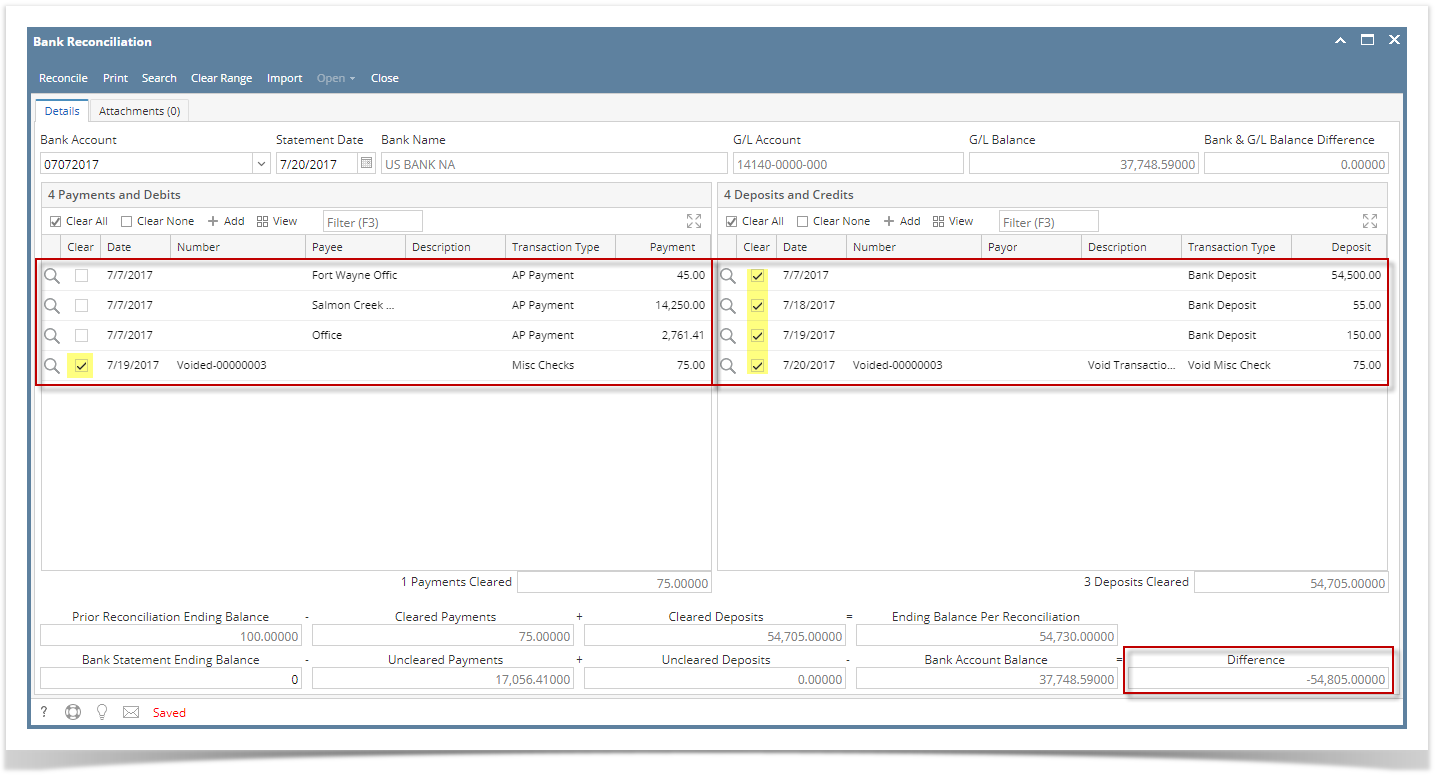

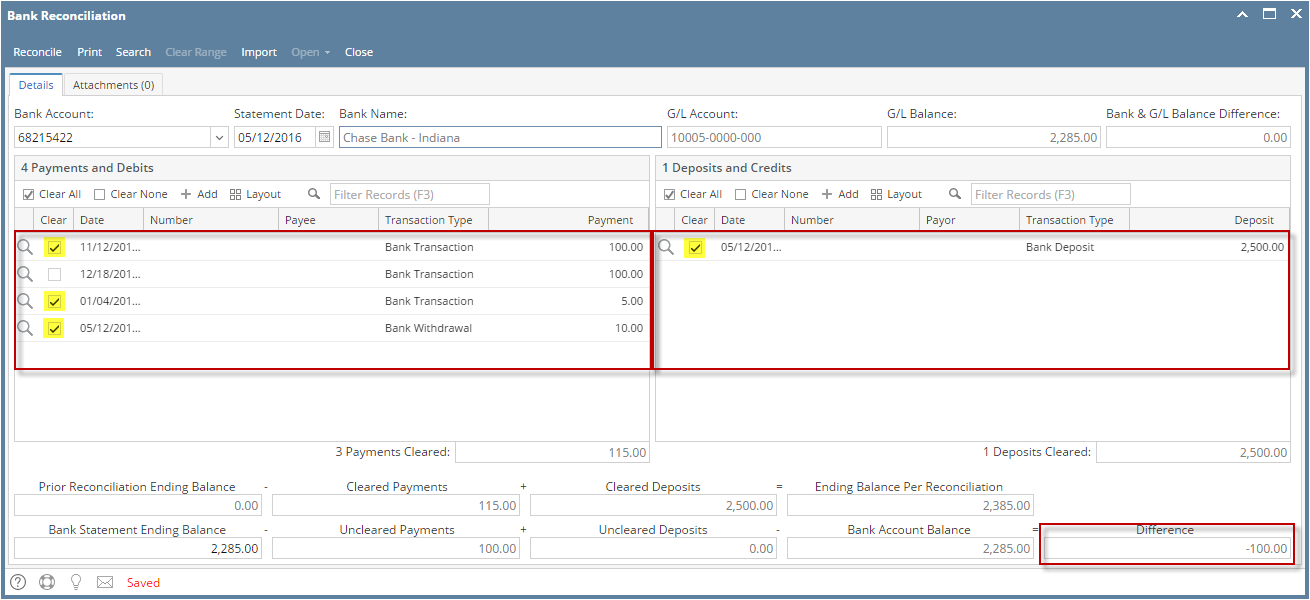

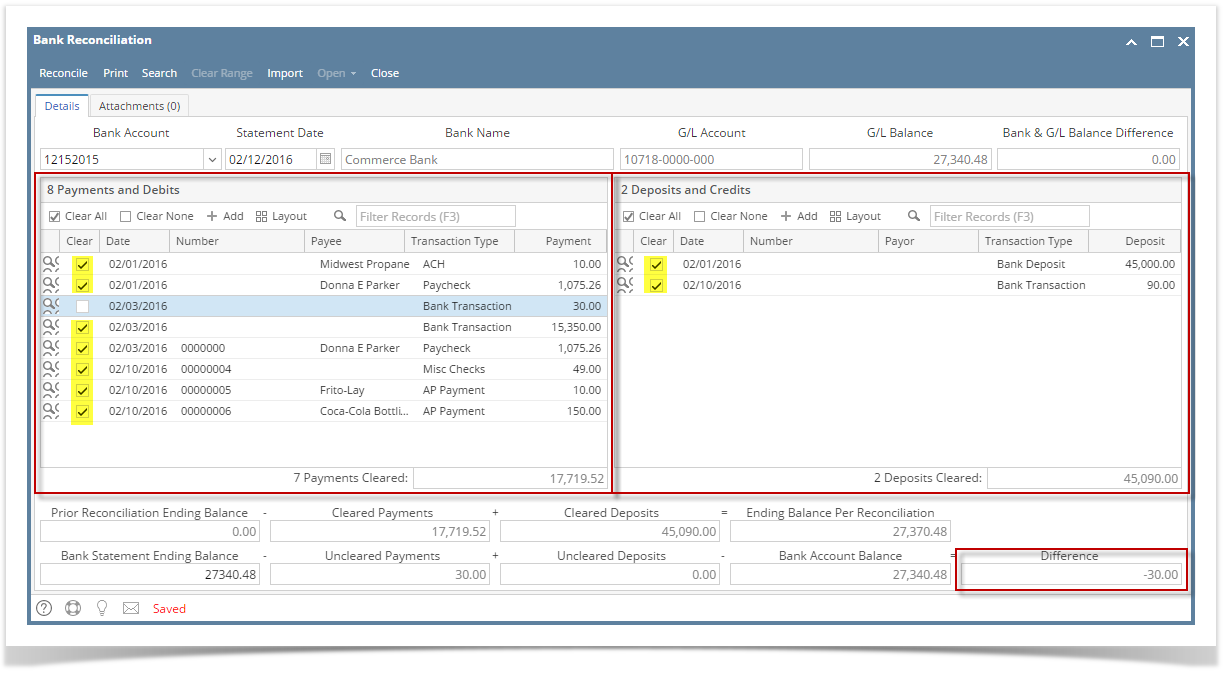

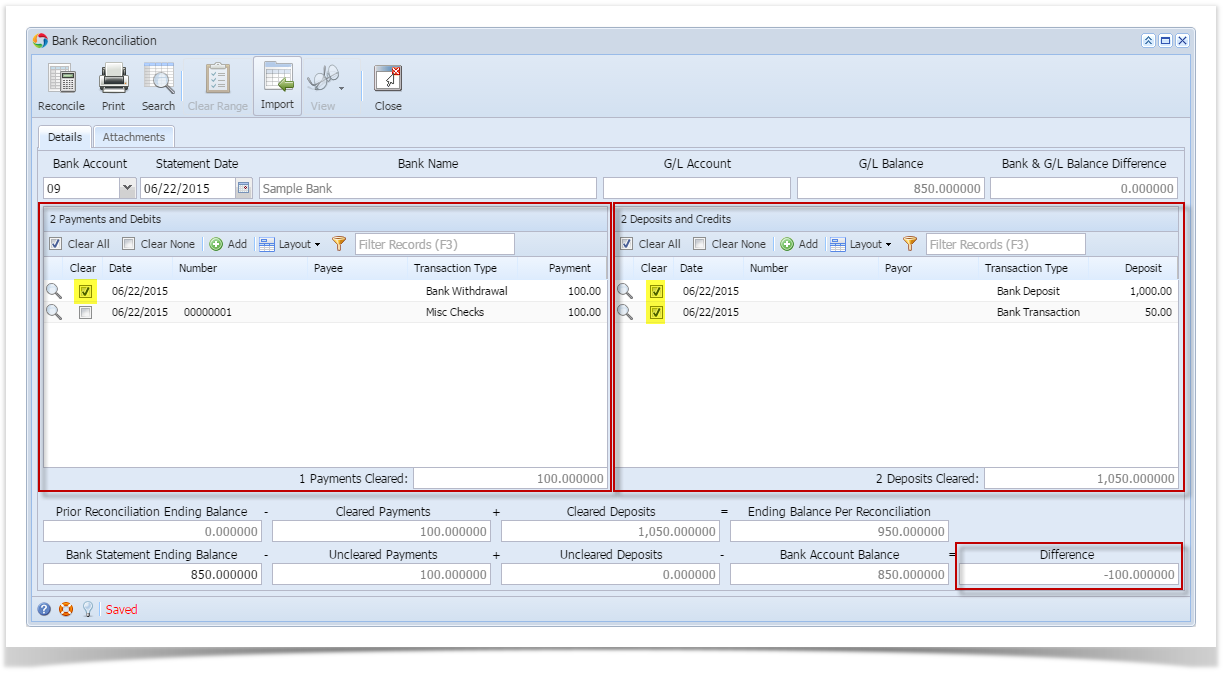

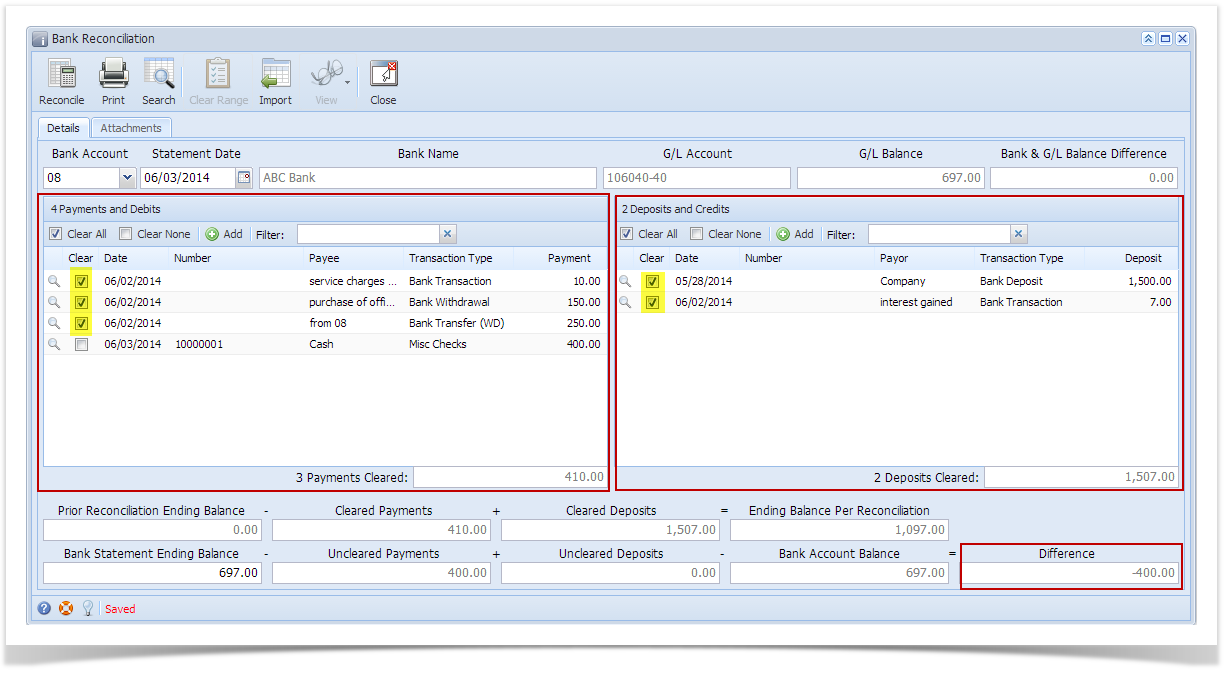

