Mark to Market inquiry screen will need inputs from the following screens to function

1- Company preference -->Risk Management preferences --> M2M subsection

2- Basis entry screen

3- Futures/Options settlement prices

4- Derivative Entry screen

5- Contract sequences

The information from the above screens will be plugged in to find contract price & market price and compute m2m unrealized gain or loss

Prior to running the Inquiry, be sure that

a.Mark values/differentials are up to date. Check Basis Entry screen

b.Futures prices are up to date. Check Future settlement Price

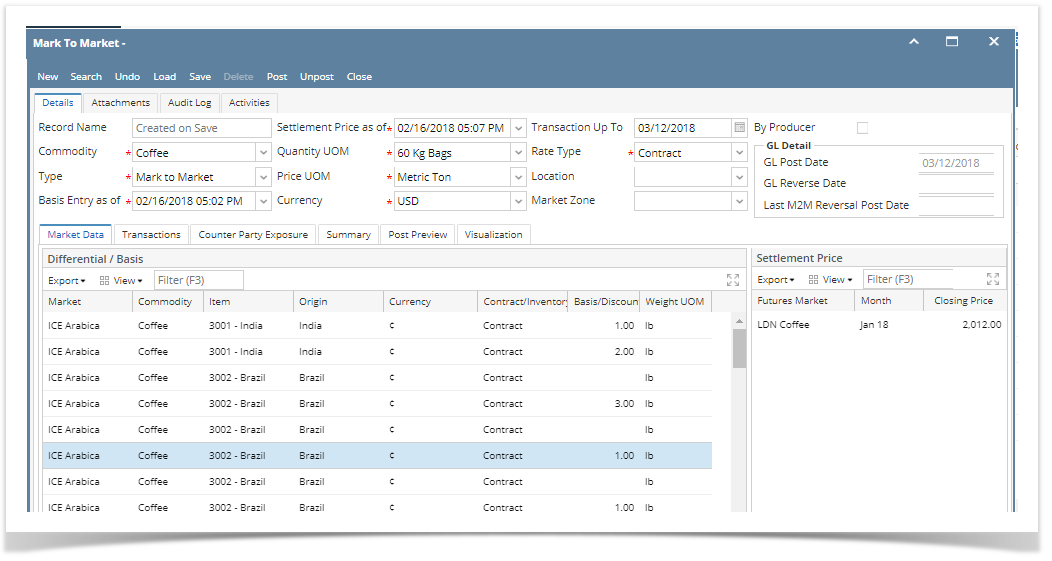

Market Data Tab :

Market premium tab will show the details from the Basis Entry screen and Future settlement price screen

- Diffrential/Basis

Basis value which is entered against the item and market in the Basis entry screen will be displayed in the Market differential grid

Here data will be populated based on the date which we selected in " Basis Entry as of " .

Basis Entry as of drop down will populate the latest entry from the Basis entry screen .

Enter the basis value in basis entry screen against a contract.

Refer-How Basis Entry works

When the mark to market loads it will populate all the basis value details against the selected basis entry as of date.

- Settlement price:

Settlement price as of drop down will populate latest date available in the settlement price screen against the commodity

Future settlement price which is entered against the future market and month details will be displayed in the closing price grid .

Settlement price section will show only the active furue months settlement price .

will show all the settlement price from future settlement price based on the selected commodity.

Enter settlement price in - Risk management - Future settlement price.

If there is no contracts available for any specific future month in the transaction tab then those month will not show in the settlement price section

