Undeposited Payments are payments received from customers awaiting deposit. These payments received are from Origin and the actual deposit is to be done on i21. It is through i21 Bank Deposit where undeposited payments can be added. Follow the steps below on how to add undeposited payments to Bank Deposit.

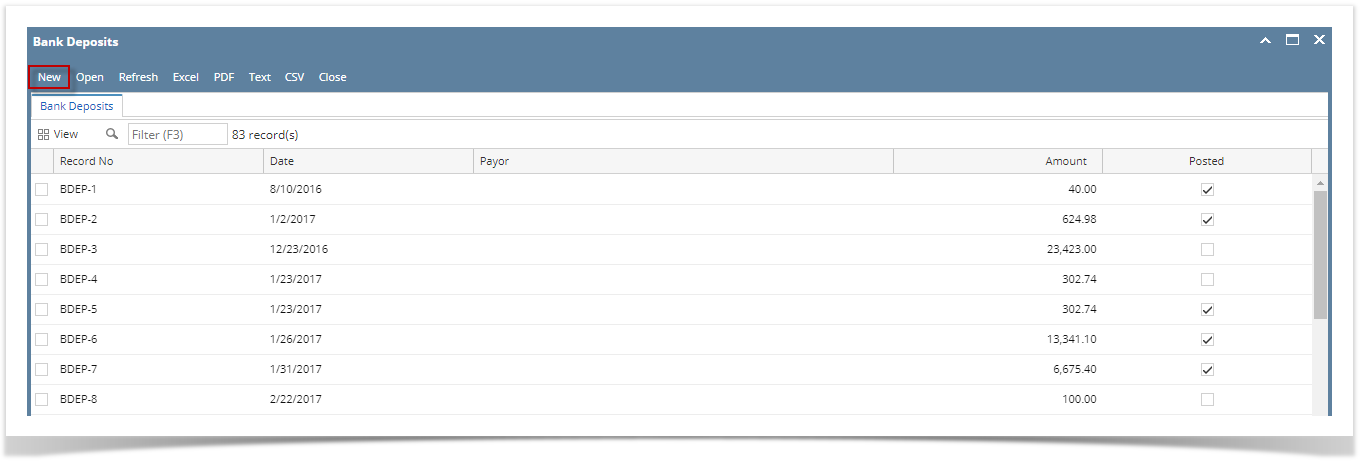

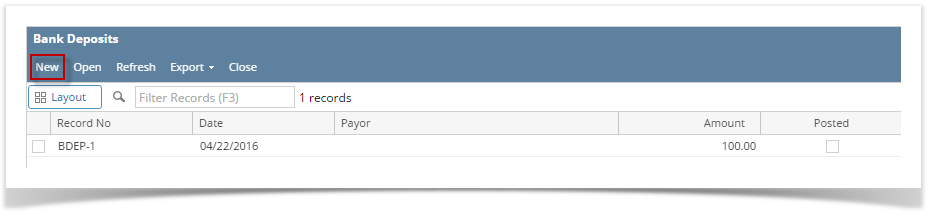

- From Cash Management module click Bank Deposits.