There will be instances when book record will not match that of bank record or vice versa. This is where the Difference field at the bottom left corner of the screen is useful. If the amount shown in this field is not equal to 0.00, you will have to determine if the problem is with your book record or with your bank. Here are some examples when this field will show other number than 0.00.

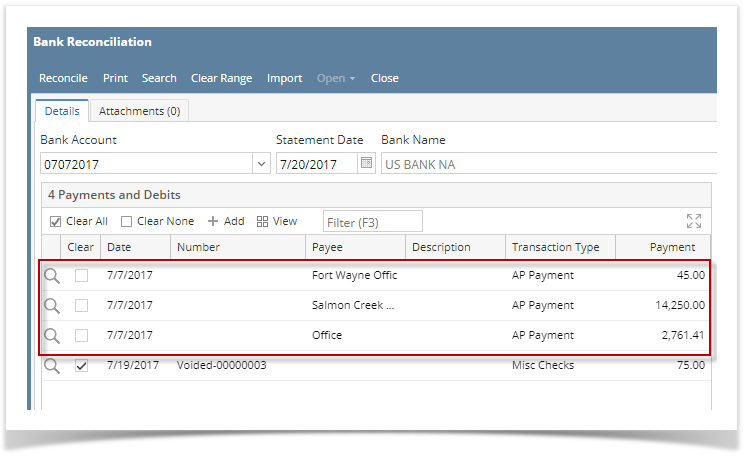

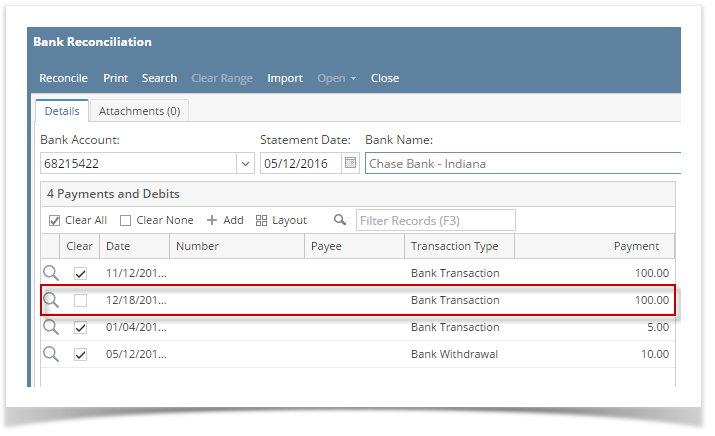

- If all transactions shown on your bank statement are present in the Payments and Debits and Deposits and Credits panels but there are left unchecked transactions in these panels.

