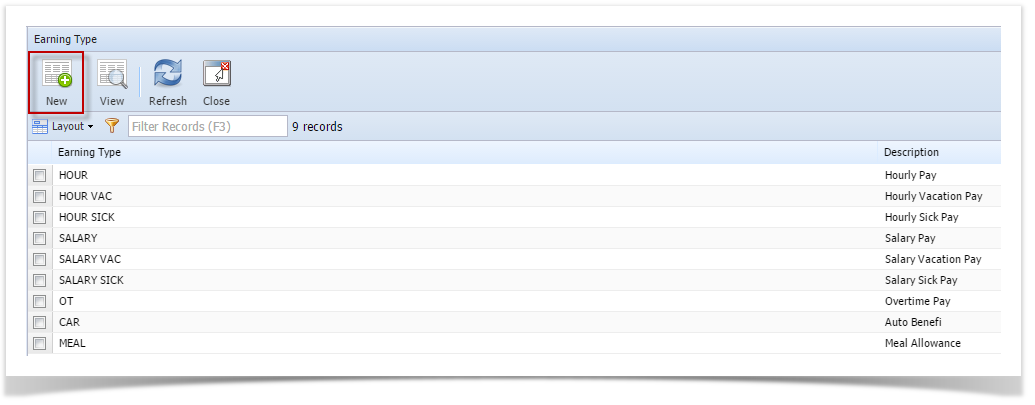

- From Payroll module > single click the Earning Types.

- If this is the first record you are to create, it will open directly the Earning Type screen where you can add the Earning Type. Otherwise, it will open the Earning Type screen where existing Earning Types are displayed. Click the New toolbar button to open new Earning Type screen.

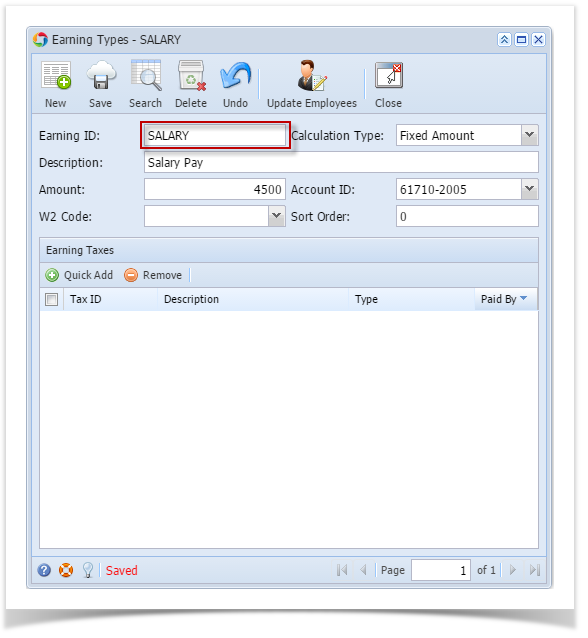

2. Fill in the Earning Type information:

a. The Earning ID field is a unique ID where you can enter alphanumeric character

b. Calculation Type by default is set to Fixed Amount. Click the drop down combo box button to select the Calculation Type applicable to your Earning Type.

c. In the Description field, enter the Earning Type description.

d. In the Amount field, enter the amount.

e. Select the Account ID by clicking the drop down combo box button. Expense Accounts will only displayed on the list

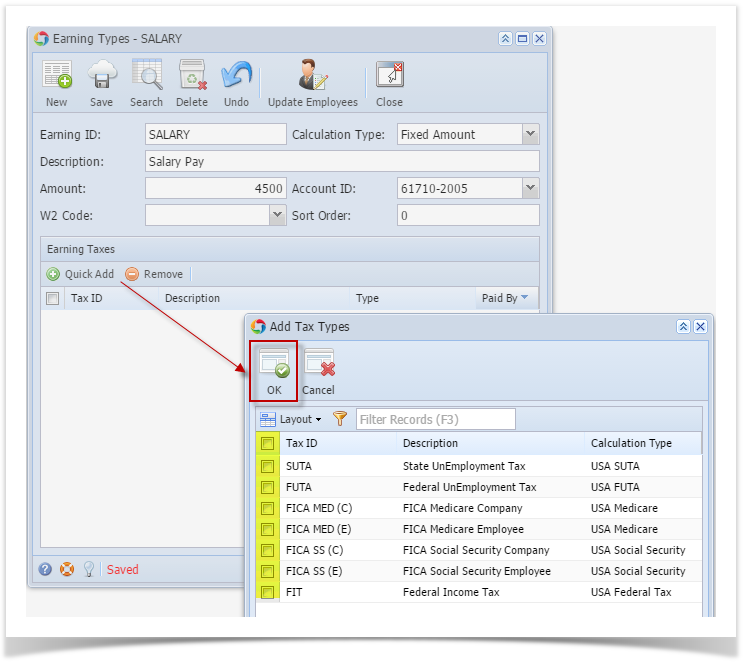

3. In the Earning Taxes tab, click the Quick Add grid button to Add Tax Types (Employee and Company). The selected Tax Types will be associated to Earning Type.

4. Click the Save toolbar button to save the added Earning Type.

5. Click the Close toolbar button to close the Earning Type screen.