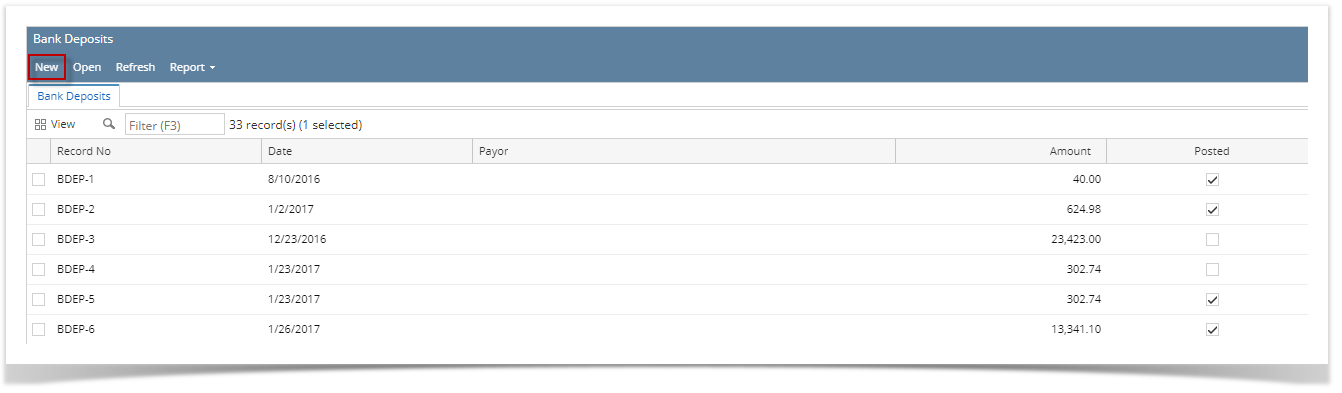

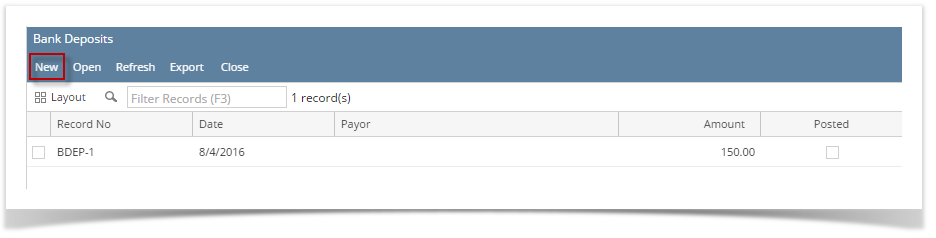

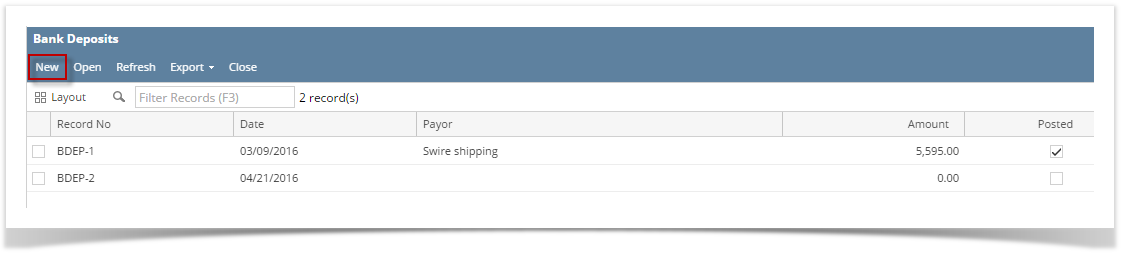

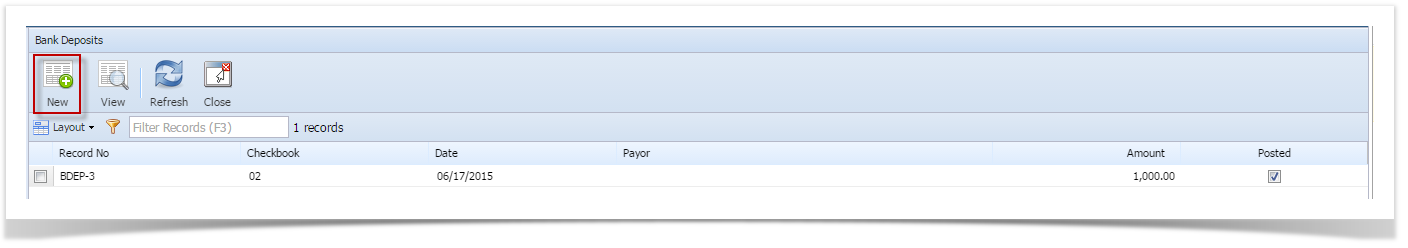

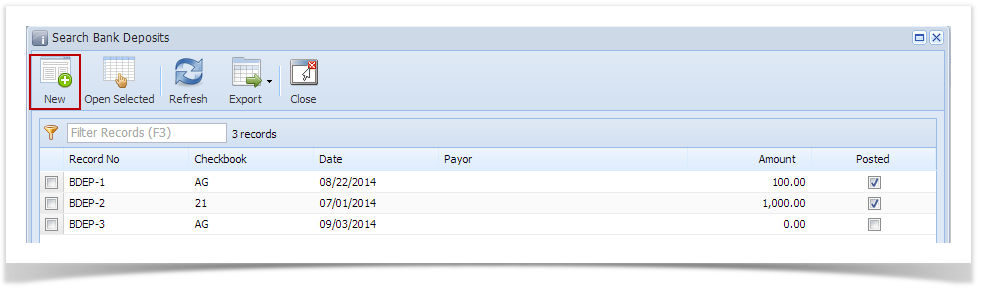

- If this is the first record you are to create, it will open directly on new Bank Deposit screen where you can then add the transaction. Otherwise, it will open the Search Bank Deposits screen where existing bank deposits are displayed. Click the New toolbar button to open the new Bank Deposit screen.

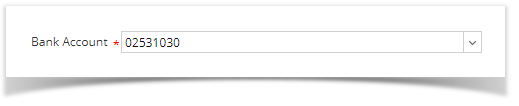

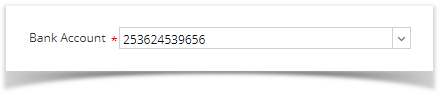

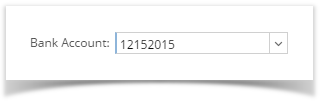

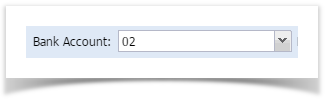

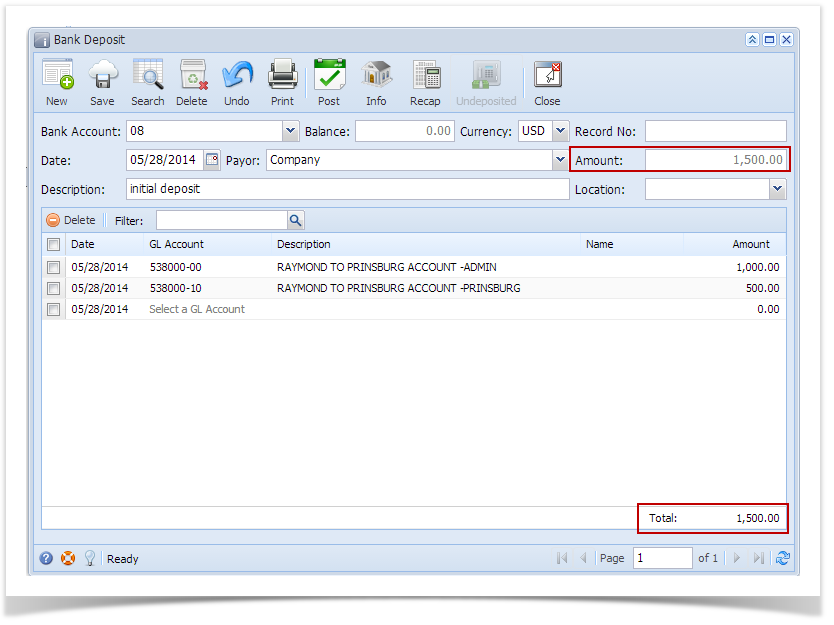

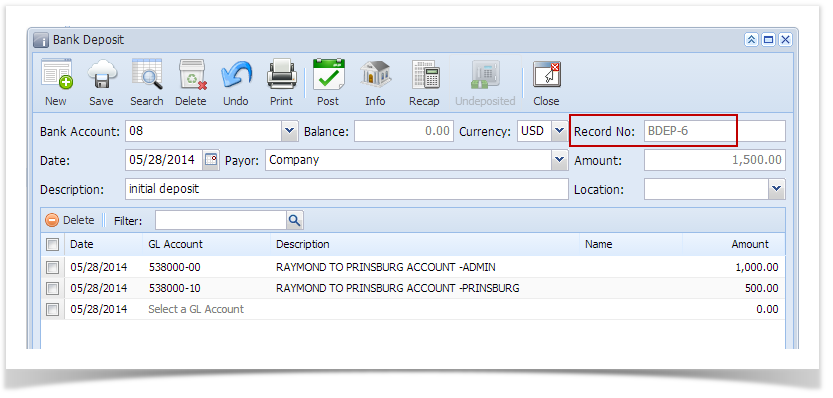

In the Bank Account field, click the dropdown combo box button to open the combo box list and select the bank account you want to make a deposit to.

Make sure that the bank account you want to make a deposit to had been added in the Bank Accounts screen. If not, see How to Add new Bank Account to guide you on how to add it.