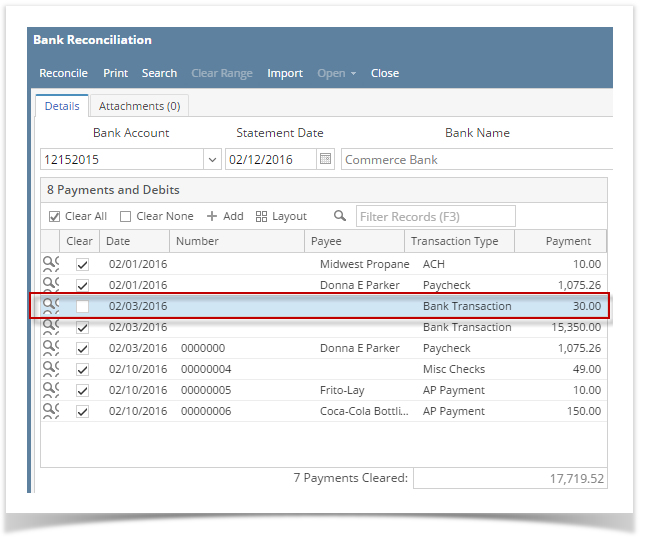

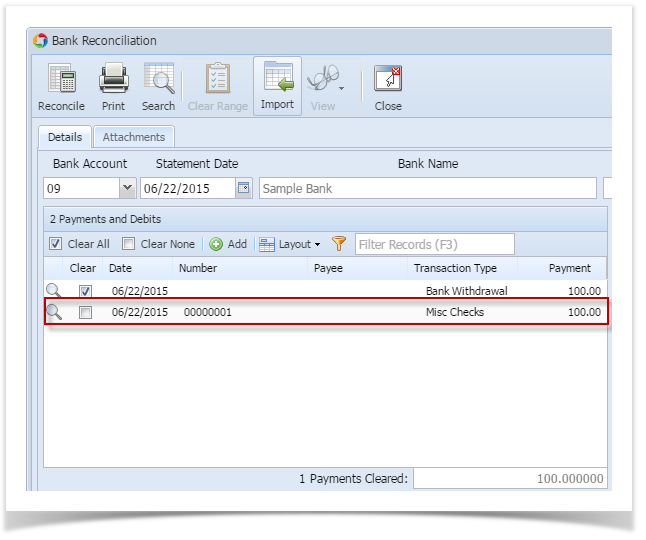

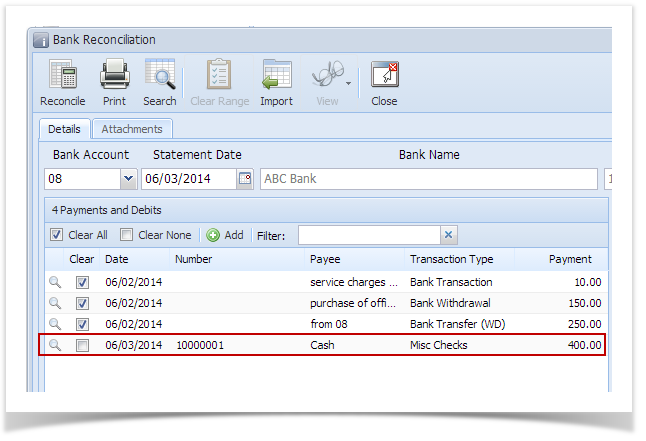

Here is a sample of unchecked transaction. With this kind of scenario, the said transaction will be forwarded to the next reconciliation as transaction awaiting to be cleared. Other case might be, the transaction was not recorded by the bank. With that, you may want to verify it with your bank. If there are transaction/s shown on your bank statement but are not shown in the Bank Reconciliation screen, then you will have to add that missing transaction on your book record so it appears in the Bank Reconciliation screen without having to close the Bank Reconciliation screen. This is what we call adding on the fly the deposit/credit or payment/credit transaction. See, How to Add Deposits and Credits transaction directly on Bank Reconciliation screen, How to Add Payments and Debits transaction directly on Bank Reconciliation screen.

Overview

Content Tools