| Module | Description | How To | ||

|---|---|---|---|---|

| Payroll |

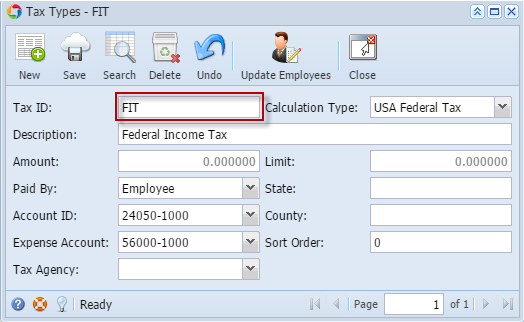

| Go to Payroll menu > Tax Type | ||

Enter the Tax ID, select the Calculation Type from the list. Select the Paid By that will indicate if this is an Employee or Company Tax | ||||

| 2. Create Earning Type | Go to Payroll menu > Earning Type | |||

Enter the Earning ID and select the calculation Type. Click the Quick Add grid button to add the created Tax type so that when you select the Earning ID in the Employee screen, Taxes will automatically populated

| ||||

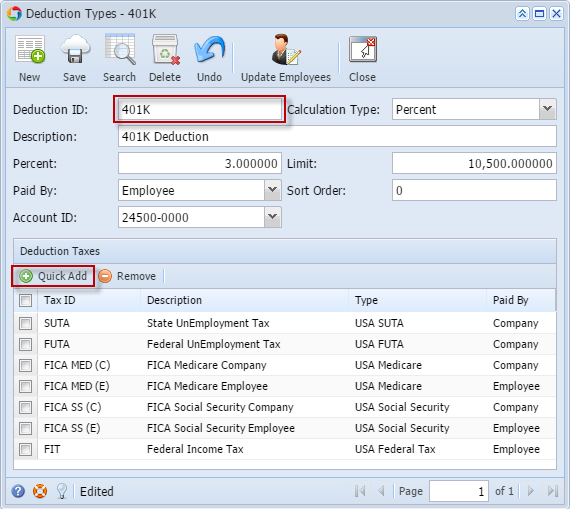

| 3. Create Deduction Type | Go to Payroll menu > Deduction Type | |||

Enter the Deduction ID and select the Calculation Type. Click the Quick Add grid button to add the Employee and Company Taxes so that when this Deduction ID is selected in the Employee screen,Taxes will automatically populated. | ||||

| 4. Create Employee Pay Group | From Payroll menu > Employee Pay Groups | |||

Create Pay Group and select the Pay Period. Select the Cash Account in Bank Account field that will be the default when you create the Employee Paycheck | ||||

| 5. Create Employee | Go to Payroll menu > Employees | |||

Overview

Content Tools