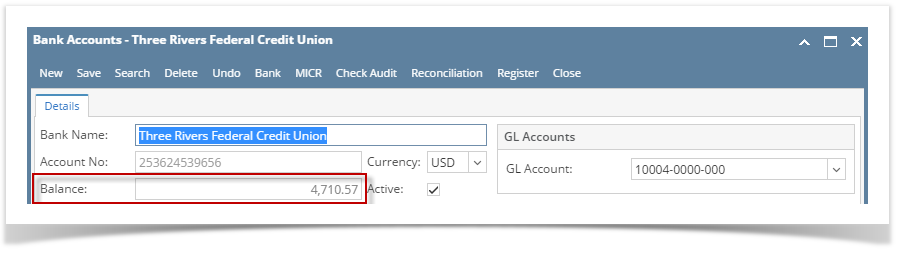

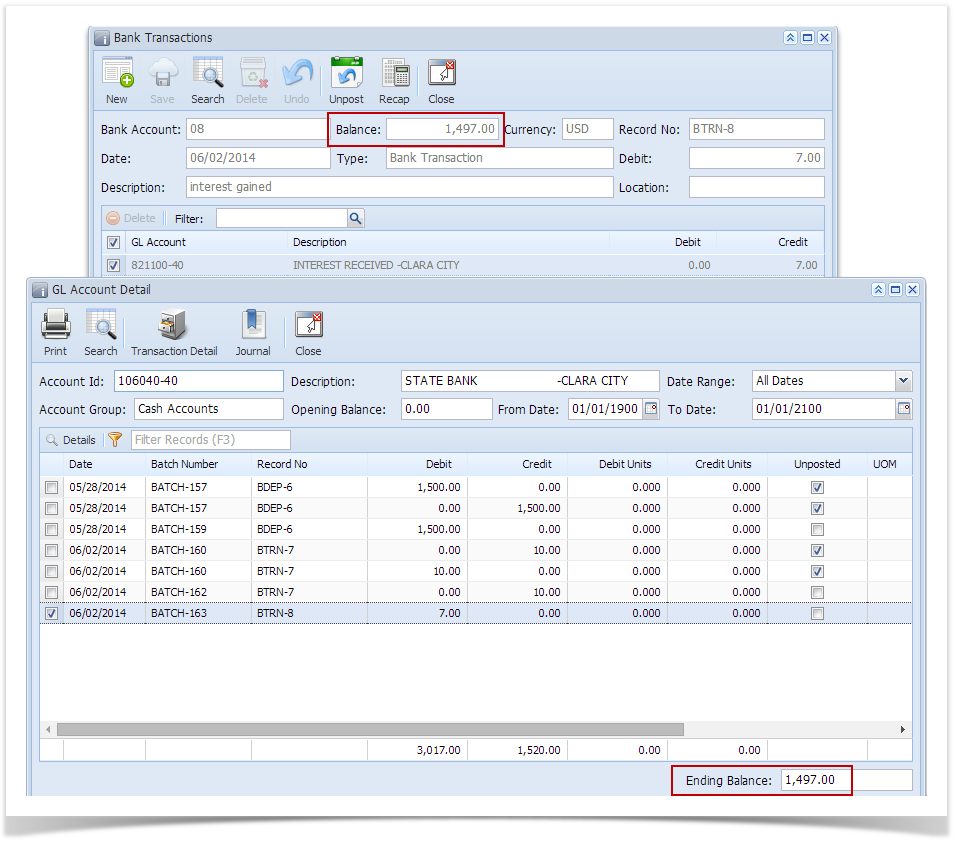

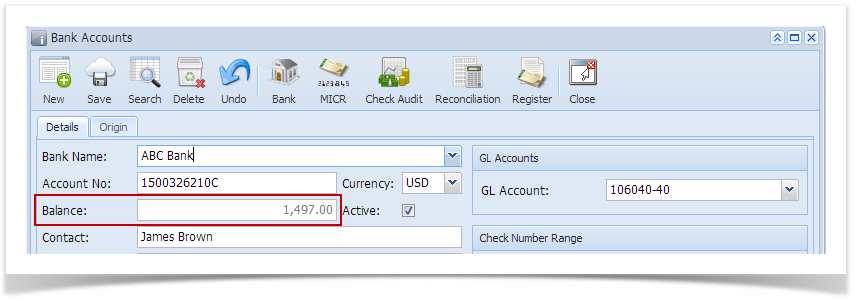

If you open the Account assigned for the bank account used in the bank transaction, the Ending Balance field at the bottom will show the same amount shown in the posted bank transaction. - Bank Accounts screen > Balance field for the selected bank account will be updated with the Bank Transaction amount. That same amount matches that of the posted Bank Transactions > Balance field.