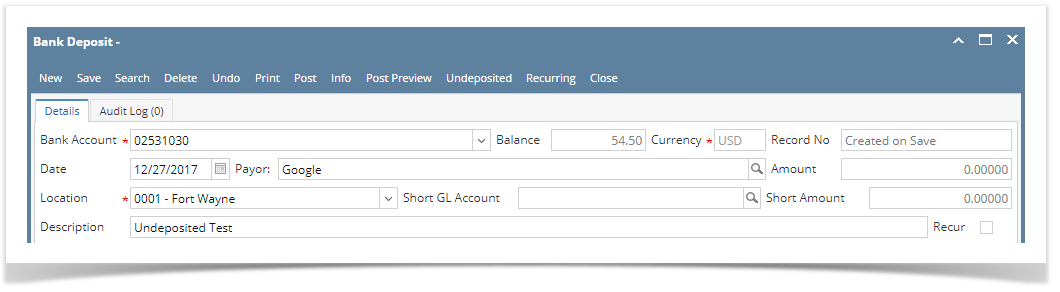

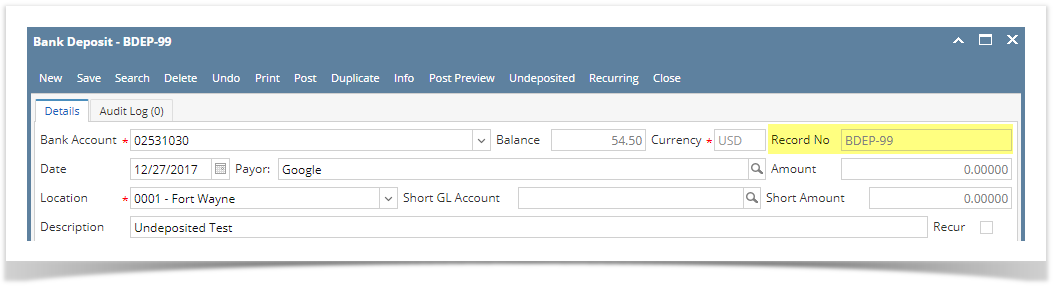

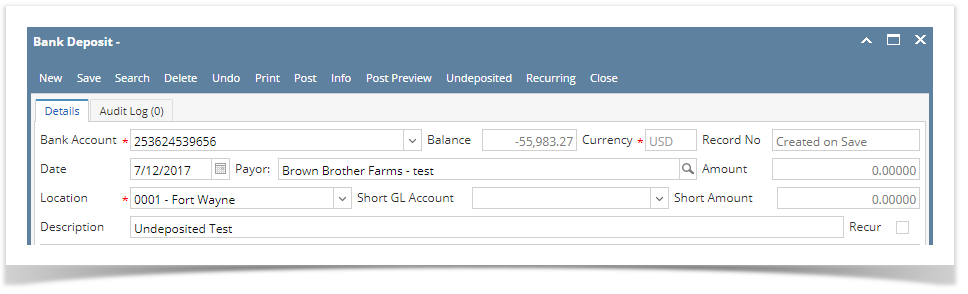

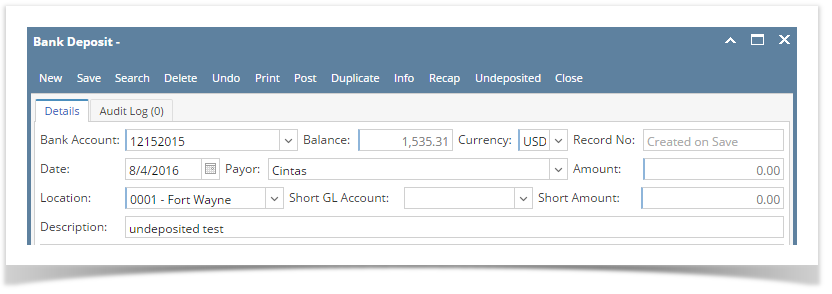

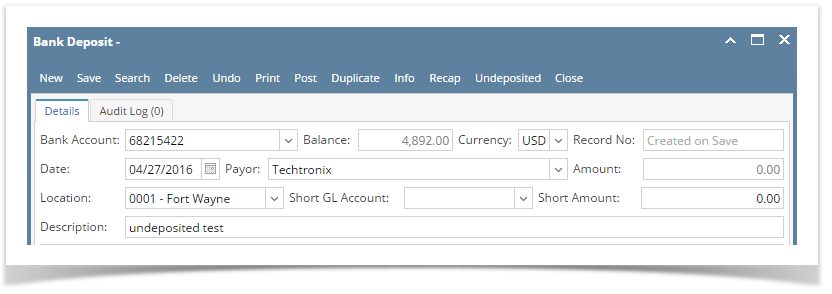

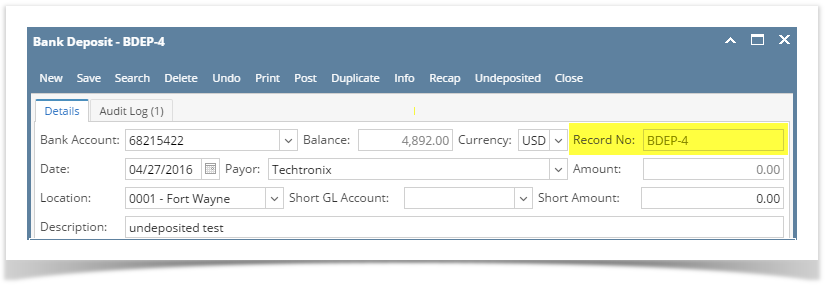

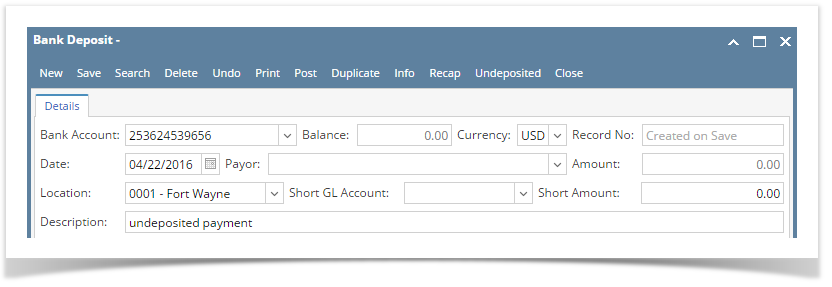

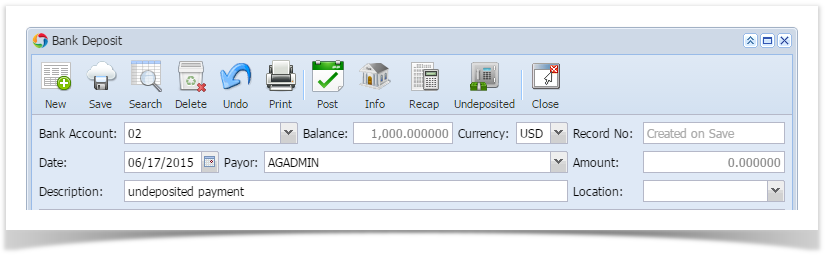

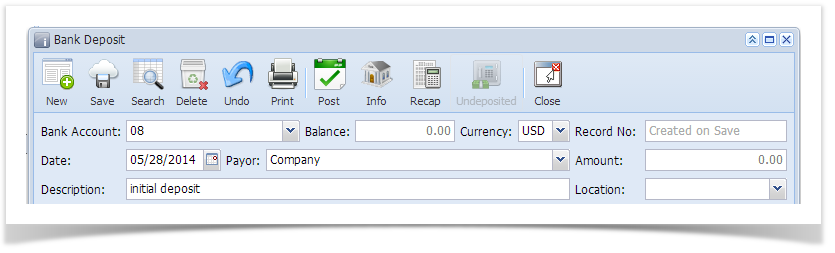

- Fill in Bank Deposit header information.

- The Balance field will show the current balance for the selected back account. This is a good way to track how much is the current bank account balance.

- The Currency field by default will show the Currency setup from the selected Bank Account.

