Page History

- Click Employees from Payroll module.

- If there are no employee records yet, the Create New Entity screen will be displayed directly. Otherwise, a list of existing employees will be displayed.

- Click New toolbar button.

- Set the value of the following fields:

- Name

Contact

Info Contact refers to contact name.

- ZIP/Postal

- Country

- Phone

- Address

- Click Find Duplicates toolbar button.

If some values are the same to other employees, it will be displayed in Duplicate Entities- To create new employee, Click Add button

- To merge new employee to an existing record, select employee with duplicate data and click Merge button

- The information from Create New Entity screen will reflect on their respective fields in Employee Entity screen.

Fill in other fields as necessary.

Info In Entity tab, the required fields are Entity No, Location Name, and Timezone.

Setup employee details in Details tab under Employees tab.

- Input data on required fields:

- Pay Period

- Last Hire Date

- Workers Comp

- Social Security

- Set Time Entry Password

- Select Department/s

- Select Supervisor/s

Set GL Location Distribution

Info GL Location Distribution is optional

Percent should always equal to 100%

- Input data on required fields:

Setup employee details by using template

- Click Template button

- Select template and click OK button

- Click Template button

Setup employee details manually.

- Set up taxes in Taxes tab under Employees tab.

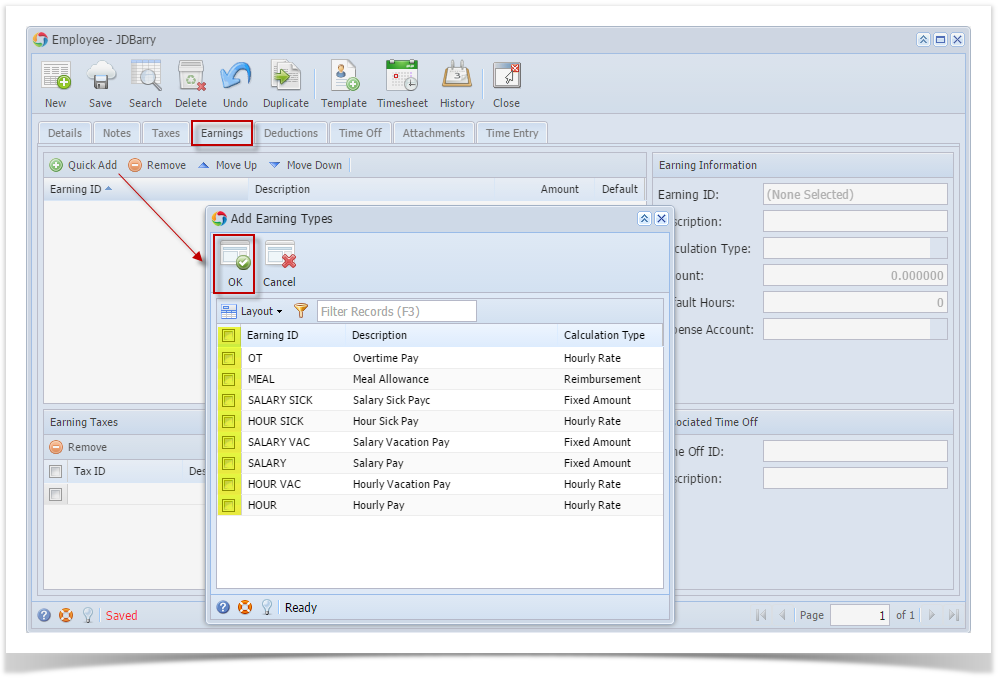

- Set up earnings in Earnings tab under Employees tab.

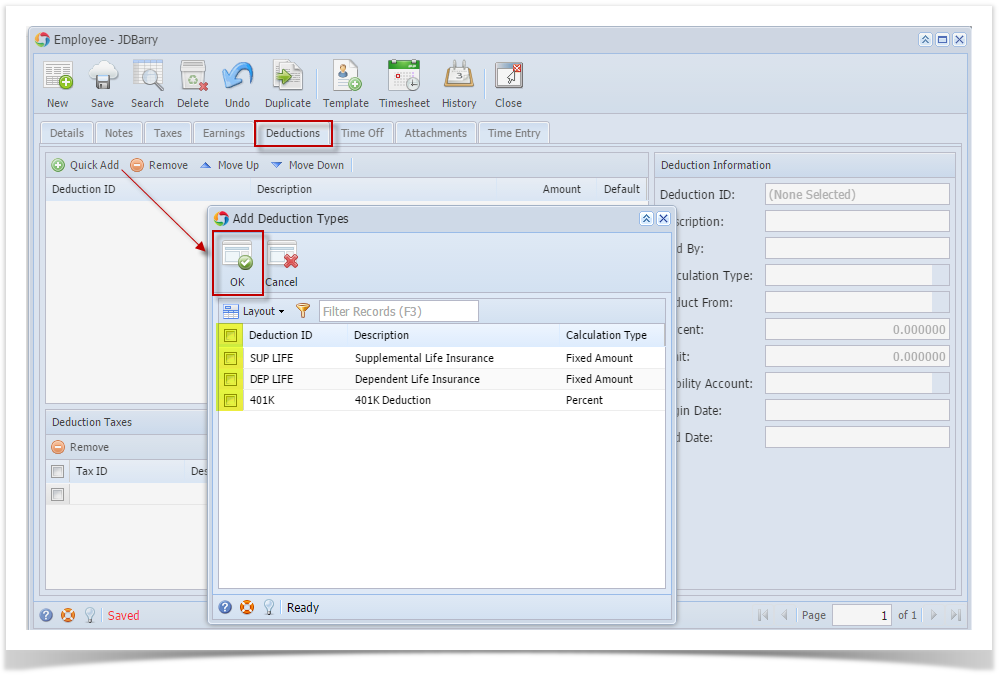

- Set up deductions in Deductions tab under Employees tab.

- Set up time offs in Time Off tab under Employees tab.

- Set up taxes in Taxes tab under Employees tab.

- Click Save toolbar button to create employee record.

- Newly created employee should appear in the grid.

| Expand | ||

|---|---|---|

| ||

|

...

|

...

|

...

|

...

|

...

|

...

|

...

|

...

|

...

|

...

|

...

|

...

|

...

|

...

| Expand | ||

|---|---|---|

| ||

|

Overview

Content Tools