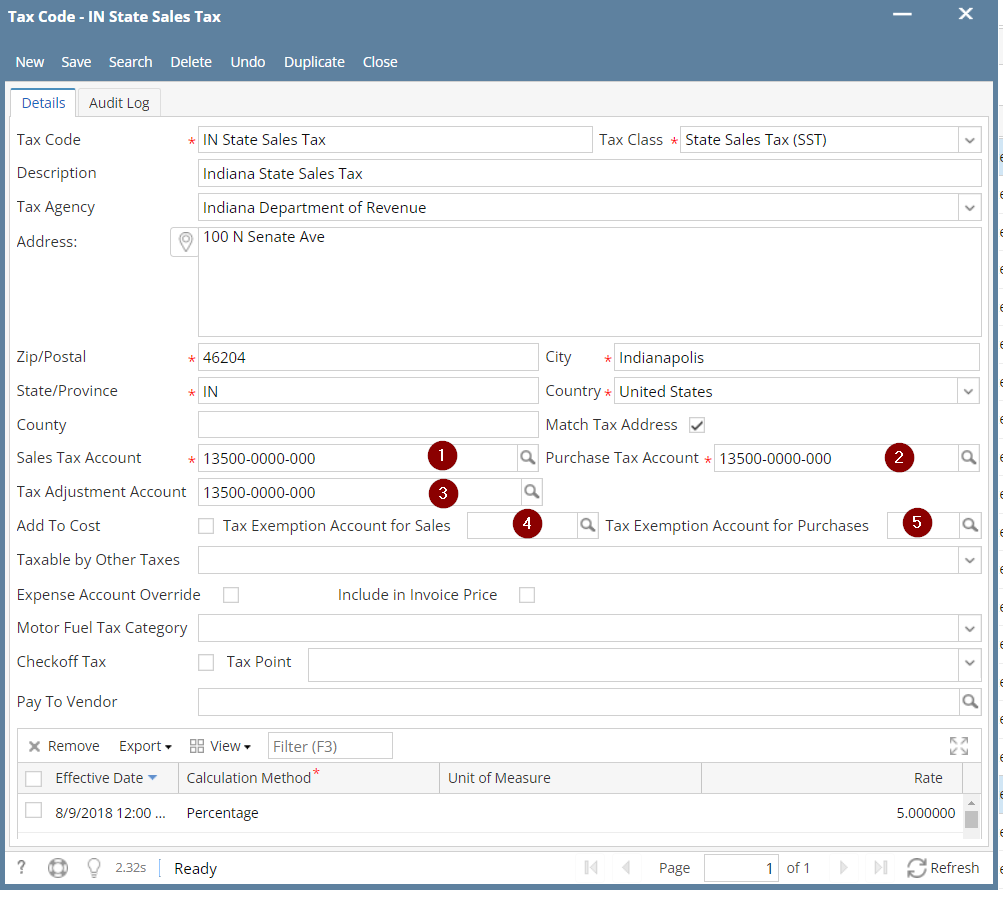

| Item | Description | Category | Purpose |

|---|---|---|---|

| 1 | Sales Tax Account | Purchase tax account | This is the credit account used on the sale for the amount of tax on the invoice |

| 2 | Purchase Tax Account | Purchase tax account | This is the debit account used on the purchase where tax is applied on purchase. |

| 3 | Tax Adjustment Account | Purchase tax account | This is the account used for tax adjustments in Accounts payable and accounts receivable. |

| 4 | Tax Exemption accounts for Sales | Purchase tax account | This is the account where the credit for adjustments is booked |

| 5 | Tax Exemption account for Purchases | Purchase tax account | This is the account where debit for adjustments are booked. |

Overview

Content Tools