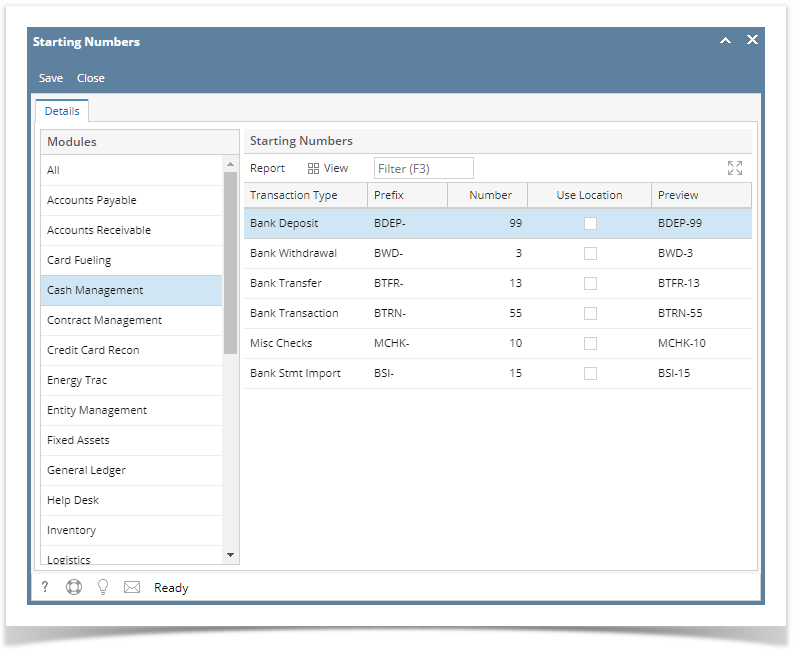

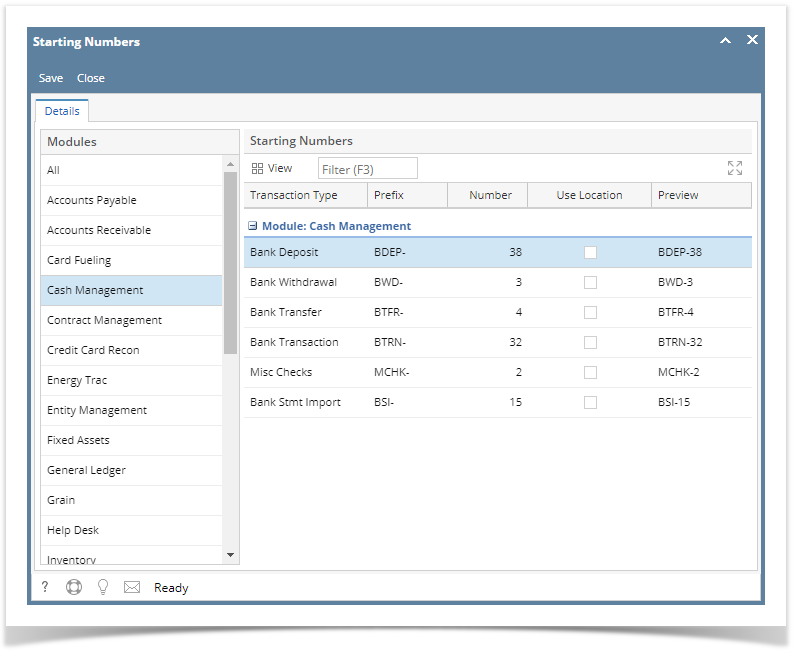

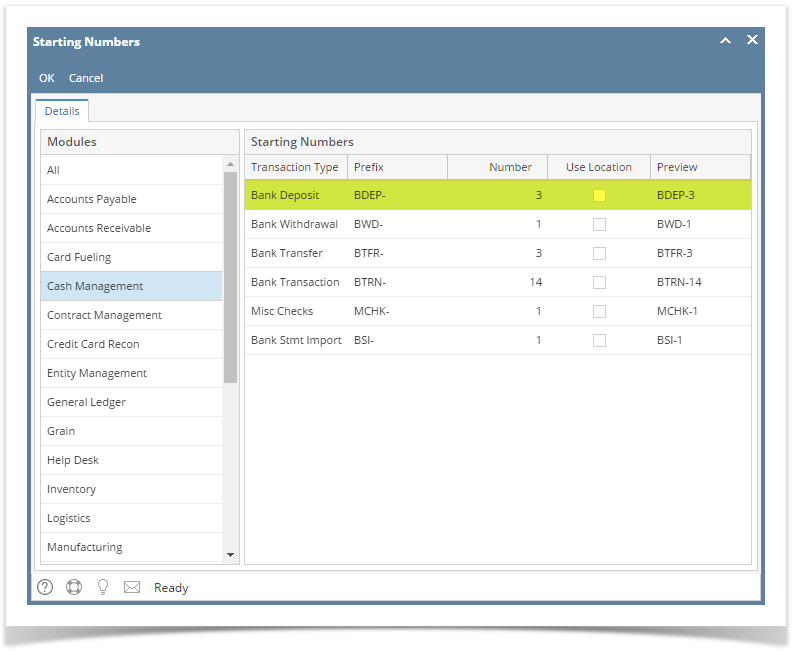

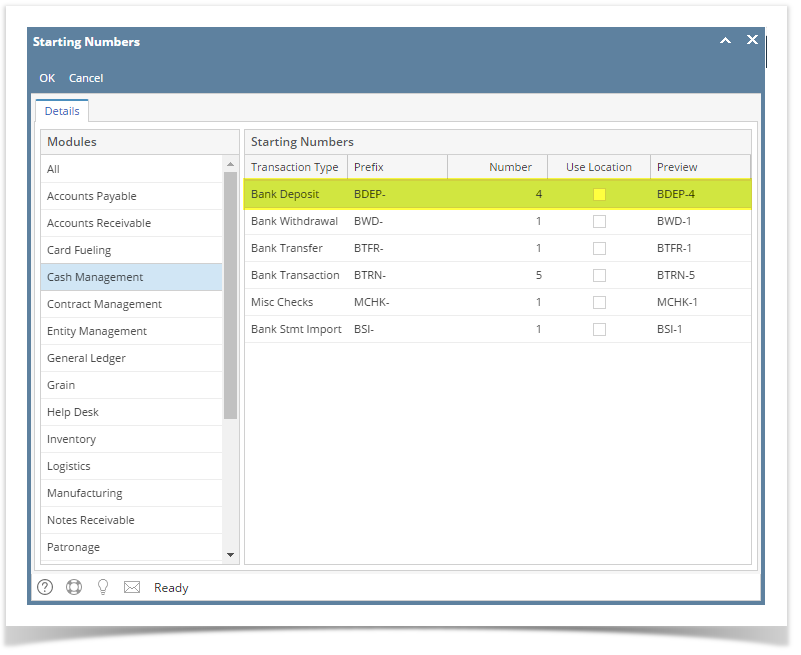

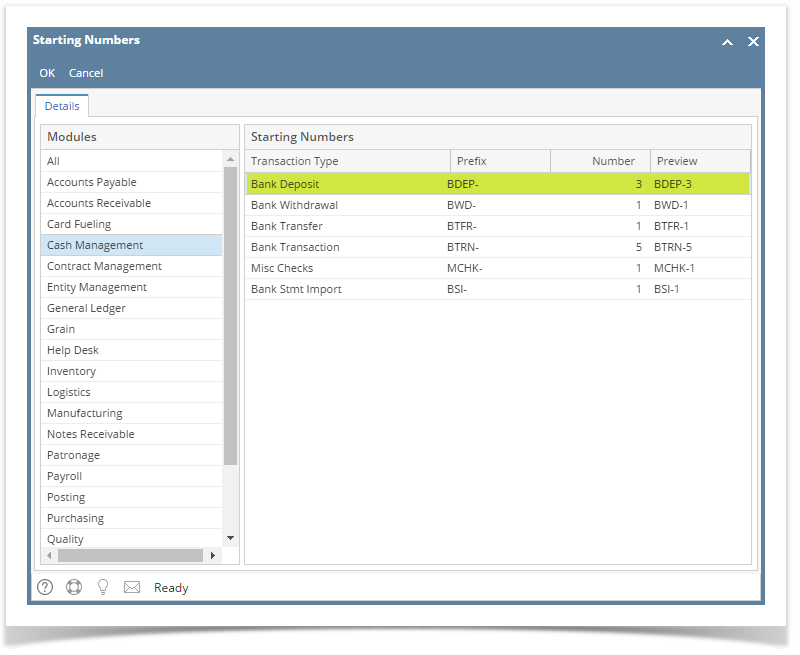

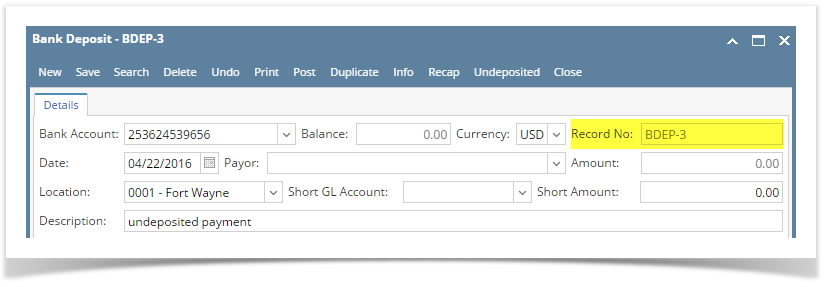

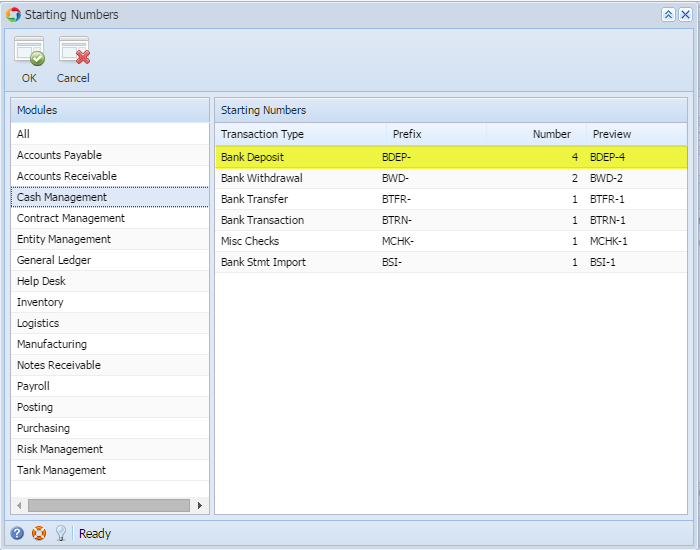

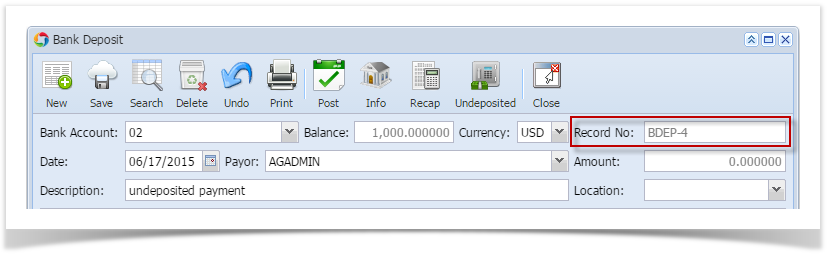

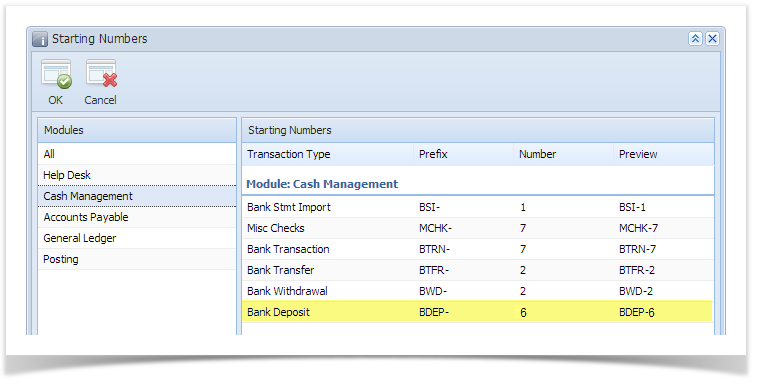

- The Record No field will only be filled with the deposit transaction number as soon as the Bank Deposit is saved. This will be based in the Starting Numbers setup from the Starting Numbers screen > Bank Deposit. That screen can be opened from System Manager > Starting Numbers.

This number will also be used to track the transaction later on. - The Date field by default will show today's date. Change this date as you feel necessary.

- Select Payor from the combo box list or add it on the fly. The Payor field is used to enter the name of an individual or company who pays in the form of deposit. Can be a customer or can be a memo for what the Receipt of cash is for. Click the dropdown combo box button to bring down the combo box list. This list will show all customers added in the Accounts Receivable module along with contacts added on the fly.

- Enter a description for the Bank Deposit in the Description field.