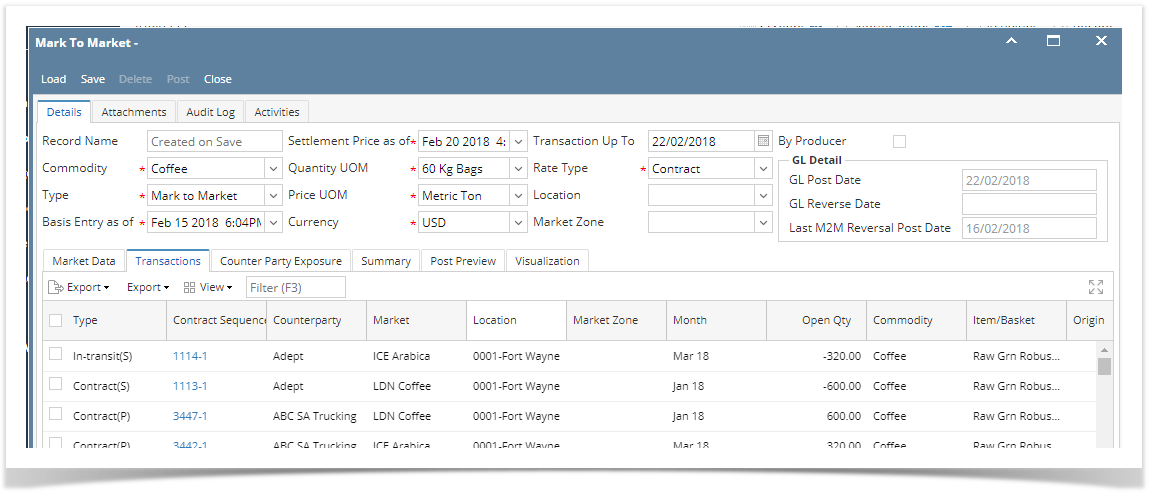

Mark to Market - Transactions tab

This is the place where you can see the Net profy and loss of each physical contracts.

- When a contract sequence is created then the type will show the Contract (P) for that sequence . and it will show all the corresponding details such as Quantity, Month , contract futures and contract basis from the contract sequence , Market basis from the basis entry screen and Market Future from the future settlement price and finally it will calculate the Result . P&L , P&L Basis and P&L Futures.

- When the supplier sends the shipment and user will enter the logistics inbound shipment detials in i21. when they post the inbound shipment the contract is in intransit stage.

This time Mark to market will show the same contract in In- Transit(P). This stage also it will calculate the Net pnl based on the quantity shipped. - When the same contract is received in to warehouse i21 will enter the Inventory receipts .

This stage the same contract will show inthe status " Inventory (P)" - To delivery this contract user will create inventory shipment or outbound entry in logistics .

once the outbound is created the same contract will be in the stage of In- Transit-(s) . This time it will calculate the Net Pnl and Basis

Pnl and Future Pnl according to the deliered quantity.

Net Pnl will be calcualted as (Market Price -Adjusted price)* Quantity - When the invoice is generated against the same contract Mark to market will not show the same contract .

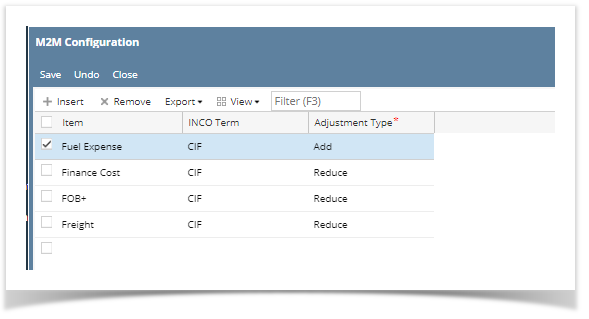

Costs

Each sequence user can enter the costs. This costs will be appeard in the mark to market based on the inco term used against the same contract we have m2m configurations where we can predefine each cost and against specific inco term to be added or reduce the cost for the net pnl calculation .

To configure this we can go to Risk Management- Maintenance section - M2M Configurations.

.

- Based on the configurations from the above screen the cost will get adjusted with the ( Plus or Minus) contract total and will get the adjusted Price for the same sequence,

- If the contract is a Basis contract then the contract price will consider the future settlement price for the future month which is attached with the same contract

- If the contract is HTA then those type of contract does not have basis price . Hence the market diffrentiual of the same contract will be loaded with the contract basis column

- Quality column will be populated based the UOM selected in te Quantity UOM.

If any of the derivative entry and physical contract have expired month then we will not be allowed to view Mark ro market

In this case we need to rool over the future month to the next active future month and then load.

Record number is autogenerated number while saving .

GL Posting.

To post the P&L values to the Gl account we need to have few predefined setup in configuration screen .

1.Open system manager-Risk management

In GL account tab we need to have following accounts

- Unrealized Gain on Basis

- Unrealized Gain on Futures

- Unrealized gain on Cash

- Unrealized Loss on Basis

- Unrealized loss on futures

- Unrealized loss on cash

- Unrealized gain on basis( inventory offset)

- Unrealized gain on futures( inventory offset)

- Unrealized gain on futures( inventory offset)

- Unrealized gain on cash( inventory offset)

- Unrealized gain on in-Transit( inventory offset)

- Unrealized Loss on Basis( inventory offset)

- Unrealized Loss on futures( inventory offset)

- Unrealized Loss on cash( inventory offset)

- Unrealized Loss on in-Transit( inventory offset)

All the above accounts should be belong to General category

GL Post date will be transaction date.

Once the transaction is saved we can see that the post preview tab will show the debit and credit entries of each contract number

GL Reverse date field will be enabled only after the record is been saved.

When you open the saved batch we will be able to enter the GL Reverse date and it is allowed ot enter only future date.

Now we should be able to post the transaction .

Post button will be enabled only when the type is " Mark to Market"

When the type is " Stress Test" we will not be able to post the transaction .

