Certain Schedules and Forms have Configurable values that need to be either updated for each reporting period (for example, Indiana changes its GUT rate monthly), or when business scenario changes (for example, Indiana adjusts GUT Allowance Rate based on business volume), or when the state requirement changes. Due to these reasons, you must be aware of these Configurable values for the Schedules and Forms you use, and also update them before you start your monthly verification process.

Each state has their own unique requirements on MFT filing. Due to this nature, the exact Configurable values are categorized by State, then Form, then Schedule (when applicable). Check the individual state's page for exact values needing updated. On the other hand, how to change these values are consistent, regardless which state they are for

Follow the below steps to change Configurable values:

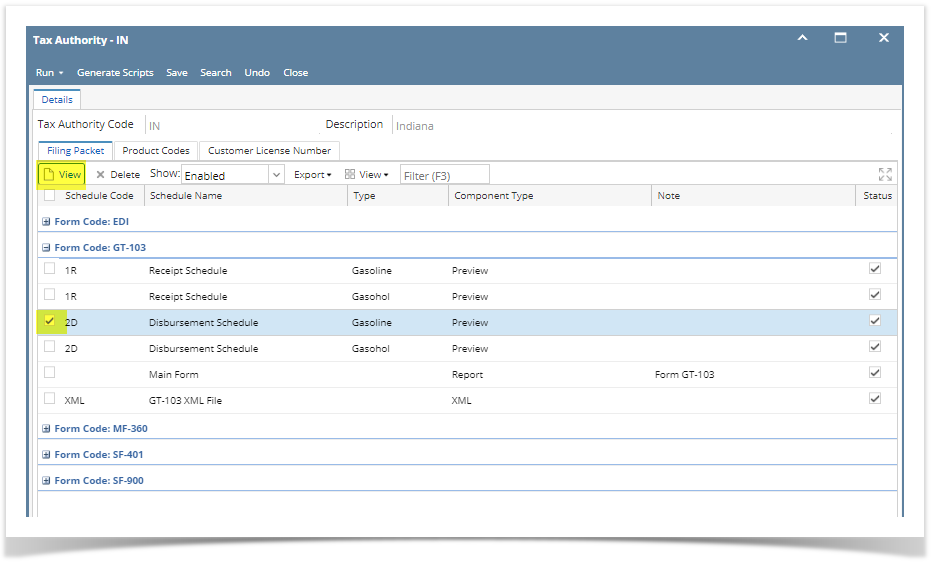

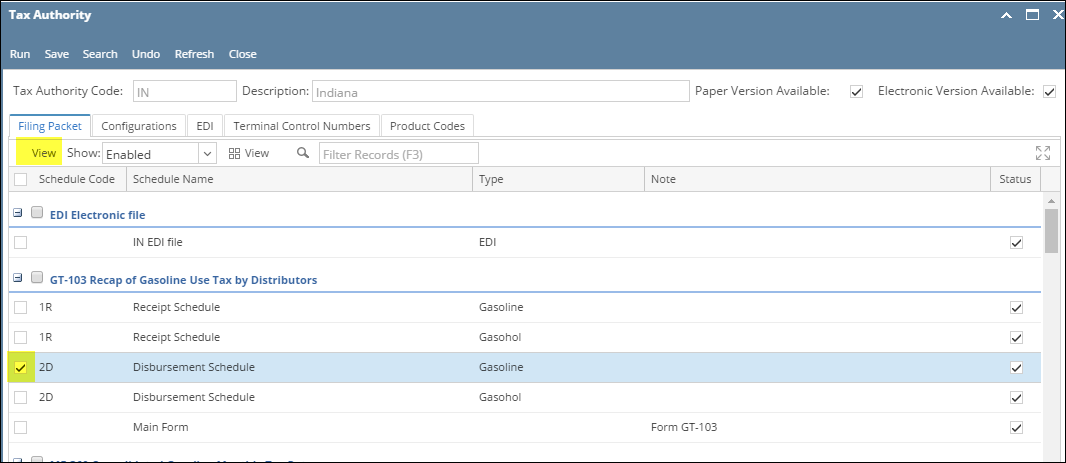

- On Tax Authority screen, select the Schedule or Form for which there are Configurable values, then click View.

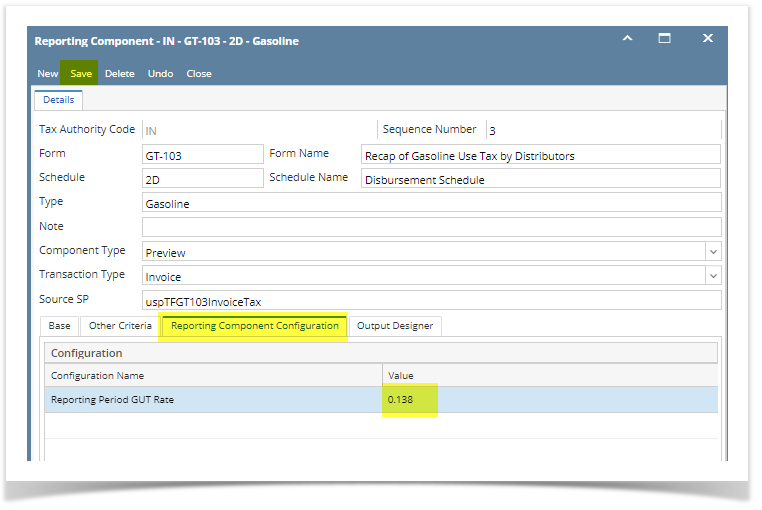

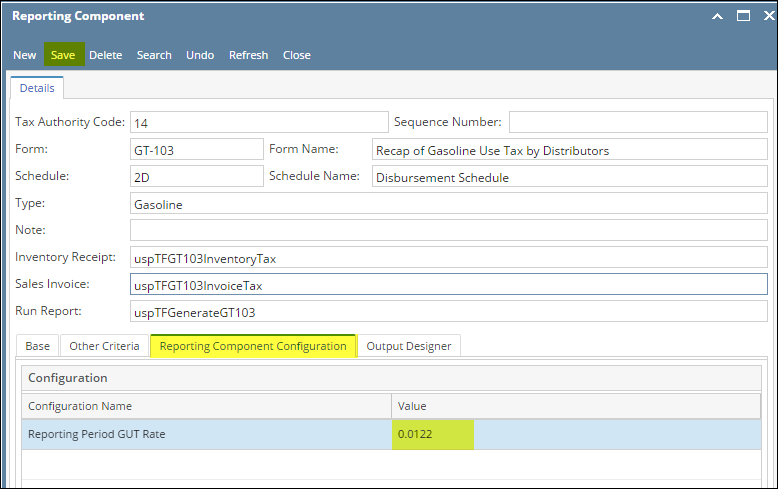

- On Reporting Component screen, go to Reporting Component Configuration tab. Enter the new value in the Value column for each Configuration, then click Save. You may need to repeat this process for each impacted Schedule and Forms.