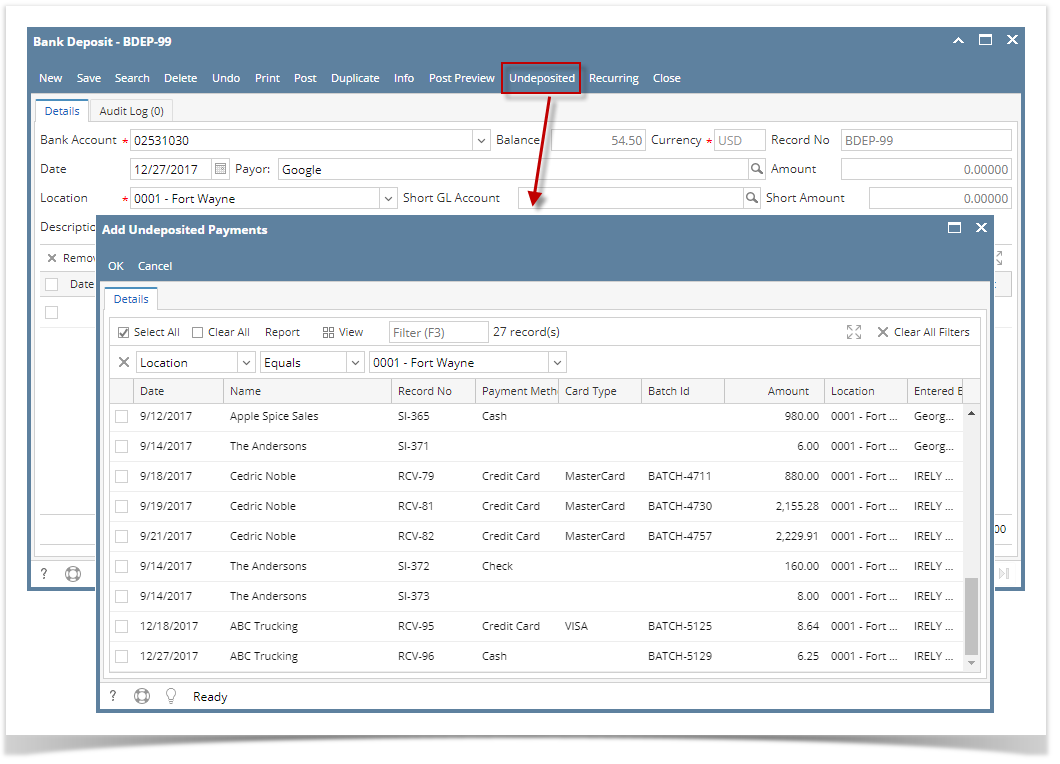

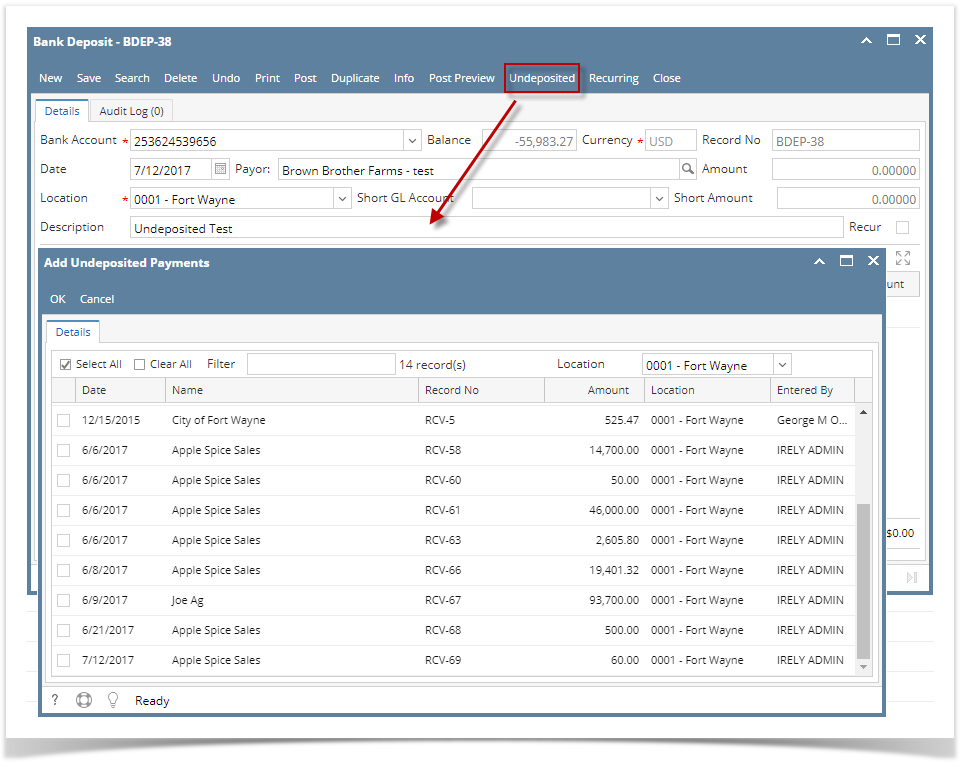

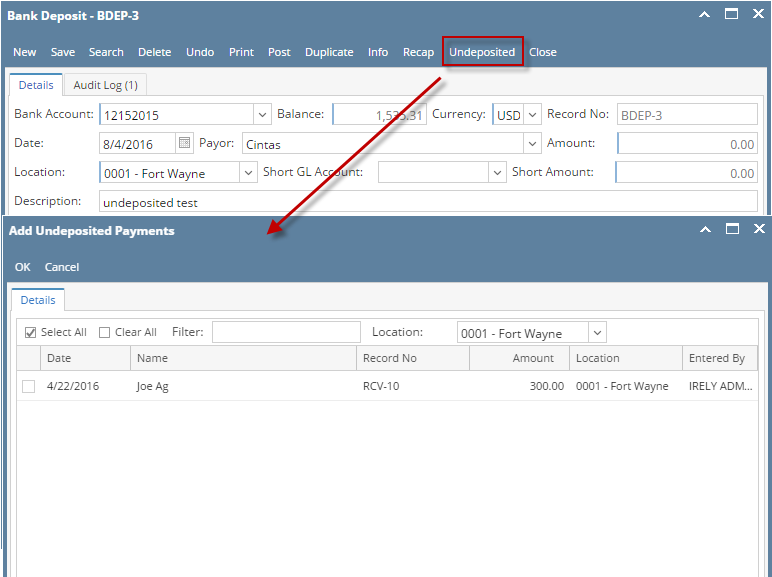

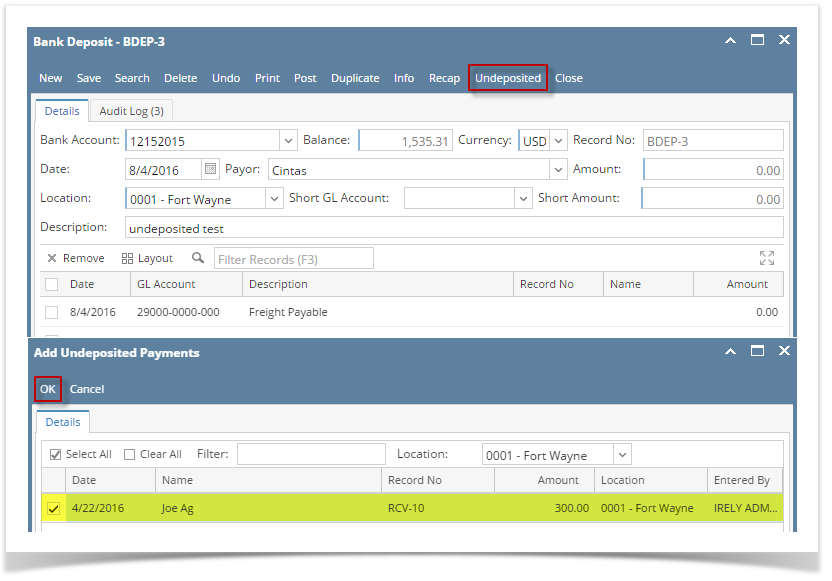

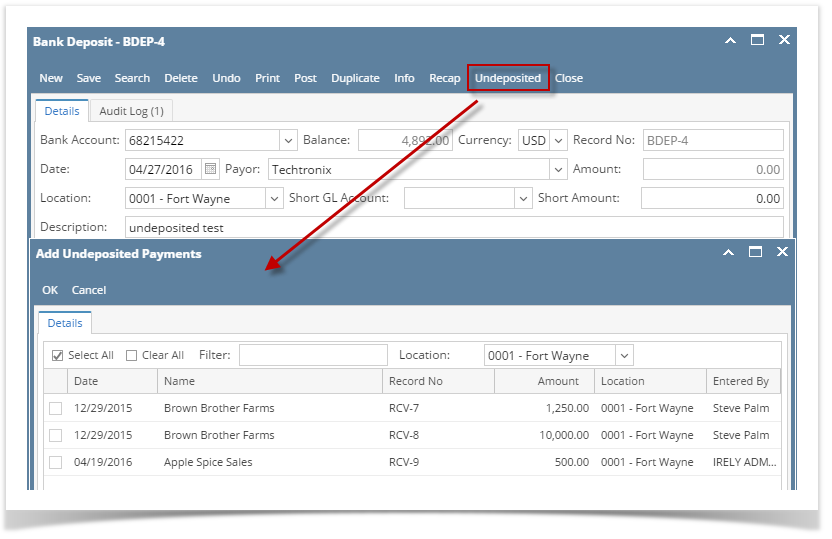

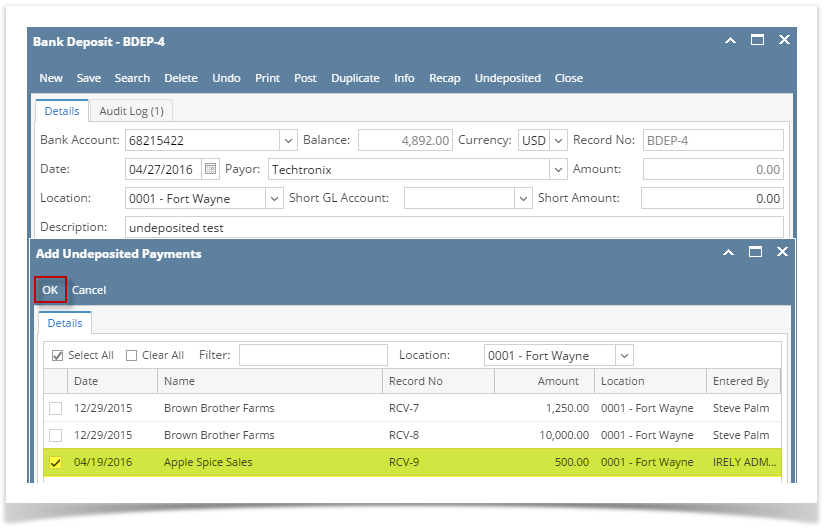

