- On the user’s menu panel go to Common Info folder then click Tax Codes

- If there are existing records, Search Tax Codes screen will open

- If there is no existing record, the new Tax Codes screen will open

- From Search Tax Codes screen click New toolbar button

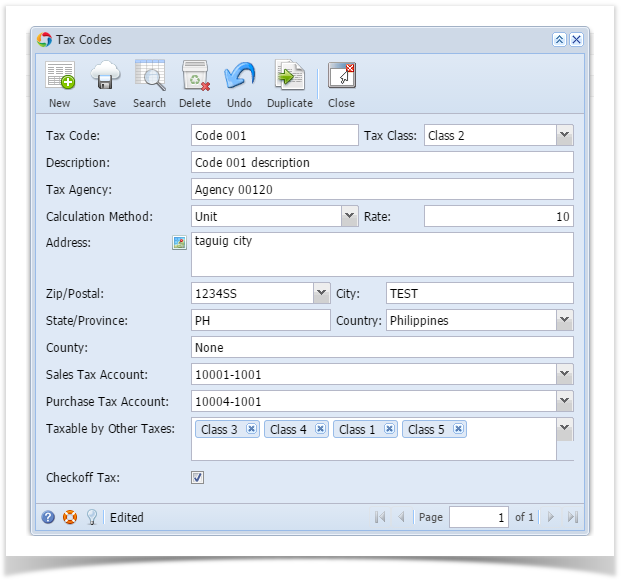

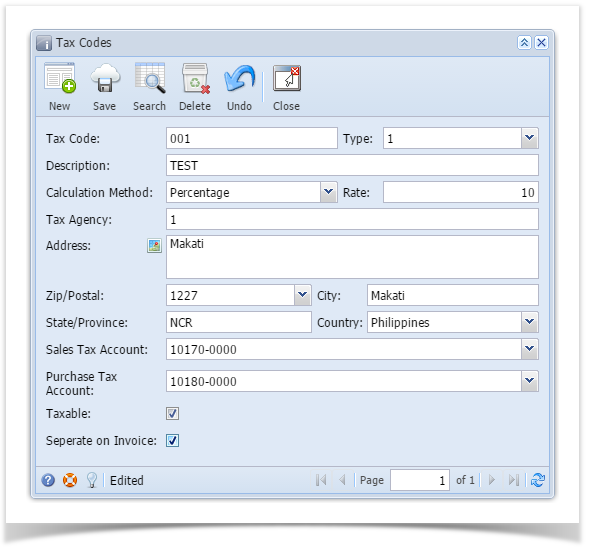

- Enter necessary details on the form

- Click Save toolbar button

| Tax Code | Tax code name (ie. Indiana Sales Tax) |

|---|---|

| Description | A more detailed description of the tax (optional) |

| Tax Class | User can select from different tax classes created in Tax Classes screen. Required field. |

| Tax Agency | This is who the tax check will be written to when payment is issued. This tax will be tracked to the tax agency. |

| Address | User enters address of tax agency. |

| Zip/Postal Code | Zip/Postal Code of the tax. Required field. |

| State | User can define the state associated with the tax. Needed to create templates from tax schedule. Required field. |

| Country | User can define the country associated with the tax. Needed to create templates from tax schedule. Required field. |

| City | User can define the city associated with the tax. Needed to create templates from tax schedule. Required field. |

| County | User can define the county associated with the tax. |

| Match Tax Address | Default to being checked. If unchecked, the system will not search for a match based on the address and will just tax if it is in the tax group list. |

| Sales Tax Account | Select from accounts under Sales Tax Account category and Purchase Tax Account category. Required field. |

| Purchase Tax Account | Select from accounts under Sales Tax Account category and Purchase Tax Account category. Required field. |

| Tax Adjustment Account | User can select the GL account for Tax Adjustment Account |

| Add to Cost | If the check box is checked, the tax amount will be added to Cost or COGS. |

| Tax Exemption Account for Sales | User can select the GL account for Tax Exemption of Sales Tax |

| Tax Exemption Account for Purchase | User can select the GL account for Tax Exemption of Purchase Tax |

| Taxable by Other Taxes | A list of other existing tax codes |

| Tax Only / Balance |

|

| Expense Account Override | Enable the customer to expense the tax on an item to the expense account. |

| Include in invoice price | If the check box is checked, tax will be included in the Invoice Price |

| Motor Fuel Tax Category | Displays values that matches the Tax Code's State/Province field |

| Store Tax No. | The tax code will be associated to the Store Tax No. entered used on Registers tracking |

| Checkoff Tax | If the check box is checked, the calculated amount will be offset into the invoice amount for that line item |

| Pay To Vendor | Selection of vendor entities |

| Texas Loading Fee | "Texas Loading Fee" or "Texas Petroleum Products Delivery Fee". In reality, this is a Tax levied by the State, but not a Fee/Surcharge initiated by a Vendor or iRely Customer. |

| Effective Date | Date when tax rate will be effective |

| Calculation Method | Either % of total or an amount per dollar |

| Rate | Enter either the percentage or the amount per dollar |

Overview

Content Tools