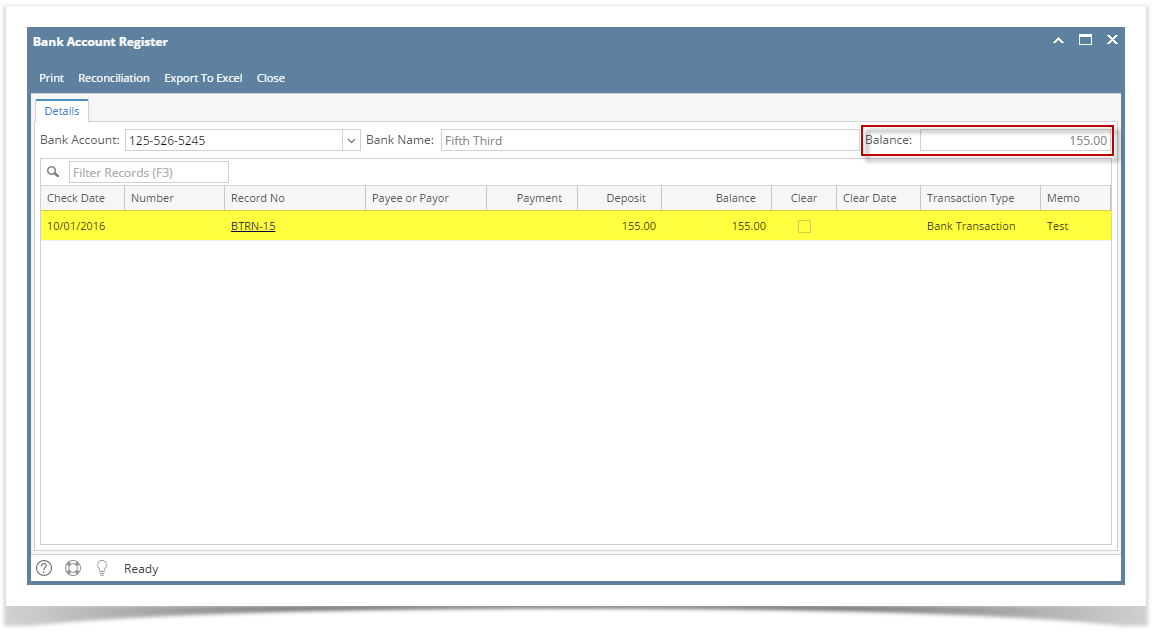

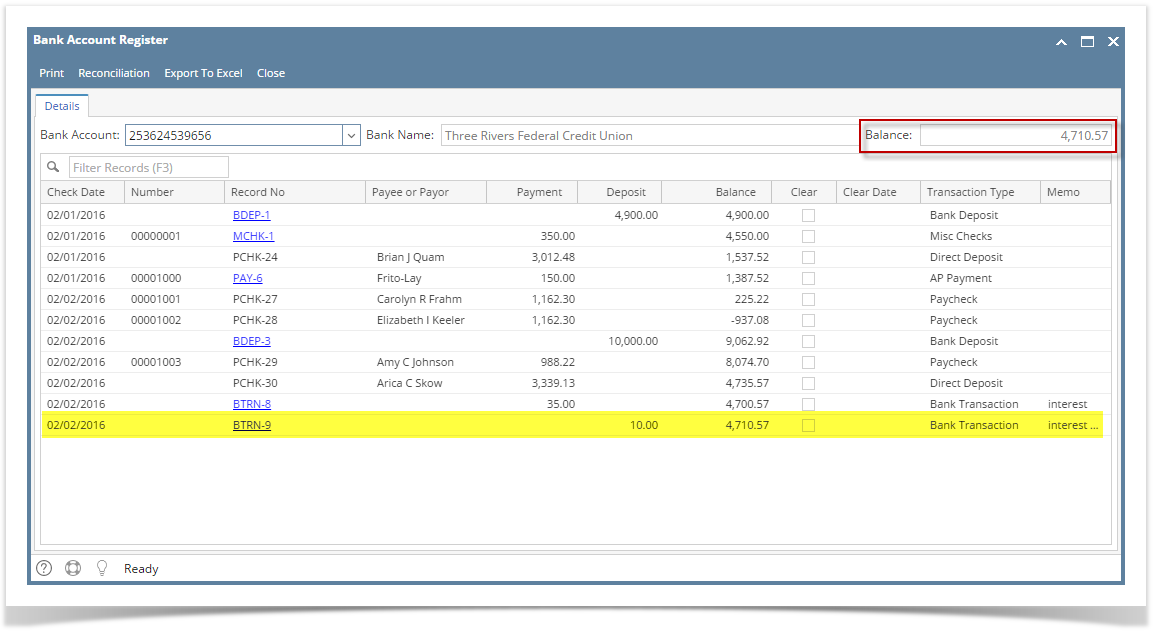

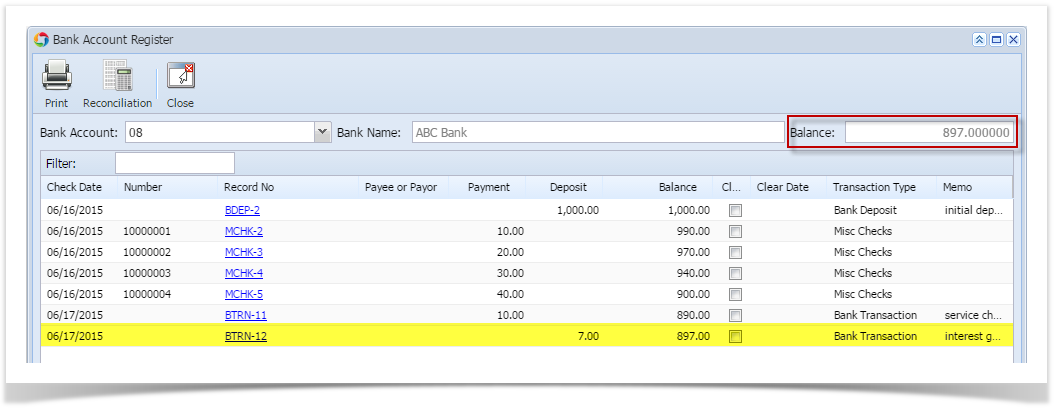

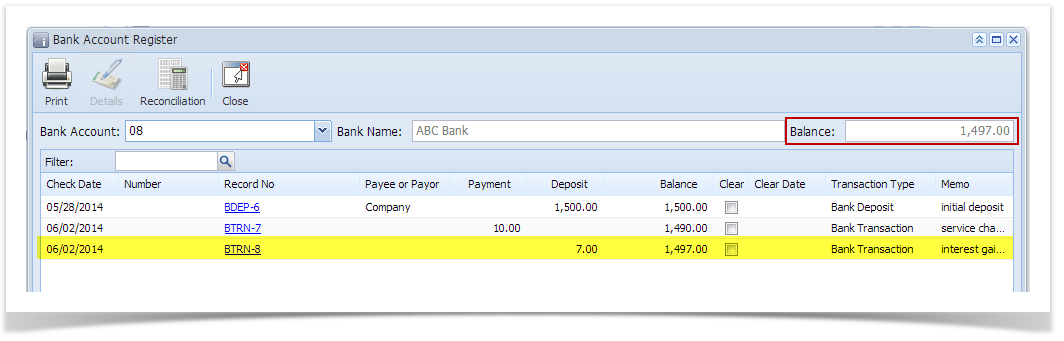

- Bank Transaction is recorded in the Bank Account Register for the Bank Account used. Balance field matches that of the posted Bank Transactions > Balance field.