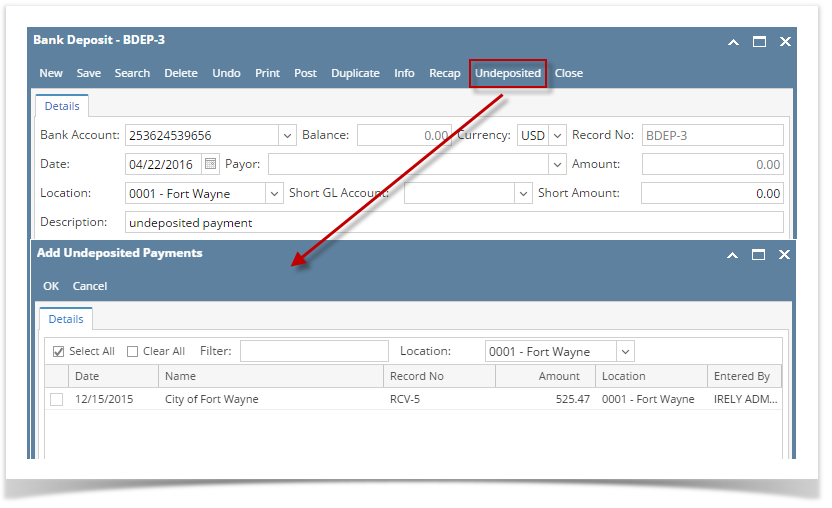

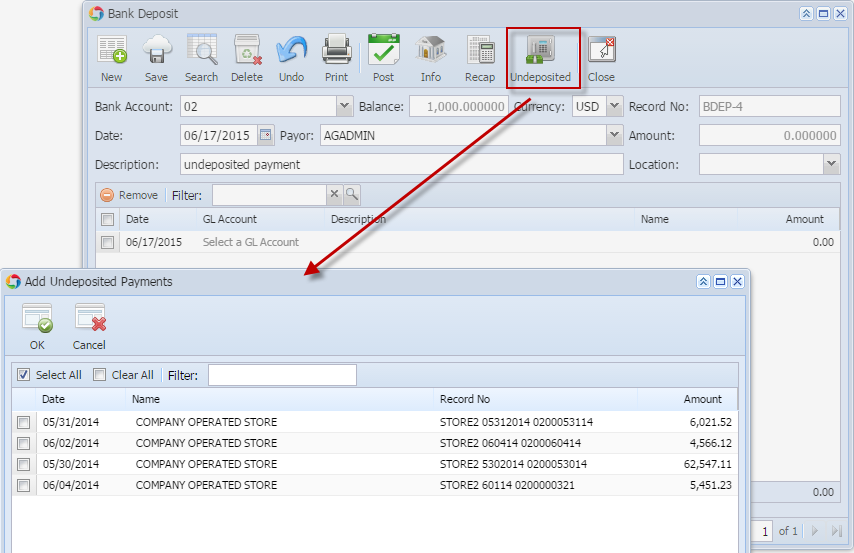

- Click Undeposited toolbar button. Add Undeposited Payments screen will appear listing payments that uses Undeposited Funds account from origin and i21.