Saved BAtch details and transaction detials can be view in search screen it self.

TVerify the GL Account details for teh Mark to Market Entry

go to General ledger module → Open General journal details→Select transaction tab

We can verify the credit and debit entries by Batch ID

Credit and debit entries should be same as the m2m inquiry debit and credit entries.

M2M Inquiry - Counter Party Risk

Business Benefits of this tab is

- Helps in keeping a check on counterparty risk.

2. Helps to mark the open positions to market.

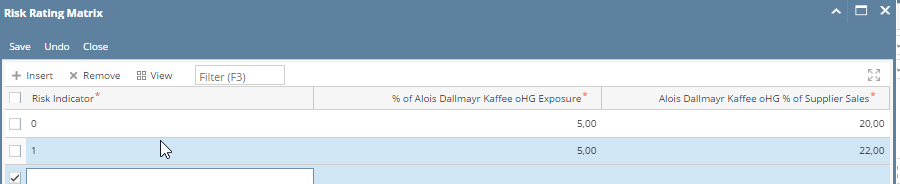

Few configurations need to be in place to run the new vendor exposure inquiry

- should set the risk rating and for the rating % of exposure and % is supplier sales to be entered .

- This screen available in Risk Management - Risk Rating Matrix

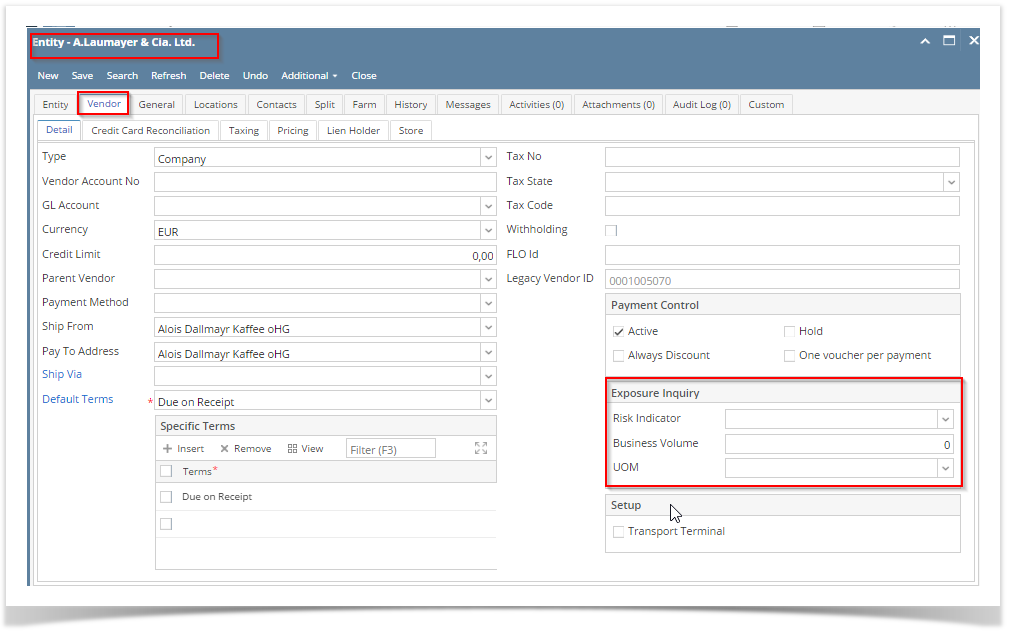

3. In the vendor (entity) configuration we need to configure the risk rating and the total business volumes ( Vendor Screen is available in the Account payable Module )

“Risk Indicator”. - This will be a drop down and the options will be whatever has been entered in the first column of the above configuration (1,2,3,4,No rating).

Total Business volume – is an entry field ( this will playa role when calculating the exposure against the same vendor)

Vendor Exposure Tab will mainly calculate the % of the company spend , % of the company share with supplier and potential additional

volume . For this calcualtion we need to total committed volume(Fixed and unfixed purchase volumes) and Total committed value(

Fixed purchase value + unfixed purchase value |

) .

| % of total comapny spend (X) | (Total committed value for the vendor/ sum of total committed value for all vendors) X 100 | ||

| % of company share with supplier(Y) | (Total committed volumes per vendor/ total volume of business done by the vendor (a number entered in the supplier configuration) X 100 | ||

| Verify the M2M | Sum of result column of the given vendor | ||

| Verify Potential additional volumes | X=( Total committed volumes / % of total company spend )* % Company Exposure

Y= (Total committed volumes/% of comapny share with supplier) * comapny % Sup Sales | % company EXPOsure from risk Rating Matrix screen | (pick the smaller number of the compared values of X and Y) - Total Committed Volum |

Summary Tab:

It will display the summary of all the physicals, inventory and the futures