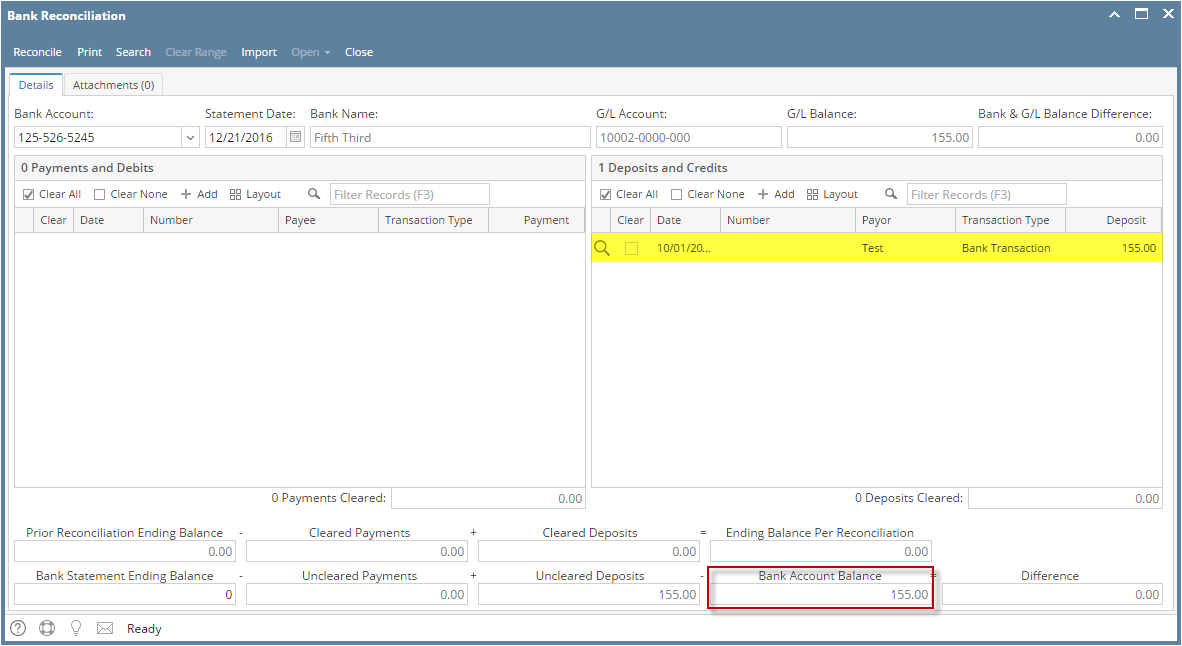

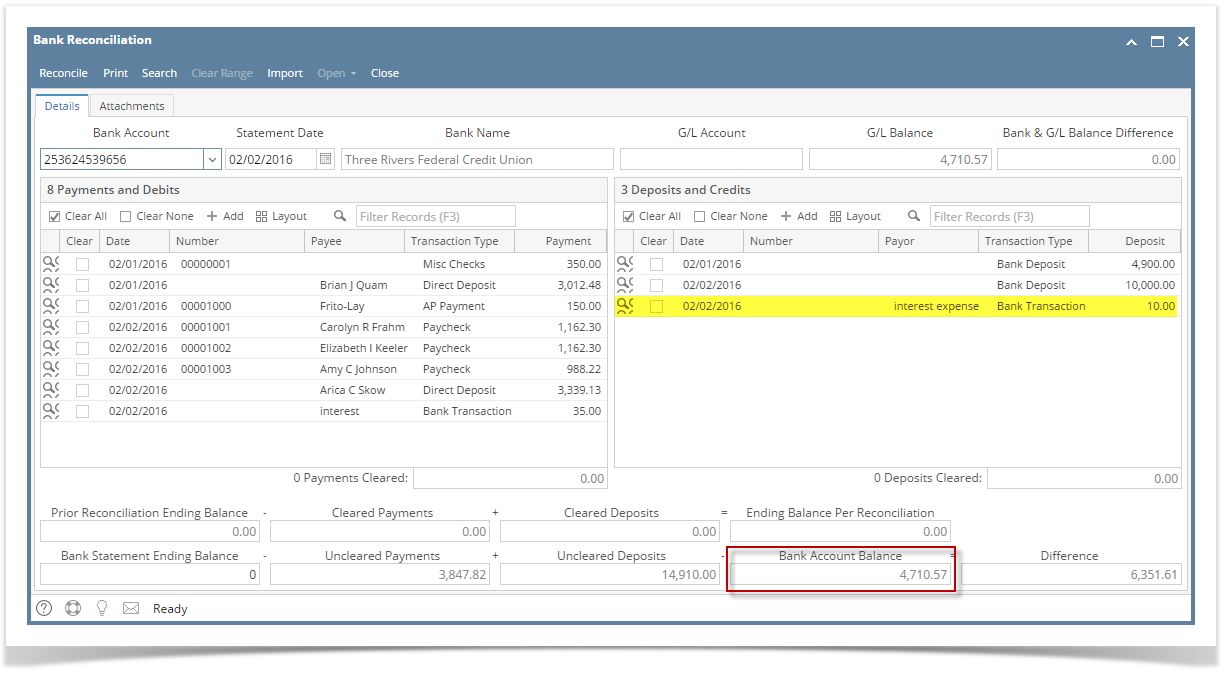

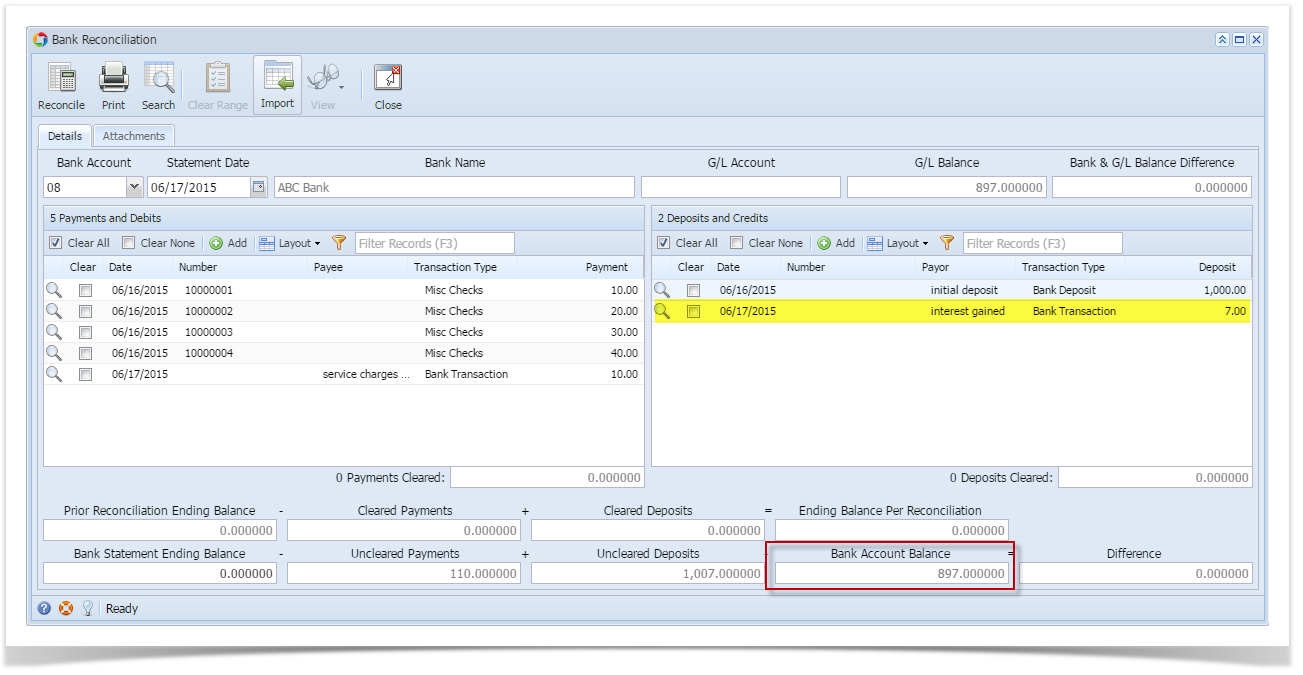

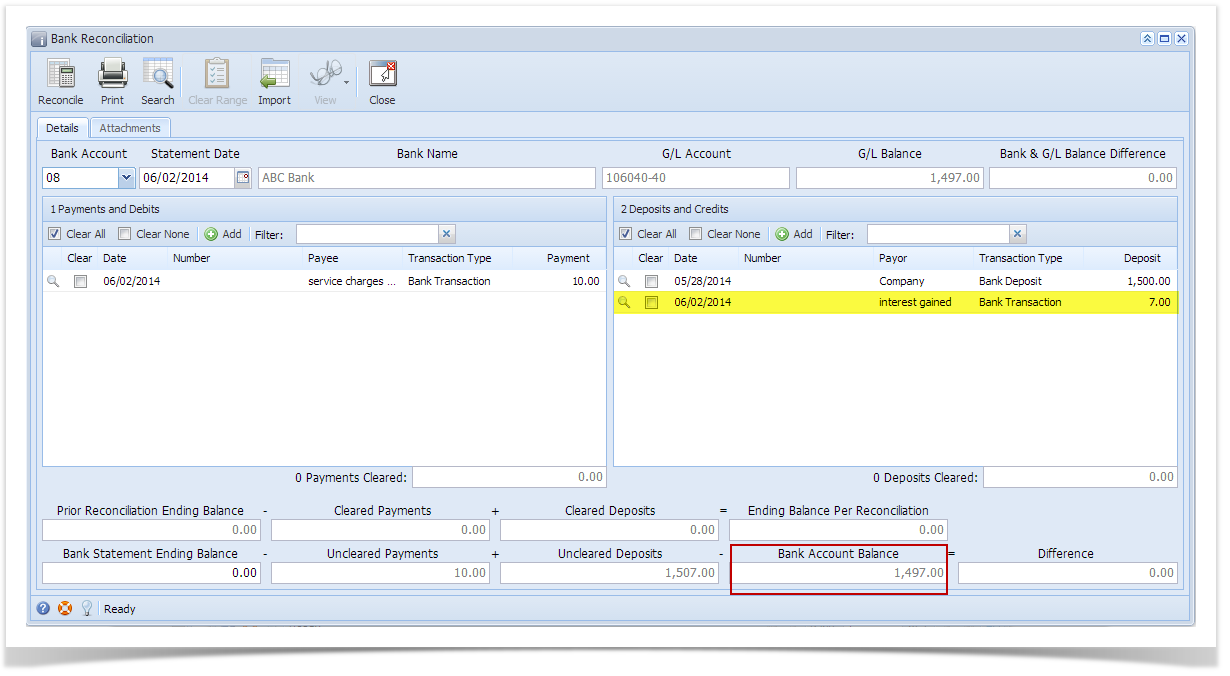

- Bank Transaction is recorded in the Bank Reconciliation > Payments and Debits panel for the Bank Account used. Bank Account Balance field matches that of the posted Bank Transactions > Balance field.

- In the GL Account Detail. You may open any account used from the bank transaction, then select the bank deposit transaction by clicking the checkbox before the Date field and click Transaction Detail toolbar button. That will open the GL Transaction Detail screen, where accounts affected by the bank transaction are shown.

Overview

Content Tools