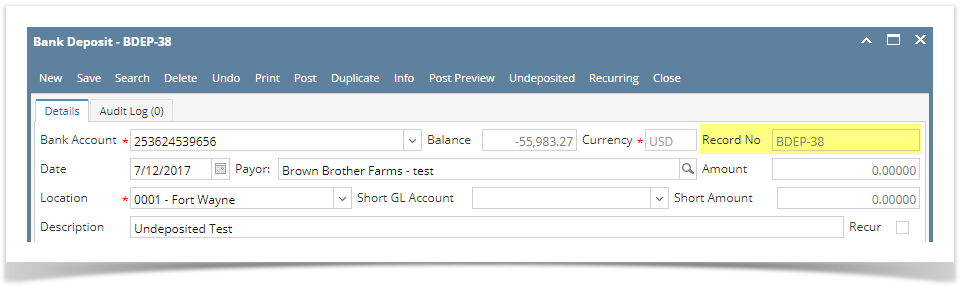

- The Record No field will then show the deposit transaction number assigned for this transaction since upon click in Undeposited toolbar button, Bank deposit will then be saved.

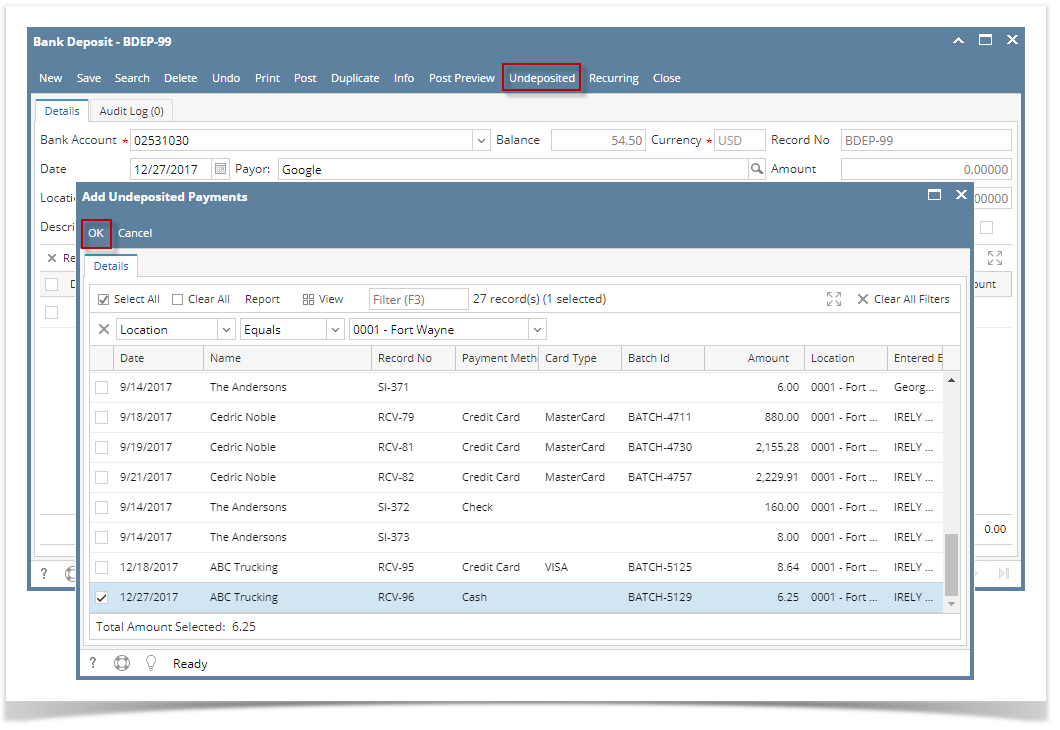

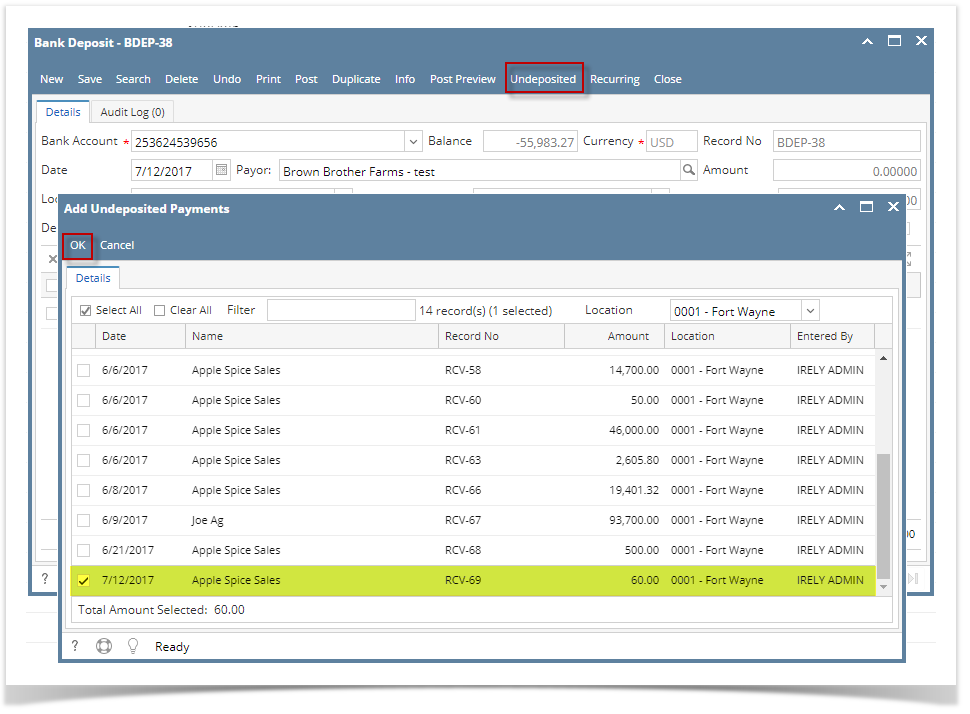

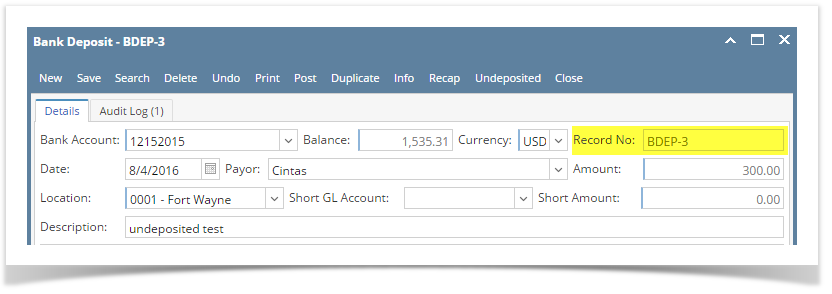

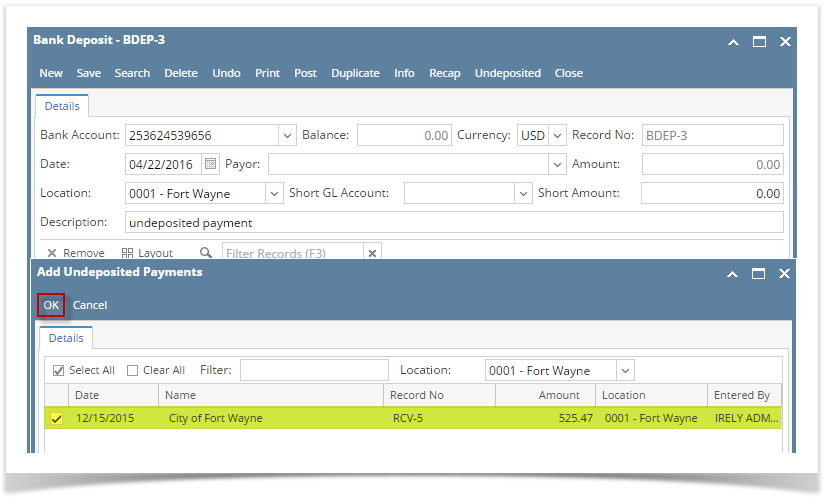

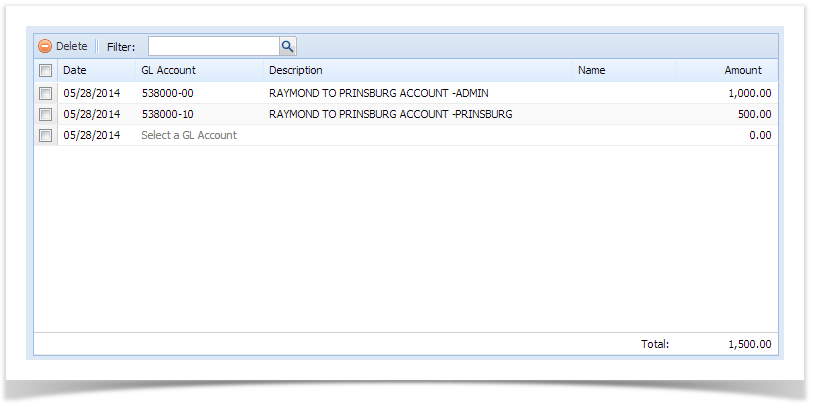

7. Select payment awaiting deposits and click OK button. Selected payments will then appear on the grid.

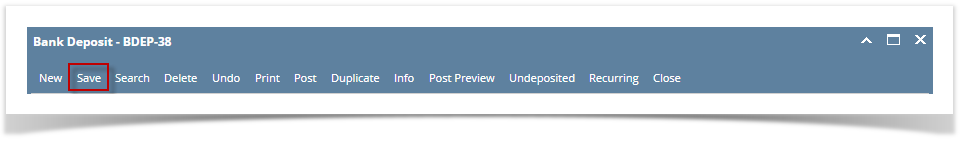

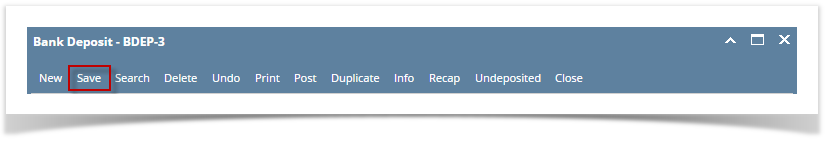

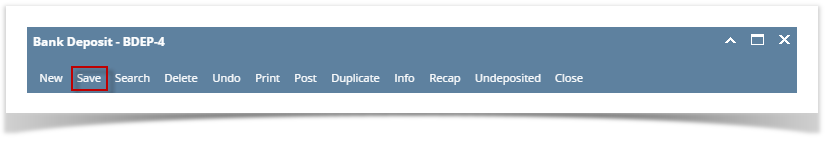

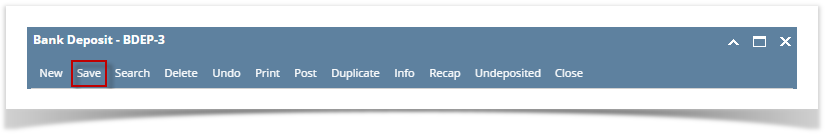

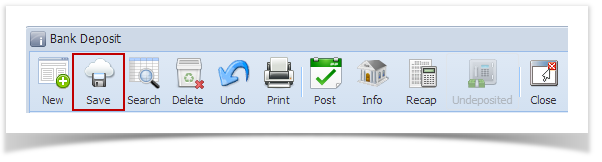

8. Click Save toolbar button to save the bank deposit.

If the transaction is to be posted right away, you may skip saving it. Instead, click Post toolbar button and it will save and post the transaction. See How to Post Bank Deposit.

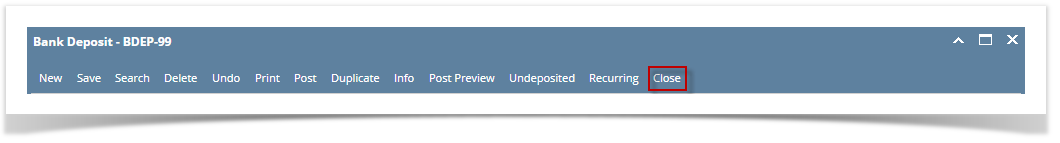

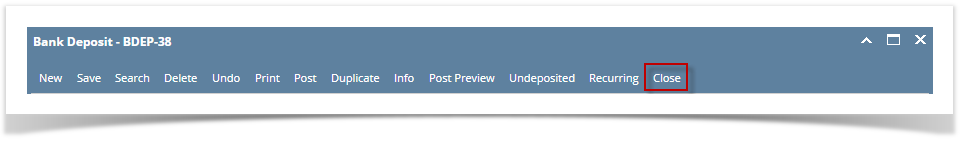

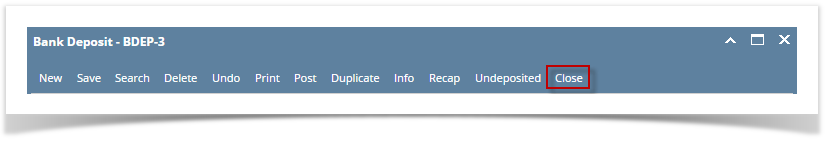

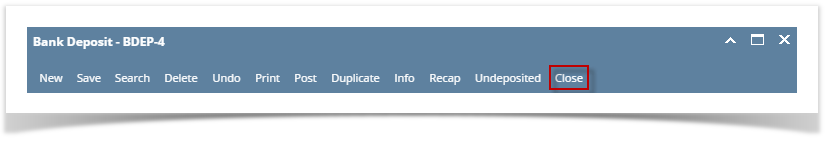

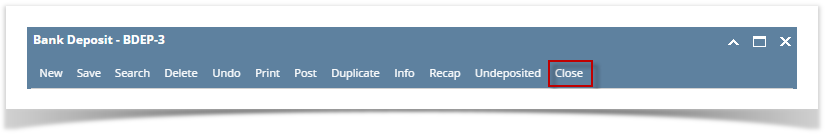

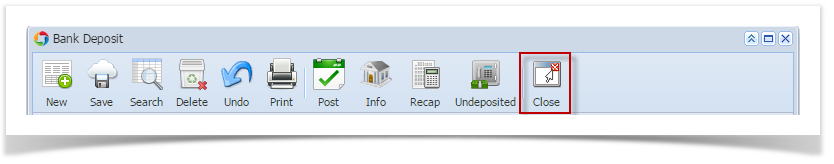

9. Click Close toolbar button to close the screen.